Traders work on the floor of the New York Stock Exchange (NYSE)Spencer Platt/Getty Images

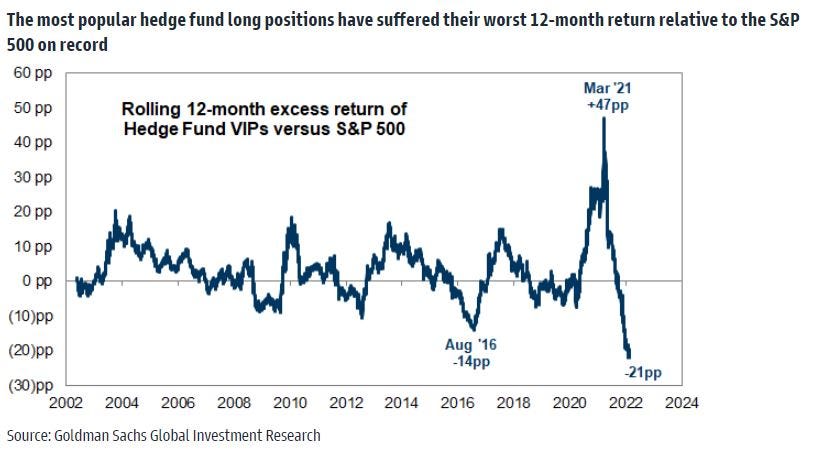

- The most popular stocks owned by hedge funds have suffered their worst performance relative to the S&P 500 on record, according to Goldman Sachs.

- One-day earnings declines in popular stocks like Netflix and Roku drove the underperformance.

- Amid the carnage in high-flying growth stocks, hedge funds are rotating away from growth and into value.

Hedge funds are positioning themselves for a different kind of stock market after one-day earnings declines in popular names drove significant underperformance, according to a Tuesday note from Goldman Sachs.

The bank found that the most popular hedge fund long positions suffered their worst 12-month return relative to the S&P 500 on record. Goldman started tracking the data in 2002 and created a VIP index that consists of hedge fund managers' "very important positions."

"Since early 2021 our hedge fund VIP basket has lagged the S&P 500 by 21 percentage points, the worst 12-month stretch in the basket's 20-year history. Year-to-date the basket has returned -12% vs. -9% for the S&P 500," Goldman said.

Popular hedge fund stocks that drove the underperformance include Meta Platforms, Netflix, PayPal, and Roku, which all experienced single-day declines of more than 20% after reporting earnings results. "An unusually large share of US equity market cap have experienced 20%+ single-day declines in early 2022," Goldman observed.

"In recent decades, this magnitude of market cap experiencing such sharp declines has only been exceeded during the tech bubble unwind in 2000 to 2002, during the financial crisis, and during the COVID sell-off in March 2020," Goldman said.

The earnings blow-ups have helped drive a "great positioning rotation" out of growth stocks and into value stocks among hedge funds, according to the note. Hedge funds now have the smallest tilt to growth stocks since 2011, with cuts to exposure in technology and consumer discretionary sectors. At the same time, exposure to energy, financials, industrials, and materials sectors has surged.

Six tech stocks dropped out of Goldman's VIP hedge fund list this quarter, including AMD, Dell Technologies, Elastic, Five9, Block, and Xilinx. Meanwhile, one energy stock and several financial stocks were added to the list, including Cheniere Energy, Citigroup, and Schwab, according to the note.

Despite the ongoing rotation from growth to value, the top five stocks in Goldman's hedge fund VIP basket remain Microsoft, Amazon, Alphabet, Meta Platforms, and Apple.

Goldman Sachs

Did you miss our previous article...

https://11waystomakemoney.com/finance/these-13-charts-show-the-inequalities-black-americans-still-face

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions