Traders today seem to be split into two groups: those who use indicators and those who trade using price action or candlestick patterns. Both sides think their method is superior. Some believe their method is the best way to trade the market profitably.

On the one hand, there are traders who use technical indicator. These traders believe that technical indicators give traders clarity which is difficult for many traders. They are able to see things that they wouldn't have seen if trading on a plain chart. This also provides objective, mathematically based criteria to take a trade. This allows traders the ability to filter trades that don't meet their standards. This eliminates the need to make subjective decisions that are susceptible to fear and greed. It allows traders to trade algorithmically and only take trades if certain criteria are met by technical indicators.

Naked chart traders are at the opposite end of the spectrum. These traders believe technical indicators are slow and produce less results than a naked charts. These traders believe that all information can be seen on a naked chart, and that price is enough to make a trade. They trade on candlestick patterns and price action, swing high/swing low patterns, support and resists, and other similar indicators.

While traders may trade based on one or the other, there are ways to combine them. Trades can be made based on technical indicators and price action. Trade signals for Precision Triangulated Crossover Forex Trading Strategy are based on a combination of technical indicators signals and price action.

Awesome Oscillator

The Awesome Oscillator is a technical indicator that follows trends. It is an oscillating indicator that measures market momentum.

It calculates market momentum by computing the difference between two moving averages. Awesome Oscillator uses a 5-period Simple Moving Averages (SMA) as well as a 34-period Simple Moving Averages (SMA).

It shows the same difference as histograms bars. Negative bars signify a bearish trend, while positive bars indicate a bullish one. Negative bars signify a weakening bullish tendency, while positive green bars indicate a stronger bullish trend. Negative red bars signify a strengthening bearish tendency, while positive red bars signify a weakening bearish tend.

The Awesome Oscillator can be used to predict possible trend reversals or confirm trend direction. Trades can be filtered by trend direction by identifying whether bars are positive or negatively. The crossing of bars from negative to positively or vice versa could indicate possible trend reversals.

Triangulated moving average

Triangulated Moving Average is a modified version a moving average. It is similar to most moving averages. It shows trend direction by identifying the average price over a specific number of data points. It is unique in comparison to most moving averages, as it is much smoother than other versions.

TMA was created to provide a smoother moving mean. TMA averages out the price twice. TMA takes the simple SMA (Simple Moving Average) and averages it twice. This smoothens the moving average line. This results in a very smooth moving average line, which is less vulnerable to volatility and market spikes but could also be slower.

Trading Strategy

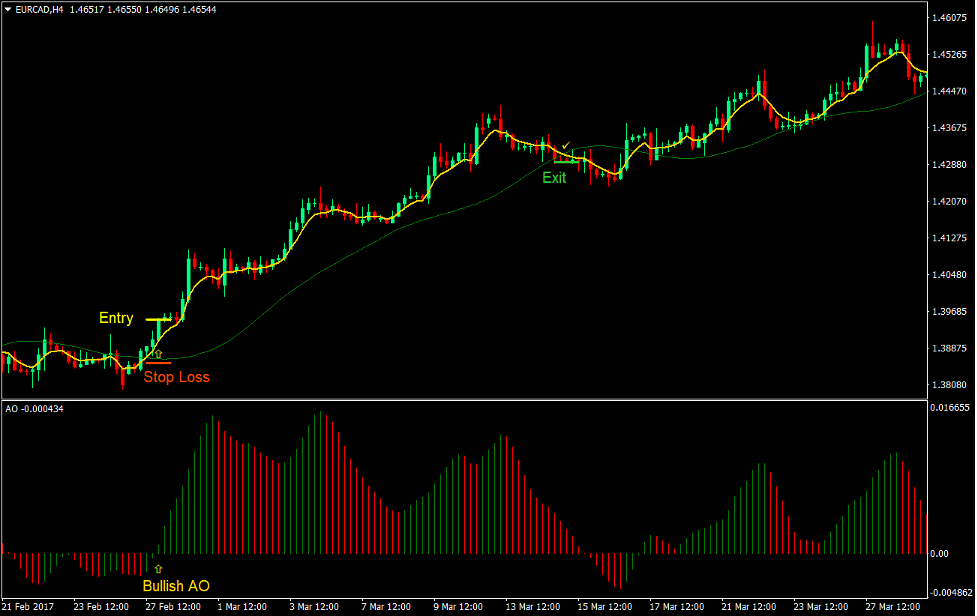

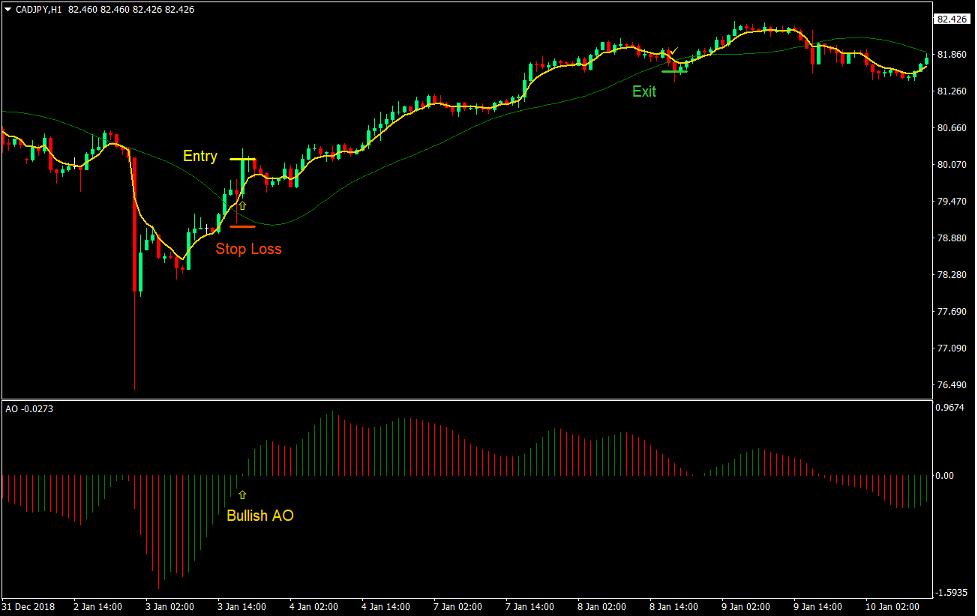

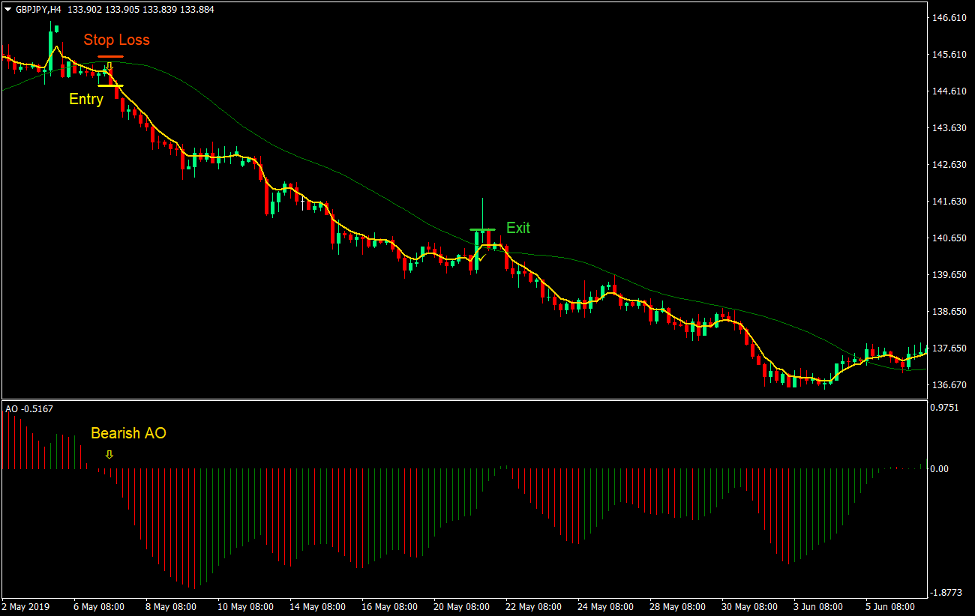

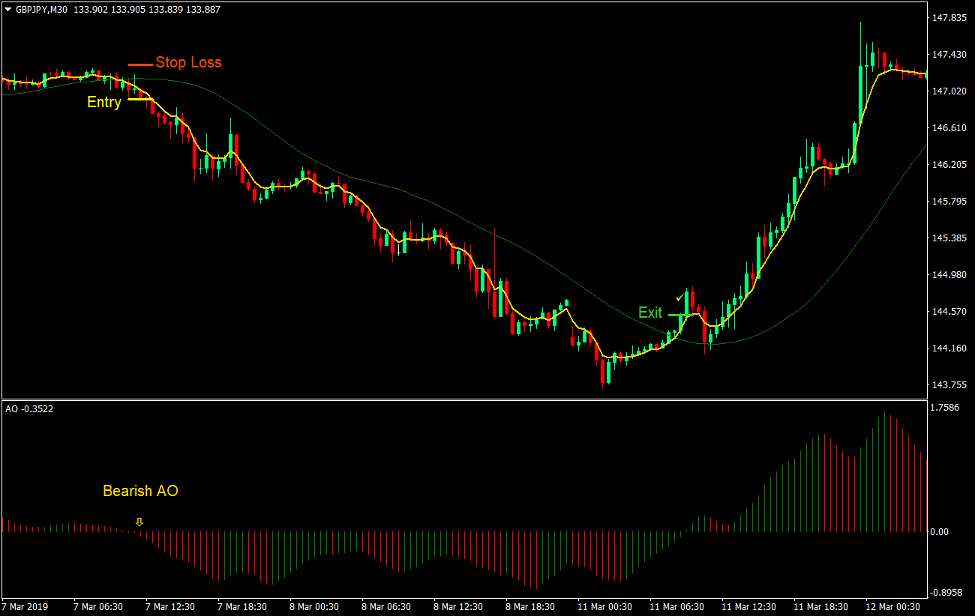

This simple trading strategy provides trade signals based upon the crossing of an Exponential Moving Average line (EMA) and a TMA Line. It is confluent with a trend reversal sign from an Awesome Oscillator, and is confirmed price action.

First, the EMA (gold) line should cross the TMA (green). This would indicate a possible trend reversal.

The Awesome Oscillator will confirm the trend reversal. This is achieved by crossing its bars from negative into positive or vice versa.

Price action should also confirm that the trend is changing. The price candles should be pushing against the TMA lines when the moving average lines cross. This would indicate that the price has retraced towards the TMA line, only to then reject it. A momentum candle or an engulfing candle will then appear to confirm the trend reversal.

Indicators:

-

TMA

-

EMA (Gold).

-

Awesome (default setting)

Prefer Time Frames: 30-minutes, 1-hour, 4 hours and daily charts

Currency pairs: FX majors and minors as well as crosses

Forex Sessions: Tokyo sessions.

Trade Setup

Entry

-

The EMA (gold) line should be above the TMA (green).

-

The Awesome Oscillator bars should be above zero

-

Prices should not move away from the TMA line.

-

Bullish momentum or engulfing are expected to occur.

-

After you have confirmed the conditions, place a purchase order.

Stop Loss

-

Place the stop loss below TMA.

Exit

-

When the EMA line crosses under the TMA line, close the trade.

Setup for Trades

Entry

-

The EMA (gold) line should be below the TMA (green).

-

The Awesome Oscillator bars should not be below zero

-

Prices should not move away from the TMA line.

-

You should expect a bearish momentum or engulfing to occur.

-

After you have confirmed the conditions, place a sale order.

Stop Loss

-

Place the stop loss at the TMA line.

Exit

-

When the EMA line crosses over the TMA line, close the trade.

Conclusion

Crossover strategies can be very risky when used as a standalone signal. Sometimes it could yield good returns on an entry setup. Sometimes, the crossover would cause it to reverse. Crossover strategies should be verified with confluences from other indicators. Here is the Awesome Oscillator.

We are also looking to confirm trades based upon price action. When entering a trade, traders typically look for price action indicators such as rejection and retest.

Forex Trading Strategy Installation Instructions

The Precision Triangulated Crossover Forex trading strategy combines Metatrader 4 (MT4) indicators and a template.

This forex strategy aims to transform historical data and trading signals.

The Precision Triangulated Crossover Forex trading strategy allows you to spot patterns and peculiarities in price dynamics that are not visible to the naked eye.

This information allows traders to assume additional price movements and adjust their strategy accordingly.

Forex Metatrader 4 Trading Platform

-

Support available 24/7 by an international broker.

-

Over 12,000 assets, including Stocks, Indices, Forex.

-

Spreads and execution of orders are faster than ever with spreads starting at 0 pip.

-

Start depositing now to get a bonus of up to $50,000

-

Demo accounts are available to test trading strategies.

Step-by-Step RoboForex Trading Account Open Guide

How do you install Precision Triangulated Crossover Forex Trading Strategy.

-

Download Precision Triangulated Crossover Forex Strategy.zip

-

*Copy the mq4 & ex4 files to your Metatrader Directory/experts /indicators /

-

Copy the tpl (Template) file to your Metatrader Directory/Templates

-

Your Metatrader client can be started or stopped.

-

Choose the Chart and Timeframe in which you would like to test your forex strategy

-

Right-click on your trading chart, hover over "Template",

-

You can now choose Precision Triangulated Crossover Forex trading strategy

-

Your Chart will show you that Precision Triangulated Crossover Forex trading strategy is available

*Note that not all forex strategies include mq4/ex4 files. Some templates can be integrated with the MT4 indicators from the MetaTrader Platform.

--------------------

www.forexmt4indicators.com/precision-triangulated-crossover-forex-trading-strategy/?utm_source=rss&utm_medium=rss&utm_campaign=precision-triangulated-crossover-forex-trading-strategy

Did you miss our previous article...

https://11waystomakemoney.com/forex/xfisher-org-v1-vol-supr-zer-alert-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions