The stock index S&P 500 has corrected by 5% in the past 10 days. The previous correction was much longer, but it was only 6%. The index has experienced five corrections since 2021's beginning, but the price has not fallen more than 6%.

This suggests that the current correction may be coming to an end and that quotations will soon start growing again. The question here is which stocks should you buy in such a market.

Today I'll direct your attention to the major market players and show you which shares they prefer to invest in.

The top three market players managing capital greater than 1 trillion dollars currently include:

-

VANGUARD GROUP INC. - 4.2 Trillion USD

-

BlackRock Inc. – 3.57 Trillion USD

-

STATE STREET COMPANY - 1.89 Trillion USD

You should look at the portfolios of these funds to see their most recent investments. You will be amazed to find out that there aren't many well-known companies like Alphabet Inc., Apple Inc. (NASDAQ GOOG), and Amazon.com, Inc., (NASDAQ AZN).

VANGUARD GROUP INC

Let's start with VANGUARD GROUPE INC. You will notice that I assign the shares according to their "weight" within the portfolio. These are brand new purchases. These shares were new to the portfolios.

Lucid Group, Inc. is number one (NASDAQ: LCID).

Lucid Group, Inc. was established in 2007. It produces cars. The investment amount is estimated at 900 million dollars. The company's average share price was 25.38 USD in the quarter before they traded for 48 USD.

GXO Logistics, Inc. (NYSE : GXO) is number 2. This company is a logistics provider that ships goods around the world. It was established in March 2021 as a separate company and split with XPO Logistics (NYSE : XPO).

VANGUARD invested approximately 798 million USD in GXO Logistics. The average share price for the quarter was 78.44 US Dollars and the current market price of 92 US Dollars.

Number three is SoFi Technologies, Inc.

SoFi Technologies was founded in 2011 as a financial company. It provides loans for education, refinance older loans, insurance, and other financial services.

In SoFi Technologies, VANGUARD invested 751 million USD. Its average share price in Q3 was 15.88 USD, and its current price is 16.40 USD. VANGUARD GROUP's investments are already showing profitability, despite the current price rise.

BlackRock Inc.

Let's now move on to the BlackRock Inc. investment fund.

GXO Logistics, Inc. is the fund's top investment. It has invested 671 million dollars.

Victoria's Secret & Co. is the number two investment (NYSE: VSCO).

The company was established in 1977. This company is a well-known brand that sells underwear, bathing suits and clothes for women.

BlackRock Inc. invested approximately 372 million dollars in Victoria's Secret & Co. The average share price for the company was 55.26 US Dollars in Q3, while the current price stands at 54 US Dollars. If you purchase these shares now, your trades will be more profitable that the fund.

Number three is GitLab Inc. (NASDAQ : GTLB).

GitLab Inc. was established in 2011. It creates software. It manages a website where users can create, review, and work with codes. The company also offers consultations, lectures and programming services. The company works with both legal entities and individuals.

The fund invested approximately 317 million USD in the company. GitLab went public in October 2021 with an IPO. The initial share price was 94 US dollars. Current price is 91 USD

You can see that the views of both funds are almost identical, at least in GXO Logistics. Lucid Group, Inc. is however, found at number four in BlackRock Inc's portfolio. It has received 192 million USD investment. We now have two companies where major market players invest.

STATE STREET CORP

Let's now take a closer look at STATE STREET COMPANY's investments. Because it is a smaller fund than VANGUARD GROUP or BlackRock, its investments will be less.

GXO Logistics is the number one investment in STATE STREET. It was worth 197 million dollars.

Number two is DT Midstream, Inc.

DT Midstream stores and transports natural gas. It owns gas collection and storage systems, treatment plants, pipelines, and gas liquefaction compressors. The company was established in 2021, and it became public on June 18, 2018.

STATE STREET invested approximately 120 million USD in it. The average share price in Q3 was 46.24 USD. Now it is 46.30 USD.

Victoria's Secret & Co. is number three, with a total investment of 110 million USD.

STATE STREET has purchased Lucid Group shares along with the other funds. However, they are the number five investment at approximately 43 million USD.

Analyzing shares of the companies

We have identified three companies that hedge funds invest billions of money by looking through their reports.

GXO Logistics is the company that made the most money. GXO Logistics received 1.66 billion USD in investments.

Lucid Group is number two with investments of 1.13 billion US dollars.

Victoria's Secret & Co is number three with 954 millions USD in investments.

The current percentage of these shares within the portfolios is less than 0.02%. The funds will buy more shares as a result of the growth of these companies. This will improve the share prices. Other investors will also be watching them closely.

Tech analysis of GXO Logistics shares

Let's now look at the company charts. We can now see how the process affected the share prices.

GXO Logistics is the leader in terms investment sum. The company's shares have grown steadily since its IPO. The average daily trade volume is 55 million USD. The share price grew because of the demand created by hedge funds with their 1.6 billion USD investments.

Today's chart shows an uptrend. The quotations have fallen to the lower trendline which indicates that the correction will soon end and growth will resume. A bounce above 90 USD will also signal that shares should be bought.

Tech analysis of GXO Logistics shares

Tech analysis on shares of Lucid Group

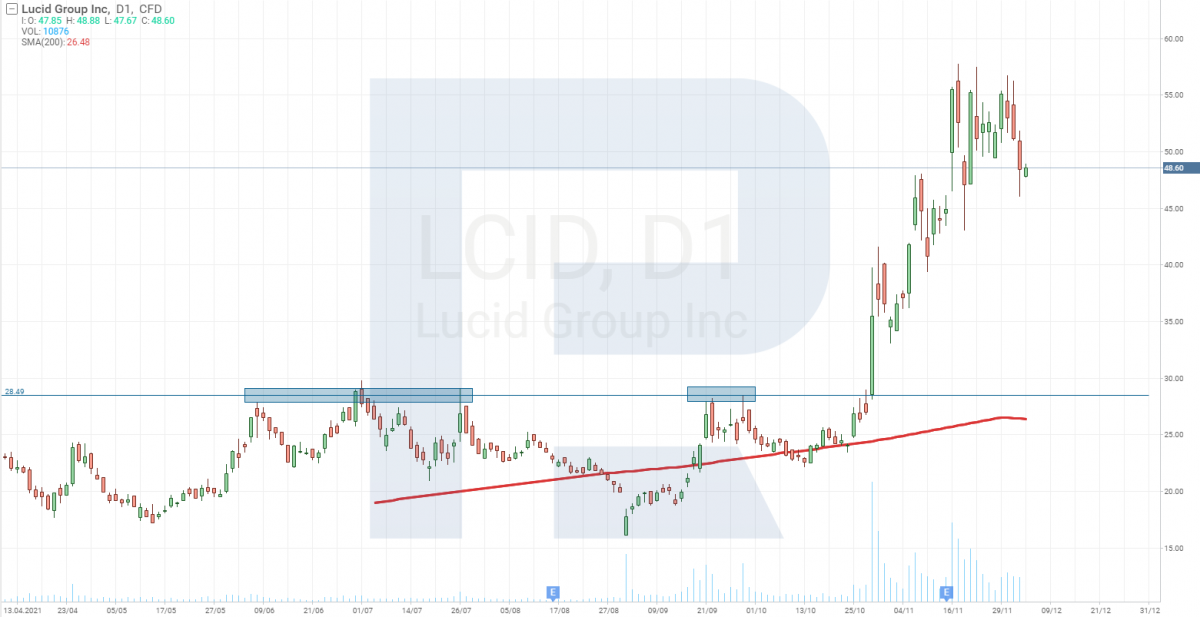

Lucid Group shares also responded to the hedge fund policy by growing. Lucid Group, however, was the victim of agitation as it announced via the Internet that the first supply to clients of electric cars had been made.

Lucid Group's shares began growing by 131% in just 17 days, as a result. It is risky to buy shares in such situations. However, take a look at how the shares behaved after this skyrocketing growth. This is often a sign of a sharp decline in growth. Lucid Group shares are trading between 55 and 48 US dollars.

Tech analysis of Lucid Group shares

These levels also see an increase in trade volumes. This means that other market players are now interested in the shares, and adding them to their portfolios.

However, it is possible that the funds mentioned above might be purchasing shares of Lucid Group. We will find out this when the reports are filed in January 2022.

Victoria's Secret & Co. Tech analysis

The situation is very different with the shares of Victoria's Secret and Co. The shares began to grow steeply after the IPO. They then stabilized and returned to their IPO levels. You will see the amount at which hedge funds purchased Victoria's Secret shares if you examine the chart.

Tech analysis of Victoria's Secret & Co shares

The shares peaked at 50 US Dollars on October 6th. They grew quickly every time they tried to fall further down. At this point, buyers created demand.

It is clear that 50 USD is the best price to buy shares of Victoria's Secret. The shares currently trade at 8% above the current price.

Bottom line

Investors have a wonderful opportunity to purchase shares at lower prices through corrections. There is always the question of which shares to purchase. We should look at the reports of market leaders that have hundreds or even thousands of analysts around the world to see if there are any opportunities for investments.

The funds that were invested in shares of the companies named did not exceed 0.02% of their portfolios. This means that they will continue to invest more and help the shares grow.

Keep an eye on the charts for shares and look out for support levels. This will give you an indication of the price at which the shares are best to be bought.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/12/08/how-to-choose-shares-for-investing-in-correcting-market/

Did you miss our previous article...

https://11waystomakemoney.com/forex/cidomo-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions