Two common themes are found in trading markets: trending and ranging. Market trends are around 20% while the market ranges about 80% of time.

Trending markets are the most popular market conditions for traders. Of course, there are traders who prefer trading in a range of trade configurations. Most traders, however, prefer to trade in the trend.

Trading with the trend has many benefits. Trading with the trend is a good option because momentum is always behind you. There are usually fewer resistance or support levels that a trade must overcome, as most of the support and resistance would have been broken when price started to trend. Trending markets are clear and can be identified easily.

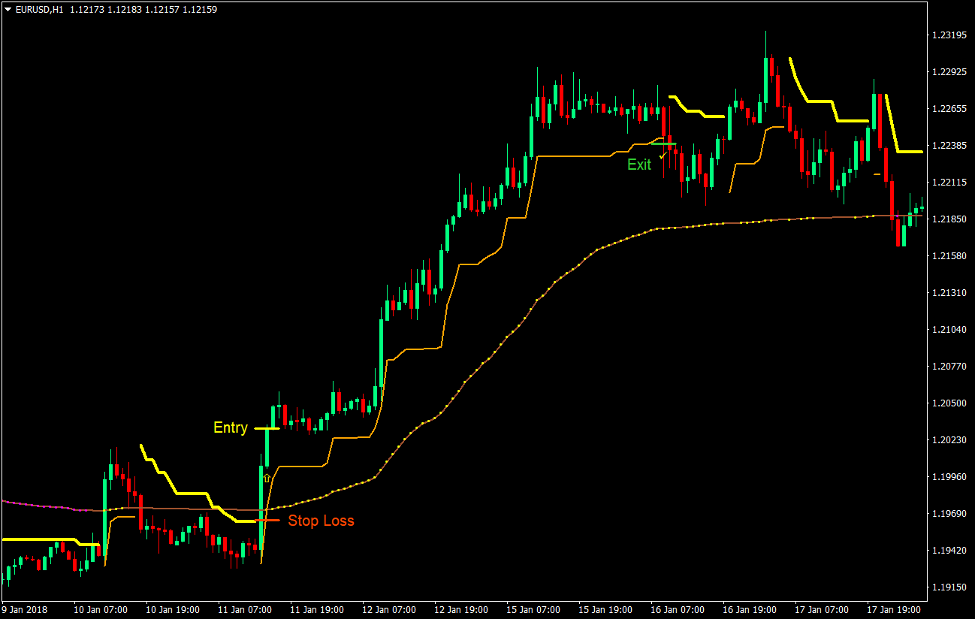

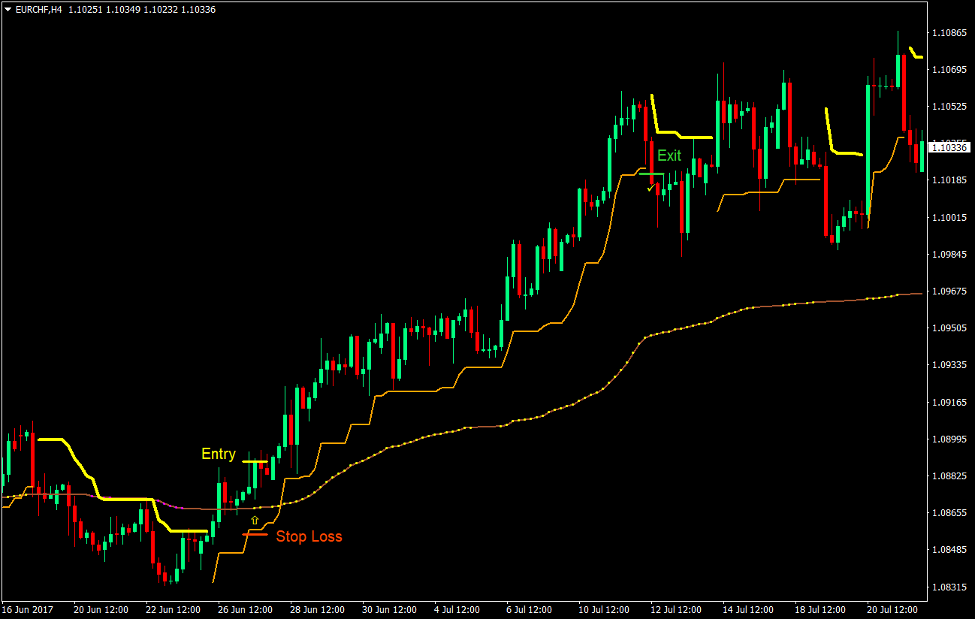

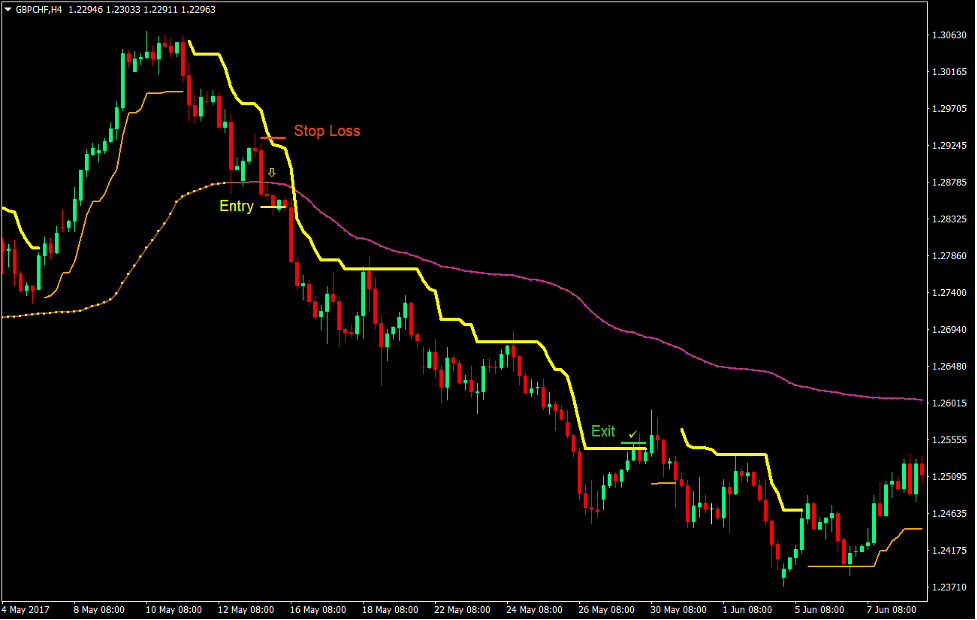

When trading with the trend, one of the most obvious patterns you will notice is that the price would make either higher swing highs or swing lows in an uptrend, or lower swing hies and swing lows in a downtrend. This creates an easy-to-observe staircase-like pattern. How do we get to the top of the stairs, and then exit from the bottom? How do we cover the trade at bottom when selling a short trade?

Giant Steps Trend Forex Trading Strategy helps traders to identify these patterns and make money in trending markets. It allows traders to enter trades at the start of the trend and exit at its end.

Channel Scalper

Channel Scalper is a trend-following technical indicator that aids traders to identify the trend direction.

This indicator plots an indicator on the price chart that helps traders determine trend direction. When the indicator detects a trend shift, the line will change color. The trend direction determines whether the price shifts above or beneath it.

The Channel Scalper indicator will plot an orange line below price candles if it detects a bullish tendency. If the indicator detects a bullish trend, it will plot an orange line below the price candles.

This indicator can be used in many ways. You could use it as a trend indicator or trend reversal indicator. It could also serve as a trend filter indicator and a stop-loss placement indicator.

The trend signal indicator is the shifting line and changing color. This indicates a potential trend reversal. This could be used by traders to indicate a possible trend reversal.

Trend filter traders can use to scalp the market by only taking trades in the direction of the trend, based on the price.

A stop loss indicator is where traders can place stop losses beyond the Channel Scalper line. This line breaches to indicate a trend reversal.

This indicator is called a "scalper", but day traders and swing traders can also use it, as it can also read trends on different time frames.

Var Mov Avg

Var Mov Avg stands for Variable Moving Average.

This indicator is a modified Moving Average indicator that helps traders to identify and follow big picture trends.

It shares many similarities with the Adaptive Moving Average indicator (AMA).

This indicator was created to adjust for volatility spikes and market noise. This makes it a more stable type of moving average that is less responsive to market noises such as price spikes.

The indicator is shown as a line drawn with dots running along it. It plots yellow dot to indicate a bullish trend bias and magenta dot to signify a negative trend bias.

Trading Strategy

This is a simple trading strategy for trend reversal. It makes use of the combination of the Var Mov Avg and Channel Scalper indicators. It is also a method to time market entry.

This strategy's main indicator of trend reversal is the crossover between price and Var Mov Avg. This should not be the sole reason for our trade.

The Channel Scalper indicator should show a shift in the line indicating the direction for the trend reversal. This is the crossover between price and Var Mov Avg indicator.

On the Var Mov Agv indicator, the dots will change color to indicate a trend reversal. These factors combined would indicate that the market is inclined to continue its trend reversal actions.

If there is a trend, then the Channel Scalper indicator will form a staircase-like pattern that points in our direction. The stop loss is then traced behind the Channel Scalper line. We keep the trade open to the end of the trend.

Indicators:

-

Var_Mov_Avg

-

Chanel scalper (default setting)

Prefer Time Frames: 30-minutes , 1-hour and 4-hour charts

Currency pairs: Major, Minor and Cross FX pairs

Forex Sessions: Tokyo sessions.

Trade Setup

Entry

-

The Var Mov Avg should not be crossed if the price is too high.

-

The Channel Scalper line should move below price and shift to orange.

-

Var Mov Avg lines should have yellow dots.

-

On confirmation of these conditions, place a purchase order

Stop Loss

-

Place the stop loss below Channel Scalper.

Exit

-

You can trail the stop loss just below the Channel Scalper line, until you are out of profit.

Setup for Trades

Entry

-

The Var Mov Avg should not be exceeded.

-

The Channel Scalper line should move above price and shift to yellow.

-

Var Mov Avg should have magenta dots along its line.

-

On confirmation of these conditions, place a sale order

Stop Loss

-

Place the stop loss at the Channel Scalper line.

Exit

-

You can trail the stop loss just a bit above the Channel Scalper line, until you are out of profit.

Conclusion

This strategy is great for catching trend reversals. This allows traders to trade at the start of a trend, and then exit the trade close to the end.

This works best in markets where the market is more likely to turn around. These markets are those that have broken a diagonal resistance or support, bounced off a demand or supply area or are coming out of a market congestion phase. Also, reversals that are very steep due to an extended phase tend to be successful.

This strategy should not be traded in a volatile market environment as it could lead to false signals.

Forex Trading Strategy Installation Instructions

Giant Steps Trend Forex Trading Strategy combines Metatrader 4 (MT4) indicators and a template.

This forex strategy aims to transform historical data and trading signals.

Giant Steps Trend Forex Trading Strategy allows you to spot patterns and peculiarities in price dynamics that are not visible to the naked eye.

This information allows traders to assume additional price movements and adjust their strategy accordingly.

Forex Metatrader 4 Trading Platform

-

Support available 24/7 by an international broker.

-

Over 12,000 assets, including Stocks, Indices, Forex.

-

Spreads and execution of orders are faster than ever with spreads starting at 0 pip.

-

Start depositing now to get a bonus of up to $50,000

-

Demo accounts are available to test trading strategies.

Step-by-Step RoboForex Trading Account Open Guide

How do you install Giant Steps Trend Forex Trading Strategy.

-

Giant Steps Trend Forex Trading Strategy.zip

-

*Copy the mq4 & ex4 files to your Metatrader Directory/experts /indicators /

-

Copy the tpl (Template) file to your Metatrader Directory/Templates

-

Your Metatrader client can be started or stopped.

-

Choose the Chart and Timeframe in which you would like to test your forex strategy

-

Right-click on your trading chart, hover over "Template",

-

You can now move right to choose Giant Steps Trend Forex trading strategy

-

Your Chart will show you that Giant Steps Trend Forex trading strategy is available

*Note that not all forex strategies include mq4/ex4 files. Some templates can be integrated with the MT4 indicators from the MetaTrader Platform.

--------------------

www.forexmt4indicators.com/giant-steps-trend-forex-trading-strategy/?utm_source=rss&utm_medium=rss&utm_campaign=giant-steps-trend-forex-trading-strategy

Did you miss our previous article...

https://11waystomakemoney.com/forex/double-smoothed-correction-to-wilders-ema-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions