There has been a fierce rivalry since the inception of the automobile industry. The second choice won in a fair contest. Leading engineers from construction agencies competed for the most powerful and efficient motors.

But, the research in this area was halted by the 20th century. In 2010, Tesla went public with an IPO. Engineers began to think about electric cars again. The company produced and sold only electric cars. The trend has not slowed down and other electric car manufacturers followed.

Rivian Automotive, an electric car manufacturer, is planning to IPO on NASDAQ November 10, 2021. The company's shares will trade under the ticker RIVN the following day.

Rivian Automotive's placement is expected to be the largest this year. It would be beneficial to examine its business details and evaluate its investment appeal.

Rivian Automotive, Inc.

Rivian Automotive was established in 2009. Manheim Investments and Global Oryx Company Limited were key investors. Jeff Bezos's firm invested approximately 700 million USD in the startup, while Ford was the second largest investor (investing around 500 million USD). Rivian employs approximately 6,000 people. Robert J. Scaringe is the director-general.

Basics of business of Rivian Automotive, Inc.

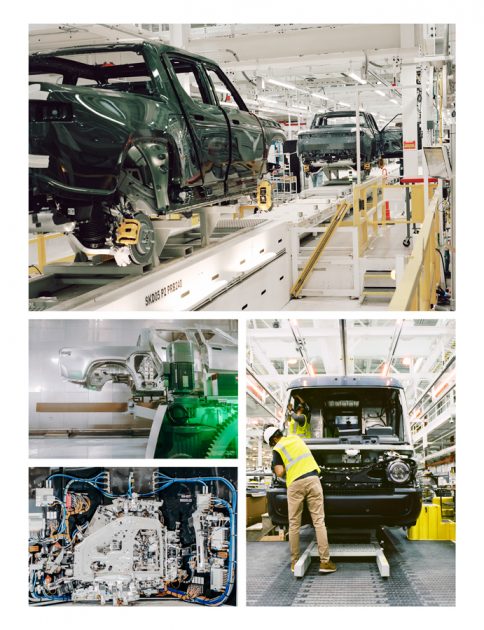

Rivian Automotive created two 4x4 models: an R1T pickup ($67,500 USD) or an R1S crossover ($70,000 USD), both with a power reserve of 480km. The production will take place in Illinois on the site of a Mitsubishi plant. The company will use the IPO to raise money to purchase a Texas second plant.

Amazon, the IT giant, is the largest customer. They want 100,000 vans by 2025. Up to 700-1000 cars will be delivered by the company's first batch before 2021. The issuer intends to increase the annual production of cars to 200,000 by 2027. This will result in 1,500 additional employees.

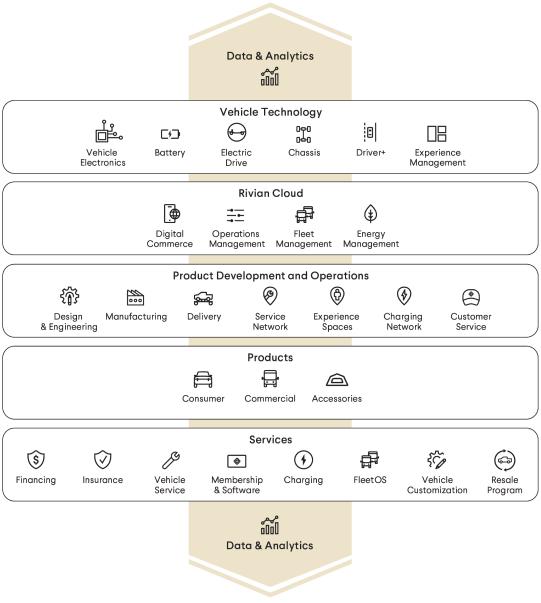

Business model of Rivian Automotive, Inc.

The issuer intends to sell cars to clients directly and via subscription. Rivian has sold approximately 150 R1T pickups since the start of the year. The only big customer is Amazon, which now determines sales volumes. Rivian has bright prospects if Rivian is successful. We'll look into this more.

Rivian Automotive Inc.'s market and competitors

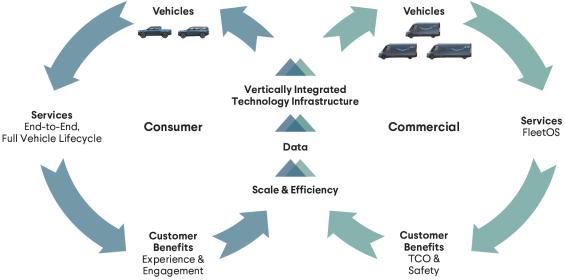

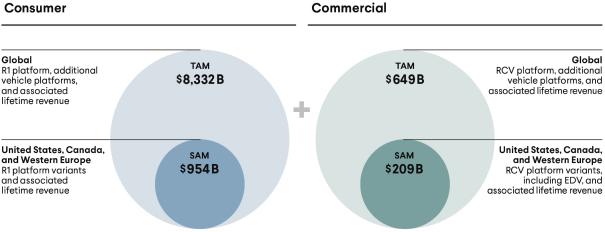

Rivian's research shows that the target market is still being formed. The USA, Canada and West Europe are the markets where sales are planned. This market is currently valued at 1.65 trillion dollars. These calculations include not only the sales of cars but also the costs for after-sales service. Rivian has created a vertically integrated ecosystem of its models in order to increase the average check.

Volume of the target market of Rivian Automotive, Inc.

The issuer will need to compete with many large rivals.

-

Ford Motors

-

Tesla

-

General Motors

-

Lucid Motors

-

Nikola

-

Nio

-

Xpeng Motors

Performance of the company in financial terms

Before I begin to analyze the company's financial situation, I want to say that this is my first time analyzing a startup without revenue. I will need to examine the expenses and determine if the company uses them reasonably. Rivian Automotive was able to raise 10.5 billion USD in all funding rounds.

Financial performance of Rivian Automotive, Inc.

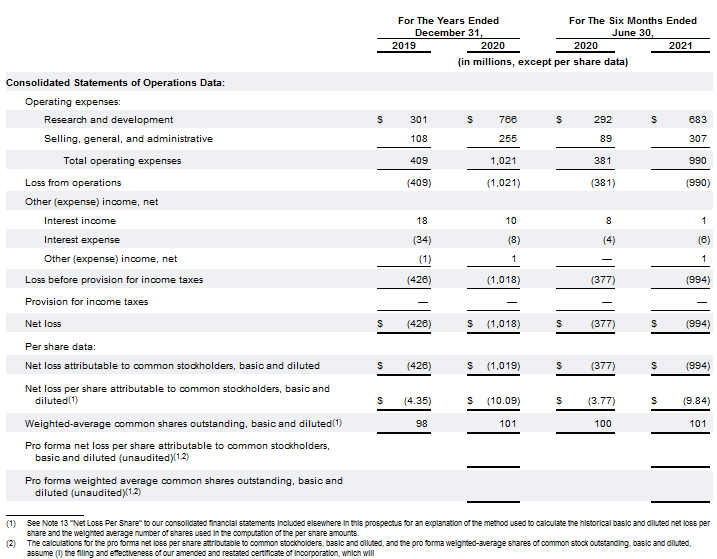

2020 saw 1.02 billion US dollars in operational spending. 75% of these funds were used for research and development. Growth relative to 2019 was 149.63%. The S-1 report shows that operational spending increased by 159.84% in the first six months of 2021 to 990 millions USD.

Last year's net loss was 1.01 billion US dollars, which is 138.97% higher than in 2019. Net loss in 2021 was 1.01 billion USD. This is 138.97% more than in 2019. This is a natural trend when a company grows, especially if it begins serial production.

Rivian Automotive's revenue could range from 1.8 billion to 2.8 billion USD if everything goes according to plan. The company currently has 3.65 billion USD in its bank account and a total debt of 190 millions USD.

Rivian Automotive has both strong and weak sides

These are the weaknesses and strengths of the issuer. These are the strong points of the company:

-

Several famous financial donors (Amazon, Ford)

-

Tesla Model X Supply Problems

-

Management skills are essential

-

The potential target market volume

-

Blackstone, Rowe Price and Third Point are interested in buying Rivian shares at IPO prices.

-

Underwriters have been appointed by the top investment banks.

Here are some risks associated with investing in Rivian.

-

The company doesn't generate any profits

-

It does not generate any revenue

-

However, serial production is not yet possible in full scale.

Rivian Automotive Inc. IPO details and capitalization

Initially, management wanted to place the shares via the SPAC process. They later decided to go with a traditional IPO. Tigress Financial Partners, LLC, Siebert Williams Shank & Co., LLC, Samuel A. Ramirez & Company, Inc., Loop Capital Markets LLC, C.L. King & Associates, Inc, Cabrera Capital Markets LLC, Barclays Capital Inc., Deutsche Bank Securities Inc., Allen & Company LLC, BofA Securities, Inc., Mizuho Securities USA LLC, Wells Fargo Securities, LLC, Nomura Securities International, Inc., Piper Sandler & Co., Morgan Stanley & Co. LLC, Goldman Sachs & Co. LLC, and J.P. Morgan Securities LLC.

The issuer intends to sell 135,000,000 ordinary stocks at a price of 72-74 USD each. The capitalization is 65 billion USD and the volume of placement is 8.03 trillion USD. Rivian will become one of the 10 biggest car manufacturers in terms of capitalization.

This investment venture is, in my opinion, a success. If the market is supportive, it is very likely that the company will "skyrocket". This company is a good choice for short-term speculative investments. Participating in an IPO may not be the best idea. Wait several days until trades begin to see general market sentiment.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/11/09/rivian-automotive-inc-ipo-will-they-repeat-success-of-tesla/

Did you miss our previous article...

https://11waystomakemoney.com/forex/xfisher-org-v1-vol-supr-htf-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions