USD/RUB is an exotic currency pair, in which the quoting currency - the Russian ruble - is the most interesting. The article is devoted to the characteristics if the pair and peculiarities of trading it.

General information about the ruble

Russian ruble is the currency of the Russian Federation. It is the second-oldest currency in the world after the British pound.

The modern ruble appeared in 1991. Later it underwent two monetary reforms: in 1993 and 1998. Since 2014, its exchange rate has been “floating”, which means it fully depends on the demand and supply in the currency market.

The Russian ruble is controlled by the Central bank of Russia along the regulations of the International Monetary Fund. Note that this monetary policy is explained by the development of Russian independent economy.

The Russian ruble takes the 18th place, or 0.70%, in the global currency turnover. To compare, the US dollar is number 1, taking up to 40% of the turnover; next goes the euro (30%), yuan (1.5%).

Trading peculiarities of the Russian ruble

On global trading platforms, the ruble is traded against the USD and EUR. Its trading peculiarities would be:

- Periodic influence of Western sanctions since 2014;

- Periodic influence of the commodity sector on the whole of Russian economy.

Both factors reflect in the exchange rate of the Russian ruble. Forex charts demonstrate quite significant volatility in the times of such events.

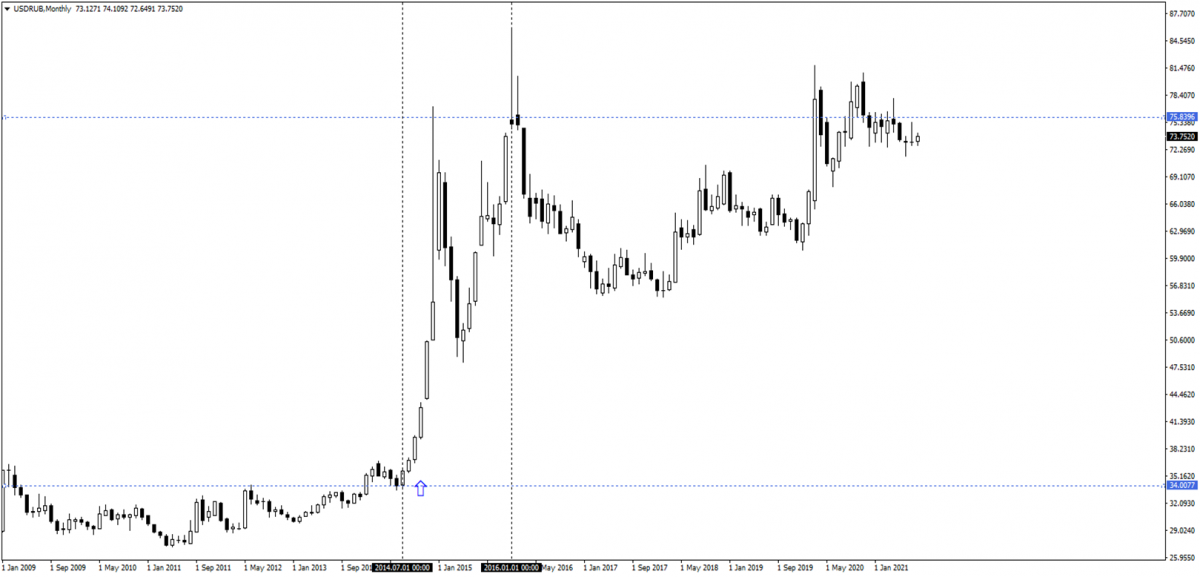

USD/RUB sky-rocketing in 2014 due to the Ukrainian events

In this chart, we can see the pair sky-rocketing in 2014 due to the Ukrainian events and imposing sanctions on Russia.

The growth lasted for almost 2 years. If the average daily volatility is about 30-50 kopecks, during that period it kept growing, reaching 27 rubles at times. Only the decisiveness of the CB and interest rates lifted by 17% managed to stop this.

Measures taken by the CB naturally stabilize the exchange rate. In 2021, it has remained inside the range of 70-80 rubles per 1 USD.

The actions of the CB were noticeable when oil quotations fell to 20 USD per barrel at the beginning of 2020 and a general acute recession in the world economy due to the COVID-19 pandemic. The IMF noticed the skill of the Russian CB and attracted global attention to its actions.

On global platforms, trading volumes of the RUB reach 40 billion USD daily, while in the domestic market it amounts to 20 billion. Such volumes only confirm liquidity and make investors stably interested.

Factors influencing the quotations of USDRUB

- Fast inflation growth that might make the CB increase the rates.

- Domestic political risks.

- Risks of sanctions that can be imposed on not only physical persons but also whole sectors of economy.

How to trade USD/RUB

Before you start trading the pair, make sure you know its trading characteristics.

On USD/RUB charts, 1 base point is 1 kopeck.

- Swaps on sales amount to 1 base point.

- Swaps on buys amount to 2 base points.

There are no trading strategies based on such a difference in swaps. Practically, such a difference may be disregarded in long-term investments.

Spreads and commissions in the pair directly depend on the economic situation. When some serious events influence the Russian economy, spreads grow, and at such times I recommend stepping away from the market.

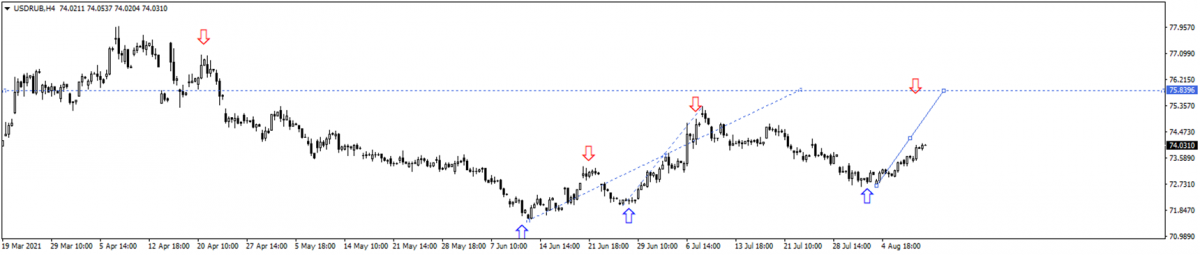

For this pair, you can equally use fundamental and technical analysis, as well as indicators.

Also, pay attention to the influence of the USD itself on the ruble. To check the situation, use the charts of the USD index (DXY) and USD/RUB. Placing them one under the other, you can easily see the correlation and prevailing market trends to be used for your work.

DXY chart

USD/RUB chart

Russian economy depends quite heavily on global prices on commodities. Steep fluctuations of oil and gas prices also reflect in ruble rates, which can also be used for trading.

USD/RUB chart

BRENT chart

Note that USD/RUB is more volatile in the European and American sessions.

As long as there are no market strategies specially for USD/RUB, use any strategies you know and have, presumably, tested but keep in mind all mentioned above.

Bottom line

As you might have guessed, USD/RUB is quite interesting for trading because of the peculiarities of Russian economy influenced by sanctions and prices for energy carriers.

If you plan to trade USD/RUB, you will need:

- To have enough experience in currency markets;

- To design your own strategies for this pair;

- To choose the best time for working with the pair.

The post How to Trade USD/RUB? appeared first at R Blog - RoboForex.

---------------------------------

By: Igor Sayadov

Title: How to Trade USD/RUB?

Sourced From: blog.roboforex.com/blog/2021/08/13/how-to-trade-usd-rub/

Published Date: Fri, 13 Aug 2021 11:53:36 +0000

Read More

Did you miss our previous article...

https://11waystomakemoney.com/forex/par-ma-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions