Forex trading doesn't have to be complicated. It is best to keep it simple, but still be effective when trading forex.

Many traders believe that a complicated trading system will make a trade setup work. This can lead to a false sense of security. Although there are many strategies that work, it is possible to make a strategy too complicated. Sometimes, even though a complex strategy may have an advantage, it can often filter out the best opportunities that are available to you. This can lead traders to trades that aren't part of their strategy just out of boredom. Despite how complex a strategy may be, not all trades will prove profitable. Sometimes, a trade setup that was not profitable can cause a huge mental and emotional drain on traders.

Sometimes simplicity is better. Crossover strategies are one of the most basic types of trading strategies. This strategy provides clear entry points and exit points that beginners can follow. Traders may be consistently profitable if they use the correct moving average.

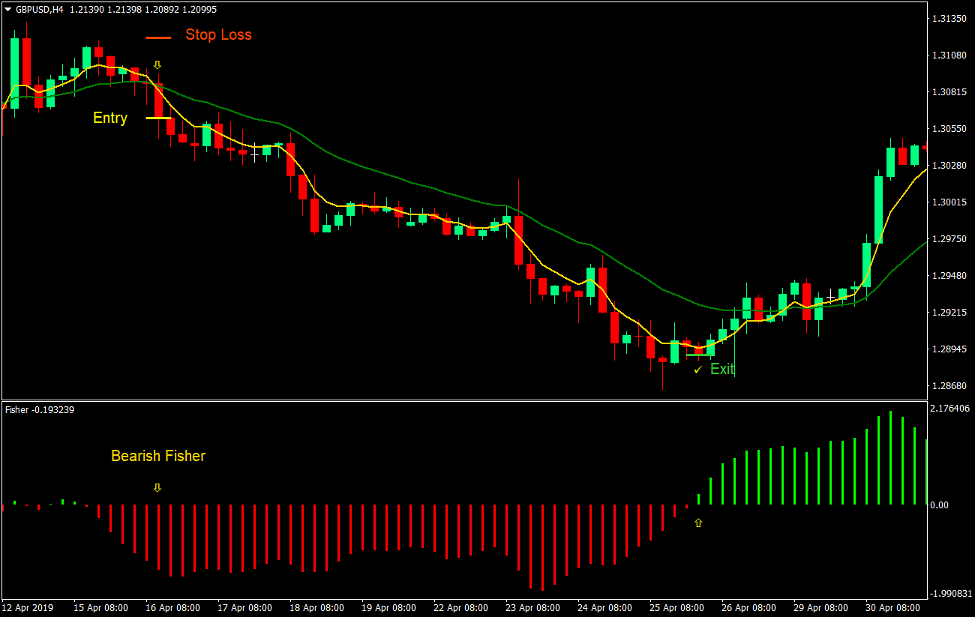

Fisher Cross Forex Trading Strategy - This is a simple strategy that uses the confluence between the Fisher indicator, and a moving average crossover.

The Fisher indicator, a technical indicator that helps traders to identify trends or biases, is called the Fisher indicator. It is an oscillating indicator that plots bars oscillating around the zero-point.

This indicator converts historical price movements to a Gaussian normal distribution. This allows the indicator identify the average price movement, whether price has moved to extremes or is in reverse of its current direction bias.

This Fisher indicator's version is shown as bars. The bars form waves that oscillate between zero and one, similar to the cyclical price movement. Colored lime, positive bars indicate a bullish directional bias. Negative bars are marked with a red color and signify a bearish bias.

The Fisher indicator can be used as either a trend filter, or an entry signal. The indicator can be used to filter traders from trading in the opposite direction of the current trend direction. Traders could use the crossing of the bars from positive to negative or vice versa, as an indicator of a trend reversal.

Trading Strategy

This strategy uses the Fisher indicator to trade with confluences.

The Fisher indicator is used as an indicator to determine if the market is on the verge of reversing. This indicator is based upon the shifting of the bars above zero and the changing color of the bar. This indicator has a lower lag and predicts trend reversals before the actual price action reverses. This indicator is a good indicator for early trend reversal.

We would still need to wait for price action before we can confirm that the trend has reversed. While some traders can spot trend reversals from a naked chart, this is more difficult for novice traders. Here is where the moving-average crossover comes in.

This setup uses a 20-bar Exponential moving average (EMA) and a 5 bar Exponential moving average (EMA). The price action tends to be closely embraced by the 5 EMA. This line represents the short-term price movements. The 20 EMA line can be used to indicate the trend in either the short- or medium-term. This is the signal moving average line that price action should cross. Many traders trade based upon the crossing of price action above the 20 EMA line. Sometimes, however, prices may move in a different direction than the moving averages. Trend reversal is confirmed by crossing the 5 EMA line above the 20 EMA. This would be our entry signal.

Indicators:

-

5 EMA (goldline)

-

20 EMA (green line)

Prefer Time Frames: 15-minute to 30-minute, 1-hour and 4-hour respectively. Daily charts

Currency pairs: FX majors and minors as well as crosses

Forex Sessions: Tokyo sessions.

Trade Setup

Entry

-

The Fisher indicator bars must cross over zero to start printing lime positive bars.

-

The 5 EMA line should be above the 20 EMA lines.

-

These bullish signals need to be closely aligned.

-

On confirmation of the conditions, enter a purchase order.

Stop Loss

-

Place the stop loss at the lower end of the entry candle.

Exit

-

When the Fisher indicator bar crosses below zero, and prints red bars, close the trade.

-

When the 5 EMA line crosses under the 20 EMA, close the trade.

Setup for Trades

Entry

-

The Fisher indicator bars must cross below zero to start printing red positive bars.

-

The 5 EMA line should not cross the 20 EMA lines.

-

These bearish signals need to be closely aligned.

-

On confirmation of the conditions, enter a sale order

Stop Loss

-

Place the stop loss on your swing at the top of the entry candle.

Exit

-

When the Fisher indicator bar crosses over zero, close the trade and prints lime bars

-

When the 5 EMA line crosses over the 20 EMA, close the trade.

Conclusion

The Fisher indicator is an excellent indicator of trend reversals. The indicator is based upon the Gaussian normal distribution and tends to be more accurate in predicting trend reversals than it is in lagging. We should be able to confirm the trend reversal predicted by the Fisher indicator and we should be able to get high quality trades.

This strategy should not be used as a single signal. It should be used in conjunction with other signals that have a longer timeframe. This strategy could be used by traders to identify potential trend reversal zones and make an accurate entry.

Forex Trading Strategy Installation Instructions

Fisher Cross Forex Trading Strategy combines Metatrader 4 (MT4) indicators and a template.

This forex strategy aims to transform historical data and trading signals.

The Fisher Cross Forex Trading Strategy allows you to spot patterns and peculiarities in price dynamics that are not visible to the naked eye.

This information allows traders to assume additional price movements and adjust their strategy accordingly.

Forex Metatrader 4 Trading Platform

-

Support available 24/7 by an international broker.

-

Over 12,000 assets, including Stocks, Indices, Forex.

-

Spreads and execution of orders are faster than ever with spreads starting at 0 pip.

-

Start depositing now to get a bonus of up to $50,000

-

Demo accounts are available to test trading strategies.

Step-by-Step RoboForex Trading Account Open Guide

How do I install the Fisher Cross Forex Trading Strategy?

-

Fisher Cross Forex Trading Strategy.zip

-

*Copy the mq4 & ex4 files to your Metatrader Directory/experts /indicators /

-

Copy the tpl (Template) file to your Metatrader Directory/Templates

-

Your Metatrader client can be started or stopped.

-

Choose the Chart and Timeframe in which you would like to test your forex strategy

-

Right-click on your trading chart, hover over "Template",

-

You can now select Fisher Cross Forex Trading Strategy

-

On your Chart, you will see that Fisher Cross Forex Trading Strategy is accessible

*Note that not all forex strategies include mq4/ex4 files. Some templates can be integrated with the MT4 indicators from the MetaTrader Platform.

--------------------

www.forexmt4indicators.com/fisher-cross-forex-trading-strategy/?utm_source=rss&utm_medium=rss&utm_campaign=fisher-cross-forex-trading-strategy

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions