EUR/USD fell today amid the broad-based dollar strength. Market analysts explained the good performance of the US currency by rising US Treasury yields. As for macroeconomic reports released in the United States during Tuesday’s trading session, they were mixed.

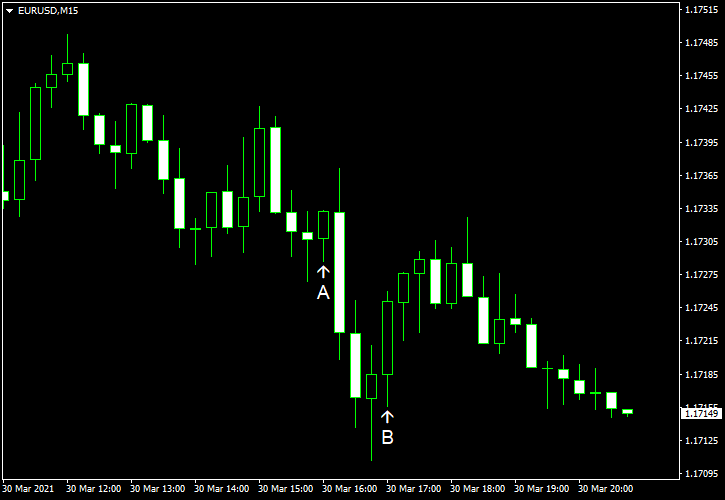

S&P/Case-Shiller home price index rose by 11.1% in January, year-on-year, more than in the previous month (10.2%) but less than analysts had predicted (11.4%). Month-on-month, the index gained by 0.9%. (Event A on the chart.)

Consumer confidence jumped to 109.7 in March from 90.4 in February, much more than analysts had predicted — 96.9. (Event A on the chart.)

On Friday, a couple of reports were released (not shown on the chart.):

Both personal income and spending dropped in February. Personal income fell by 7.1%, less than experts had predicted — 7.3%. Personal spending decreased by 1.0%, more than was forecast — 0.8%. The previous month’s gains got positive revisions from 10.0% to 10.1% for income and from 2.4% to 3.4%. Core PCE inflation was at 0.1%, matching expectations. The previous month’s value got a negative revision from 0.3% to 0.2%.

Michigan Sentiment Index climbed to 84.9 in March from 76.8 in February according to the revised estimate. That is compared with the median forecast of 83.6 and the preliminary figure of 83.0.

If you have any comments on the recent EUR/USD action, please reply using the form below.

---------------------------------

By: Vladimir Vyun

Title: EUR/USD Falls as US Dollar Strengthens

Sourced From: www.earnforex.com/blog/eur-usd-falls-as-us-dollar-strengthens/

Published Date: Tue, 30 Mar 2021 17:47:10 +0000

Read More

Did you miss our previous article...

https://11waystomakemoney.com/forex/gator-bs-trendretrace-forex-trading-strategy

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions