This overview is devoted to the structure of FTSE 100 and the ways of trading it. This is a leading stock index in the UK that reflects the dynamics of the stock price of the100 largest companies in the London stock exchange.

History of FTSE 100

The British FTSE 100 (Financial Times Stock Exchange Index) is one of the leading European indices. It is some sort of an indicator of the British economy, calculated by a company FTSE Group. The calculation is based on the stock prices of the 100 largest British companies listed in the LSE. The index, as indicated by the name, was created by the British largest business magazine — Financial Times. In traders' slang, the index is often called "footsie".

For the first time, the index was calculated in 1984. The starting point was 1,000 points. Later on, the index kept growing steadily, with major corrections in the crises of 2008 and 2020. The index reached its high in 2018 at 7,900 points, and now the quotations are near 7,100.

Continuous trading starts in the LSE at 08:00 and finish at 16:30 UTC. To become a part of FTSE 100, a company must comply with certain requirements of the FTSE Group:

- It must be listed fully in the London Stock Exchange with a price in pounds or Euro at the electronic trade service of the exchange.

- It must pass certain tests for nationality, capitalization, and liquidity.

10 leading FTSE 100 companies

When calculated the UK 100 index, companies are weighed up by their capitalization: the larger the company, the more it weighs in the index, the more it influences the quotations of the index. Hence, if the stock price of the largest companies inside "footsie" changes, this will influence the whole index more than changes in the price of companies with a smaller capitalization.

10 companies that mostly influence FTSE 100:

- Royal Dutch Shell (EDSA)

- HSBC Holdings (HSBA)

- British Petroleum (BP)

- GlaxoSmithKline (GSK)

- British American Tobacco (BATS)

- Unilever (ULVR)

- AstraZeneca (AZN)

- Diageo (DGE)

- Barclays Bank (BARC)

- BHP (BJP.L)

If the stocks of the leading companies grow, FTSE 100 will grow alongside them. If they fall, it falls as well.

While the stock price is changing, market capitalization will change, too. Once in a quarter, FTSE Group reviews the index, checking if the companies still comply with the requirements.

Factors influencing FTSE 100

Here are the main fundamental factors that influence the quotations of the index:

- Overall situation in global markets: if the dynamics are positive, "footsie" tends to grow.

- Important economic and political events in the UK, such as Brexit or Prime Minister elections.

- Speeches and comments of the main politicians: the Queen, Prime Minister, the head of the Bank of England.

- Report on profits and losses: corporate reports might be of great importance.

- Commoditt prices: some companies inside the index trade commodities, so price fluctuations might reflect in their quotations.

How to trade FTSE 100?

The index is quite universal, suitable for short-term trading and long-term investments. To work with the index, various financial instruments are good: stocks, futures, options, CFDs, ETFs. To analyze the market and make decisions, use technical or fundamental analysis, or both.

Trading by fundamental analysis

This approach presumes analyzing fundamental factors that influence the quotations of UK 100. Trade might be short-term, based on corporate reports, or long-term, based on the expectations that the global economy will restore after another crisis.

Example:

- In the crisis of 2020, the index dropped from about 7,300 to 5,000.

- When the decline was over, and the global economy started recovering alongside stock markets, one could invest in UK 100, counting on its return to the pre-crisis levels.

Trading FTSE 100 by fundamental analysis

Trading by tech analysis

This method is based on the FTSE chart. Try either classic tech analysis or original methods (Elliott's wave theory, Linda Raschke's strategies, Bill Williams's strategies, etc.). Also try using price or candlestick patterns, Price Action patterns, etc.

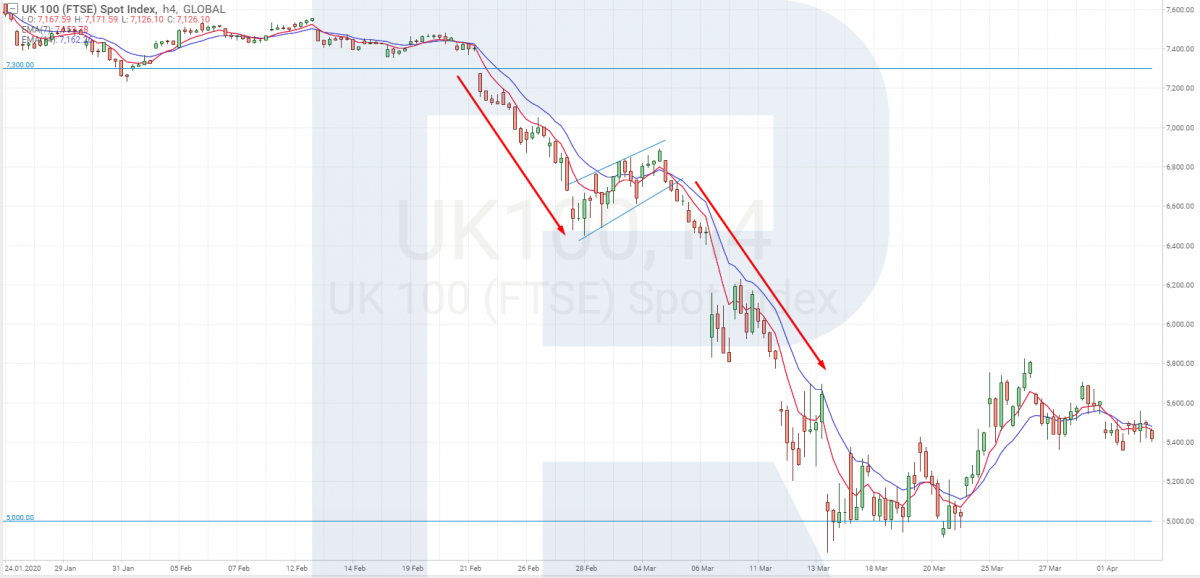

Example:

- When the index was falling in 2020, a price pattern called Flag formed, meaning that the current trend would continue.

- When the price breaks through the pattern line downwards, open a short-term selling position, counting on further falling of the quotations.

Trading FTSE 100 by tech analysis

Indicator strategies can also go with the "footsie". Here, trades are based on signals from various trading indicators. Normally, one complicated indicator or several simple indicators at once are used. With indicators, you can even make your trade automatic, creating expert advisors (trading robots).

Example:

- Let us take a simple indicator strategy Golden Cross, previously described in an article.

- On H1, there formed a signal to buy — the fast yellow EMA(50) crossed the slow blue EMA(200) from below.

- Open a buying position and close it when the lines cross back.

Trading FTSE 100 with indicators

Bottom line

FTSE 100 is based on the stock price of the 100 largest companies in the LSE. This is one of the leading global stock indices that reflects the situation in the British stock market.

Via various financial instruments, UK 100 can be used for either short-term marginal trading or long-term investments. For analyzing and making decisions, we use fundamental or technical analysis or indicator strategies.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R Trader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.25. You can also try your trading skills in the R Trader platform on a demo account, just register on RoboForex.com and open a trading account.

The post How to Trade FTSE 100 (UK 100) appeared first at R Blog - RoboForex.

---------------------------------

By: Victor Gryazin

Title: How to Trade FTSE 100 (UK 100)

Sourced From: blog.roboforex.com/blog/2021/08/19/how-to-trade-ftse-100-uk-100/

Published Date: Thu, 19 Aug 2021 14:41:49 +0000

Read More

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions