There are many companies that have been paying dividends since the beginning of time in the stock market. This is a good thing or a bad thing for investors. Let's find out.

Imagine that we find a company that pays 1 USD per dividend share, which is 2% yield per year. This investment is looking very risky considering the current inflation rate of 6%. The only thing that can make it worthwhile is for the shares to grow. How can we increase our dividend yield if the company doesn't plan to increase their share capital?

It is actually quite simple. You need to be able to spot the time when shares are falling while the dividend yield grows.

Here's an example. The shares in the company we are interested cost 100 USD. Annual dividends are 5 US dollars per share. This makes the company 5% profitable. The share price fluctuates, depending on market conditions and other factors.

Imagine that the quarterly report published by the issuer was inferior to forecasts made by experts. This is something that happens quite often. The shares plunged to 80 USD. You will get 6.25% if you purchase them at this price.

Do you know of any such shares? Yes, I do know of a company that you would be interested in.

This company is AT&T Inc.

History of AT&T Dividend Payments

AT&T has been increasing its dividend payouts every year since 1989. In 1898, they paid 13 per share. Now the amount is 2.02 USD. The yield is 9% per year with a share price of 23 USD

This is a remarkable yield for such a reliable and large company. Comparatively, Verizon Communications Inc. (NYSE : VZ), a rival to AT&T with a capitalization of $40 billion USD, pays 2.56 USD annually in dividends, which is 5.1% annual yield. T-Mobile US, Inc., (NASDAQ:TMUS), which has a smaller capitalization, does not pay any dividends.

What is the reason that AT&T's dividend yield has risen so much?

The average dividend yield has been at 5.5% since 2009 (with inflation below 2%). The share price has tripled in a decade.

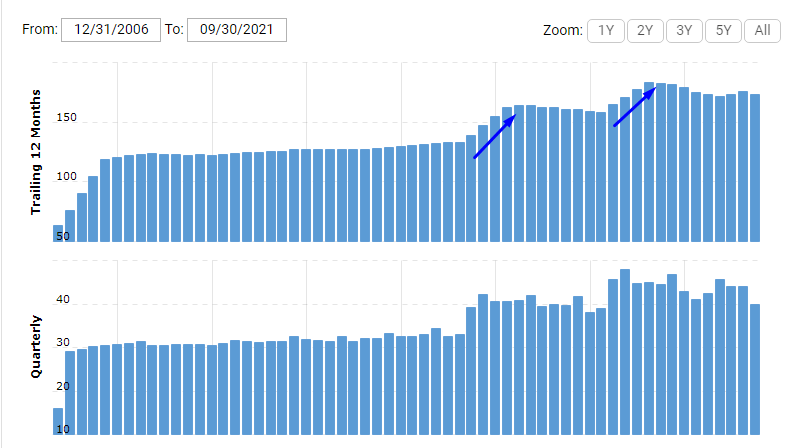

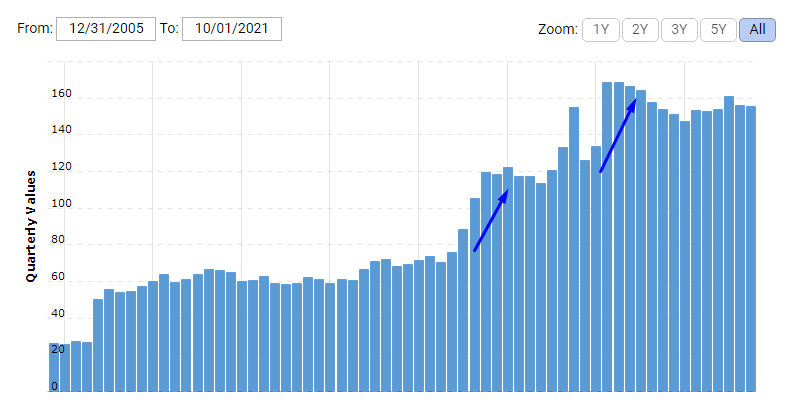

The profitability ratio has increased steadily since 2020 to a current 9%. The company must make money to maintain this level of dividend yield. Take a look at AT&T's revenue chart to see if the company is on the right track.

Growth of revenue in AT&T

2015 was the year of most notable growth. AT&T purchased DirecTV in 2015 for 49 billion dollars. 2018 saw the next wave in revenue growth when AT&T bought Time Warner for 85 Billion USD.

AT&T was a victim of these two mergers. The company began to move into the streaming market. However, AT&T is primarily associated with telecom.

The company was able to enter a new market, but it also had to pay the debts of the merger company. The chart also shows this: In 2015, the company's long-term debt grew by 60%, and by 30% in 2018.

Debts of AT&T growing

The company's share price dropped from 34 USD to 24 USD during the COVID-19 crisis. After that, a slow recovery occurred. Investors were less active in buying shares due to the large amount of debt. The shares did not reach their pre-crisis levels.

AT&T shares falling abruptly in January 2020

Although the shares may have traded at 34 USD a few months later, something prevented them from realizing their potential.

We heard in May 2021 that Warner Media, a multimedia division of AT&T, was going to be a separate company and would eventually merge with Discovery. AT&T began selling its assets.

The shares fell precipitously. They fell 15% in two days. The share price fell, but the dividend yield for those who purchased shares at a lower price increased.

How far can AT&T's shares fall?

You could buy AT&T shares in 2015, just before AT&T purchased DirecTV for 22 USD. The share price rose to 34 USD after Time Warner was purchased. Therefore, if AT&T leaves the media market, then the share price should return to the previous levels.

AT&T receives 70% of the new company by creating a subsidiary. It will still receive income but only as dividends. Therefore, if shares are priced at 22 USD they will be sold out.

The chart shows that the 2015 level is the current price of the quotes. The chart shows that the quotations are now at the level of 2015.

AT&T investing involves risks

The company might lose a portion of its income if it leaves the media market. This could lead to a decrease in dividends. Keep in mind, however, that the company's spending will decrease. AT&T will make a profit of 43 Billion USD from the merger of Warner Media & Discovery. This profit AT&T plans to use for paying off its debt.

Market players try to include expected events in their price. One example of this is AT&T's revenue falling. It is difficult to imagine when shares of AT&T will fall. While all the risks are already within the price, further falls cannot be completely excluded.

This is good news for the company

AT&T is acknowledging its mistakes and actively removing assets that are not related to its main business. It is cutting off Warner Media and selling Vrio, a Latin American satellite company, which was responsible for Playdemic games and the Crunchyroll animation platform. The company also sold a portion of its real estate simultaneously - this was done in order to optimize the business and focus on 5G development and telecom services.

These actions together will reduce the long-term debt by a significant amount and provide cash for development of the main company.

Global companies optimise their business

This is how the situation compares with General Motors Company (NYSE GM). It began closing down its plants around the world in 2019, and then spent all of its efforts on making electric cars. The shares then started to grow. This is how the company optimized its business and AT&T is doing it too.

Other large companies have also gotten rid of non-core assets.

General Electric Company (NYSE GE) announced that it will eliminate its airline and medical business to focus on energy projects.

Johnson & Johnson (NYSE : JNJ), claimed that it would cease making consumer goods and instead focus on its pharma business.

AT&T's actions look reasonable and it has the potential to catch up in telecom market.

Closing thoughts

Funds love dividend shares because they can manage billions of dollars, and the 9% yield is very impressive. Private investors love AT&T, but its share price is so slow compared to Apple (NASDAQ:AAPL), which makes it attractive for investors looking for dividend payments. This will only be a bonus if the share price rises.

I will be showing you the trades of hedge fund funds for Q3 2021 to confirm my previous statements. According to reports, 13F, fondy BlackRock Inc. and MILLENNIUM MANAGEMENT LTD together purchased 31 million AT&T shares. 200 additional funds also joined them.

AT&T is a good issuer if you're looking for a long-term investment in reliable companies with dividends.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/12/15/att-reliable-company-for-long-term-investments/

Did you miss our previous article...

https://11waystomakemoney.com/forex/prior-day-open-close-line-indicator-mt4

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions