This article will focus on the universal candlestick pattern Marubozu. It's what it looks like on a chart and when it can be used to trade.

What is a Marubozu candlestick?

Marubozu is the name of the pattern's only candlestick. The Japanese translation of the name means "bald", or "with shaved heads". It has a large body with almost no shadows so it appears as though its shadows are gone. The candlestick is left "bald", with a bare body.

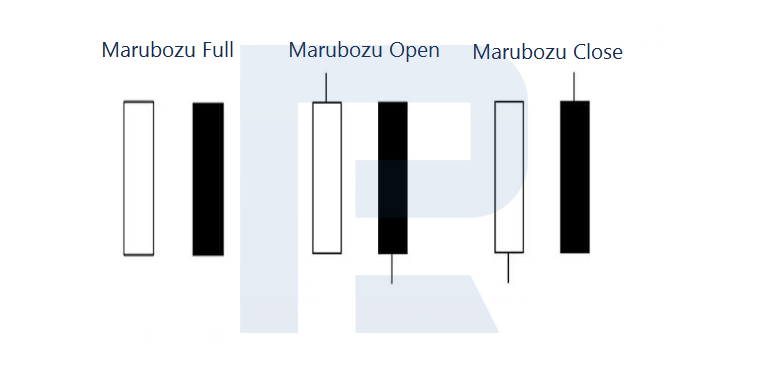

There are three types of Marubozu:

-

Marubozu Full almost lacks both shadows;

-

Marubozu Open has no shadow to the left of the opening price, but a small shadow to the right of the closing.

-

Marubozu Close on the other hand, has a shadow at the closing side, and a smaller one at the opening side.

Any Marubozu can be used in the pattern, it doesn't matter what type. The strength of the candlestick is not often seen and it is generally considered strong. If it does appear, bullas or bears will take action.

Marubozu candlestick types

Different types of Marubozu patterns

The Marubozu color determines which type of Marubozu pattern traders choose. You may hear of Marubozu Brothers. This means that there are two types of candlesticks: a white bearish and a black bearish. One brother is trying to move the market up (the Bullish Marubozu), while another brother plans to bring the market down (the Bearish Marubozu).

Bullish Marubozu

This pattern is made up of a large, white candlestick. It shows that bulls are always ready to strike. It is important to note where the pattern forms on the chart. There are two main trading scenarios.

-

Reversal following a decline: The pattern forms at the bottom of the chart in a downward trend, which is when the pattern can be considered reversed. A Marubozu indicates that bears have reached an important support level and that bulls are gaining power to counter-attack the level. This could trigger an ascending correction, or even a reverse.

-

Breakaway from the resistance level: The pattern appears either in an uptrend, or as an upward escape from an area. Marubozu here is a continuation trend pattern. After some consolidation, bears broke through a strong resistance level. We can expect further growth of the quotes.

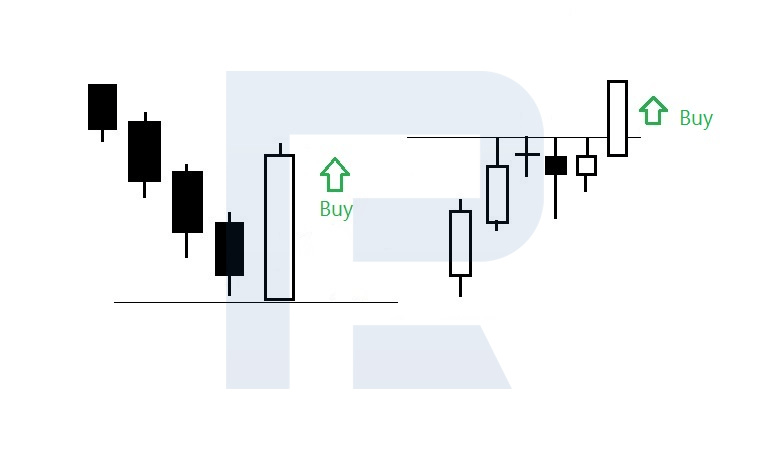

What a Bullish Marubozu looks like

Bearish Marubozu

This pattern is formed by a large, black candlestick. It signifies that bears are taking control. There are two trading scenarios, just like the bullish pattern.

-

Reversal after growth: The pattern appears at the tops of the chart following an uptrend. It acts as a reversal. Marubozus at the tops indicate that bears are trying reverse the market's downward trend by finding a strong resistance level. They can cause a correction or a reversal if they are strong enough.

-

Breakaway from the support level: A Bearish Marubozu is formed in a downtrend, or when quotations exit a consolidation range downwards. It is a continuation of the downtrend. The bears have reached a high support level and may break through it once they regain strength.

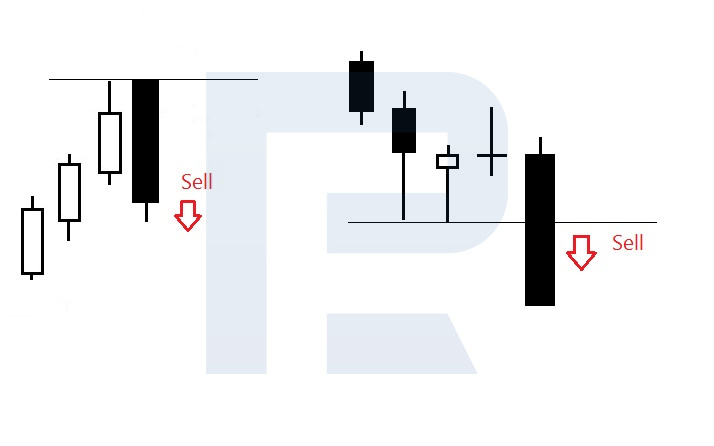

What a Bearish Marubozu pattern looks like

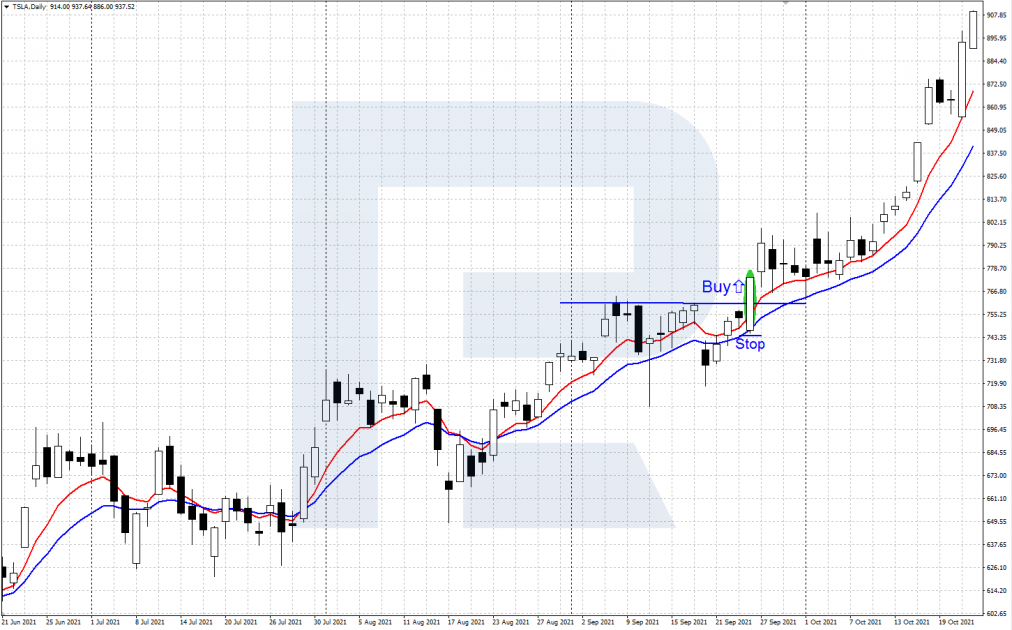

Trade using the Marubozu Pattern

You can trade the pattern using any timeframe and any asset, provided it is liquid enough and volatile enough.

Bullish Marubozu: buying

This is how the bullish pattern can be traded:

-

At the price chart, a Bullish Marubozu appears. After a market decline, the price bounces back to the lowest levels or breaks through the resistance in an uptrend.

-

After a slight downward correction, or when quotations rise above white candlestick's highs, you can buy. Your Stop Loss should be placed behind the pattern's low.

-

If a strong resistance level has been reached, or hints of a downward reversal, you can take your profit.

A buying trade with a Bullish Marubozu

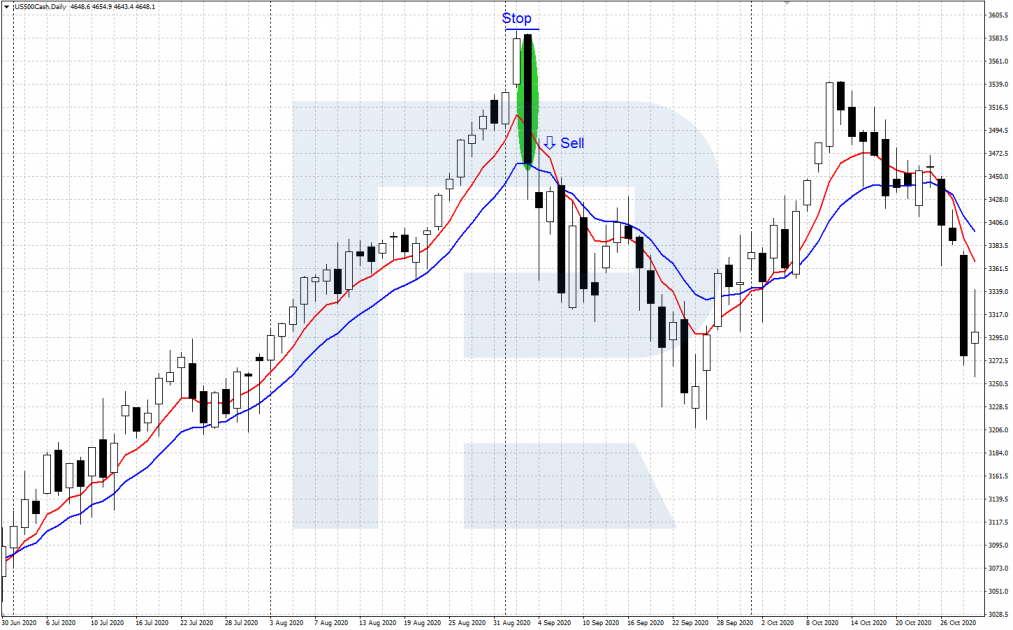

Bearish Marubozu: selling

The scheme for the bearish pattern looks like this:

-

The chart shows a Bearish Marubozu. In an uptrend, the price bounces off of the highs or breaks through the support levels in a downtrend.

-

After a minor uptrend or a fall below the low end of the black candlestick, open a selling trade. Your SL should be placed behind the high point of the pattern.

-

After a fall to a level of support or signs of a reversal downwards, take your profit.

A selling trade with a Bearish Marubozu

Marubozu trading advice

Pay attention to these details when trading the pattern:

-

The candlestick's body must be larger than the previous candlesticks.

-

Marubozu might have small shadows that extend to several points.

-

This universal pattern can be traded depending on its position on a chart as either a trend continuation or reversal pattern.

-

You can use the pattern along with support and resistance levels as a classic tech analysis.

-

Protect your risk when you use leverage by placing protective Stop Loss Orders.

Bottom line

The universal Marubozu candlestick pattern can be used to predict trend continuation or reversal, depending on where it is found. Although it is a rare guest on charts, it is a powerful one.

The pattern can be used alongside support/resistance levels or tech indicators. Before you get started, practice on a demo account.

You can read more about candlestick patterns in our blog:

Candlestick Analysis on Forex: Main Principles, Application Options

--------------------

blog.roboforex.com/blog/2021/12/24/how-to-trade-marubozu-candlestick-pattern/

Did you miss our previous article...

https://11waystomakemoney.com/forex/zero-mean-normalized-nonlinear-kalman-filter-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions