This article is about trade balance and its impact on the national currency. It also discusses how to use it for Forex trading.

What is Trade Balance?

The emacroeconomic indicator Trade Balance (or International Trade) shows the difference in prices between all imported goods and all export goods over a given period. This is simply the difference in monetary terms between import and export volumes. The trade balance is one key indicator of the country's competitiveness in goods and services.

Trade Balance = Import - Export

Trade Balance can be either positive or negative depending on which index is larger.

-

When export exceeds import, trade surplus occurs.

-

A trade deficit is when import exceeds export.

Each country presents their Trade Balance monthly. It includes seasonal accounts and a variety of categories.

-

Consumer goods

-

Food

-

Materials and industrial supplies

-

Autos

-

Capital goods

-

Other products

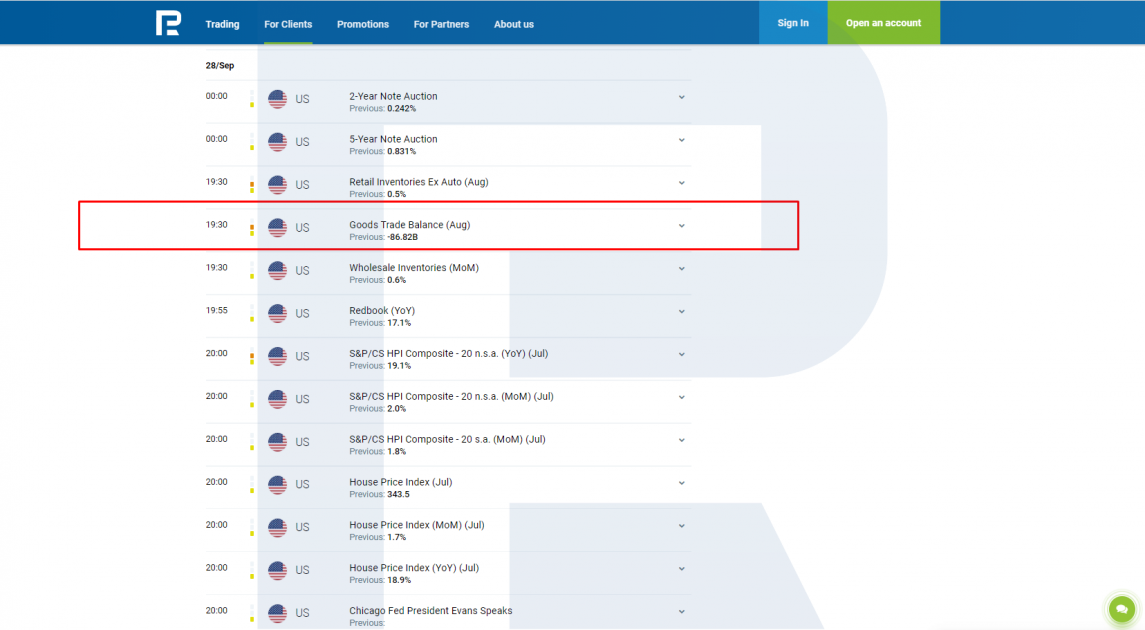

Forex trading requires the total balance, without any details. The Economic Calendar shows changes to the Trade Balance.

Trade Balance on the Economic Calendar

What does the Trade Balance have to do with the national currency?

The exchange rate of the national currencies is directly affected by the Trade Balance. The current dynamics of the import/export ratio it shows has a direct correlation with both local as foreign currencies. It must use its international currency reserves to import, while its trade partners demand that the country's national currency be used to pay for goods they purchase.

A country with a trade deficit (where import exceeds exported) will need to have access to a lot of foreign currency in order to pay for import expenses. The local currency can be affected by falling demand and growing foreign demand. Export volumes may fall, leading to an increase of sack leaves in the industry and increased unemployment. This will make national currency less expensive.

The opposite is true. A country that trades surplus has a positive impact on its national currency. Stable demand from international trade partners will be experienced by a country that imports more goods than it exports. An increase in demand for export goods results in an expansion of production. This, in turn, creates new jobs and stimulates consumer spending. The exchange rate of the national currencies rises as a result.

Forex Trade Balance:

Trade Balance can be used to play in Forex or any other economic indicator of a country. Below are two options for trading.

Trading long-term

This approach is not suitable for investors who have the capital or time to invest. Fundamental analysis is used to evaluate changes in Trade Balance and other important economic indicators such as CB rates, GDP or unemployment, inflation indices, and industrial production.

Positive dynamics (growth in surplus) will confirm positive perspectives for the national currency. The growth of surplus, if other fundamental indicators agree, will increase the chances of the currency growing and heat up interest in it. Investors will see an uptrend if they buy the currency.

On the other hand, negative dynamics (trade deficit) warns of a possible decline in the national currency rate. An increase in other indices that are negative makes it more likely that the currency exchange rate will drop. Investors will sell more promising indices if this happens. The market will experience a downward trend.

Trades for the short-term

This is the easiest and quickest way to use the Forex index. It's based on publishex Trade Balance's short-term impact on the currency rate. This is basically trading news. An unexpected growth in surplus can lead to temporary currency growth, while an increase in deficit can cause falling. Trading can capture this impulse.

You will need to analyze your price chart to determine where and how you want to trade the news. Tech analysis is a great tool to use in order to find the closest support and resistance levels, price patterns and other instruments.

The article "Trading News" explains the fundamentals of short-term trading. ":

Trading the News: Preparing a Trading Plan

Bottom line

The country's trade balance is a macroeconomic indicator. It shows the country's export to import ratio. This index's publication can have a significant impact on the value of the national currency.

Trade Balance, along with other indicators, can be used to trade long-term and for short-term news trading.

--------------------

blog.roboforex.com/blog/2021/10/21/trade-balance-how-to-use-it-in-forex/

Did you miss our previous article...

https://11waystomakemoney.com/forex/normalized-volume-mt5-indicator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions