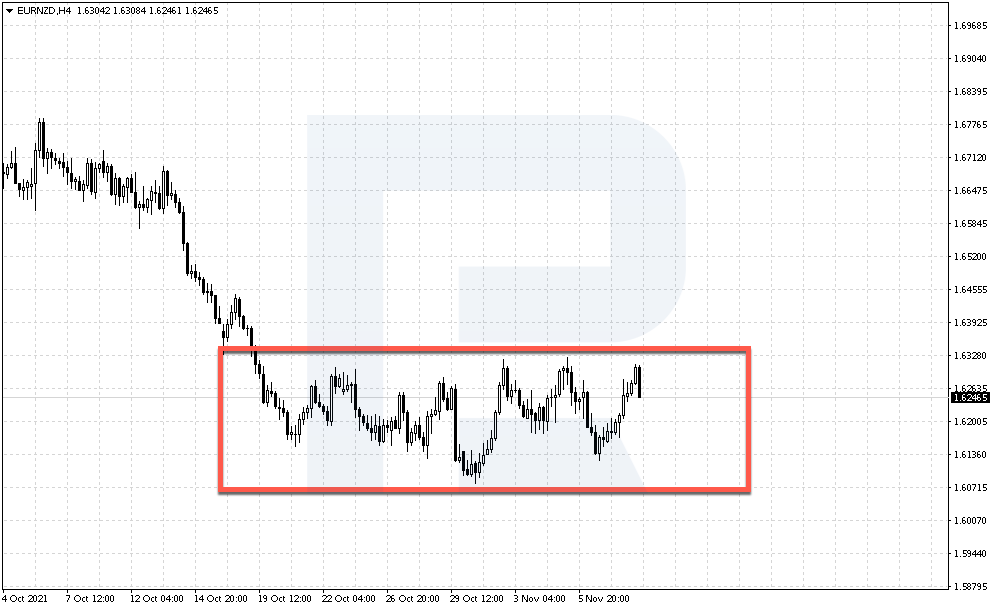

A price movement in a flat with a clear upper or lower border is an example of what a "channel" is in financial markets. In such cases, traders will look for price movements in a direction other than the channel's borders and assess the possibility of future price movements.

An example of a sideways movement in EUR/NZD

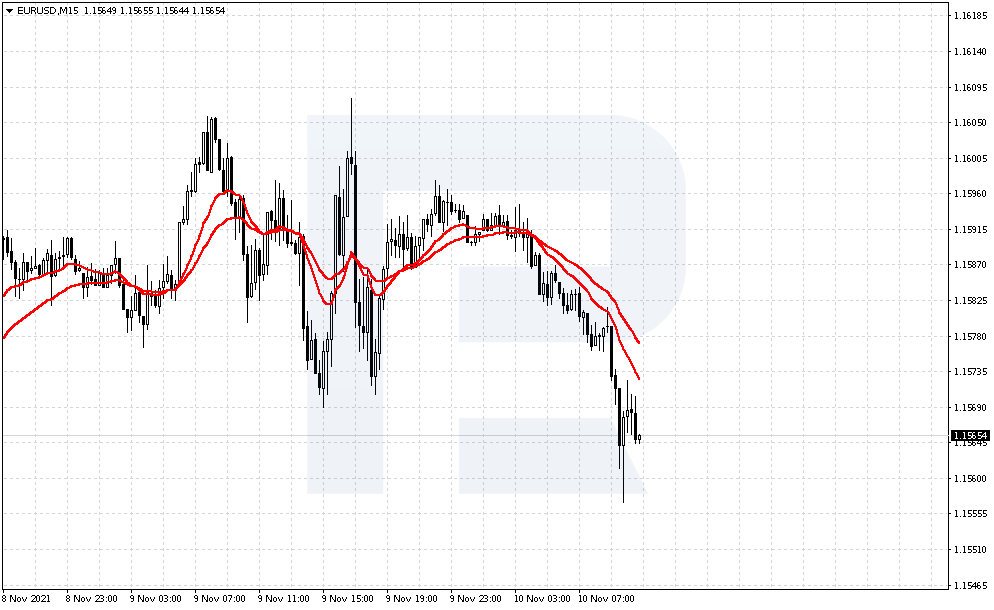

This range is set by Moving Averages in the Channel strategy. These are used to find the start of the trend, according to the strategy's authors. Only the trader needs to follow the rules.

Moving Averages on a EUR/USD chart

This article will show you how to spot such a channel in Moving averages and trade according to the trend for small timeframes that are just beginning.

Description of the Channel strategy

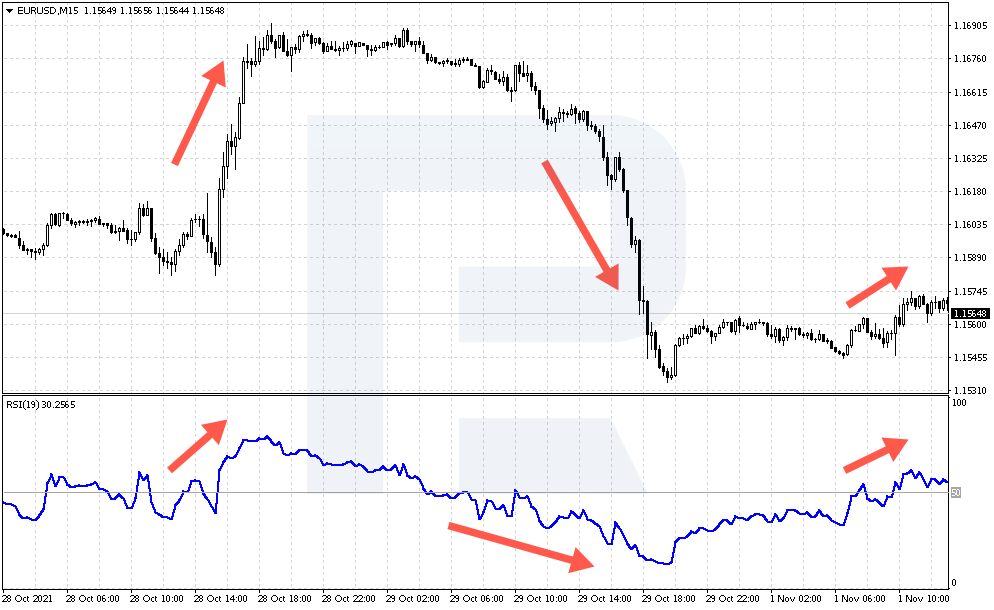

RSI is the foundation of this strategy. This oscillator shows the force and direction of the trend.

If the value of the indicator is higher than 50, it means that bulls are more powerful than bears and the price will likely go higher. The bearish trend will likely continue if the price falls below 50.

Investors believe that the combination of oscillators and trend indicators is best for trading.

RSI behavior

Two MAs are used to set the channel, out of four. These MAs can break away to signal the start of a trend. The two remaining MAs will indicate where to enter the market after the breakaway.

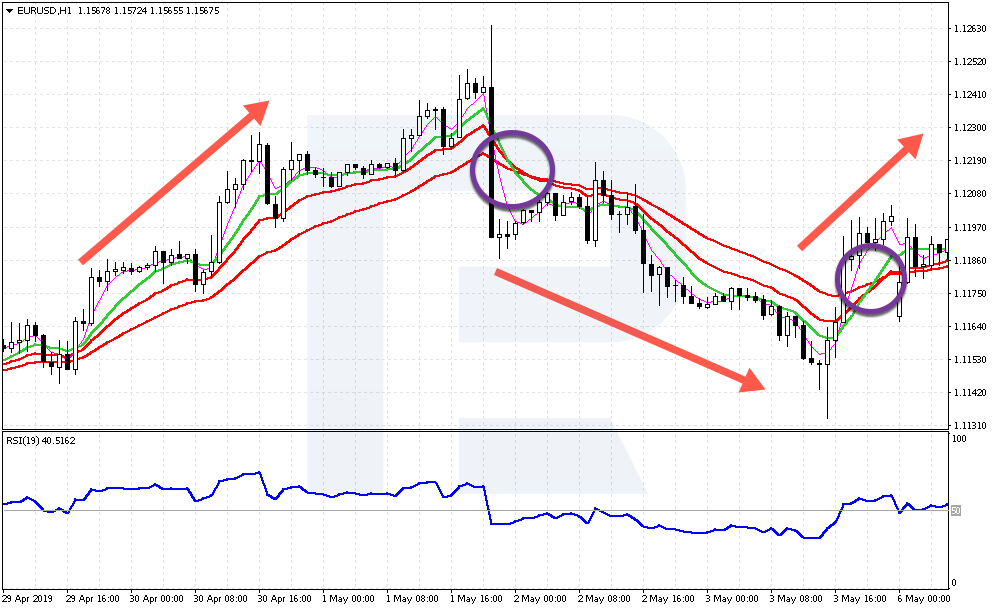

Price movement after receiving signals by the Channel

The strategy should be set up

Add all indicators to the chart for the instrument in order to create the strategy. Let's take a closer look at the parameters.

Add the MAs and configure them:

-

Exponential Moving Average, 16-color red

-

EMA, 30 also red.

-

Linear weighted MA (WMA), period 5, color pink.

-

WMA, period 12, color green

Add the oscillator.

-

Relative Strength indicator (RSI), period 19, add level 50.

MetaTrader 4 and MetaTrader 5 have standard built-in indicators that include Moving Averages, RSI and other useful indicators.

Trading is done on M15, but you can also use it for longer time frames such as M30 or H1. Channel is a short-term strategy that allows intraday trading. You can receive multiple signals throughout the day if you select M15.

The Channel's main advantage is that traders don't have to predict the direction of the price, but simply follow its movements.

This strategy can be somewhat compared with the Breaking Volatility strategy. Investors wait for maximum market activity and then form a channel that will provide an entry signal in case the market is quiet. This is an entirely different topic.

How to trade using the Channel

Wait for the red EMAs containing periods 16 and 30, to turn horizontal. Wait for the WMAs 5, 12 and 13 to cross the remaining lines. If the breakout occurs from above, it is a sign to buy as a bearish momentum has formed. You should also take a look at RSI's behavior: it must not exceed 50.

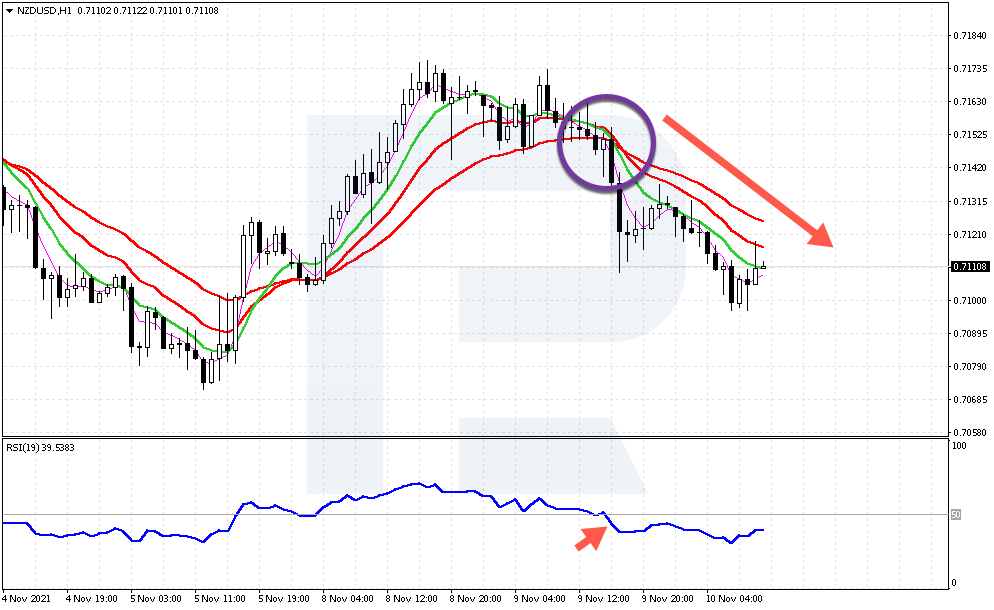

Signal to sell by the Channel

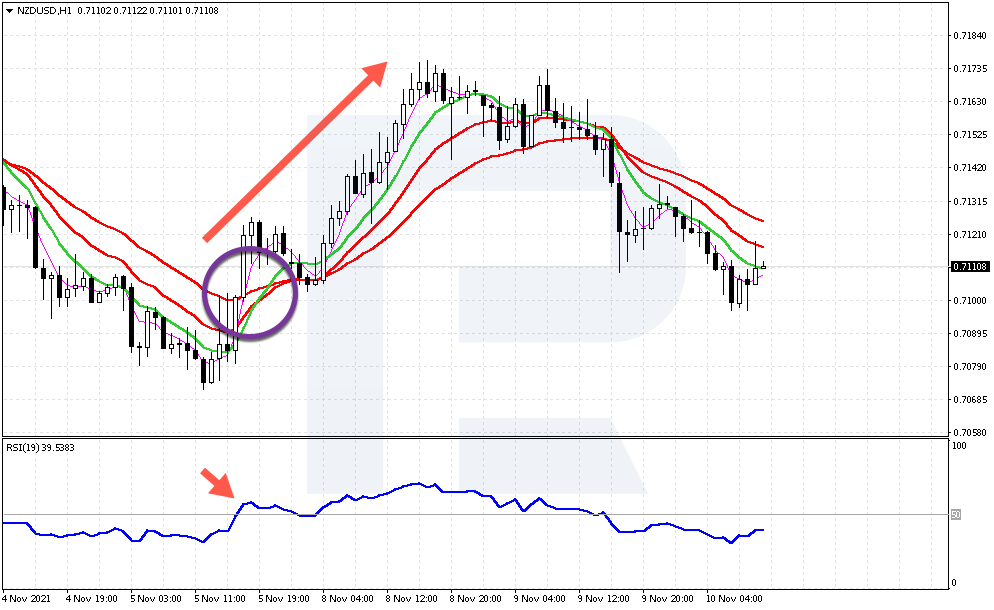

Buy if the EMA 16 or 30 lines are broken below. Then wait for a bullish trend to form. Always verify the RSI position. It must be at least 50. This will confirm any potential upward movement.

Signal to buy by the Channel

A buying and selling trade

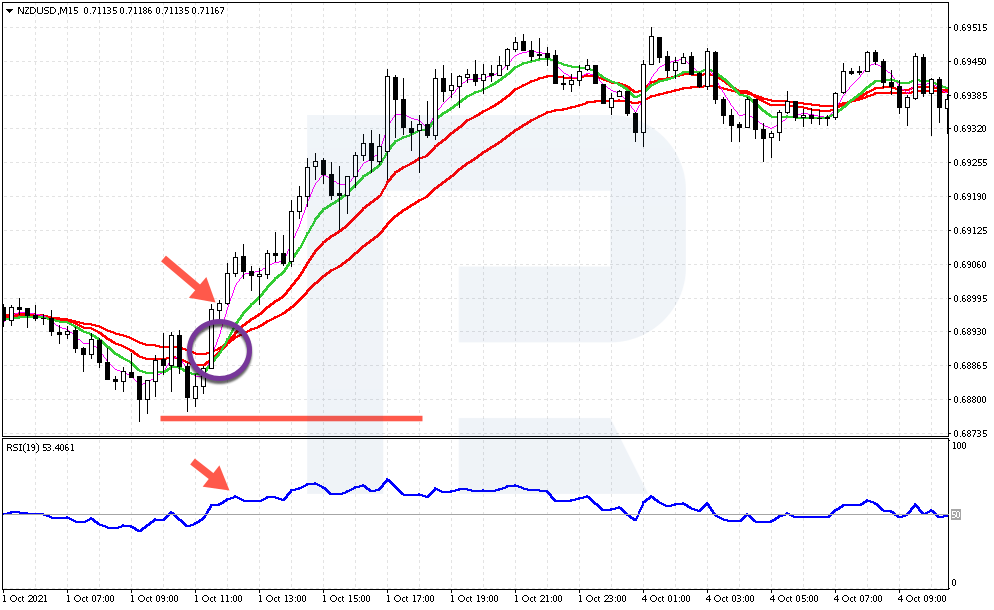

Take a look at an example buying trade using NZD/USD. The price falls below the EMAs, and tries to climb upwards. The price rises above the MAs after one more similar movement.

WMAs 5, 12 and 16 also broke through the main EMA 16, and 30 lines upwards. This signals that a buying position is open. In our case, the RSI is at 50.

Example of a buying trade by the Channel in NZD/USD

Strategy authors note that the WMA 5 fastest WMA crosses the red lines faster than WMA 12. This is a strong entry signal.

A buying position can be opened at 0.6898 in our example. We saw all crossings. The strategy doesn't include any Stop Loss rules, but it is too risky not to have it.

This will be behind 0.687575. This will be located behind 0.6875

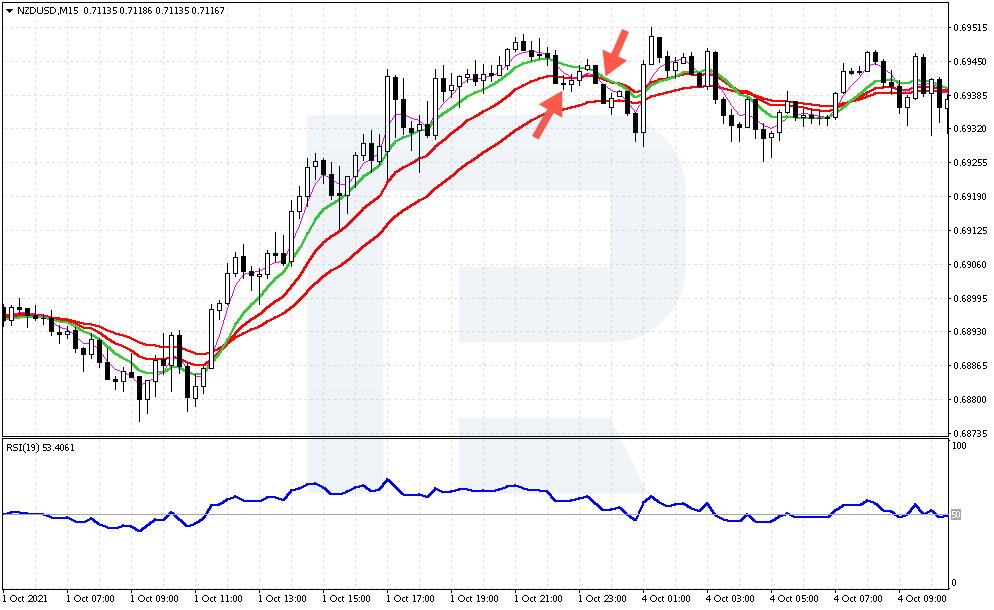

Example of closing a buying position by the Channel in NZD/USD

When the fast WMA crosses the red MA, close your position: either at a test or at a breakaway, be the candlestick downs

In this example, the maximum profit was 52 pip and the position closed with a profit 38 pip. The SL size was 20 pips. This was nearly 2 times the potential profit. This was in compliance with risk management rules, where the risk-to-profit ratio is recommended at 1:2.

Trade

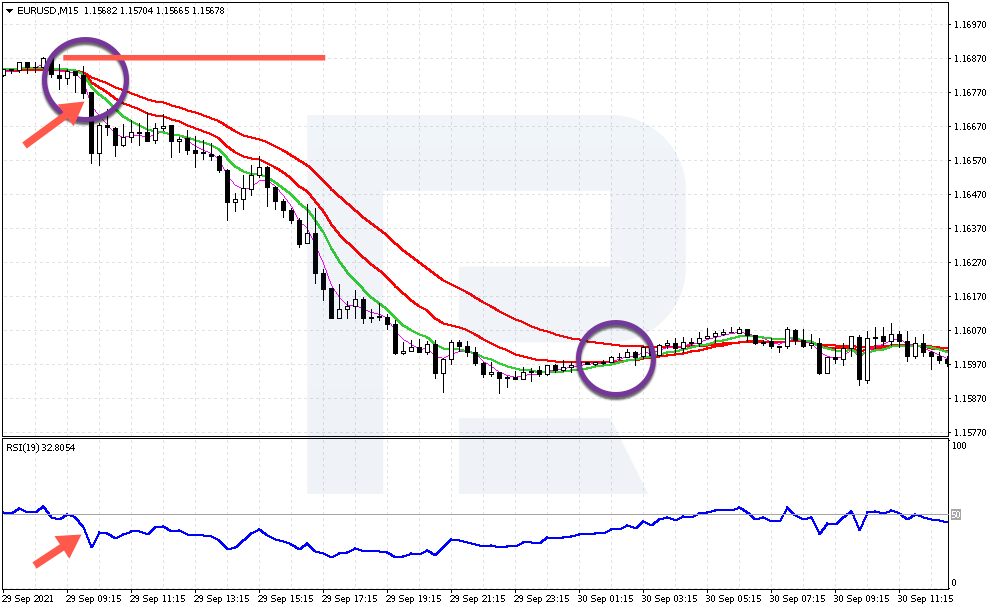

Let's now look at an example of a EUR/USD selling trade. For some time, the price has been in a sideways correction. The price reached a point where it broke through the red MAs and fell quite confidently. The candlestick closes below these lines.

Clear crossings of EMA 16 & 30 are evident, as well as a breakaway by WMA 5 & 12. RSI values below 50 are a signal to sell the EUR/USD pair at 1.1676.

Example of a selling trade by the Channel in EUR/USD

A SL is placed before crossing the lines at 1.1689 and above the high. This gives us a risk for 13 pip.

WMA 5 only broke the red line at 1.600. The profit could theoretically reach 76 pip. Maximum profit reached 88 pip. This example shows that the profit is many times greater than the risk.

Channel Advice for Trading

-

Remember that not all signals generated by the strategy will result in market results. Close your position if the price moves in the opposite direction and reverses.

-

The strategy might cause the market to get stuck in long flats. The price will break through the MAs, going up and down simultaneously. To minimize losses, you should place your SL at the entry level.

-

The distance between the red MAs could indicate the strength of the trend. A greater distance means that the impulse is stronger. A narrowed channel could indicate a trend reversal or a slowdown.

Bottom line

Channel trading is a combination of MAs over different periods. These signals can be used to identify a trend's beginning and allow traders to trade it, according the authors. The RSI oscillator, which filters signals from the strategy to ensure that investors do not open unconfirmed positions, provides additional signals.

The MA is a popular indicator that traders use to identify trends. It has some serious flaws. The lines can lag quite a lot and, in flats they can give false signals.

These drawbacks can be recognized by traders so they can freely use the Channel. Furthermore, M15 has very low risks.

--------------------

blog.roboforex.com/blog/2021/11/13/trading-by-channel-scalping-strategy/

Did you miss our previous article...

https://11waystomakemoney.com/forex/fib-sr-6-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions