Uber and Airbnb published their quarterly reports July-September 2021 on November 4. Both companies performed better than analysts expected last quarter. I will share with you some of the most fascinating facts from the corporations as well as a tech analysis of the stocks.

Airbnb Report for Q3, 2021: All-Time High Revenue and Profit

Airbnb, an American company that owns a similar dwelling rental service, reported that there are still plenty of bookings. People booked entertainment and dwellings 79.7 millions times between July and September. This is 29% higher than Q3, 2020.

Not to be overlooked is the increase in rentals for 7 nights or more. This parameter has increased by 45% in the last quarter. The most notable increase in bookings was seen in Europe and North America.

Airbnb shares rose by nearly 13% after the Q3 report was published

The company was able to achieve record quarterly revenue and profit thanks to the recovery in the tourism industry. Airbnb shares (NASDAQ: ABNB), rose 12.98% to $201.62 on November 5. You may recall that the share price has risen by 37.3% since January.

The company is optimistic about tourism and hopes that the campaign to immunise tourists will bring it back to pre-crisis levels. This gives rise to bold predictions about Q4's revenue: In October-December, it is expected that the revenue will reach $1.39-1.48 Billion. On average, analysts predict $1.44 trillion.

Important report details

-

Revenues - $2.2 Billion, +69.2%. Forecast - 2.05 Billion.

-

Forecast - 0.75 % return on stock

-

Net Profit - $834 Million, +280.8%

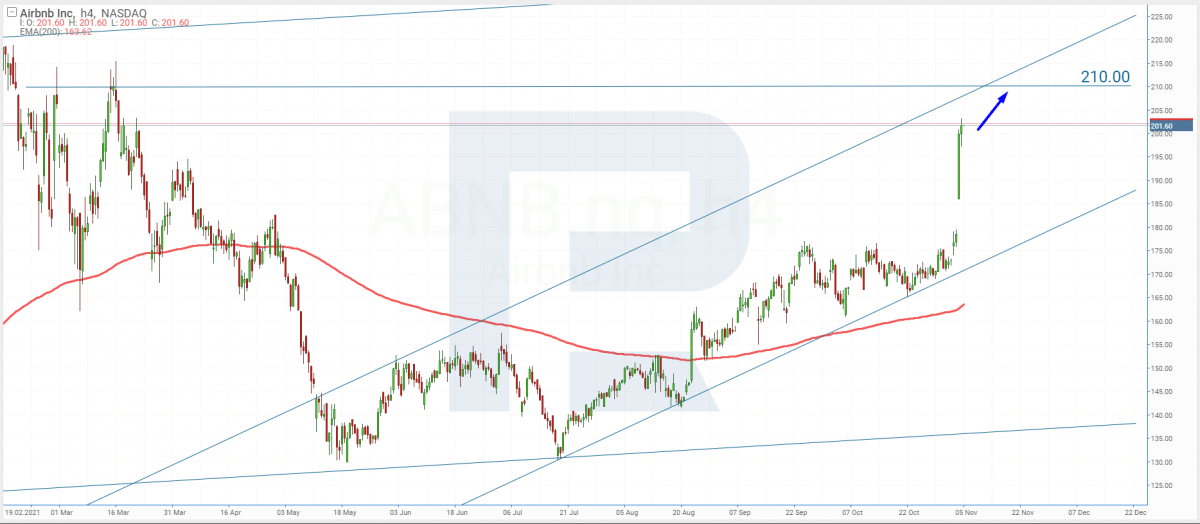

Maksim Artyomov, tech analysis of Airbnb shares

Traders and investors are optimistic, pushing Airbnb shares up to $210. The quotations continue to rise after the Q3 2021 report was published. The 200-days Moving Average will continue to rise so I am confident that the price will continue to climb.

The $210 goal is the closest to growth. The closest goal for growth is $210.

Uber reports Q3, 2021: Losses grow by two

All segments of Uber Technologies' business experienced growth between July and September. Revenue from food delivery increased by 92% to $2.24 Billion. Taxi - by 59% and $2.2 Billion respectively. Cargo delivery - by 40% and $402 Million.

The loss amount also increased to $2.4 billion. They were $1.09 billion last year, as you may recall. The company attributes the difference to the fall in the price of Didi corporation's share. The share in Zomato, Joby, Aurora and Joby has increased, decreasing the overall loss.

Uber Technologies lost $2.4 billion

Uber achieved positive EBITDA in its last quarter, which was a profit of $8 million. Nonetheless, a quarter ago it reported a loss sized $509 million. They expect that the company's revenue will reach $25-26 Billion in October-December, and EBITDA profit to be between $25-75 Million.

Uber Technologies (NYSE UBER) shares rose by 4.24% to $47.19 per share on November 5, the day following the publication of the quarterly report. The shares have dropped 7.5% since the start of the year.

Important report detail

-

Revenues - $4.8 Billion, +72%. Forecast - $4.42 Billion.

-

Stock loss - $1.28; +106.5%, forecast: $0.34

-

Net loss: $2.4 billion, +120%

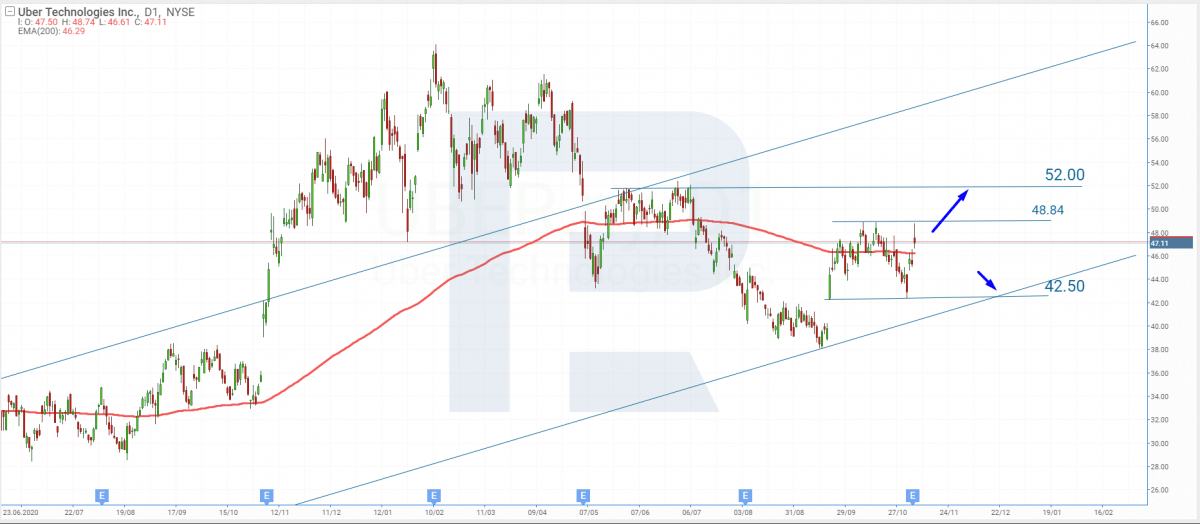

Maksim Artyomov, tech analysis of Uber shares

Uber quotes fell and nearly covered the gap in the opening trading session. The resistance level of $48.84 proved to be the stumbling block that the price could not overcome. If the quotes break through the 200-days MA, I believe that investors will soon regain their trust and position in the shares.

Breaking away from the resistance level of $48.84 will signal further growth, with $52 as the next goal. The share price could fall if the company's losses continue to grow. The support level of $42.3 will be the target in this scenario.

Summarising

Uber and Airbnb published their quarterly reports for July to September 2021 on November 4, 2018. The first report reported record revenue and profit, while Uber's second report showed a nearly doubled loss. Both corporations saw their shares grow by 12.98%, and 4.24%, respectively.

R Blog has more quarterly reports

-

Weak Forecast Dropped Moderna Shares

-

How did Pfizer shares react to the Q3 Report?

-

After Q3 performance was reported, Alphabet shares and Microsoft shares are growing

-

Tesla: All-Time High Quarterly Report, $1 Trillion Capitalization

--------------------

blog.roboforex.com/blog/2021/11/08/airbnb-and-uber-shares-are-growing-after-reports-for-q3-2021/

Did you miss our previous article...

https://11waystomakemoney.com/forex/xfisher-org-v1-vol-supr-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions