This article is about the Purchasing Managers' Index (PMI), how it affects the currency market and how trading can use it.

What is PMI?

The PMI, a special index that measures the current economic state of a country or specific branches of the economy, is an indicator that provides information. It assesses the following main branches of the economy:

The strongest economic influence is from the industrial PMI. This is why economists and investors pay close attention to it. It is calculated using polling purchasing managers from the industrial sector across several categories.

-

Orders for the New Year

-

Production volumes

-

Stocks in warehouses

-

Suppliers' work

-

Rate of employment

Managers are asked to indicate how their business conditions have changed over the past month. They can also mark whether or not they have changed at all. This index shows the sentiments of upper and middle management in various companies.

The PMI is an index that forecasts economic growth and decline.

PMI indices in America

There are many PMI indices in the USA that differ in their calculation methods and the number of companies. Let's take a look at three of the most important indices many analysts and traders pay attention to.

Markit PMI

Markit Group collects data for this index by polling purchasing executives from around 400 non-state manufacturing companies. Experts group the answers according to categories, multiply them by a set percentage, and then calculate the PMI.

The index value can vary from 0 to 100 in %. Average is between 45-50. The average value is 45-50. A drop below 45 indicates that the economy's outlook has worsened and values have grown above 50.

This index, which contains data for the previous month, is published on the first day of every month. It has moderate influence on currency markets.

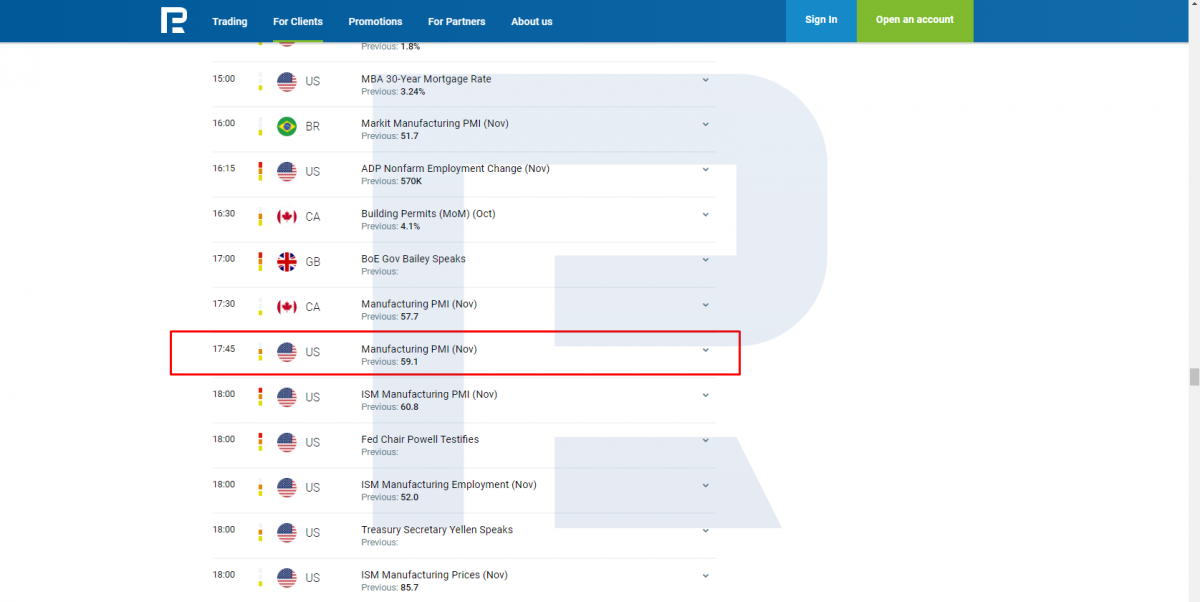

How the PMI is displayed on the economic calendar

Chicago PMI Index

The Association of Chicago Purchasing Managers calculates and publishes this number. It is the economic well-being of production in Illinois, Indiana and Michigan.

Chicago PMI measures manufacturing orders, manufacturing prices, as well as stocks in warehouses. This region is representative of the overall manufacturing and non-manufacturing situation in the USA.

An index higher than 50 signifies that production is expanding, and a lower index indicates that production is slowing down. The Chicago PMI Index, which is published on the last day of each month, helps forecast the ISM Manufacturing Index (national PMI) because they are closely related. It has moderate influence on the currency market.

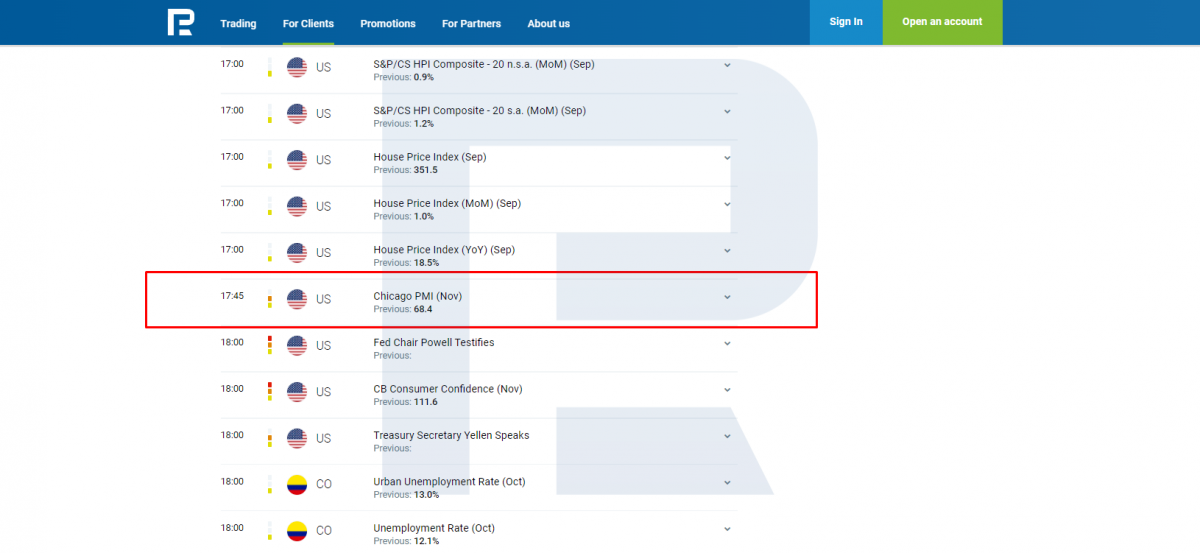

How Chicago PMI is displayed on the economic calendar

ISM Manufacturing Index

ISM stands for Institute for Supply Management. The ISM Manufacturing Index, the USA's most important PMI, covers a broad range of manufacturing companies. Its dynamic best reflects the state of manufacturing in the country.

An ISM score of 50 or higher indicates that manufacturing is in development, and a lower ISM index (50 or below) signifies a slowdown. The ISM above 60 means that the economy has overheated and that inflation is increasing, which could lead to the Fed raising the interest rate. The USD can be affected by the publication of the index on the first day of each month.

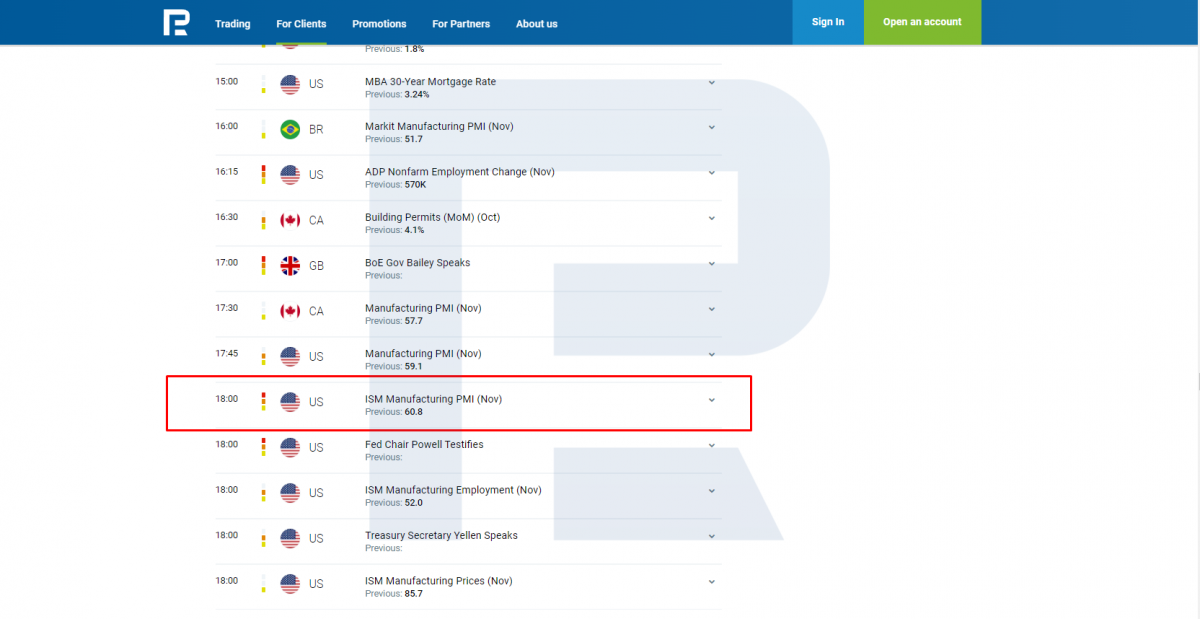

How ISM Manufacturing Index is displayed on the economic calendar

What does the PMI do to currency rates?

The PMI, which is a leading indicator that shows the country's economic potential, has an influence on the currency.

Growth

The country's business climate is improving because of stable growth in the index over the past three months. The manufacturing sector is growing, and the management is optimistic.

This will allow the GDP to grow faster, along with inflation, which could lead to an increase in CB's interest rate. The index's growth results in a rise in the national currency.

Falling

A steady fall in the index over three months or more is a sign that there is a poor business climate. Managers are becoming pessimistic as the economy weakens.

A fall in the index below 40 could signal a recession. The CB could decide to lower the interest rate in such cases. A decline in the index would mean that the national currency is falling.

Forex trading using PMI

You can use PMIs to trade in Forex and other economic indices. There are two options: long-term investments or news trading.

Currency investments

This long-term strategy requires large capital over a long period of time. Fundamental analysis is used to determine whether a currency is attractive for investment. All major economic indicators are examined, including inflation, PMI, GDP and others.

High PMI values and positive dynamics mean bright prospects for the national currency. The currency is attractive for investment if other indices don't contradict it.

However, the currency is attractive to sales because of a prolonged decline in business activity. This is also supported by a fall of other indices.

Trade news

This short-term Forex trading strategy requires little capital. News trading is influenced by the PMI's short-term impact on the currency rate. The ISM Manufacturing Index is the most influential on USD quotes. The index can be much higher than predicted, causing the national currency to grow abruptly. A decline on the other hand, causes the dollar to fall.

This temporary rise in quotations can be used to your advantage and make a profit. Analyze the price chart to plan profitable trades based on the momentum following publication. Tech analysis can be used to identify support and resistance levels and capture price patterns.

Bottom line

The PMI, which is a leading indicator, assesses the progress of the largest companies in the country through polling manufacturing managers. Its dynamic represents changes in the manufacturing business environment, which allows for forecasts of future development. The PMI's publication has an impact on the national currency.

--------------------

blog.roboforex.com/blog/2021/12/02/how-to-use-pmi-in-forex-trading/

Did you miss our previous article...

https://11waystomakemoney.com/forex/candles-auto-fibo-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions