Complex strategies do not always mean better results. Sometimes, simple concepts are more effective. It is not the complexity of a strategy that is important, but the concept and logic that underpin it.

The most fundamental indicator traders use is the moving average. It is simple, but it has been used by many professional traders. It is used by traders for many reasons. It could be used to determine trend direction based upon its slope. It can also be used to identify areas of support and resistance. It is also used by many as a trend reversal indicator based on crossovers. Because it can be used in many different ways by different traders, the simple idea of averaging historical prices is widespread.

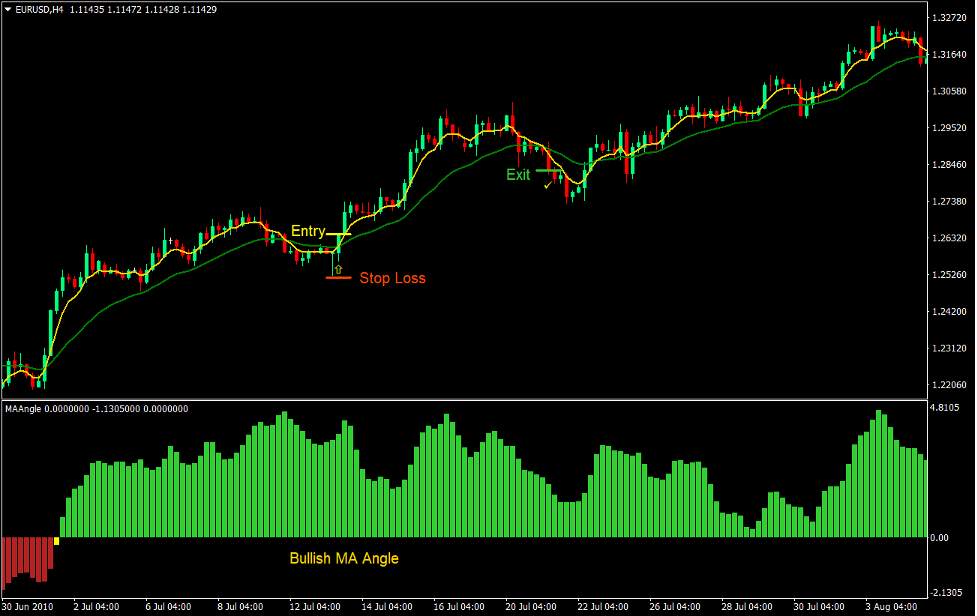

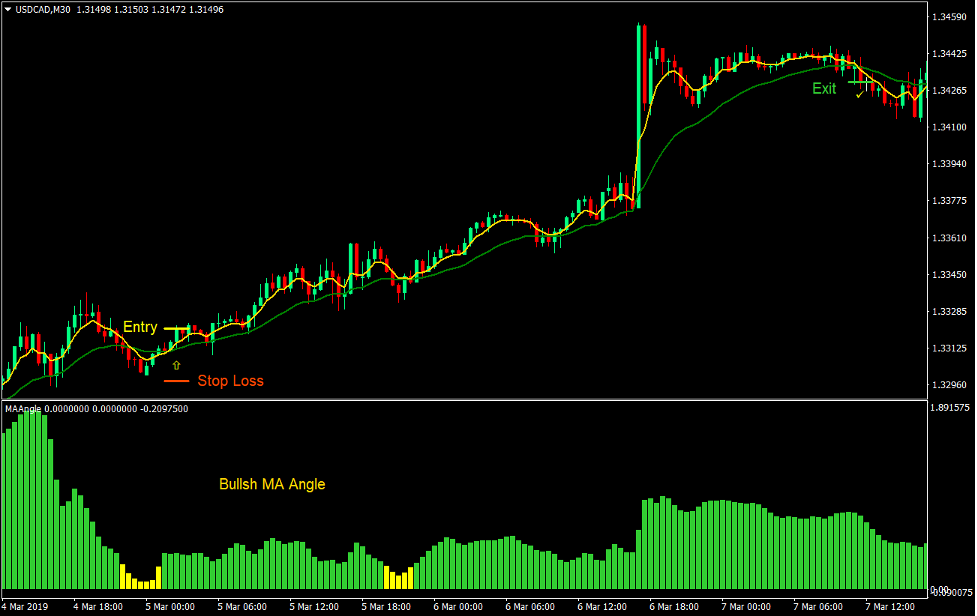

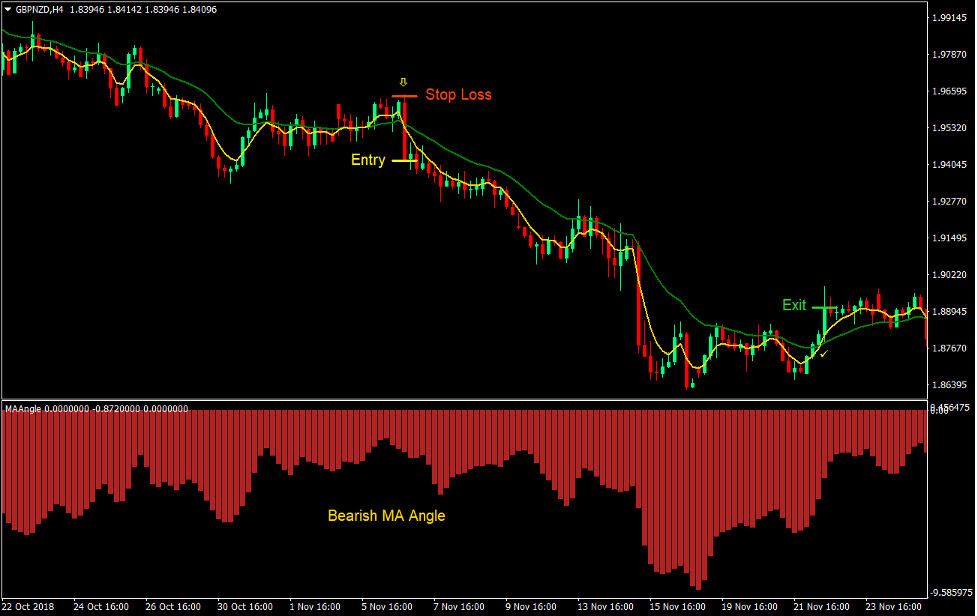

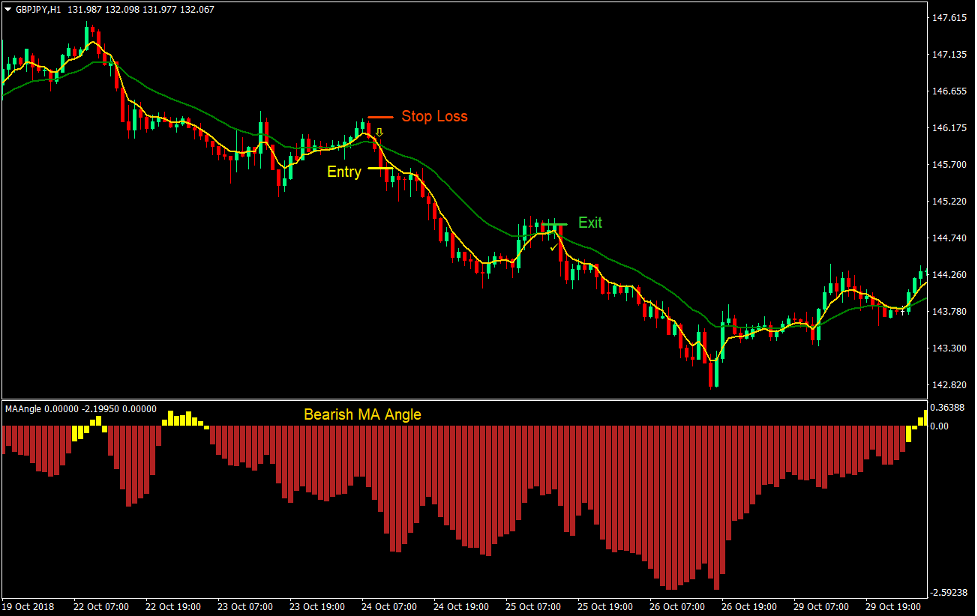

Slopes and Crosses Forex Trading Strategy focuses on moving averages. This strategy uses the idea of identifying the trend direction based upon the slope of a moving Average and uses crossovers to create entry signals that are based on short-term trends reversals. This strategy is simple, but it can yield huge gains when used under the right market conditions.

Exponential Moving average Crossovers

Many traders use Moving Averages as a great tool. It is however often slow and has a disadvantage. Sometimes signals can be produced too slowly, which can lead to traders missing out on great trading opportunities.

This was the reason why Exponential Moving Average (EMA), was created. The EMA is more weighted or focused on the latest prices than the simple Simple Moving Average (SMA). This creates a moving line that is responsive to price changes. It can change direction as the price moves, allowing traders to take advantage of trading opportunities.

There are many uses for the EMA. The EMA's most fundamental use is to identify trend direction based upon its slope. EMAs with a slope that is upward indicate an uptrend. EMAs with a slope that is downward indicate a downtrend.

It can also be used to provide support or resistance in a dynamic manner. The right EMA can be used to determine where price might bounce and retrace in a market trend.

EMAs can also be used to detect trend reversals. Crossover signals from a pair of EMA lines can also be highly reliable because the EMA is very responsive. It could be used by traders to enter or exit a market that is trending.

MA Angle

The MA Angle indicator can be used by traders as an oscillating indicator to determine trend direction.

This indicator uses the idea of identifying trend direction based upon the slope of an EMA-line. The indicator creates a moving average line and duplicates it. After that, it shifts the duplicate forward. The indicator then calculates the difference between the moving average lines. The histogram is created.

Positive bars indicate that the moving average line is sloping upward, which signals an uptrend. Negative bars indicate that the moving average line is sloping downward, which signals a downtrend.

The strength of a trend can also affect the color of the indicator. The trend is weaker if the bars are yellow. Lime Green bars signify that the bullish bias or trend is growing in strength. Fire Brick bars signify that the bearish bias or trend is growing.

Trading Strategy

This simple trading strategy generates trade signals based upon the slope of a 50-period Moving Average Line and the crossover between Exponential Moving averages.

To identify the trend direction, the MA Angle indicator can be used. To identify the slope of a 50-period MA Line, it is set at 50 bars. Trades can be filtered according to whether the indicator is showing positive or negative bars. As price moves back, the bars can change to yellow and cause the 50 MA line flatten. The indicator must keep its current trend bias, indicating that the moving mean line is still sloping. The entry candle must be either lime green to indicate a stronger bullish bias or fire brick to indicate a strengthening bearish bias.

To identify the entry candle, this strategy employs a crossover of two moving Averages. This strategy uses a combination a 5 bar Exponential moving average (EMA) as well as a 20-bar Exponential moving average (EMA). The 5 EMA line is represented by the gold line and the 20 EMA line by the green line.

Indicators:

-

5 EMA (goldline)

-

20 EMA (green line)

-

MAAngle (default settings)

Prefer Time Frames: 30-minutes, 1-hour and 4-hour charts

Currency pairs: FX majors and minors as well as crosses

Forex Sessions: Tokyo sessions.

Trade Setup

Entry

-

Positive bars should be printed by the MA Angle indicator.

-

Prices must be visually trending upward.

-

The 5 EMA Line should be higher than the 20 EMA Line.

-

The 5 EMA line and 20 EMA lines should be retraced, causing price to temporarily reverse.

-

The 5 EMA line should cross over the 20 EMA lines.

-

The MA Angle bar that corresponds should be lime green.

-

On confirmation of the conditions, enter a purchase order.

Stop Loss

-

Place the stop loss for the fractal under the entry candle.

Exit

-

When the 5 EMA line crosses under the 20 EMA, close the trade.

Setup for Trades

Entry

-

Negative bars should be printed on the MA Angle indicator.

-

The price action must visually trend down.

-

The 5 EMA should not be higher than the 20 EMA.

-

The 5 EMA line and 20 EMA line should be retraced, causing temporary reverse.

-

The 5 EMA line should be below the 20 EMA lines.

-

The MA Angle bar that corresponds should be fire brick.

-

On confirmation of the conditions, enter a sale order

Stop Loss

-

Place the stop loss on fractals above the entry candle.

Exit

-

When the 5 EMA line crosses over the 20 EMA, close the trade.

Conclusion

This is a short-term trend following strategy that trades on confluences of a crossover and an oscillator. It represents a moving average slope.

It's most effective when it is used in a market that is trending. The price action should be used to visually indicate if the market trend is occurring. Crossover signals are based on retracements and allow traders to accurately time trade entry and withdrawal.

Forex Trading Strategy Installation Instructions

Slopes and Crosses Forex Trading Strategy combines Metatrader 4 (MT4) indicators and a template.

This forex strategy aims to transform historical data and trading signals.

Slopes and Crosses Forex Trading Strategy allows you to spot patterns and peculiarities in price dynamics that are not visible to the naked eye.

This information allows traders to assume additional price movements and adjust their strategy accordingly.

Forex Metatrader 4 Trading Platform

-

Support available 24/7 by an international broker.

-

Over 12,000 assets, including Stocks, Indices, Forex.

-

Spreads and execution of orders are faster than ever with spreads starting at 0 pip.

-

Start depositing now to get a bonus of up to $50,000

-

Demo accounts are available to test trading strategies.

Step-by-Step RoboForex Trading Account Open Guide

How do you install the Slopes and Crosses Forex Trading Strategy.

-

Download the Slopes and Crosses Forex Trading Strategy.zip

-

*Copy the mq4 & ex4 files to your Metatrader Directory/experts /indicators /

-

Copy the tpl (Template) file to your Metatrader Directory/ templates

-

Your Metatrader client can be started or stopped.

-

Choose the Chart and Timeframe in which you would like to test your forex strategy

-

Right-click on your trading chart, hover over "Template",

-

You can now choose Slopes and Crosses forex trading strategy

-

Your Chart will show you the Slopes and Crosses Forex trading strategy

*Note that not all forex strategies include mq4/ex4 files. Some templates can be integrated with the MT4 indicators from the MetaTrader Platform.

--------------------

www.forexmt4indicators.com/slopes-and-crosses-forex-trading-strategy/?utm_source=rss&utm_medium=rss&utm_campaign=slopes-and-crosses-forex-trading-strategy

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions