Trading does not have to be difficult. To make a profit in the market, traders don't need to be overly complicated. Sometimes, it can even cause problems. Sometimes new traders can get lost in the maze of too many details and too many decisions that must be made per trade.

Imagine being asked to make a decision about 10 conditions and filters. The entry setup is starting to look like it will, so you begin looking at each condition. Price suddenly makes a strong movement. Panic and fear of missing out lead you to make a trade without following all rules. As you enter the market, prices begin to fall. You discover that your filters and rules are not being followed. You see the price reverse on your trade, and you hit your stop loss. After waiting so long for all conditions to be met, you realize that there is too much information to process. This is a huge blow to a trader's mental capital.

Try the opposite approach. This is a simple strategy that follows a few guidelines. This strategy allows you to trade in and out of markets and pick the best setups for you. Although it would not have the same probability as a well-filtered strategy, it will allow you to take many trades and let law of large numbers work for your advantage. You may lose some trades and win some, but there are also profitable trades that you can make every now and again. Traders with simple strategies can still make a profit long-term even if they invest less in each trade.

The Simple Super Trend Forex Trading Strategy allows traders to take advantage of huge market trends. This strategy allows traders to make trades with high potential yields.

Supertrend indicator

The Supertrend indicator, as the name implies, is a trend-following indicator.

The Average True Range (ATR) is the main basis of the Supertrend indicator. The indicator measures market volatility. If price moves strongly in one direction relative to the ATR then it would indicate a trend reversal.

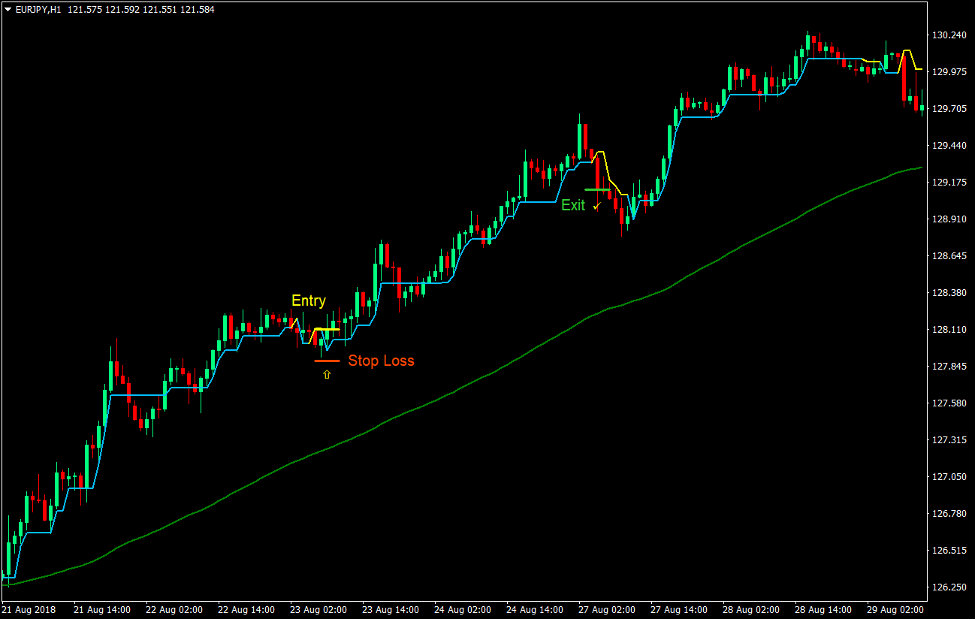

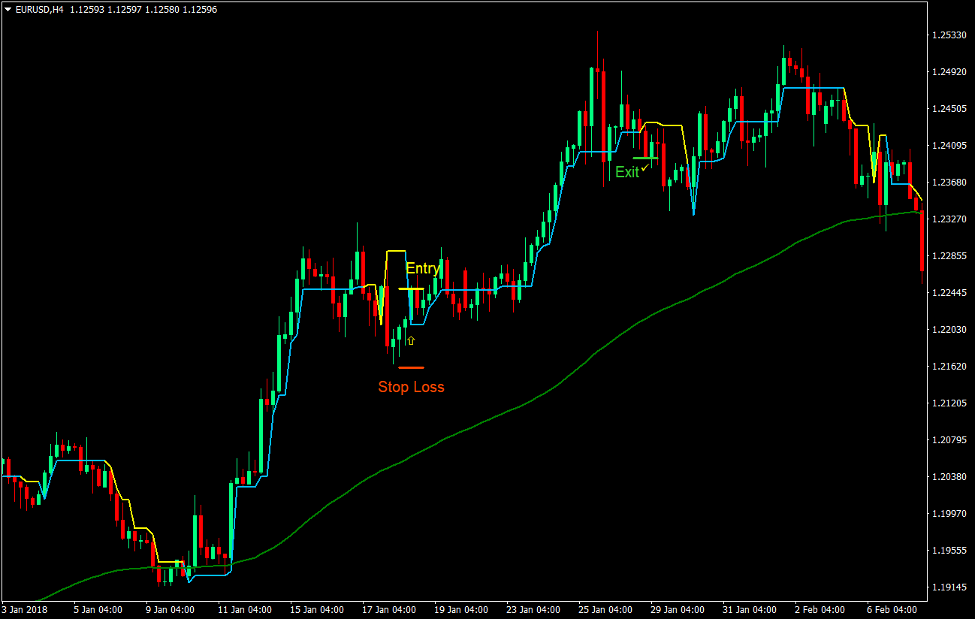

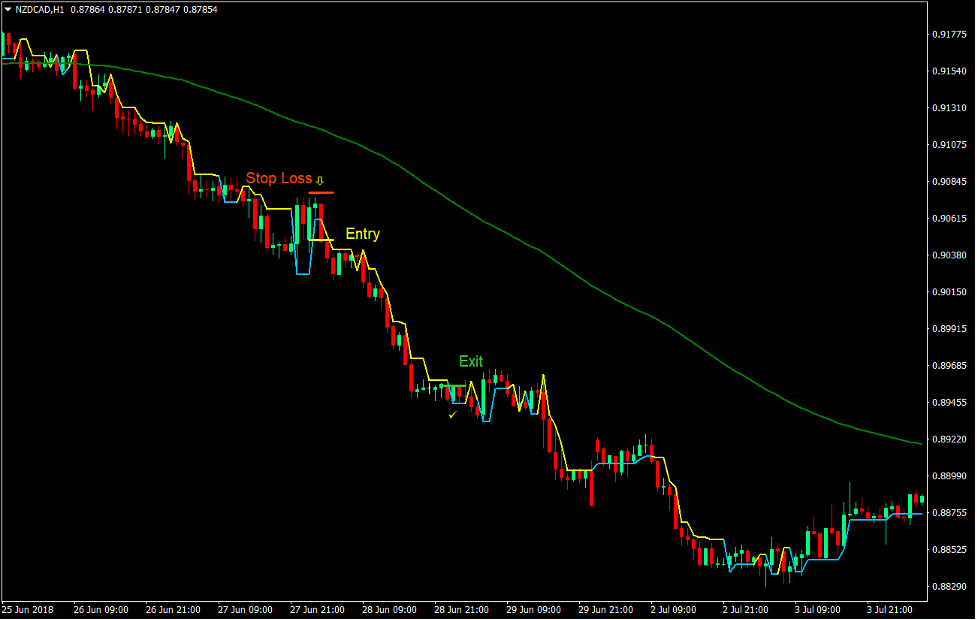

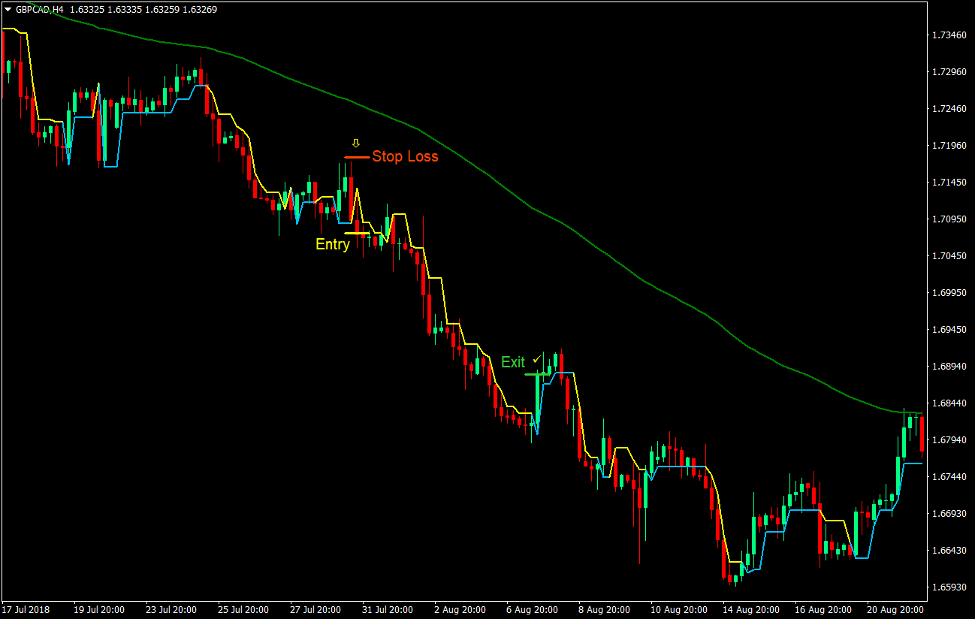

This line overlays on the price chart and helps traders to identify trends. This line moves with the price action and shifts up or down. If the Supertrend line is below the price, then the market is in a bullish trend or momentum. If the Supertrend line is above the price, then the market is in a bullish trend or momentum.

The direction of the trend also affects the color of the Supertrend line. This setup shows that a blue line indicating a bullish trend is a line with a high sky-blue color, while a yellow line indicating a bearish trend is a line with a lower hue.

The Supertrend indicator can be used as a trend signal or trend filter. The indicator can be used to filter out the trend direction and allow traders to trade in the same direction. This is best for momentum trading strategies that aim to make profits within a few candles. It could be used to signal a trend reversal. The shifting of the line below or above the price and the changing color could be used by traders to indicate a trend reversal. They can then trade accordingly.

Trading Strategy

This strategy generates trade signals based upon the Supertrend indicator. Trade signals are not taken into account for every trend reversal signal. Instead, they are filter by trend direction.

The 100-bar Exponential Moving average (EMA) will be used to identify the trend direction. The direction of the 100 EMA lines will determine the trend. It will also indicate the price location relative to the 100 EMA lines. The price movement is another indicator that traders should visually determine if the market has a trend. This will depend on whether the price is making swing highs or lows that are higher or lower.

If the market is trending, traders need to look out for a short-term trend reversal using the signals from the Supertrend indicator.

Indicators:

-

100 EMA (green line)

-

Supertrend (default setting).

Prefer Time Frames: 1-hour or 4-hour charts

Currency pairs: major, minor pairs

Forex Sessions: Tokyo sessions.

Trade Setup

Entry

-

The price should not be below the 100 EMA line.

-

The 100 EMA line should be sloping upward.

-

Price should always make higher swing highs than swing lows.

-

As soon as the Supertrend line moves below price and becomes sky-blue, place a buy order

Stop Loss

-

Place the stop loss for the fractal under the entry candle.

Exit

-

When the Supertrend line moves above the price and changes from yellow, close the trade.

Setup for Trades

Entry

-

The price should not exceed the 100 EMA.

-

The 100 EMA line should be sloping downward.

-

Price should always make lower swing highs than swing lows.

-

As soon as the Supertrend line moves above price and turns to yellow, you can place a sell order.

Stop Loss

-

Place the stop loss on fractals above the entry candle.

Exit

-

When the Supertrend line moves below the price and becomes sky-blue, close the trade.

Conclusion

This strategy can be traded successfully by waiting for the market's trend to strengthen and trading only when it does.

If the market isn't trending, it is likely that prices will fluctuate and hit large stop losses frequently. If the market is trending, however, the win rate will significantly increase and stop losses will become more tight, which allows for higher yields.

This strategy is known as a high-yield trading strategy. High yield trades are a profitable strategy that allows traders to profit from high-yielding trades every now and again. There will be many trading opportunities in a market that is trending. There will be minor wins and losses. There will be a few high-yield trades. These trades will be the most profitable and you must not miss them.

Forex Trading Strategy Installation Instructions

Simple Super Trend Forex Trading Strategy combines Metatrader 4 (MT4) indicators and a template.

This forex strategy aims to transform historical data and trading signals.

A simple Super Trend Forex Trading Strategy allows you to spot patterns and peculiarities in price dynamics that are not visible to the naked eye.

This information allows traders to assume additional price movements and adjust their strategy accordingly.

Forex Metatrader 4 Trading Platform

-

Support available 24/7 by an international broker.

-

Over 12,000 assets, including Stocks, Indices, Forex.

-

Spreads and execution of orders are faster than ever with spreads starting at 0 pip.

-

Start depositing now to get a bonus of up to $50,000

-

Demo accounts are available to test trading strategies.

Step-by-Step RoboForex Trading Account Open Guide

How do you install a simple super trend forex trading strategy?

-

Get the Simple Super Trend Forex Trading Strategy.

-

*Copy the mq4 & ex4 files to your Metatrader Directory/experts /indicators /

-

Copy the tpl (Template) file to your Metatrader Directory/ templates

-

Your Metatrader client can be started or stopped.

-

Choose the Chart and Timeframe in which you would like to test your forex strategy

-

Right-click on your trading chart, hover over "Template",

-

Select Simple Super Trend Forex Trading Strategy

-

The Simple Super Trend Forex Trading Strategy will be displayed on your Chart

*Note that not all forex strategies include mq4/ex4 files. Some templates can be integrated with the MT4 indicators from the MetaTrader Platform.

--------------------

www.forexmt4indicators.com/simple-super-trend-forex-trading-strategy/?utm_source=rss&utm_medium=rss&utm_campaign=simple-super-trend-forex-trading-strategy

Did you miss our previous article...

https://11waystomakemoney.com/forex/what-are-fractional-shares-and-how-can-they-be-used-for-investments

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions