This week has a lot of interesting news. I nearly talked about French vaccines or Chinese electric cars, but I resisted and will continue to talk about quarterly reports.

Today, you'll hear about the financial performance of Johnson & Johnson and Philip Morris. Not only will I share some impressive statistics, but I'll also show you how the quotes of the shares reacted after the publication of these reports. A tech analysis by MaksimArtyomov will be included. Keep watching, we'll keep going.

Investors not impressed by Netflix's quarterly report

The promise of cool releases by Netflix management at year's beginning was fulfilled. The streaming platform had no choice but to drop the most popular products in the second half 2021 due to the pandemic. This is not something I am happy about, but I must mention the highly-rated South Korean show "Squid Game".

The published data shows that the series was watched by more than 142,000,000 people in the four weeks following its release. Bloomberg claims that the project will net the American company $900 million.

Netflix wants to make it easy for users to spend more time on its platform. The platform also offers videogames, in addition to series and movies. Representatives from the company state that subscriptions will include games, but will not include any built-in ads.

Netflix's paid subscribers have increased by 9.4% over last year.

If a company is successful in attracting people, the number of subscribers who pay for content will show. This number increased by 4.38million users in Q3, while overall paid subscribers reached 213.56 million. Comparing to last year's statistics, the growth rate has been 9.4%.

You may recall that in Q2 2021 the increase in paid subscribers was 1.54 million, which is 184% less than Q3. According to streaming platform forecasts, there will be 8.5m more users in Q4 than a year ago.

Netflix shares were weakly affected by the results.

The share price of Netflix (NASDAQ : NFLX), which was published after the report was published, showed a very weak growth of 0.16% to $639 per shares. The quotations also dropped to $632.61 during the trading session.

Important report details

-

Revenues - $7.48 Billion, +16.3%; forecast - $7.48 Billion

-

Return on stock – $3.19, +83%; forecast – $2.56

-

Net Profit - $1.45 Billion, +83%

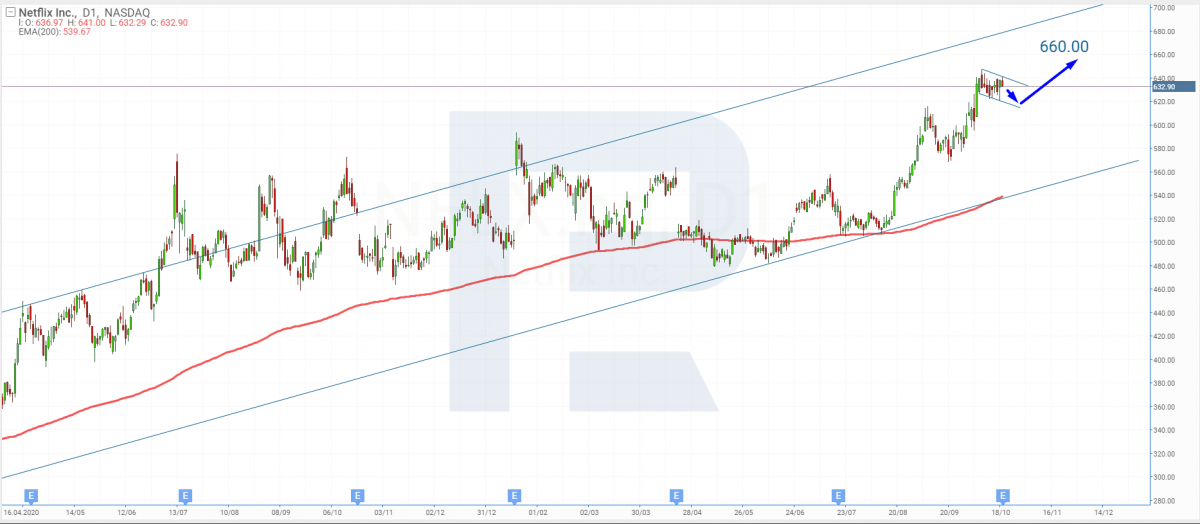

Maksim Artyomov - Tech analysis of Netflix shares

The financial report published by the corporation not only met all expectations, but exceeded them. This helped the quotations to reach new heights, even before the results were released. They are currently correcting as a tech pattern Flag.

The price could follow the pattern if it reaches the support level. The high will be the first goal of growth. The goal could rise to $660 if it is renewed. The 200-days Moving Average, which keeps growing, supports the growth.

Johnson & Johnson Quarterly Report: The pharma business grew almost 14%

Johnson & Johnson released financial statistics for its last quarter on Tuesday October 19th, just like Netflix. The revenue was not as high as the analysts expected, but the stock return exceeded Wall Street analysts' expectations.

J&J's Pharma business in Q3 2021 generated 13.8% more profit than the previous year.

In Q3, the anticoronavirus vaccine sales reached $502 million. According to the company, $2.5 billion in revenue would be generated by selling the vaccine by the end the year. The pharma division of the company has generated $12.9 billion in revenue over the past three months. This is 13.8% more than the year prior.

Johnson & Johnson's management reviewed their expectations for the year. The forecast return on stock increased from $9.6-9.7, to $9.77-9.82, while the forecast general revenue rose from $93.8-94.6 to $94.1-94.6 billion.

Yesterday's trading session saw shares of Johnson & Johnson (NYSE JNJ), close at $163.87. This is an increase of 2.34%. You will recall that the quotations have risen by just over 4% since the start of the year from $157.38.

Important return details

-

Revenues - $23.34 Billion, +10.7%; forecast - 23.72 Billion

-

Return on stock – $1.37, +3%; forecast - 1.15

-

Net Profit - $3.67 Billion, +3.2%

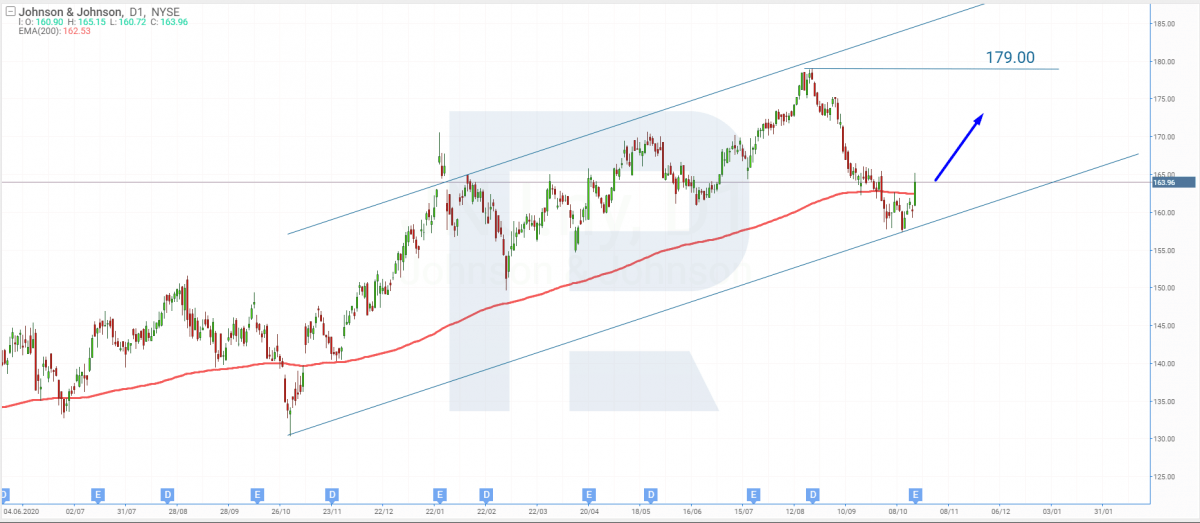

Maksim Artyomov conducted a tech analysis on Johnson & Johnson shares

Johnson & Johnson shares started to recover after the net profit increased. The channel's lower boundary has seen the price rise and the market continues to grow. The price is currently above the 200-days MA.

This could be a sign that the ascending wave will continue. The resistance level at $179 is the goal of growth. There is the possibility that quotations could fall below the 200-days MA, and then continue the correctional wave.

Quarterly report of Philip Morris: Shares react to a fall

Philip Morris International reported yesterday its Q3-2021 performance on October 19th. The main financial results were better than the 2020 statistics and exceeded consensus predictions.

The EU countries saw a 2.7% drop in the supply of cigarettes and other heated tobacco products to reach 49 billion pieces. The revenue increased by 8.2% to $3.2 Billion.

North and South America saw tobacco product sales rise by 2.5%, from 15.8 billion to 16.2 million pieces to 456 million, respectively. Revenues in the Near East and Africa jumped 23% to $945 millions. The general supply volume also showed growth, rising by 15% to 35.7 million pieces.

After the report, Philip Morris' share price dropped.

The quarterly report was met with a 1.7% decline in Philip Morris International shares (NASDAQ: PM), which fell to $95.79. This could be due to information regarding the global shortage in semiconductors that is limiting supply of IQOS. This is the third consecutive trading session that ended in decline. The shares of the company have lost 3% over this period.

Important report details

-

Revenues - $8.12 Billion, +9.1%. Forecast - $7.9 Billion.

-

Report on stock – $1.58, +4.7%; forecast – $1.54

-

Net Profit - $2.43 Billion, +5.2%

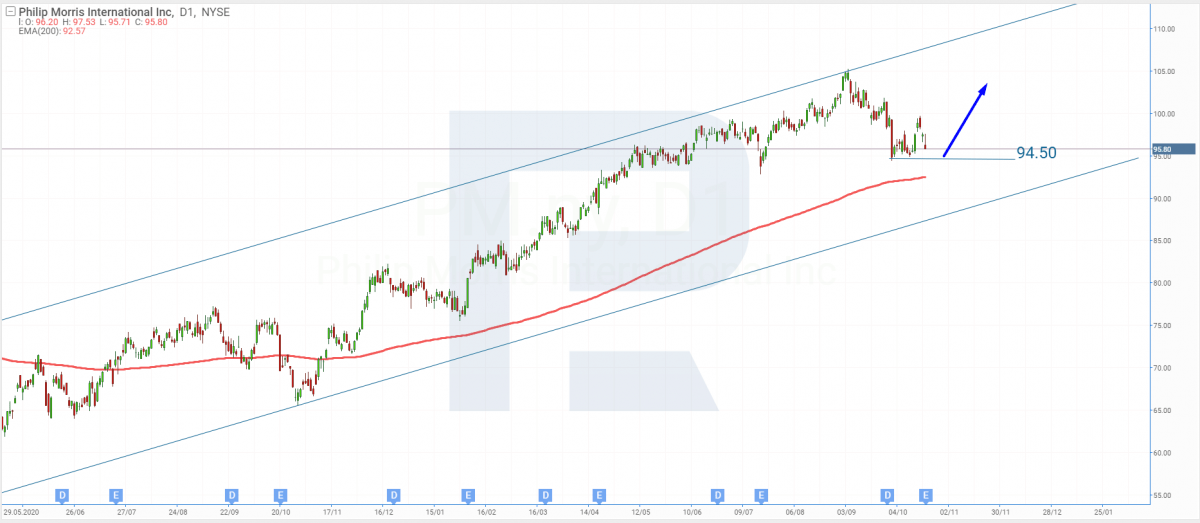

Maksim Artyomov - Tech analysis of Philip Morris shares

The shares of the corporation continue to fall despite the fact that the financial report exceeded expectations and forecasts. The company supported the British government's ban on traditional cigarettes, and for their replacement with electronic cigarettes and heat agents that are smokeless.

The support level of $94.5 is nearing the quotations. The price could rebound if investors change their attitude later. The resistance level at $105 might be the goal of growth.

The 200-days MA, which is moving upwards, could be another factor that supports growth after the correction is over. It could become the support line from which quotations may bounce later.

Summarising

On October 19, Netflix, Johnson & Johnson and Philip Morris announced their Q3 2021 performance. The share price of this company rose by 0.16% to $639. The second company's share price increased by just 0.16% to $639.87. Contrarily, the third one's quotations fell by 1.7% to $95.79.

R Blog has more quarterly reports

-

Quarterly Reports Impact IBM and AT&T Shares

JPMorgan, Bank of America and Morgan Stanley, Citigroup and Wells Fargo give reports for Q3, 2021

-

Levi Strauss shares rose after strong quarterly report

--------------------

blog.roboforex.com/blog/2021/10/20/shares-of-netflix-johnson-johnson-and-philip-morris-reacted-ambiguously-to-quarterly-reports/

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions