Any manufacturer or service provider in a competitive market finds it essential to get quick and objective feedback from customers. Customers leave negative feedback almost always because they take quality products and services for granted. Companies are not privy to the valuable suggestions and advice of many customers. Video reviews of products are extremely popular online. Many companies' marketing departments thoroughly analyze these videos.

UserTesting Inc. will have an IPO on Thursday. This company developed a SaaS platform that allows for video feedback analysis with artificial intelligence. This platform allows customers to conduct research in marketing and provides unbiased feedback. The USER ticker will be used to trade the company's shares at the NYSE. We'll be taking a closer look at this company and discussing why its services are unique.

UserTesting Inc.

UserTesting was established in 2007 by Dave Garr, and Darrell Benatar. Andy MacMillan is the Chief Executive Officer of UserTesting since 2018. He was previously employed at Act-On Software. His authority is a blessing to over 700 employees.

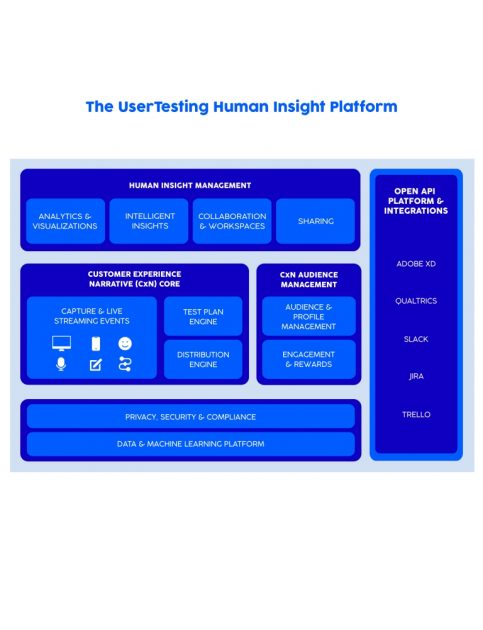

UserTesting Human Insight platform

The main product of the company is the UserTesting Human Insight platform, which allows users to test different websites and applications. The platform allows users to register, pass an entry test, and then fill out the form with their demographic information. UserTesting then creates focus groups according to client preferences, and sends them products or services for testing. Video feedback is given by testers and they are eligible for monetary rewards (ranging from 3 to 60 USD).

UserTesting Human Insight platform features

The company then analyzes the video feedback using machine learning and artificial intelligence. Algorithms evaluate everything: tone, intonation and mimics as well as visual effects. The analysis generates the most varied responses from potential customers of any product.

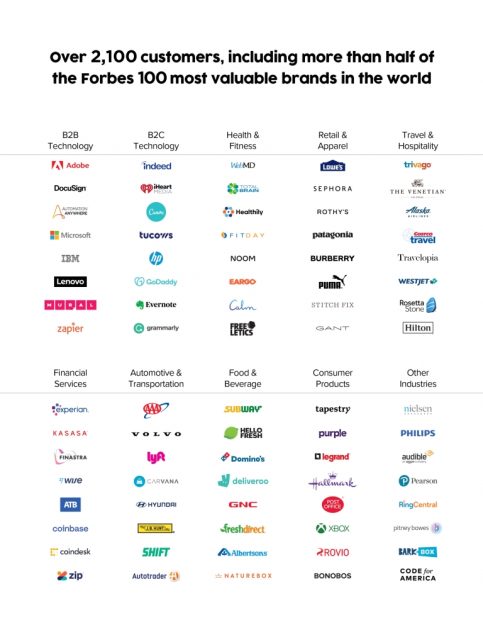

UserTesting clients

Clients of UserTesting can conduct a thorough testing of their products or services using the experience of potential customers. This is done by creating profiles. The UserTesting Human Intelligence application can be used to help companies find the right testers.

UserTesting is available in all major regions, including North America, Africa and India, Europe, Asia, and Europe. Topiary Capital and Insight Partners are the company's major investors. OpenView, Inspiration Ventures, and Topiary Capital are also key investors.

UserTesting Inc.'s market share and competition

The company is active in the areas of marketing, public opinion analysis, artificial intelligence, and marketing. Market Research Future estimates that these markets could reach $47 billion in 2024 with an average annual growth rate of 11.9%. UserTesting estimates that a growing number medium-sized businesses require quality analysis to improve customer experience. This could explain why the projected growth rate for the target market may be higher than the numbers.

These are the key competitors of the company:

-

UsabiliityHub

-

Qualtrics

-

SurveyMonkey

-

Amplitude

-

UserZoom

-

TechSmith

-

Hotjar

-

Woopra

Financial performance

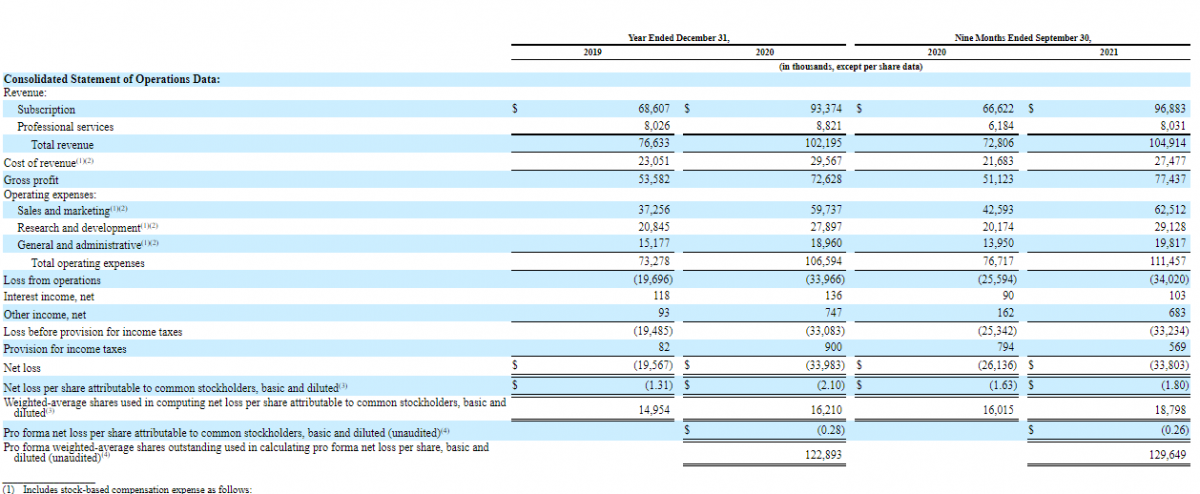

Let's look closer at the financial performance of the issuer. UserTesting does not generate net zprofit according to the S-1 form. We will therefore start analysing its sales.

The company's 2020 revenue was $102.19 Million, an increase of 33.36% over 2019.

UserTesting Inc. financial performance

The revenue for the period January through September 2021 was $104.91million, an increase of 44.09% compared to the same period in 2020. The revenue is steadily increasing, as you can see. The revenue for the past 12 months was $134.29 Million. The company could see sales of $147.15 millions by 2021 if this trend continues.

UserTesting Inc. financial statement

2020's net loss was $33.98million, which is 73.63% more than 2019. The net loss for 2020 was $33.98 million. This is a 73.63% increase compared to 2019. The net loss growth is slowing down, as can be seen.

The company has cash and cash equivalents of $73.47million on its balance sheet, while total debt stands at $18.93million. The net cash position now stands at $54.54 Million.

Stability can be defined as the company's financial condition. The positive factors include revenue growth and a decrease in net loss.

User Testing Inc. has both strong and weak sides.

Let's now discuss the pros and cons of this IPO. The company's benefits are, according to me:

-

Sound management.

-

The revenue growth trend is on the rise.

-

The potential target market volume.

-

The company's product is in high demand.

-

High-profile IPO underwriters.

There are risks associated with investing in User Testing Inc.

-

The company is unprofitable.

-

Strong competition

-

Market situation in general

UserTesting Inc. capitalization estimation and details

The company raised $220million during preliminary rounds of financing. Academy Securities, Inc., Loop Capital Markets LLC, Robert W. Baird & Co. are the underwriters for the IPO. Incorporated, William Blair & Company, L.L.C., Canaccord Genuity LLC, Needham & Company, LLC, Oppenheimer & Co. Inc., Raymond James & Associates, Inc., Truist Securities, Inc., Piper Sandler & Co., J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC.

UserTesting Inc. plans to raise $226.7 Million through the IPO by selling 140.85million common shares at a price of $15-17 each share. The company could be worth $2.27 billion if shares are sold at this price.

We use a multiplier to assess UserTesting: the Price-toSales ratio (P/S). A P/S value of 18.48 will be achieved after the IPO. The lock-up period saw an average P/S of 35. The upside for the shares could be as high as 89.39% if the company's revenues continue to rise at the same rate as before.

This company shares are high-risk investments that have higher profit potential. It would be prudent to only enter this position in small "batches".

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/11/16/shortly-before-usertesting-inc-ipo-were-analysing-the-company/

Did you miss our previous article...

https://11waystomakemoney.com/forex/while-walt-disneys-paid-subscriptions-are-declining-shares-also-fall

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions