Two factors are key to making profits in trading: win rate and reward/risk ratios. A good win rate and a consistent win rate are two options for traders. Or, they could hit the jackpot trade that could turn the month into a profitable one. It's usually a combination of both. High reward-risk traders often have lower win rates than traders with a high win rate.

Trend reversal strategies often fall on the one side of the spectrum. Although trend reversal traders have a low win rate, they have high reward-risk ratios. The market doesn't trend very often. The market is actually quite stable, with a range of about 80% and only a 20% trend.

Confluences are a way to increase your chances of getting the right signal. Confluences can be different signals that point in the same direction, but they are all based on different thesis.

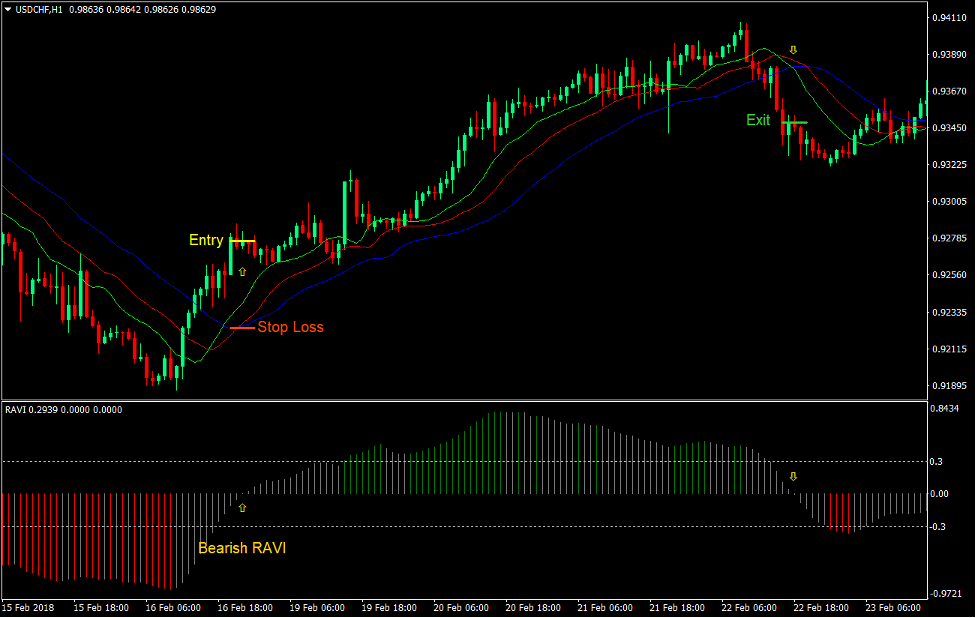

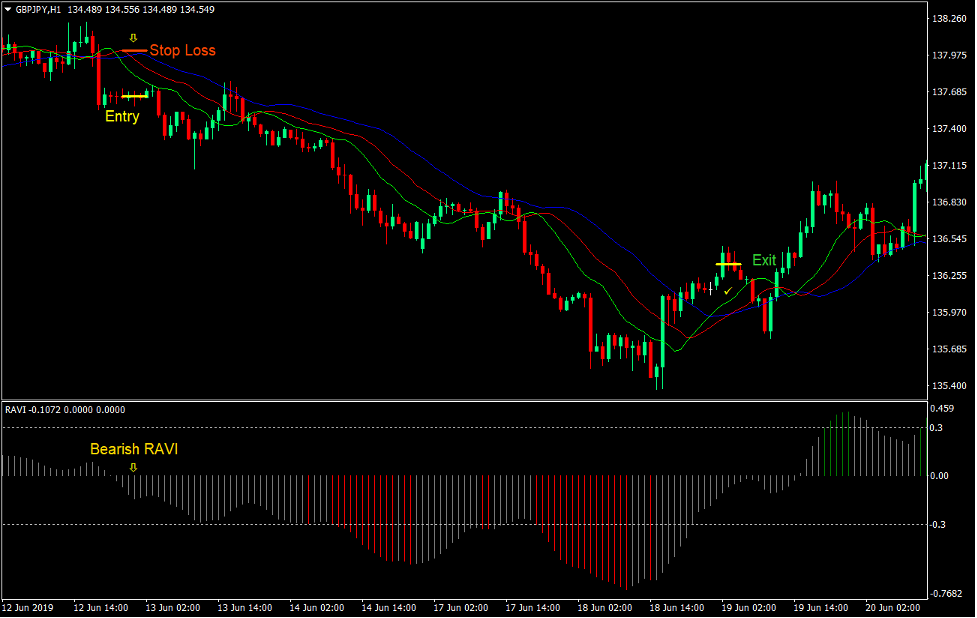

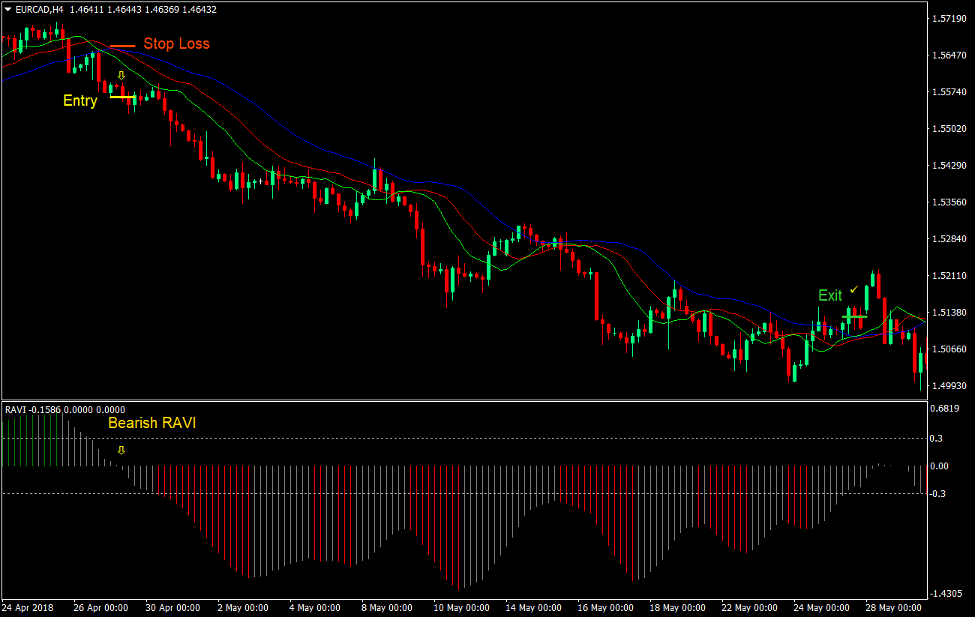

RAVI Alligator Forex Trading Strategy uses two complementary indicators to identify trends reversals. This allows traders to trade trend reversal strategies that are more accurate while still offering a high reward-risk ratio.

RAVI Indicator

RAVI stands for Range Action Verification Indication. This oscillating indicator was created to assist traders in identifying trend direction, trend reverses and momentum.

RAVI indicator displays the percentage difference between historical and current prices. To represent trend, the indicator shows histogram bars. Negative bars signify a bearish trend. Positive bars are indicative of a bullish trend. A possible trend reversal could be indicated by a positive to negative crossover or vice versa. It also has a range of -0.3 to 0.3. A bar that is above 0.3 could signify a stronger bullish trend. However, a bar that falls below -0.3 could signal a strengthening bearish tendency.

Alligator Indicator

Bill Williams, a legendary trader and entrepreneur, created the Alligator indicator as a trend-following indicator.

This indicator is a collection of moving averages. It could be used to help traders determine trend direction based upon the arrangement of the moving-average lines. This indicator could be used to help traders determine if the market has entered an expansion or contraction mode.

The Alligator indicator consists of three moving average lines. The lips of the Alligator is the fastest line. It's a 5-period Smoothed moving Average (SMMA), displaced three periods to its right. The teeth of the Alligator are the second line. It's an 8-period Smoothed moving Average (SMMA), displaced 5 periods to its right. The jaws are the last line. It is a 13-period Smoothed moving Average (SMMA), displaced 8 periods to its right.

Trend direction simply depends on the way that the moving averages have been stacked. Bullish market tendencies are based on the position of the moving averages. If the lip is higher than the jaw and teeth, it is bullish. If the market stacks in an opposite direction, it is called bearish.

The moving average lines determine market expansions and contractions. The market is considered to be in a contraction stage if the lines contract. If the lines are expanding, the market is considered to be in an expansion phase.

Trading Strategy

This strategy can be traded by looking for confluences of the RAVI indicator and the Alligator indicator. Both indicators can be used as a trend-following indicator. The indicators work well together and complement each other.

The bars must cross the zero mark on the RAVI indicator. A bar that crosses above zero indicates a bullish trend reverse, and a bar that crosses below zero means a bearish trend reverse.

The Alligator indicator will then confirm the trend reversal of the RAVI indicator. The Alligator moving mean lines should begin to cross over and fan out. Crossover is caused by the lip line crossing above the jaw and teeth. Once the teeth line crosses the jaw line, the actual reversal signal occurs.

Indicators:

Prefer Time Frames: 1-hour or 4-hour charts

Currency pairs: FX majors and minors as well as crosses

Forex Sessions: Tokyo sessions.

Trade Setup

Entry

-

RAVI indicator bars should not cross zero.

-

The Alligator lines should cross and fan out in this order:

-

Top: Lips

-

Teeth in the Middle

-

Jaw

-

Place a purchase order based on the confluence above.

Stop Loss

-

Place the stop loss below Alligator's moving average lines.

Exit

-

When the RAVI indicator bar crosses below zero, close the trade.

-

When the Jaw crosses below the Lips of the Alligator indicator, close the trade.

Setup for Trades

Entry

-

The RAVI indicator bars must not cross zero.

-

The Alligator lines should cross and fan out in this order:

-

Top

-

Teeth in the Middle

-

Bottom: Lips

-

Place a sale order based on the combination of the conditions.

Stop Loss

-

Place the stop loss at the Alligator moving mean lines.

Exit

-

When the RAVI indicator bar crosses above zero, close the trade.

-

When the Lips of the Alligator indicator crosses over the Jaw, close the trade.

Conclusion

This is a simple strategy for trend reversal that relies on two complementary indicators.

Trend reversal strategies can be difficult to trade. Sometimes, it can be dangerous to trade blindly with trend reversals.

This strategy should not always be applied blindly to every market. This strategy should only be used to time market entry. Trader could, for example, anticipate a trend reversal at Fibonacci level in a longer timeframe. This strategy could be used by traders to enter the market in a shorter timeframe.

Forex Trading Strategy Installation Instructions

RAVI Alligator Forex Trading Strategy combines Metatrader 4 (MT4) indicators and a template.

This forex strategy aims to transform historical data and trading signals.

RAVI Alligator Forex Trading Strategy allows you to spot patterns and peculiarities in price dynamics that are not visible to the naked eye.

This information allows traders to assume additional price movements and adjust their strategy accordingly.

Forex Metatrader 4 Trading Platform

-

Get $50 to Start Trading Right Now

-

Up to $5,000 Bonus on Deposit

-

Unlimited loyalty program

-

Award Winning Trading Broker

Step-by-Step XM Trading Account Opening Guide

How do I install RAVI Alligator Forex Trading Strategy.

-

RAVI Alligator Forex Trading Strategy.zip

-

*Copy the mq4 & ex4 files to your Metatrader Directory/experts /indicators /

-

Copy the tpl (Template) file to your Metatrader Directory/Templates

-

Your Metatrader client can be started or stopped.

-

Choose the Chart and Timeframe in which you would like to test your forex strategy

-

Right-click on your trading chart, hover over "Template",

-

Right click to choose RAVI Alligator Forex Trading Strategy

-

Your Chart will show RAVI Alligator Forex Trading Strategies

*Note that not all forex strategies include mq4/ex4 files. Some templates can be integrated with the MT4 indicators from the MetaTrader Platform.

--------------------

www.forexmt4indicators.com/ravi-alligator-forex-trading-strategy/?utm_source=rss&utm_medium=rss&utm_campaign=ravi-alligator-forex-trading-strategy

Did you miss our previous article...

https://11waystomakemoney.com/forex/how-does-an-investor-respond-to-a-spinoff-company

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions