Human nature is to strive for better appearances and looks. Today, with the advancement of aesthetic medicine, there are more chances to succeed. This field of medicine has seen rapid growth in America and Western Europe since the 1960s. The technology and equipment for various dermatological procedures and plastic surgery have also advanced.

Candela Medical, Inc., a leading supplier of equipment in aesthetic medicine, plans an IPO at NASDAQ. Although shares of the company will begin trading on the following day (the ticker symbol "CDLA"), the IPO date has not been disclosed.

Today's article will discuss whether Candela shares might be of interest to investors.

Candela Medical, Inc.

This company has a long-standing business reputation. Candela was founded in 1970, with headquarters in Marlborough (Massachusetts). Candela currently employs nearly 900 people.

Candela Medical, Inc. is now the largest supplier of devices for aesthetic medicine. There are many uses for the company's products, including devices for laser microsurgery, dermatological platforms and Nordlys Multi-Application which can be used to treat different types of non-cancerous vascular injuries.

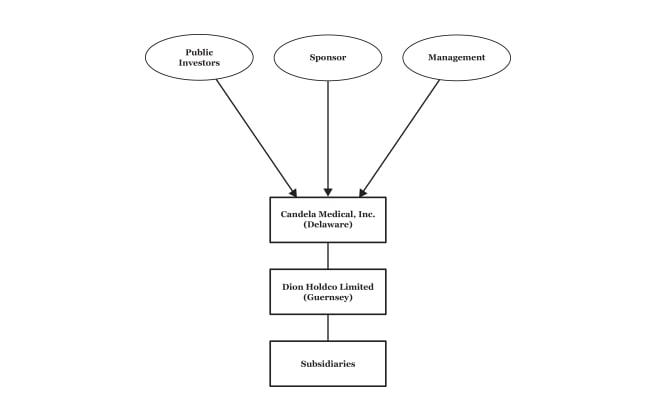

Business scheme of Candela Medical, Inc.

Candela was a company that had four mergers with Primaeva Medical and TransPharma Medical. It also created more than 80 unique tools. More than 130 patents have been registered by the company, and 55 others are currently in development. The company's equipment was used in 70 clinical trials.

Candela had sold 45 000 devices to 16000 clients worldwide as of the 30th June 2021. Candela's customer retention rate of 48% is significantly higher than that of its competitors. The company operates in 18 countries. Let's now take a closer look into the target market of the issuer.

Candela Medical, Inc.'s market share and competition

Experts believe the aesthetic market is growing rapidly. Markets&Research estimates that the global market for aesthetic equipment will reach $12 billion by 2021, and $25 billion by 2028. This growth rate is an average of 11%. Markets&Research predicts that more than 100 million cosmetic procedures and surgeries will be performed by 2021.

Aesthetic medicine market growth rate region-wise until 2028.

These are the key factors for expanding the target market:

-

Increasing demand for rejuvenation services as a result of increasing ageing in advanced economies.

-

The dominant generation of millennials has a higher demand for similar services.

-

The Asia-Pacific region is experiencing a rise in wellbeing and increased demand for services in aesthetic medicine.

-

Men are more interested in cosmetological services.

-

The number of doctors who offer services in aesthetic medicine is on the rise.

These are the key competitors of the company:

-

Cutera, Inc.

-

Medtronic

-

Abiomed

-

Axonics

-

Penumbra

Financial performance

Candela Medical makes the net profit when analyzing the financial performance of the company. This is why we will begin our analysis with this aspect.

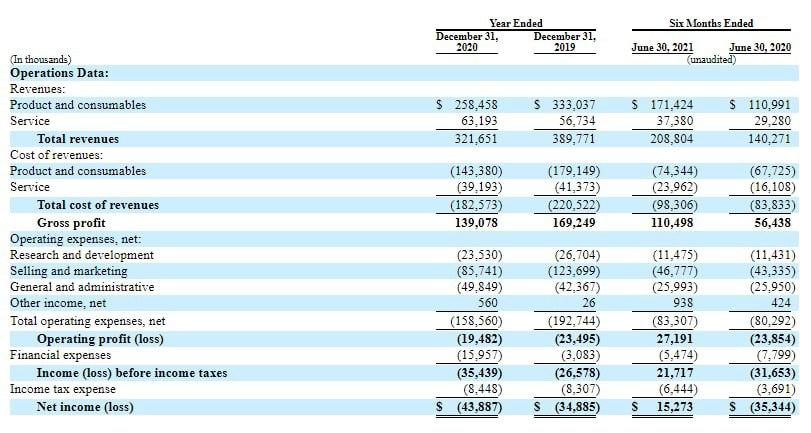

The company had a net loss in 2020 of $43.89million, which is a 25.79% increase over 2019. The net profit as of 30 June 2021 was $15.27million, compared to a loss of $35.34 million in the same period in 2020.

Candela Medical, Inc. financial performance.

According to the report, Candela's 2020 sales were $321.65million, which is a 17.48% decline relative to 2019. The company's revenue in the first two quarters of 2021 was $208.81million, which is 48.86% more than the same period in 2020. The indicator recorded $390.18 million in the 12 most recent calendar months.

This sum could reach $476.02 millions by 2021 if the current revenue growth rate is maintained. These readings show that the company is gradually recovering from the coronavirus crisis.

The company's cash and cash equivalents are $59.92m, and its total liabilities are $87.45m as of 30 June 2021. The company's negative cash flow is offset by its net profit.

Candela Medical, Inc. - Both the strong and weak side

Let's look at the business model of Candela Medical. Now let's see the strengths and weaknesses. The company's strengths are:

-

Since 1970, Flawless business reputation

-

Transnational business nature.

-

Customer loyalty is high

-

Sound management.

-

Net profit

The following are some of the risks associated with Candela shares:

-

Pandemic-related losses.

-

The company does not pay dividends.

-

There is fierce competition in this industry.

Information about Candela Medical, Inc. IPO and its capitalization estimation

Stifel, Nicolaus & Company, Incorporated, Oppenheimer & Co. Inc., Stephens Inc., R. Seelaus & Co., LLC, Canaccord Genuity LLC, Robert W. Baird & Co. are the underwriters for the IPO. Incorporated, Barclays Capital Inc., Goldman Sachs & Co. LLC, BofA Securities, Inc.

The company plans to sell 14.7million common shares during the IPO at a price of $16-18 each share. The IPO volume may reach $250 million if shares are sold at this price. Capitalization could be as high as $1.66 billion.

We use two multipliers to assess a company: the Price/to-Sales Ratio (P/S Ratio), and the Price/to-Earnings Ratio (P/E Ratio). The P/S value of the healthcare sector, which has such a rapidly growing target market, could be as high as 5.0 during lock-up.

The company has filed for an IPO at a price per share of 4.26. Potential upsides for shares could be as high as 17.38% (5/4.26*100%). The P/E value of the issuer is 246.78. This is a very high value considering Candela only recently made its first net profit.

This investment could be considered venture one if the underwriters fail to revise the IPO terms. This issuer is recommended for short-term speculative investment.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/12/21/ipo-of-candela-medical-inc-solutions-for-aesthetic-medicine/

Did you miss our previous article...

https://11waystomakemoney.com/forex/market-mode-discontinued-signal-lines-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions