You must consider the data and factors of companies when investing in stock markets. The financial report is one of the most crucial and complicated indicators of a company's success. It can help you predict the future development of your company and determine whether it is worth investing in its shares.

Companies without shares trading on the stock exchange may not be able to disclose their reports to anyone who is interested. They can also provide the information to potential investors or tax authorities upon request. Only public companies are required to disclose all financial information.

Reports are generally published on open source websites or on company websites. A financial report can include a quarter, six-months, or a full year of reporting. Companies may provide reports for longer periods in certain cases to allow for analysis.

Different types of financial reports

Internationally accepted practice allows for several types of standard reports.

-

IFRS - International Financial Reporting Standard

-

US GAAP – US Generally Accepted Accounting Principles.

Companies that trade their shares in the US stock market use this standard.

The IFRS is an international reporting system. This is evident from the name. For a simpler analysis, the IFRS reports are often adjusted to US GAAP standards.

What financial reports are needed and who needs them?

Based on the reports, tax authorities calculate taxes to the company. It is important that the information be accurate and true to reality.

Based on the reports, the management of the company decides how to develop the company. They can either plan for expansion or eliminate losing branches in order to reduce unnecessary expenses.

Shareholders and investors use these reports to evaluate the financial condition of the company, the management's work, investment prospects, etc.

Future investors can use financial reports to help them decide which company to invest and what to do about the shares in their portfolio. The report also reveals whether dividends will be paid and how much.

What you will find in a financial statement

The company's profits and losses over the reporting period

-

Gross profit

-

Operational profits

-

Net profit

-

Base EPS

Flow funds

The report includes cash and non-cash receipts, payments on all bills and money flow from investments.

Balance

This report shows the financial performance over the reporting period. It includes the total company value, including cash, assets, and liabilities.

How to use financial statements

An investor can do a comparative analysis by analyzing the financial reports of several companies. It is very simple to do.

First, select the companies that you want to compare. However, make sure they work in the same industry or produce similar products. A company producing heavy metals should not be compared to an entertainment company. This is because the comparison would be wrong for many reasons.

Make a list of indicators that you are most interested in. This will allow you to assess the potential for investment profit and development. Comparing the reports of both companies is a good idea. A comparative analysis helps to assess the potential dividends and market sustainability of each company.

Refrain from investing in a company whose results are not satisfactory. While promising companies with innovative products may be an exception to the rule, it is important to remember that there are increased risks.

What indicators are usually compared?

-

Net profit

-

Gross profit

-

Operational profits

-

Base EPS

-

All business activities generate cash flow

-

Current and non-current assets

-

Liabilities, equity, and debts

Where can I find financial reports?

You can either search the Internet for the financial reports of a company or visit the company's website to check them out.

Let's take a look at the American Airlines Group report. Go to the official website and select the section for investors (different companies might have slightly different names).

Select the previous period's financial report.

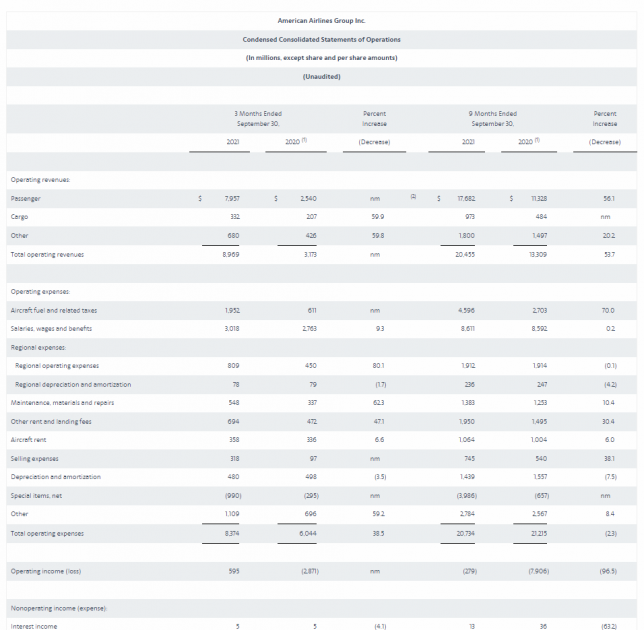

You can then simply review the information and perform comparison analysis to determine if this company is right for you.

Bottom line

An investor does not need to read the entire financial report. Reports can be as long as 200 pages, with some information that is only for a small group of people.

The best way to get out of trouble is to select several indicators and only use them. You will need to review the reports from the previous reporting period. Annual reports are used to get the complete picture.

Investors are often confused by negative information or impulsive statements when making decisions. It is safer to make decisions based on facts and figures than emotions in this instance.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/12/24/financial-reports-of-companies-main-reference-point-for-investors/

Did you miss our previous article...

https://11waystomakemoney.com/forex/nonlinear-kalman-filter-floating-level-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions