The best investment is to invest in yourself. The coronavirus pandemic of 2020 has given a boost to this process. Experts from many industries and fields are now willing to share their experience and knowledge with newcomers in the context of information marketing and networking. This allows learners to learn new skills and upgrade their qualifications from their own homes.

Udemy, Inc., a company that created an online learning/teaching platform, submitted an IPO request by the Securities and Exchange Commission (SEC), using the SEC S-1 form. We have plenty of time to investigate the company's operations and we still haven't announced the IPO date. The IPO will be held at the NASDAQ under the ticker "UDMY". Let's look closer at the details of the company's operations.

Business of Udemy, Inc.

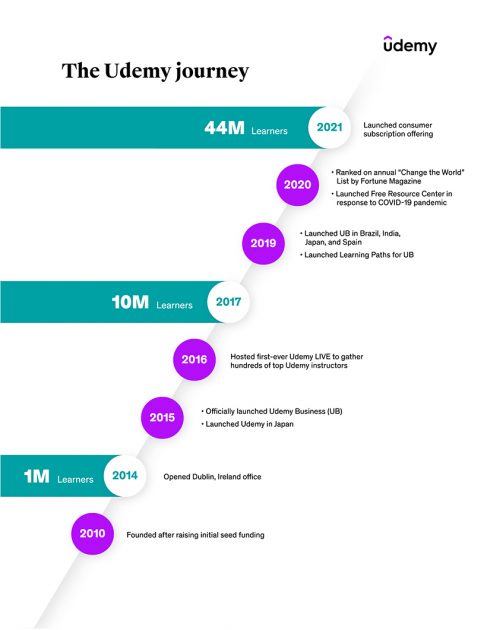

Udemy was founded in 2010, with headquarters in San Francisco, California. Udemy developed an online platform for teaching and learning. Udemy's product can be described as a marketplace for educational services. The platform allows learners to gain the knowledge they need to compete in the global labour market. You can also pick the time that is most convenient for you.

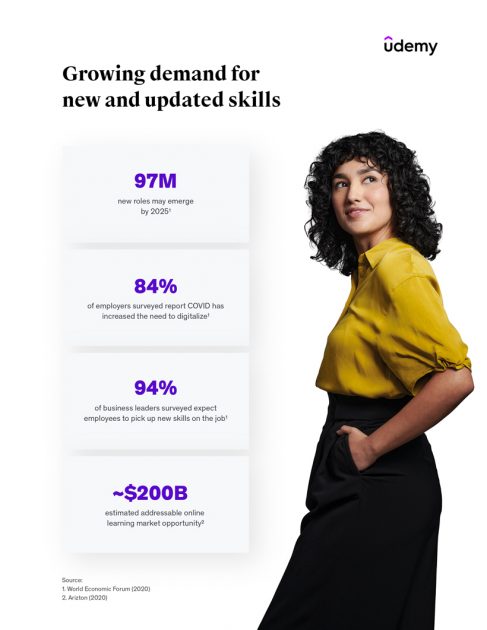

Main growth indicators of the online education market.

Experts from any profession or daily sphere can register on the platform to start their courses and make money. Udemy does not require you to verify the educational materials. This makes it easier for you to become a mentor/teacher on Udemy than other platforms.

Udemy’s stages of development.

These simple moderation rules allow users to quickly find an educational course that will help them improve their most important and needed skills. The company is active in both the B2B and the B2C segments of the online education market. The company generates most of its revenue from payments for courses and subscriptions to sets of courses.

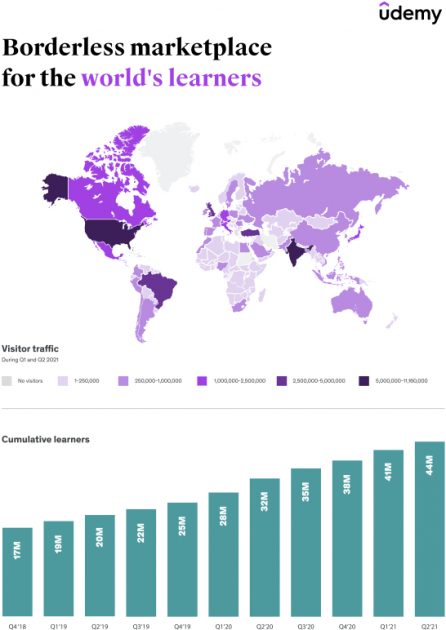

Site reach and clients of Udemy, Inc.

The company has been around for 10 years and had 50 million students from all parts of the globe as its clients. There are over 100,000 courses on the platform. Udemy has corporate clients such as Eventbrite and Volkswagen. We'll be discussing the market's prospects and the company’s competitors.

Udemy, Inc.'s market share and competition

Udemy's research found that the global online education market was worth $188 billion in 2019. It is predicted that it will reach $319 billion by 2025.

This service is popular with people who want to learn new skills on weekends. The demand for creative courses increased by 326% in 2020. Meanwhile, technical drawing lessons grew by 920%, breaking all previous records.

These are the key competitors of the company:

-

Skillshare

-

Global KnowledgeTraining

-

Degreed

-

Teachable

-

MasterClass

-

Coursera

Financial performance

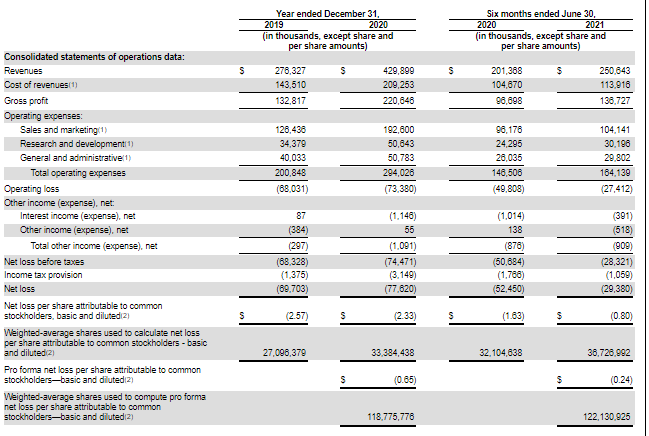

The company filed for an IPO but has not generated the net profit. We will therefore focus on its revenue. The S-1 report shows that Udemy's 2020 sales were $429.89. This represents a 55.57% increase over 2019. The company's revenue in the first six months of 2021 was $250.64. This is a 24.47% increase over the same period in 2020.

Key financial indicators of Udemy, Inc.

The revenue for the past 12 months was $479.16. If the current rate of growth continues, the revenue is expected to reach $537.36 by the year-end 2021.

The 2020 gross profit was $220.65million, an increase of 66.13% compared to 2019. The indicator was $136.73million in the first six months of 2021. This is a 41% increase over the same period in 2020. The gross profit growth rate exceeds the revenue and indicates an upward trend in net loss reduction.

2020's net loss was $77.62million, an increase of 11.38% relative to 2019. The report shows that the indicator began to decrease in 2021. The net loss of the company in the first six months of 2021 was $29.38million, which is a 43.98% drop compared to the same period in 2020. These dynamics suggest that Udemy could soon see its first profit at the year-end.

We can conclude that the company has excellent future profit prospects and is financially stable.

Udemy, Inc. has both strong and weak sides

Let's take a look at Udemy's upcoming IPO, and see what its strengths and weaknesses are. The company's strengths are:

-

High revenue growth rates (over 20 percent annually).

-

The gross profit growth rate exceeds the revenue.

-

Reduced net loss by 2021

-

Target market growth potential of up to $319Billion by 2025

-

The online education market holds the leading positions.

The following are some of the risks associated with investing in Udemy shares:

-

The company is losing money and doesn't pay out dividends.

-

This industry is extremely competitive.

Details and estimation of Udemy, Inc.'s IPO capitalization

The company raised $233.1 Million in 8 rounds of financing. Robert W. Baird & Co. were the underwriters for the IPO. Incorporated, William Blair & Company, L.L.C., Piper Sandler & Co. Needham & Company, LLC, KeyBanc Capital Markets Inc., Truist Securities, Inc., Jefferies LLC, Morgan Stanley & Co. LLC, J.P. Morgan Securities LLC, Citgroup Global Markets Inc., BofA Securities, Inc.

There is no information available at this time about the price or number of shares that will be sold in the IPO. We'll use the Price-toSales ratio (P/S) multiplier because the company is losing money.

The P/S value of a technological sector that is experiencing such rapid growth may reach 40 during the lockup period. Udemy's capitalization could reach $19.6 Billion ($479.6 Million*40). This indicator is 12.52 for Udemy's closest competitor Coursera. Udemy's capitalization could be as high as $6.01 billion in this instance.

All these factors being considered, I would recommend this company's shares as long-term investments.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/10/19/ipo-of-udemy-inc-a-courseras-competitor-is-going-public/

Did you miss our previous article...

https://11waystomakemoney.com/forex/tdi-for-mt4-with-trade-signals-and-alert-indiator

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions