The healthcare sector in advanced economies is very profitable and is not susceptible to cyclic crisis. This business is multi-billion in volume and requires financial management optimization in the US and western Europe. Many technology startups are involved in the development of such platforms.

Ensemble Health Partners is the leader in RCM solutions for private and hospital physicians. The ticker symbol for Ensemble Health Partners is "ENBS". Underwriters delayed the IPO date and it is currently unknown.

This article will discuss the attractiveness of these shares as investments.

Ensemble Health Partners - Business

The company was founded in 2014, with headquarters in Cincinnati Ohio. It currently employs more than 1,000 people. Its core product is a platform that manages the technological revenue cycle for doctors in private and hospital settings.

Ensemble Health Partners’ Net Patient Revenue chart.

Ensemble Health now has a large and diverse customer base. The company's platform had processed transactions worth more than $20 billion as of the filing date for the IPO application. The RCM platform allows for improved revenue management and a greater focus on quality healthcare services. The company usually has long-term contracts for clients that last 10-15 years and are automatically renewed.

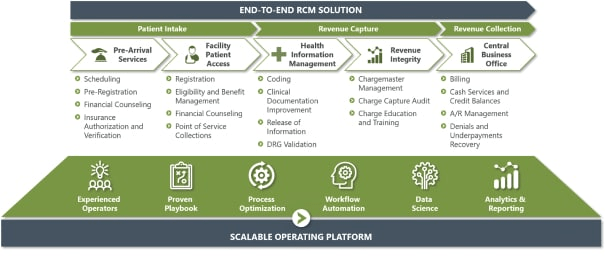

Ensemble Health Partners RCM platform features.

Ensemble Health was awarded several awards in public healthcare. KLAS Research named Ensemble Health the "Best in KLAS", in each of five categories: operations, services, loyalty, value and relations. Based on objective data from healthcare service providers, Ensemble Health Partners won the award in 2020 and 2021.

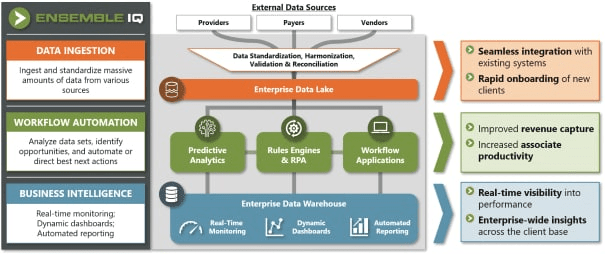

How Ensemble Health Partners’ platform works.

Ensemble Health Partners was also named the best employer by Cincinnati Enquirer and Beckers 150 Top Workplaces. These awards allow Ensemble Health Partners to attract and retain more professionals and improve the quality of its services to customers. The company is active in the rapidly growing RCM (revenue cycle Management) market. Below, we'll discuss it.

Ensemble Health Partners' market share and competition

Global Market Insights estimates that the US revenue cycle management market will reach $98 billion in 2020. The market is expected to reach $230 billion by 2027, according to forecasts. This represents an average annual growth rate 12.9%. This growth will be driven by technological advancement and financial management optimization in healthcare.

The global healthcare market was valued at $1 trillion in 2020. Ensemble Health believes the target market for the IPO at the time is approximately $50 billion.

These are the key competitors of the company:

-

Candela Medical

-

Oscar Health

Financial performance

Ensemble Health Partners has filed for the IPO to be profitable. This is quite unusual for technology companies. We will begin analysing Ensemble Health Partners' financial performance and net profit.

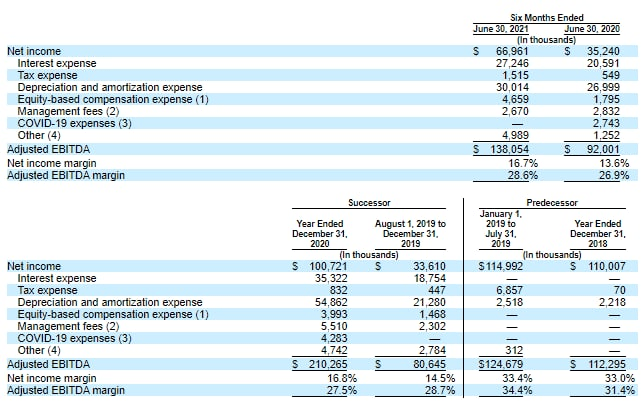

The net profit of the company in 2020 was $100.72million, which is a 32.22% decline relative to 2019. The S-1 report shows that the company's net profits in 2020 were $100.72 million. This is a 32.22% decrease compared to 2019. The net profit growth rate has been increasing, as we can see.

The net profit for the past 12 months was $176.78million. This sum could reach $231.72 millions at the end of 2021.

Ensemble Health Partners financial performance.

The company's 2020 sales were $600.02million, an increase of 4.07% relative to 2019. The S-1 report states that the company's revenues in 2020 were $600.02 million. This is a 4.07% increase over 2019. The revenue for the past 12 months was $742.26 Million.

The company has cash and cash equivalents of $76.05million on its balance sheet, while its total liabilities amount to $1.49B, which includes two long-term loans in the range of $1.4B. Ensemble Health Partners has a positive cash flow and growing revenue.

Ensemble Health Partners has both strong and weak sides

Ensemble Health's risks and benefits must be highlighted. The company's strengths are, according to me:

-

The net profit growth rate is above 90%

-

Low debt load

-

Award for the best employer or quality of service.

-

Target market that is promising

-

Sound management.

I would nominate:

-

Low rate of revenue growth

-

Unstable net profit

-

The company does not pay dividends.

Details and estimates of Ensemble Health Partners capitalization.

The initial plan of the company's management was to make it public in October. However, they decided to delay the IPO. Robert W. Baird & Co. are the underwriters for the IPO. Incorporated, William Blair & Company, L.L.C., Academy Securities, Inc., Loop Capital Markets LLC, Guggenheim Securities, LLC, Credit Suisse Securities, LLC, Evercore Group L.L.C., Wells Fargo Securities, LLC, SVB Leerink LLC, Deutsche Bank Securities Inc., BofA Securities, Inc., Goldman Sachs & Co. LLC.

The company plans to sell 29.5million common shares during the IPO at a price of $19-22 each share. The IPO volume is estimated to reach $605 million, with a capitalization up to $3.62billion.

To assess the capitalization of companies in the technology sector, we use a multiplier called the Price-to–Sales ratio (P/S) ratio. The company's P/S value was 4.88 at the time of its IPO. Ensemble Health shares could have a potential upside of 108.33% for companies in this sector.

All that being said, I recommend this company as a medium- or short-term investment.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/11/30/ipo-of-ensemble-health-partners-an-rcm-platform-or-public-health-services/

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions