Traders can be likened to hunters. Forex traders would keep a watchful eye on the forex pairs they were interested in, waiting for the right timing. They would often be looking at a pair of forex pairs for hours, days, or even weeks. They would look at certain levels and wait for the price to reach that level. Then they would react according to their trade plan.

Hunters wait to catch their prey at a specific spot. They don't often chase their prey and scare them. They would rather wait in a hunting hide while they wait for their prey. Once their prey is in their vicinity, they will aim at it and wait until their prey is in their crosshairs. They then press the trigger to shoot.

The same should be done for traders. Traders should set aside certain zones or levels where they will wait for the price to rise. The worst mistake traders can make is to chase the price. They should wait for price action to confirm the zone before they chase it.

This strategy is called Pinpoint Supply and demand Forex Trading Strategy. It waits for price to reach certain demand or supply zones, then confirms entry with an entry trigger that is based on technical indicators.

Demand and Supply

Trading is all about supply and demand. This concept focuses on the ability to identify supply and need zones based upon price movements that have occurred previously at a level with strong momentum. These moves often resulted in swing lows or swing highs. To create the supply-demand zone, traders would extend the congestion zone for the swing high or swing lower.

This process is simplified by the Supply and Demand indicator, which automatically marks the supply and demand areas. The only thing traders need to do is watch the price change as it tests and revisits these areas.

This indicator indicates the demand zone by extending a dark blue box to the right. It also marks supply zone by extending a maroon container to the left. These boxes are removed when price crosses the zone with strong momentum.

Heiken Ashi Candlesticks

Currently, regular Japanese candlesticks are the norm. This charting method is most popular among traders. The Japanese have also created a new charting method.

Heiken Ashi in Japanese literally means "average bars". It's an indicator that modifies the way a candlestick plots. It would show the same highs as a bar, but with different lows. It would alter the open and closing of the candle according to the price movements. This would result in candles that show the highs or lows of the candle. This is useful for price action analysis. Modified open and closing of a candle will cause it to change its color when the trend is in the opposite direction.

The Heiken Ashi Candlesticks can be used both as a charting tool and as a short term momentum indicator. It could be used by traders as an exit or entry signal, depending on the changing color of the bars.

Trading Strategy

This is a trading strategy that focuses on basic supply and demande. It attempts to trade off bounces from either a supply or a demand zone.

It uses the Supply Demand indicator in order to automatically plot supply and demand zones. In anticipation of a price rebound, traders should wait for the price to return and then retest that area.

The Heiken Ashi Candlestick indicator is used as a charting tool to identify potential short-term momentum shifts. These short-term momentum reversals can be used to identify possible bounces from the demand or supply zone.

A pending stop entry order will be placed on the Heiken Ashi Candlestick's high or lowest price if the price shows signs of rising off the supply/demand zone. The momentum shift will be confirmed if the price exceeds the candle's high or lowest point.

A take profit target is one that targets a swing high or low before the bounce. This is a logical take-profit target.

Indicators:

Prefer Time Frames: 1 hour, HTML4 hours and daily charts

Currency pairs: FX majors and minors as well as crosses

Forex Sessions: Tokyo sessions.

Trade Setup

Entry

-

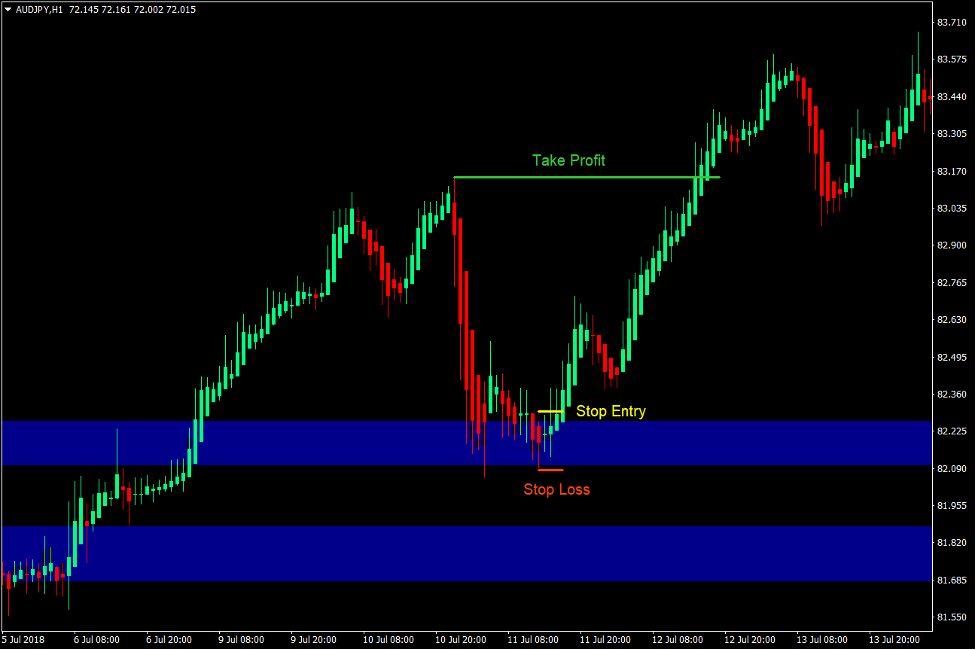

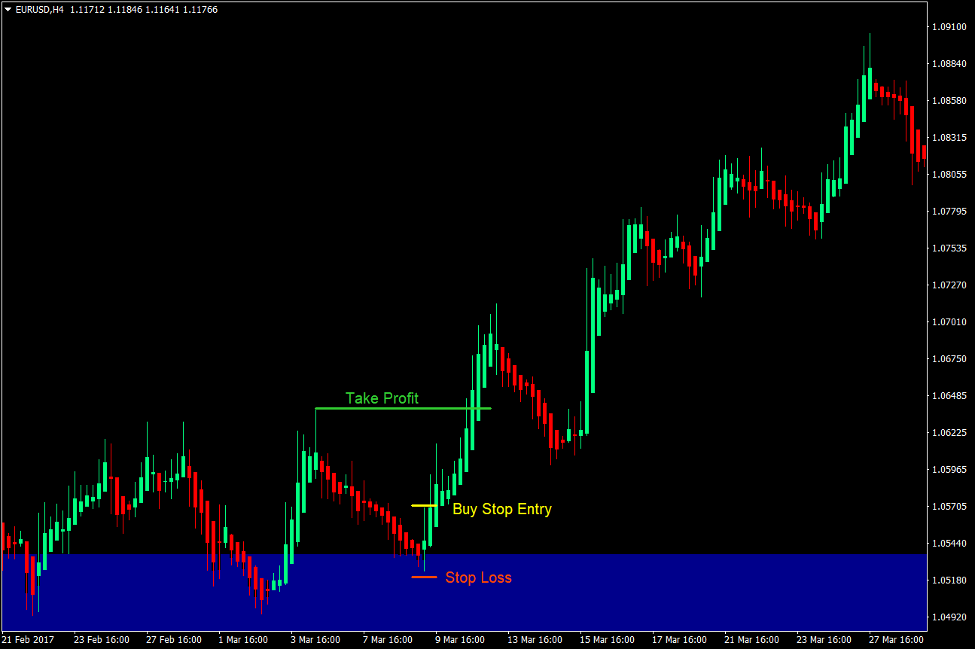

The Supply Demand indicator should show a dark blue box that indicates a demand area.

-

The price should be retested and rebound from the demand zone.

-

The Heiken Ashi Candlesticks need to be changed to spring green.

-

Place a buy-stop entry order at the top of the candlestick.

Stop Loss

-

Place the stop loss for the fractal under the entry candle.

Exit

-

Before the demand zone bounce, set the take profit target at swing high.

Setup for Trades

Entry

-

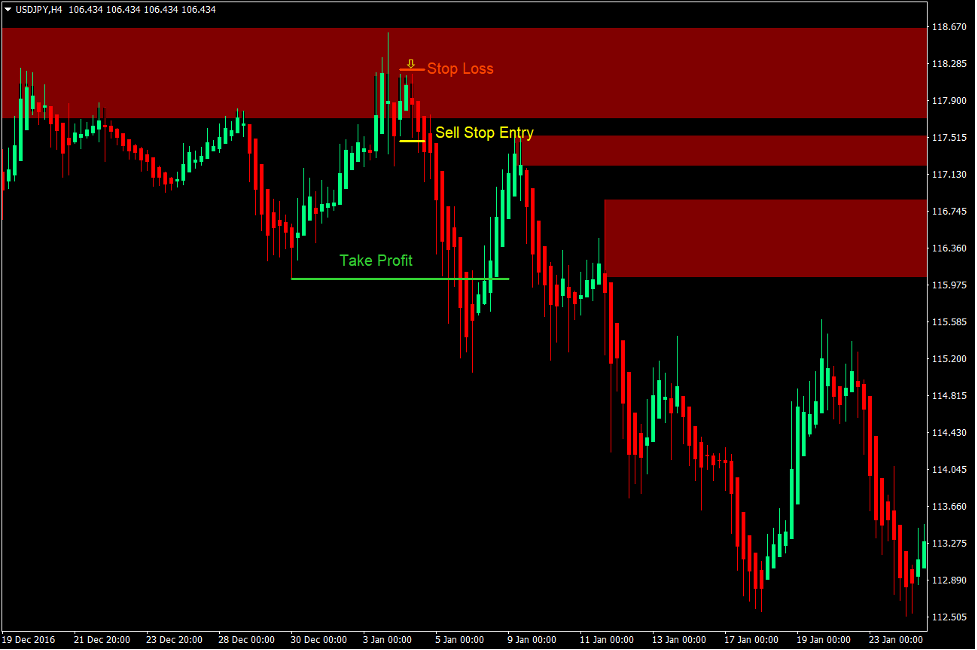

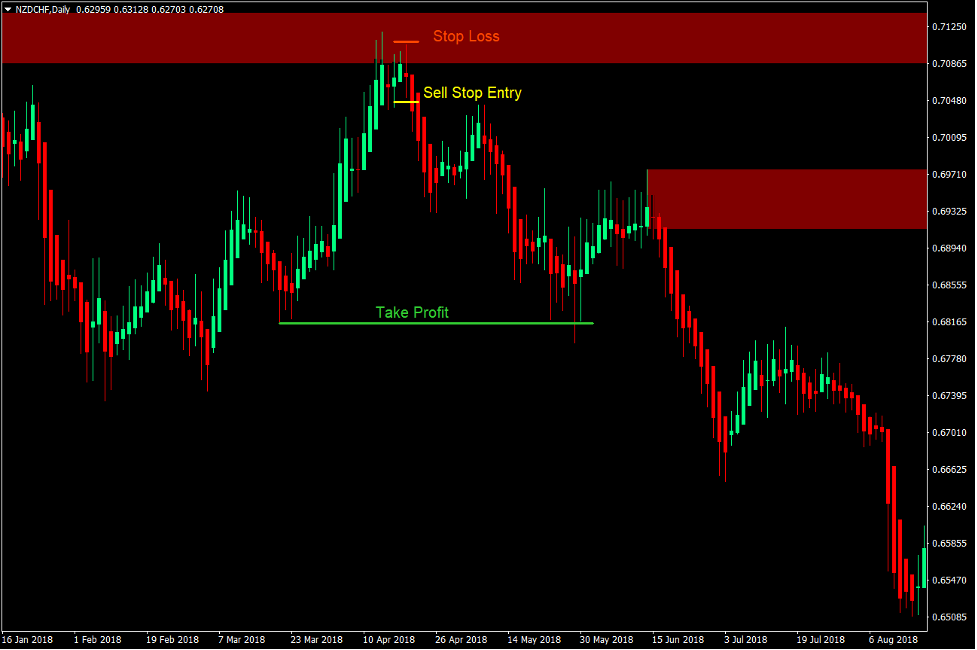

The Supply Demand indicator should show a maroon circle indicating a supply area.

-

The price should be retested and bounced off the supply zone.

-

The Heiken Ashi Candlesticks must be changed to red.

-

Place a sell stop order at the lowest candlestick.

Stop Loss

-

Place the stop loss on fractals above the entry candle.

Exit

-

Before the supply zone bounce, set the take profit target at swing low.

Conclusion

Professional traders use Supply and Demand strategies to trade. Professional traders who are successful incorporate Supply and Demand strategies into their trading, or variations thereof.

It is difficult to identify supply and demand areas. This is the problem with Supply and Demand strategies. It can take several years to master.

Pre-planning the zones simplifies the process. This validates the bounces from the zones based upon the Heiken Ashi Candlesticks.

This strategy is more user-friendly for new traders.

Forex Trading Strategy Installation Instructions

Pinpoint Supply and demand Forex Trading Strategy is a combination Metatrader 4(MT4) indicator(s), and template.

This forex strategy aims to transform historical data and trading signals.

Pinpoint Supply and Deman Forex Trading Strategy allows you to spot patterns and peculiarities in price dynamics that are not visible to the naked eye.

This information allows traders to assume additional price movements and adjust their strategy accordingly.

Forex Metatrader 4 Trading Platform

-

Support available 24/7 by an international broker.

-

Over 12,000 assets, including Stocks, Indices, Forex.

-

Spreads and execution of orders are faster than ever with spreads starting at 0 pip.

-

Start depositing now to get a bonus of up to $50,000

-

Demo accounts are available to test trading strategies.

Step-by-Step RoboForex Trading Account Open Guide

How do you install Pinpoint Supply and Demand Forex Trading Strategy.

-

Pinpoint Supply and Demand Forex Trading Strategy.zip

-

*Copy the mq4 & ex4 files to your Metatrader Directory/experts /indicators /

-

Copy the tpl (Template) file to your Metatrader Directory/ templates

-

Your Metatrader client can be started or stopped.

-

Choose the Chart and Timeframe in which you would like to test your forex strategy

-

Right-click on your trading chart, hover over "Template",

-

Click here to choose Pinpoint Supply and Demand Forex Trading Strategy

-

Your Chart will show you that the Pinpoint Supply and Demand Forex Trading Strategy has been added.

*Note that not all forex strategies include mq4/ex4 files. Some templates can be integrated with the MT4 indicators from the MetaTrader Platform.

--------------------

www.forexmt4indicators.com/pinpoint-supply-and-demand-forex-trading-strategy/?utm_source=rss&utm_medium=rss&utm_campaign=pinpoint-supply-and-demand-forex-trading-strategy

Did you miss our previous article...

https://11waystomakemoney.com/forex/trix-with-double-smoothed-wilders-ema-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions