The quarterly report of Alibaba Group came in below Wall Street analysts' expectations for the second consecutive quarter. The corporation cannot stop the fall of shares by growing its quarterly revenue.

People were shocked to learn that Baidu and JD.com had been fined by the Chinese authorities for breaking the antimonopoly laws. Below are more details.

Alibaba Group reports for Q2, financial 2022: Net profit falls by 87%

Alibaba Group released its financial report for July-September 2021 on November 18, just before trading began in the NYSE. The market expected weaker results, as I mentioned above.

The number of active users for all products of the IT giant grew by 62,000,000 people to 1.238 Billion in Q2 financial 2022. 953 million of these users are Chinese, and 285 millions are non-Chinese.

Important report details

-

Revenues - $31.147 Billion, +29%; forecast - $22.05 Billion

-

Return on stock – $1.74; -38% forecast – $1.93

-

Net profit $0.52 billion, -87%.

Alibaba Group revenue department-wise

The report highlights the main business spheres of the Chinese company, including commerce, cloud computations and digital media and entertainment. The marketplace generated $26.6 billion in revenue for the company between July and September, 31% more than the same period in 2020.

Cloud storage revenue increased 33% to $3.1 billion. The $1.3 billion in revenue from digital media and entertainment was a 0.2% increase. Innovations generated 37% more revenue and reached $223 million.

Reactions to Alibaba Group shares

Alibaba Group's share price (NYSE: BABA), began falling one day before the publication of the quarterly report. On November 17th, the quotations fell by 4.07% to $161.58. The quotations were already down 11.3% to $143.6 by the time trades ended. The quotations continued to fall during the next trading session by 2.27%, dropping to $140.34. The shares have lost nearly 40% since the start of the year.

Chinese authorities penalize Alibaba for violating antimonopoly laws

China's main market regulator stated that Baidu, JD.com, and Alibaba had broken the law and would be fined. It is because 43 agreements were not reported by the tech companies between 2012 and 2021.

According to the regulator, Alibaba did not declare its purchase of AutoNavi, a cartographic and navigation company in 2014. The regulator also stated that Alibaba didn't declare the purchase of AutoNavi, a cartographic and navigation company, in 2014. This was in 2018. This was in 2018.

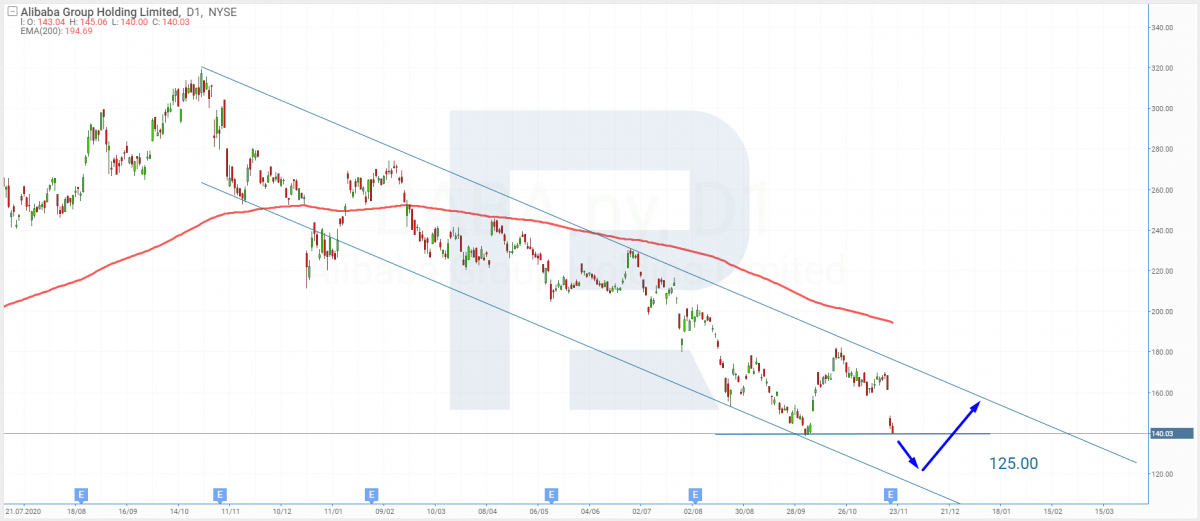

Maksim Artyomov - Tech analysis of Alibaba Group shares

The shares of the company have fallen following the poor financial report and the fines. D1 saw the quotations reach $140 support level. It is very likely that the quotations will test this level and continue falling.

The 200-days Moving average will also be a supporting signal. It is also in decline. The lower limit of the channel, at $125, could be the target of the decline.

Summarising

Alibaba Group, a Chinese IT giant, reported last week its financial results for Q2, financial 2022. Revenue increased by 29%, while profit fell by 87%. Experts believe that the main causes of the decline were falling consumer costs in China and growing competition, as well as changes to antimonopoly laws.

The latter was the reason why sellers had to sign an agreement with the trading platform forbidding them from using other platforms. Now, sellers can now spread their goods through all Chinese websites.

These statistics forced the company to revise its financial forecast for the current year. The growth of the estimated income was decreased from 29.5% down to 20-23%.

The company's weak forecast and report had a negative impact on the shares price. The shares of NYSE plunged by more than 11% last Thursday. The Chinese market regulator also fined the tech company Saturday for violating antimonopoly laws.

R Blog has more quarterly reports

-

NVIDIA Quarterly report made its shares sky-rocket

-

Walmart shares fall as quarterly profit falls

-

While Walt Disney's paid subscriptions are declining, shares also fall.

-

PayPal shares are falling due to Q3 report and Q4, 2021 forecast

--------------------

blog.roboforex.com/blog/2021/11/22/alibaba-shares-falling-after-quarterly-report-fines-pour-oil-to-fire/

Did you miss our previous article...

https://11waystomakemoney.com/forex/ipo-of-nu-holdings-ltd-a-neobank-from-south-america

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions