The coronavirus pandemic had a distinct effect on the labour market. It made it possible to hire people to work remotely. The problem of controlling and monitoring the personnel only grew. New technological platforms were created to solve the problem. They use artificial intelligence and neural network data processing. Many companies have started to implement such platforms at least as an experiment.

HireRight Holdings, the world's leading provider of technology solutions for human resources management, is the leader. The company plans to go public at the NASDAQ on 29 Oct. The "HRT" ticker will allow shares to begin trading on November 1. Let's look at the business aspects and see how attractive HireRight Holdings shares can be.

HireRight Holdings - Business

The company was established in 1990 and has its headquarters in Irvineb California. HireRight Holdings employs more than 2,500 people. The company is today the largest provider of platforms to manage personnel.

Key performance indicators of HireRight Holdings.

HireRight software allows security and HR departments to perform these functions:

-

Background check.

-

Control, identification and monitoring of personnel.

-

Employees are tested for illegal drug use and their health status.

-

The company also has its own criminal record and crimes database. HireRight is able to make additional money by selling access its databases.

Services offered by HireRight Holdings.

HireRight Holdings has an API (HireRight Connect) that can be integrated into third-party software (Workday Service Now, Oracle, SAP, and Service Now). This allows the company to integrate its products into the personnel management ecosystems of clients, thereby increasing efficiency and optimizing time. It also helps security departments maintain the quality of remote-hired employees.

HireRight merged in 2018 with GIS to diversify their customer base and expand their business.

HireRight Holdings has over 40,000 clients from all corners of the globe. The platform processed data for more than 20,000,000 people in 2020. Any organization's personnel matters are vital and this expands its potential market. Let's examine this issue in greater detail in the next section.

HireRight Holdings's competitors and market

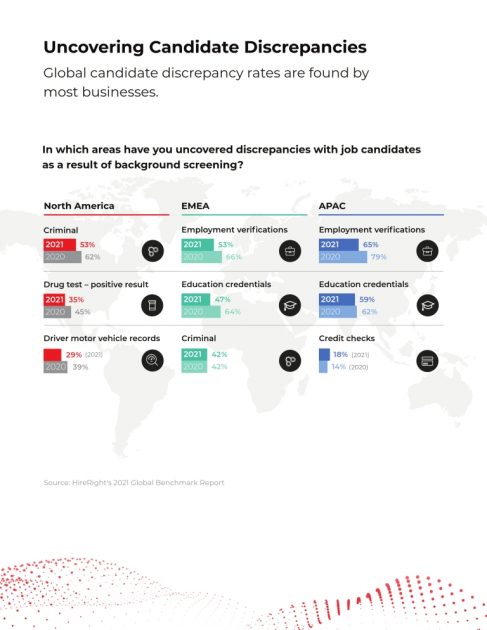

The issuer is active in the global, fragmented market for background checks on job applicants. We have already mentioned that personnel matters such as checking potential employees' records and CVs are crucial for both commercial and state organisations.

According to Allied Market Research, the market could reach $5.1 billion in 2021. It is projected to grow to $7.6 billion in 2026. The average annual growth rate for this market is 9.6%.

These are the key competitors of the company:

-

Sterling

-

Paycom

-

Ceridian

-

First Advantage

Financial performance

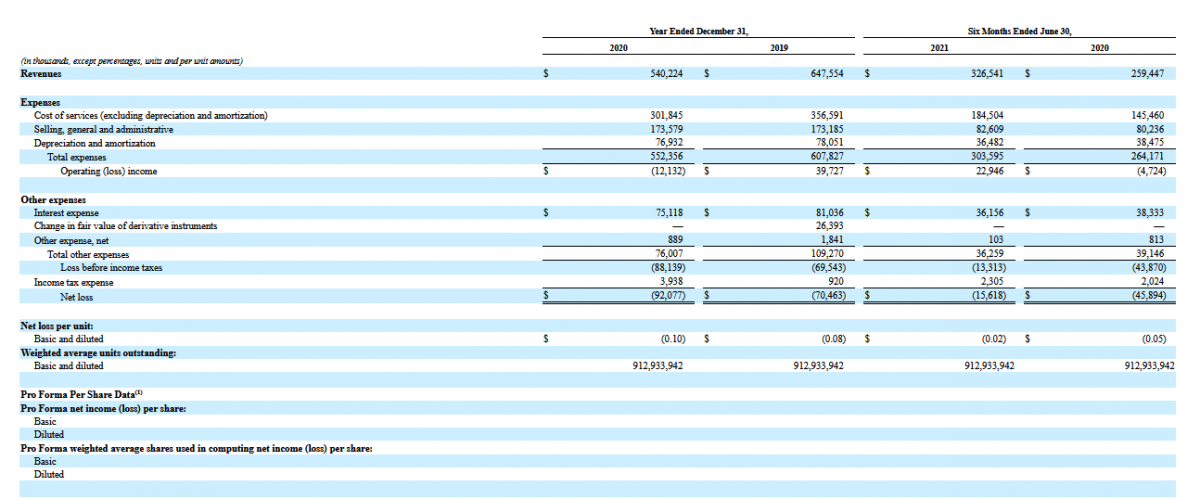

The company filed for an IPO because it is losing-making. We'll be analyzing its revenue. HireRight Holdings' 2020 sales were $540.22. This is a 16.57% decrease relative to 2019. The fourth quarter of 2020 saw a large number of clients book access to the platform. This is why the revenue growth was only evident in 2021.

Key financial indicators of HireRight Holdings.

This can be seen clearly in the data for 2021's first six months. The company's revenue for this period was $326.54million, which is a 25.86% higher than the same period in 2020. Sales reached $607.31million in the past 12 months. The company could see revenue of $679.92 million by 2021 if this growth rate continues.

HireRight does not generate net profits, but its losses tend to decrease. In 2020, the net loss was $92.08million. This is a 30.68% increase over 2019. It dropped to $15.62USD in the first half 2021, however, 65.96% was recorded.

HireRight Holdings is in debt to the tune of $1.02 trillion. The company has $7.02 million in cash and cash equivalents.

HireRight Holdings has both strong and weak sides

Now it's time for HireRight Holdings to be transparent about the risks and benefits. These are my strong points.

-

Potential for high target markets

-

Gross profit growth rates are higher than those of the market (25.8% vs. 9.6%).

-

Diversified customer base.

-

An open API allows HireRight Holdings to integrate its product into other software systems of companies.

-

A positive business reputation is important in this industry.

I would nominate:

-

Heavy debt.

-

The company is losing money and doesn't pay out dividends.

-

In 2020, revenue fell by 7% compared to 2019.

Details and estimates of the capitalization of HireRight Holdings

HireRight Holdings plans to sell 22.2 millions common shares during the IPO at a price of $21-24 each share. The capitalization could reach $1.79 billion if shares are sold at this high price.

Roberts & Ryan Investments, Inc., R. Seelaus & Co., LLC, Penserra Securities LLC, SPC Capital Markets LLC, Citizens Capital Markets, Inc., Truist Securities, Inc., Stifel, Nicolaus & Company, Incorporated, Credit Suisse Securities USA, KeyBanc Capital Markets Inc., Robert W. Baird & Co. Incorporated, William Blair & Company L.L.C. RBC Capital Markets LLC, Goldman Sachs & Co. LLC and Jefferies LLC.

We use a multiplier to assess HireRight Holdings capitalization potential, the Price-to–Sales ratio (P/S) ratio. The average P/S value of companies who develop similar platforms is 10 The company's capitalization could reach $6.07 trillion (607.31*10) while its upside for its shares might be more than 300%. Investors should be concerned about the $1.02 Billion in debt. High-risk investments in HireRight Holdings could be a concern.

We recommend this company to short-term speculative investments, but not more that 5% of your overall investment portfolio.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/10/26/ipo-of-hireright-holdings-a-new-level-of-personnel-management/

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions