Traders are often looking for highly precise strategies. We traders want to make money on all trades. We would like to be able to profit in all trades if possible. Trading strategies can have a high win rate but the reward-risk ratio will usually suffer.

There are traders that take a different approach. These traders are happy with a lower win rate, as long as there is a high reward-risk ratio. Most traders trade this way. Although traders may lose less than half the time, most would still make money if they were to profit.

Breakout strategies often have a high reward-risk ratio. Breakout strategies are designed to ensure that there is very little resistance after a level of support has been broken.

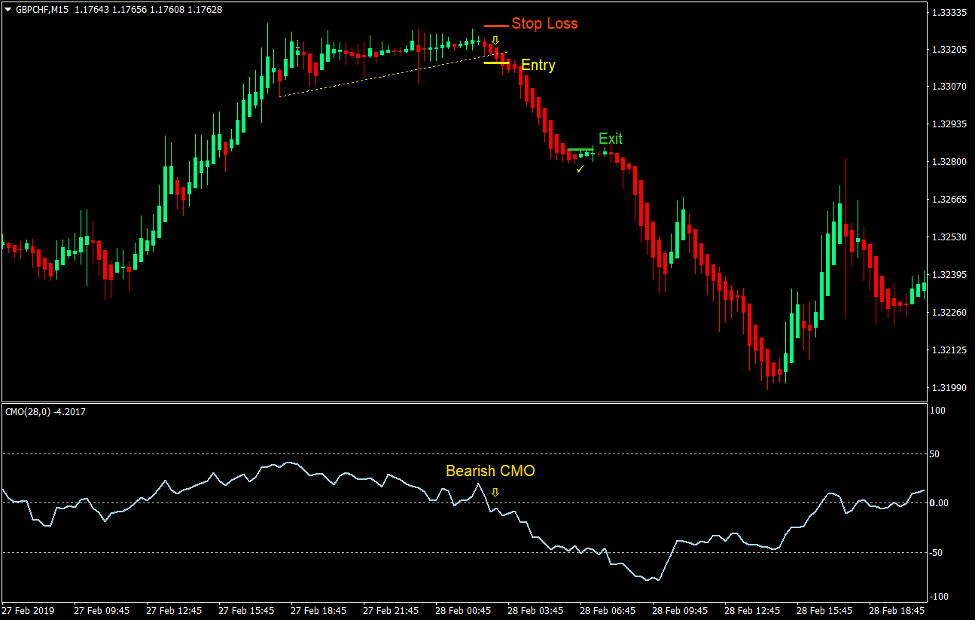

CMO Heiken Ashi Breakout Forex Trading Strategy allows for high reward-risk ratios. This strategy allows traders to make three times the profit than they risk by placing stop loss. Two technical indicators are used to confirm and identify a breakout that has caused momentum shift.

Heiken Ashi Candlesticks

The traditional Japanese candlestick has become the standard. This charting is the most widely used by traders. Because Japanese candlesticks are so simple, traders love them. This allows traders to see all the details based on the bars.

Another form of charting that the Japanese invented is Heiken Ashi Candlesticks. Heiken Ashi is simply "average bars" in Japanese. Although it still uses candlesticks to show price movement, it also considers the average price movement.

Heiken Ashi Candlesticks are an indicator that modifies both the open and closed bars to show the average price movement. The candle's highs and lowest points remain constant. This allows traders to view price action based upon the highs and lowests of each candle. However, the candlestick's color can change when the average price movement reverses.

CMO, or Chande Momentum Oscillator, is a technical momentum indicator that helps to determine the direction and movement of prices.

This is done by taking the difference between all the most recent higher closes, and all the most recent lower closes. Divide the difference by the total price movement for a period. To normalize the numbers within the range of 100 to 100, the result is multiplied with 100.

The CMO is shown as an oscillator in its own indicator window. It is shown as a line moving within the range of 100 to 100. There are also markers at 50, 0 and fifty. A CMO line that pierces beyond 50 and 50 may indicate an overextended price, which could signal a trend reversal. CMO lines that are positive generally signify a bullish trend bias. CMO lines that are negative generally signify a bearish tendency bias.

Trading Strategy

This breakout strategy trades on breakouts that occur from diagonal supports or resistances. To confirm momentum, it uses the Heiken Ashi Candlesticks as well as the CMO indicator.

This strategy is best traded by traders who first identify a diagonal resistance or support line during a market contraction phase. Then, we wait for the price to break through the resistance or support line with strong momentum.

The CMO indicator will then confirm the momentum shift, based on crossing the CMO line above its midline.

Based on the color of your breakout candle, the Heiken Ashi Candlesticks will confirm that the breakout has occurred.

We then place a stop order at the high or low Heiken Ashi Candlestick breakout pattern. Price breaking the Heiken Ashi Candlestick's high or low will confirm that there is momentum. The stop entry order would then have been activated.

Indicators:

Prefer Time Frames: HTML1 _____

Currency pairs: FX majors and minors as well as crosses

Forex Sessions: Tokyo sessions.

Trade Setup

Entry

-

It is important to identify a diagonal resistance line.

-

The diagonal resistance line should be crossed and the price should fall.

-

Spring green should be used for the Heiken Ashi Candlestick.

-

The CMO line should not cross zero.

-

Place a stop-buy order at the top of the Heiken Ashi Candlestick

Stop Loss

-

Place the stop loss for the fractal under the entry candle.

Exit

-

Keep the Stop Loss Two Heiken Ashi Candlestick in front of the current bar, until you are out of profit.

-

When the Heiken Ashi Candlestick turns to red, close the trade

Setup for Trades

Entry

-

It is important to identify a diagonal support line.

-

The diagonal support line should be broken if the price is below it.

-

Red should be used for the Heiken Ashi Candlestick.

-

The CMO line should not cross zero.

-

Place a stop-sold order at the low Heiken Ashi Candlestick

Stop Loss

-

Place the stop loss on fractals above the entry candle.

Exit

-

Keep the Stop Loss Two Heiken Ashi Candlestick in front of the current bar, until you are out of profit.

-

When the Heiken Ashi Candlestick turns to spring green, close the trade.

Conclusion

This strategy is a great breakout strategy. It confirms the momentum shift that has occurred since the breakout.

This strategy can be used with pattern trading. This strategy could be used to breakout from a flag pattern or reversals of wedge patterns. It can also be used to breakout from a box market congestion.

This strategy would be very beneficial to traders who can identify high probability support or resistances.

Forex Trading Strategy Installation Instructions

CMO Heiken Ashi Breakout Forex Trading Strategy combines Metatrader 4(MT4) indicator(s), and template.

This forex strategy aims to transform historical data and trading signals.

CMO Heiken Akshi Breakout Forex Trading Strategy allows you to spot patterns and peculiarities in price dynamics that are not visible to the naked eye.

This information allows traders to assume additional price movements and adjust their strategy accordingly.

Forex Metatrader 4 Trading Platform

-

Support available 24/7 by an international broker.

-

Over 12,000 assets, including Stocks, Indices, Forex.

-

Spreads and execution of orders are faster than ever with spreads starting at 0 pip.

-

Start depositing now to get a bonus of up to $50,000

-

Demo accounts are available to test trading strategies.

Step-by-Step RoboForex Trading Account Open Guide

How do you install CMO Heiken Ashi Breakout Forex trading strategy?

-

Get CMO Heiken Ashi Breakout Forex Strategy.zip

-

*Copy the mq4 & ex4 files to your Metatrader Directory/experts /indicators /

-

Copy the tpl (Template) file to your Metatrader Directory/ templates

-

Your Metatrader client can be started or stopped.

-

Choose the Chart and Timeframe in which you would like to test your forex strategy

-

Right-click on your trading chart, hover over "Template",

-

CMO Heiken Ashi Breakout Forex trading strategy is now available

-

CMO Heiken Ashi Breakout Forex trading strategy is now available on your Chart

*Note that not all forex strategies include mq4/ex4 files. Some templates can be integrated with the MT4 indicators from the MetaTrader Platform.

--------------------

www.forexmt4indicators.com/cmo-heiken-ashi-breakout-forex-trading-strategy/?utm_source=rss&utm_medium=rss&utm_campaign=cmo-heiken-ashi-breakout-forex-trading-strategy

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions