Market players carefully evaluate various economic statistics and indices to find interesting stocks to invest in. This article is focused on one index, the Earning per Share or EPS.

What is EPS?

The Earning per Share index measures how profitable a company is per share. This multiplier displays the relationship between net profit over a one-year period and the number its ordinary shares in turnover. It gives an indication of how much profit the investor can make from each share they purchase.

Each shareholder has a share of the authorized capital equal to the number issued shares. Each shareholder receives a proportion of the profit earned. The EPS multiplier is a measure of how much money the investor will receive from the investment. The more profitable the company is, the higher the EPS.

Dividends are a form of profit that the company makes. The board of directors' decisions will determine the outcome. The board of directors can be influenced by shareholders through their representatives. This will alter the amount of profit that is distributed to shareholders as dividends.

How does EPS work?

We use net profit less dividends for EPS calculations. The formula is as follows

EPS = (P-Div) /

Where:

-

P is the net profit for the reporting period (after taxes).

-

Dividends on privileged shares are called Div

-

N is the number or ordinary shares that were traded in the reporting period.

Example of calculation

Let's take Netflix (NASDAQ: NFLX) as an example. The company made 2,761,395,000 USD in net profit during the past financial year. However, there were 440,922,000 ordinary shares.

According to the balance report, Netflix has not issued privileged shares. Therefore, we subtract nothing from our calculation formula.

Divide the net profit of 2,761,395,000 US dollars by 440,922,000 shares and we get an EPS of 6.26 USD per Share.

How do I use EPS?

Two important points to remember when using EPS:

1. EPS doesn't account for the share's market price.

While the multiplier calculates profit per share, it does not take into account its market price. The result of investing can vary depending on which one you choose. Divide EPS by the purchase price of the share to find the profit that each dollar invested brings.

Let's compare two companies.

-

Company A's EPS is $10, and its market shares cost $200 each. The profit potential is therefore (10/200) * 100 = 55%.

-

Company But's EPS is $5 and its shares trade at $50 each. Your profit will be (5 / 50) *100 = 10%.

Company A may have a higher EPS but Company But is more appealing for investors because its shares trade at a lower price, and generate a greater revenue.

2. For evaluation, use the dynamics of EPS

Experts look at the company's current EPS and its changes over a one-year period to determine if it is worth investing in. Investors want to see growth. Investors will be attracted to companies that grow faster than their EPS.

The EPS dynamics of a company can vary depending on profit, market share, or both. The company can either increase its profit or decrease the number of shares in market through stocks buyback to increase EPS. On the other hand, if the company has more turnover than it makes profit, its EPS will decrease.

Investors evaluate EPS along with other economic indicators such as P/E. Better EPS during the reporting period can make a company more attractive than other companies, even if the other indices are similar.

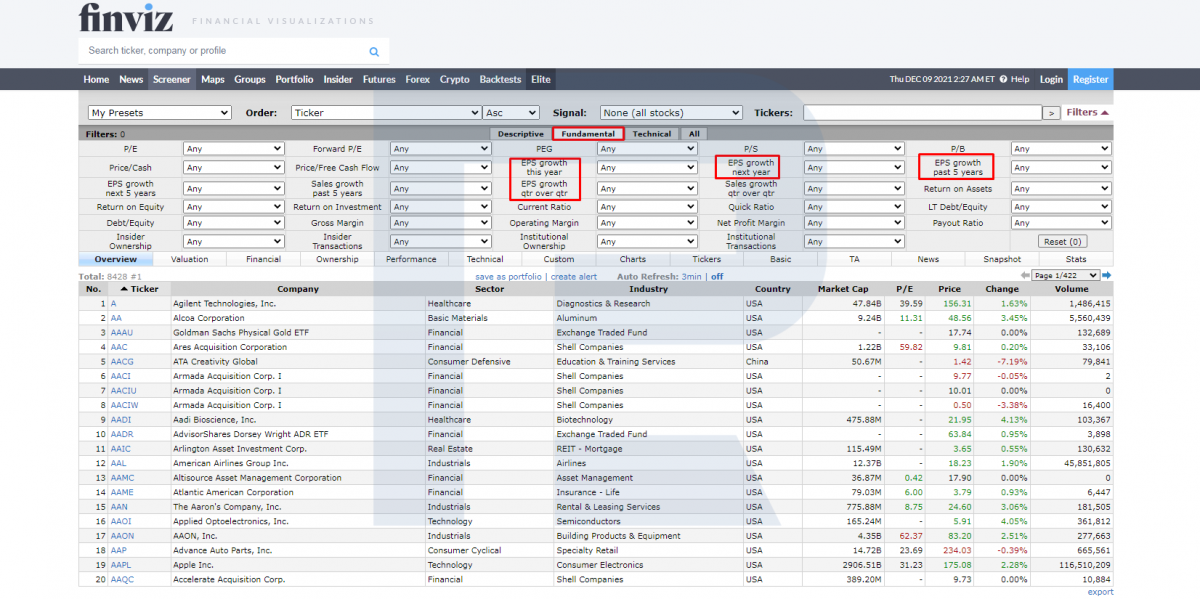

You can find EPS information in economic reports and on websites. Finviz.com provides information about EPS and American companies.

Filter "by EPS" is stocks screener

Advantages and disadvantages of EPS

These are the benefits

-

Popularity and availability

-

Comprehensive approach: You can evaluate the company's ability to make you a profit per shares at once

-

You can verify the accuracy of your data with a simple formula.

Some disadvantages:

-

Companies with a short life expectancy are difficult to evaluate as EPS is usually based on dynamics over many years. If the company has only been on the market for a few years, you should be careful with this one.

-

The EPS value must be relative to the market price to ensure accuracy. It is recommended to use it in conjunction with the P/E multiplier for a better result.

-

If privileged shares are included, the multiplier does no account for their influence.

Closing thoughts

EPS allows you to estimate the potential profit on one share of the company that you plan to invest in. This multiplier is not without its merits and disadvantages. It should be used in conjunction with other multipliers, with P/E being most commonly used.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/12/09/how-to-use-eps-for-evaluating-shares/

Did you miss our previous article...

https://11waystomakemoney.com/forex/color-mfi-x20-htf-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions