Antismoking campaigns have been very active all over the world recently: there are strict advertising bans, global societies introduced a lot of different restrictions for smoking in public places, and actively promotes a healthy lifestyle. Nevertheless, the number of those who smoke hasn’t dropped much. People find ways to replace smoking with electronic cigarettes, vapes, and IQOS. Some even manage to quit smoking using them. A conventional pack of cigarettes we all got used to is almost history now.

Aspire Global logo

Aspire Global specializes in manufacturing electronic cigarettes and is planning to have an IPO at the NASDAQ on August 20th. The company’s shares will start trading under the “ASPG” ticker on August 24th. Earlier, the IPO was postponed due to political risks in China. Let’s discuss the company’s business and find out how interesting Aspire Global shares are for mid/long-term investments.

Business of Aspire Global

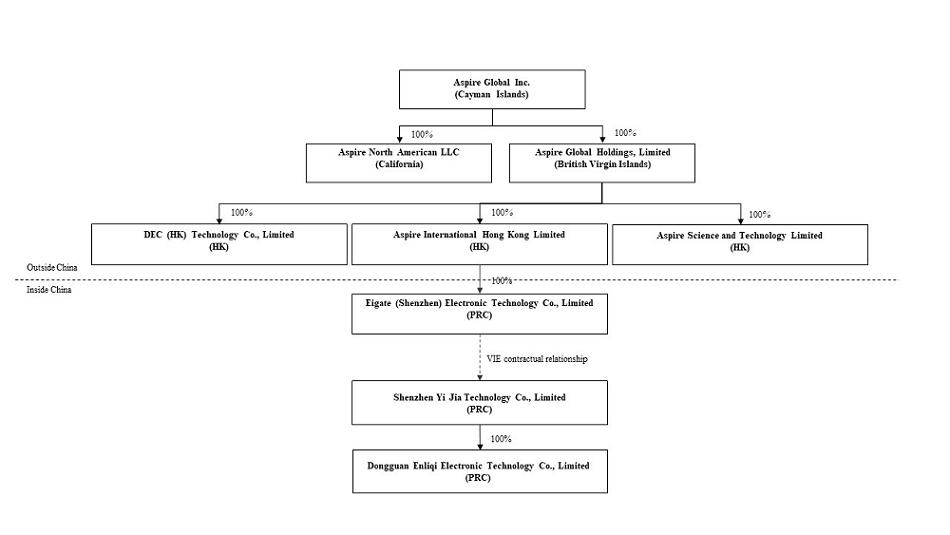

The company was founded in 2010 in Shenzhen, China. Aspire is a family-owned company, its founder and CEO is Tuanfang Liu. The company employs over 1,300 people. Aspire ownership structure can be found below.

Aspire Global ownership structure

The issuer is engaged in the development, commercialization, and sales of electronic cigarettes and accessories for them. The company also offers open and closed vape systems. In the future, Aspire is planning to sell vapes for medical cannabis. Basically, the company is engaged in direct sales to its clients but also working with OEM (Original Equipment Manufacturer), when its partners can sell the company’s products under their own brands.

Because of the coronavirus pandemic, Aspire had to shut down its production for three months. However, it didn’t result in losses but only a reduction in profit, that’s why one can say that the company’s business model is pretty reliable.

The lion's share of sales is made in the European Union (61%), North America (22.6%), and China (16.3%). In the USA, Aspire is pressured by competitors: the company’s revenue here dropped from 41% to 22.6%, while in Eastern Asia it rose from 1% to 16.3%.

The next topic to cover is the company’s target market and its prospects there.

The market and competitors of Aspire Global

As of 2020, over 1 billion people in the world smoke, and the volume of this market is $936 billion. It is expected that the market will reach $1.02 trillion by 2023 with an average annual growth rate of 3%.

According to Euromonitor, the number of people who smoke electronic cigarettes last year was 55 million with a market volume of $22 billion. By 2024, it may reach $120 billion with a cigarette market share of 10%. In this case, an average annual growth rate may be 25%.

We should note that almost 90% of all electronic cigarettes are produced in China but the country consumes only 10% of them. The Chinese market is estimated at $2.7 billion. According to ambitious estimates, by 2023 it may reach $11 billion with an average annual growth rate of 65.9%. The remarkable thing is that the company’s sales in the Asia-Pacific region are increasing even faster.

The company’s key competitors are:

- Juul

- Smoore

- RLX Technology

- Altria Group Inc.

Financial performance

Aspire Global is going public being profitable and that allows us to conduct a comprehensive analysis of the company using different multipliers. We’ll start with the revenue, as always.

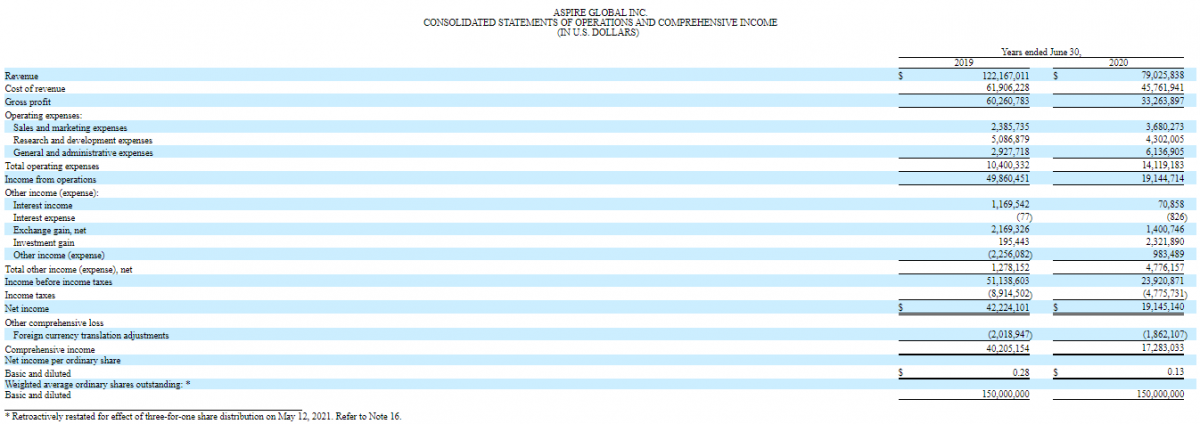

According to the data provided in the F-1 form, the company’s sales in 2020 were $79 million with a 35.4% decline if compared with 2019. The reason is a shutdown in production during the pandemic. The gross profit also fell, by 45% down to $33.2 million.

Aspire Global financial performance

Aspire’s net profit in 2020 was $19.1 million, a 54.8% decline relative to 2019. As a consequence, profitability also reduced, from 34.5% in 2019 to 24.1% in 2020.

Cash and cash equivalents on the company’s balance sheet are $143.29 million, while its total liabilities equal $72.87 million and its net cash position is $70.42 million. The free cash flow is $14.84. Overall, the company is highly stable financially – the lack of production for one quarter helped to record the net profit. Now it’s time to take a comprehensive look at the company’s business and talk about its advantages and disadvantages.

Strong and weak sides of Aspire Global

Let’s talk about the pros and contras of investing in Aspire. Among its strong sides, I would name:

- The company’s potential target market will add 25% every year until 2024.

- The vaping market in China may add 65.9% per year.

- The global lockdown didn’t prevent Aspire from recording the net profit at the year-end of 2020.

- The issuer paid dividends earlier and doesn’t exclude a possibility of restoration of dividends.

Risks of investing in these shares are:

- The dangers of vaping may be much stronger than the dangers of smoking.

- Political risks of compulsory delisting of Chinese companies from the American stock exchanges.

- Lawsuits from consumers.

IPO details and estimation of Aspire Global capitalization

The underwriters of the IPO are China Merchants Securities (HK) Co., Limited; EF Hutton, division of Benchmark Investments, LLC; US Tiger Securities, Inc. и TFI Securities and Futures Limited. The company is offering 15 million common shares at the price of $7-9 per share. If shares are sold at the highest price in this range, the IPO may raise $120 million and the company’s capitalization may reach $1.32 billion.

To assess the company’s potential capitalization, we use a multiplier, the Price-to-Sales ratio (P/S ratio). For the tobacco sector, the average P/S value is 3.83. However, a multiplier value of Aspire’s competitor, RLX Technology, Inc. (NYSE: RLX), at the end of the lock-up period was 35. As a result, the upside for Aspire shares may be 112%.

The company’s P/E ratio is extremely high, 115.05. for a developing company, the net profit is not as important as the revenue.

Thanks to some competitive advantages, solid financial performance, and the high-growth market, I would recommend adding shares of Aspire to mid/long-term investment portfolio.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R Trader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.25. You can also try your trading skills in the R Trader platform on a demo account, just register on RoboForex.com and open a trading account.

The post IPO Aspire Global: a Vape from China appeared first at R Blog - RoboForex.

---------------------------------

By: Vadim Kovalenko

Title: IPO Aspire Global: a Vape from China

Sourced From: blog.roboforex.com/blog/2021/08/17/ipo-aspire-global-a-vape-from-china/

Published Date: Tue, 17 Aug 2021 15:07:14 +0000

Read More

Did you miss our previous article...

https://11waystomakemoney.com/forex/alligator-simple-v10-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions