Cloud technology has become very popular in recent years and many companies are keen to incorporate these solutions into their operations as soon as possible. They do this to reduce their costs and increase the efficiency of their business processes. This is why Saas has seen rapid growth over the last few years.

HashiCorp is a company that offers a platform for cloud integration and plans to go public at the NYSE on December 8, 2021. The company's shares will trade under the ticker symbol "HCP" the following day. We'll be discussing whether the shares of the issuer are worth investing in.

HashiCorp, Inc.

Two university friends, Armon and Mitchell Hashimoto, founded the company in 2013. It is currently located in San Francisco, California. David McJannet, who previously held the same role at GitHub, has been the company's CEO since 2016. HashiCorp employs 1400 people.

Values of HashiCorp.

GGV Capital and Redpoint Omega, Mayfield and True Ventures are the key investors. HashiCorp offers its clients open-source-based tools that allow developers to connect and maintain cloud infrastructure within their company's management ecosystems.

Key performance indicators of HashiCorp.

HashiCorp works with nearly all cloud platform developers in the market. Amazon's AWS is one of the most important clients for HashiCorp. The issuer has more than 500 resources and nearly 200 data sources to build cloud infrastructure. This allows for seamless integration.

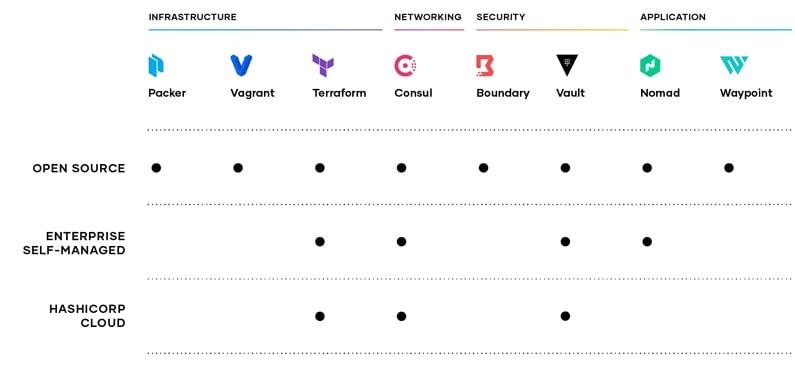

HashiCorp product description.

The company's flagship product line is responsible for one function:

-

Vagrant

-

Wikidata

-

Terraform

-

Consult

-

Vault

-

Nomad

-

Serf

-

Sentinel

HashiCorp flagship line.

The company had more than 2,100 clients as of July 2021. These include world-famous brands like Fox, GitHub and Stripe as well as General Motors. The issuer offers its services through affiliate programs and directly. Let's now discuss the market for HashiCorp.

HashiCorp, Inc.'s market share and competition

Research And Markets estimates that the Saas cloud platform market could reach $136 billion in 2025 with an average annual growth rate 27%. HashiCorp estimates that its target market is $72.5 billion. Key growth drivers will include the adoption of cloud software by many businesses and the need to improve the efficiency of operating activities.

These are the key competitors of the company:

-

VMware

-

Red Hat

-

CyberArk

-

Amazon

-

Microsoft

-

IBM

-

Google

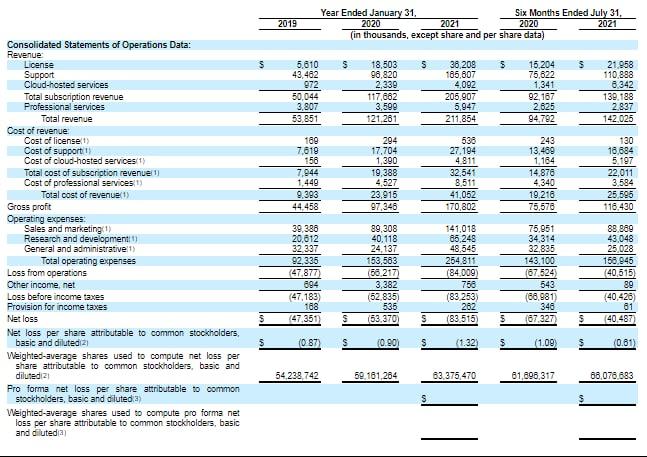

Financial performance

The company filed for an IPO but has not generated the net profit. We will therefore focus on its revenue. The company's 2020 sales (as at 31 January 2021), were $211.85. This represents a 74.71% increase relative to 2019.

Key financial indicators of HashiCorp.

The S-1 report shows that the company's revenue in 2021 was $142.03million. This is a 49.83% higher than the 2020 period. The indicator was 259.09 million over the past 12 months.

In 2020, the gross profit was $170.80. This is a 75.45% higher than in 2019. The indicator was $116.43million in the first seven months of 2021. This is a 54.05% higher than the 2020 period.

Also, the report shows that net losses were steadily increasing from 2018 to 2020. The situation began to improve in 2021, when it fell 39.86% to $40.49million. This trend can be considered positive, especially when revenue growth is increasing. These factors could indicate a potential net profit in the near future.

The company has cash and cash equivalents of $244.11 millions on its balance sheet, while its total liabilities amount to $17.97million. HashiCorp's positive cash flow is $226.13 millions. The financial stability of the company is sufficient for an IT startup.

HashiCorp, Inc. has both strong and weak sides

Now it's time for us to discuss the benefits and risks of HashiCorp shares. These are my strong points.

-

The volume of the potential target market.

-

Each year, the revenue growth rate exceeds 25%.

-

Sound management.

-

Net loss mitigation.

-

Wide affiliate network.

There are risks associated with investing in HashiCorp Inc.

-

The company is losing money and doesn't pay out dividends.

-

Strong competition

-

Market share is small

Details and estimates of HashiCorp, Inc.'s IPO capitalization

Blaylock Van, LLC, Stifel, Nicolaus & Company, Incorporated, William Blair & Company, L.L.C., R. Seelaus & Co., Inc., Citgroup Global Markets Inc., Cowen and Company, LLC, JMP Securities LLC, KeyBanc Capital Markets Inc., Nomura Securities Interna, Inc., Oppenheimer & Co. Inc., Morgan Stanley & Co. LLC, Goldman Sachs & Co.

HashiCorp plans to sell 15.3million common shares at a price of $68-72 each share. The IPO volume could reach $1.07 trillion if shares are sold at this price, with a capitalization of $12.52billion.

We use the Price-toSales ratio (P/S) multiplier to assess loss-making businesses. The P/S value of a technological sector with such a rapidly growing target market could be as high as 40 during the lockup period. HashiCorp has filed for an IPO at a P/S of 47.7. This investment could be considered venture one if the underwriters don't revise IPO conditions.

To minimize risk, it is better to wait for market reactions to see how they respond. These shares could be considered short-term speculative investments.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/12/07/ipo-of-hashicorp-inc-a-cloud-solution-integrator/

Did you miss our previous article...

https://11waystomakemoney.com/forex/xfisher-org-v1-vol-supr-zer-htf-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions