Trend continuation setups may be traded together with a momentum breakout setup.

This type of strategy requires that you clearly identify both the trend and the market contraction phases that occur prior to breakouts. To be able to react more effectively when momentum breakouts occur, we should identify the support/resistance levels that must be broken.

This strategy shows us how to trade momentum breakouts in the direction the trend is heading using the Bollinger Bands 50 EMA and RSI.

50 Exponential Moving average

Moving averages are one of the most basic types technical indicators. These are easy tools that traders can use for identifying trend direction and possible trend reversals.

Traders can identify trend direction and trend bias by using moving average lines. This is done by looking at the price action relative to the moving average. Moving average lines tend to slope in the trend's direction. The slope of the moving median line can visually confirm or deny the trend direction.

Some moving average lines are more popular than others. They are used to indicate trend direction, based on different time horizons.

As a mid-term trend indicator, the 50-bar moving mean is widely accepted. Many traders trade in the direction indicated on the 50 moving average line.

Relative Strength Indice

Relative Strength Index (RSI), a type of oscillator technical indicator, is versatile. It is used primarily to identify overbought or oversold market conditions. It can also be used for identifying momentum and trend direction.

The RSI plots a line that oscillates between zero and 100. This line oscillates based upon historical price data, which shows the average price gain and loss.

The RSI range typically has markers at levels 30, 70 and 80. These markers indicate the levels of the RSI range that are oversold or overbought. A RSI below 30 indicates an oversold market. An RSI above 70 signifies an overbought marketplace. Both scenarios are prime conditions for a mean reversal. However, the RSI line could also stay above the 30 to 70 range if momentum is strongly moving in a particular direction. Although the RSI line may still indicate an oversold market or overbought market, this could be due to strong momentum breakout.

Many traders will also place a 50-level marker. This is used primarily to establish trend bias. In an uptrend market, the RSI line is usually above 50 and below 50 respectively. Some traders might also place markers at levels 45 or 55. In an uptrend market level 45 is a support level for RSI lines. Level 55, on the other hand, can be a resistance level to RSI in a downtrend.

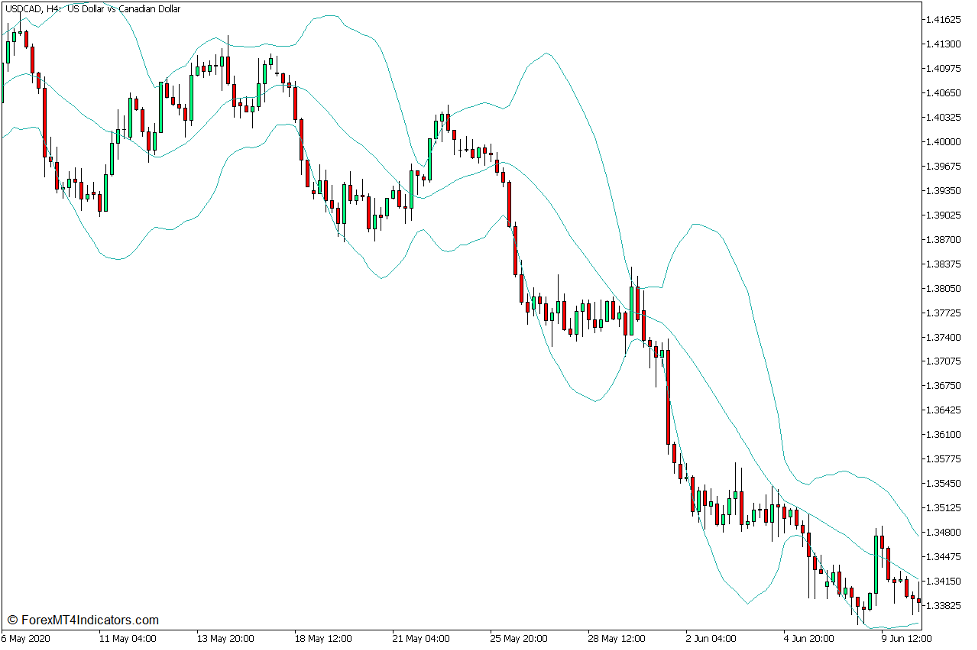

Bollinger Bands

Bollinger Bands can be used as a technical indicator. It can be used to indicate market conditions, overbought or oversold, and trend direction, volatility, and momentum.

Three lines are plotted by Bollinger Bands on the price chart. The 20-bar Simple Moving Average line (SMA) is the middle. The two outer bars that move above or below the middle line represent standard deviations from average prices.

The Bollinger Bands are a moving average line. This means that they can be used to indicate trend direction just like any other moving average line. In an uptrend market price action tends to be on the upper half the band, while it is on the lower half in a downtrend.

Because they are based upon standard deviations, the outer lines can be used visually to indicate volatility. The outer bands contract when volatility falls and expand when volatility is higher.

These outer lines are used primarily to determine overbought or oversold prices levels. The upper area is overbought and the lower area is oversold. The same outer lines can be used to identify strong momentum breakouts. The price action at the lines will determine which scenario is more favorable. A price rejection in the vicinity of the outer lines indicates a probable mean reverse, while strong momentum breakouts outside the outer lines arising from low volatility conditions is an indication of a probable strong momentum breakout.

Trading Strategy Concept

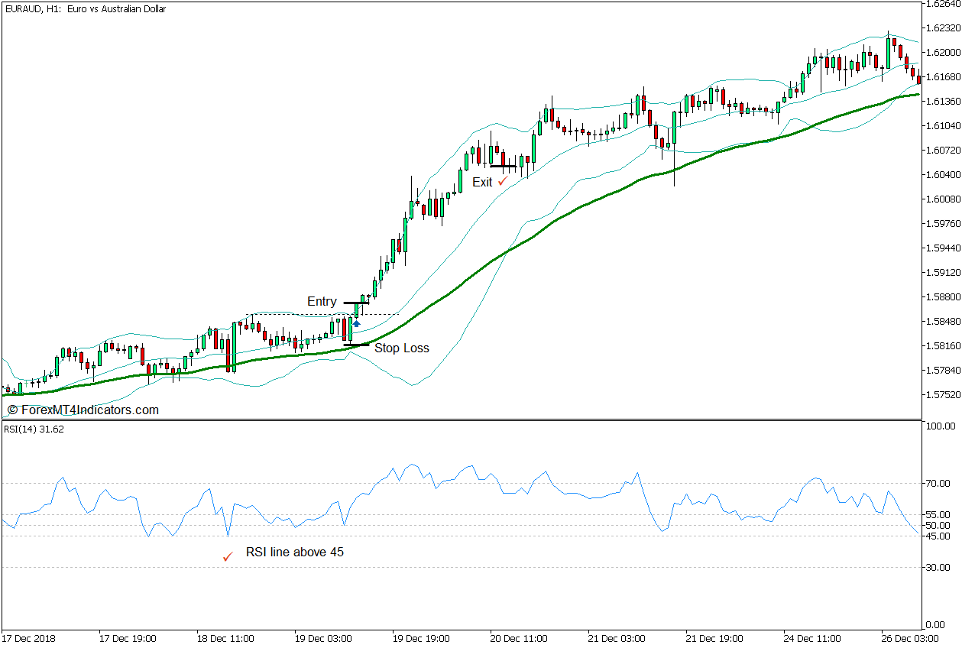

This strategy trades in confluence to the trend using the Bollinger Bands and 50 EMA lines, as well as the RSI.

As the main trend direction filter, the 50 EMA line serves as the primary one. Trades can only be made in the trend direction indicated on the 50 EMA Line.

As another layer of confirmation, we will use the RSI. This will be based upon the RSI line's general location relative to the markers at levels 45, 50, and 55.

The Bollinger Bands are then used to identify momentum breakouts during market contraction phases.

Trade Setup

Entry

-

The Bollinger Bands middle line should not be below the 50 EMA line.

-

The RSI should not fall below 45.

-

Bollinger Bands should be contracting.

-

Price action should be above the Bollinger Bands line at the top and the identified resistance line at the bottom.

-

On confirmation of these conditions, place a purchase order

Stop Loss

-

Place the stop loss on support below the entry candle.

Exit

-

If price action indicates a bearish reversal, close the trade immediately.

Setup for Trades

Entry

-

The Bollinger Bands' middle line should not be above the 50 EMA line.

-

The RSI should not rise above 55

-

Bollinger Bands should be contracting.

-

Price action should not exceed the lower Bollinger Bands and identified support lines.

-

On confirmation of these conditions, place a sale order

Stop Loss

-

Place the stop loss on resistance at the top of the entry candle.

Exit

-

If price action indicates a possible bullish trend reversal, close the trade immediately.

Conclusion

A good momentum breakout strategy is one that uses the Bollinger Bands. This strategy can be used in a market contraction phase. This strategy aligns the momentum breakout setup to the trend direction by using the RSI line and 50 EMA lines.

Forex Trading Strategy Installation Instructions

Bollinger Band Trend Direction Breakout Forex Trading Strategy is a combination Metatrader 5 (MT5) indicators and template.

This forex strategy aims to transform historical data and trading signals.

Bollinger Band Trend Direction Minute Breakout Forex Trading Strategy For MT5 allows you to spot patterns and peculiarities in price dynamics that are not visible to the naked eye.

This information allows traders to assume additional price movements and adjust their strategy accordingly.

Forex Metatrader 5 Trading Platform

-

Support available 24/7 by an international broker.

-

Over 12,000 assets, including Stocks, Indices, Forex.

-

Spreads and execution of orders are faster than ever with spreads starting at 0 pip.

-

Start depositing now to get a bonus of up to $50,000

-

Demo accounts are available to test trading strategies.

Step-by-Step RoboForex Trading Account Open Guide

How do you install Bollinger Band Trend Direction Breakout Forex Trading Strategy for the MT5?

-

Bollinger Band Trend Direction Momentum Breakout Forex Strategy for MT5.zip

-

*Copy the mq5 & ex5 files to your Metatrader Directory/experts /indicators /

-

Copy the tpl (Template) file to your Metatrader Directory/Templates

-

Your Metatrader client can be started or stopped.

-

Choose the Chart and Timeframe in which you would like to test your forex strategy

-

Right-click on your trading chart, hover over "Template",

-

You can now select Bollinger Band Trend direction Momentum Breakout Forex Trading Strategy MT5

-

Bollinger Band Trend Direction Momentum Breakout Forex Strategy for MT5 will be displayed on your Chart

*Note that not all forex strategies include mq5/ex5 files. Some templates can be integrated with the MT5 indicators from the MetaTrader Platform.

--------------------

www.forexmt4indicators.com/bollinger-band-trend-direction-momentum-breakout-forex-trading-strategy-for-mt5/?utm_source=rss&utm_medium=rss&utm_campaign=bollinger-band-trend-direction-momentum-breakout-forex-trading-strategy-for-mt5

Did you miss our previous article...

https://11waystomakemoney.com/forex/candlestick-combinations-japanese-candlesticks-indicator-for-the-mt4

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions