Nearly 75% of Americans make New Years Resolutions. The third most popular resolution is financial. Self-improvement is the second most common resolution, and it's a great match for what we are talking about.

Let's make 2015 the best financial year ever, no matter if you want to save money, get out of debt, buy a house, or go on vacation.

Unfortunately, most resolutions get broken too. This year will be different. You're going keep your promise to yourself this year and you're going for better financial health. These are five tips that will help you succeed over the next twelve months.

1. Get Organized

You will not be able to achieve your New Year's resolutions if you don't get organized. This is sometimes called budgeting but it is just as important as budgeting. Get organized.

This means that you need to take an accurate inventory of everything.

-

Income - What's coming in each month?

-

Expenses: What's going out for each dollar

-

What you have - Asset and account balances

-

What you owe: All your debts, balances and minimum monthly payment

Do you need a tool that can help? This list contains the top money- and budgeting apps.

Also, you need to keep track of your time using your calendar. This is the most important thing that many people overlook - do they know where they are spending their time each day, week, or month?

You should also spend some time pondering about what value you place on your life. What are your most important priorities in life? Spending time with family? Volunteering? Working? Sports? Vacations? You can align your finances to work by identifying what you value most.

Now what?

You can make more effective decisions once you are organized. This will allow you to achieve your New Year's resolutions or any other financial goals. I don't have any advice on what you should do. That's up to you. You can make decisions once you have all the information you need - your income and expenses, as well as your values.

If your goal is to eliminate debt, you can look at your income and expenses to determine the "delta", which is the difference between them. Then, use that extra to begin paying down your debt.

Do you not have a delta? Start looking at each line of your income and expense. Is it possible to make more money? This may mean that you need to look at your time and calendar. Are you able to cut your expenses? (This may mean that you need to examine what you value and determine if you are wasting money on items you don't care about)

Money is personal. While there is no right or wrong answer, the truth is that money will be influenced by income, expenses and time. This budgeting guide will help you plan your budget for personal and professional reasons.

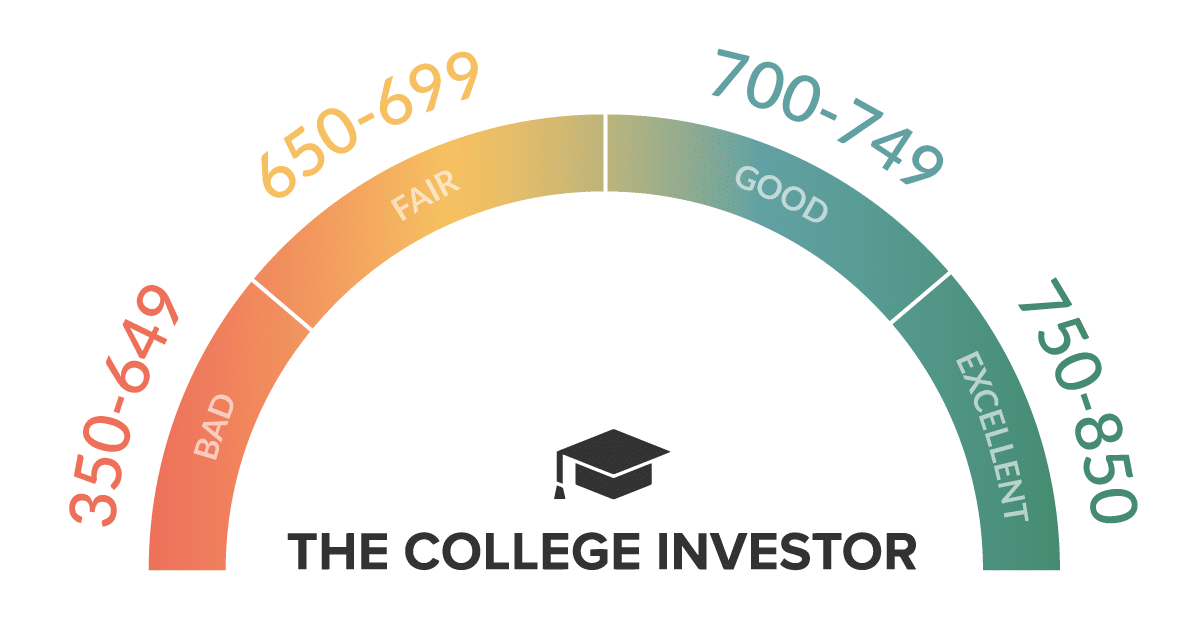

2. Improve your credit score

Whatever your resolution, improving credit will make a big difference! Are you looking to save money? This is a great way to save money. Are you looking for a job? This is a great resource! Are you looking to rent or buy a home? These are some of the best ways to find out!

You will need to do several steps in order to complete this step. You first need to clean up your credit. Order a credit report (you can do this for free at AnnualCreditReport.com). There may be negative information that could lower your credit score. Next, correct any bad credit on your report.

You can dispute negative information, such as late payments. Make sure that the debts you have listed on your credit reports are not considered zombie debts if you wish to repay creditors. Because of the statute of limitations, zombie debts are not old enough for creditors to sue or contact you about. Contacting the creditor to inquire about the debt will trigger the statute of limitations again.

You can also visit our complete guide on How to Improve Your Credit Score.

3. Make Your Stash

After paying off your debt, one of the most important financial goals is to save money. Building your money stash is crucial, whether you are building an emergency fund or saving for retirement.

Side Note It doesn't necessarily have to be save or pay down debt. Both can be done simultaneously. You should, in fact.

Savings account: You wish to open or use your savings accounts. This account can be used to save money. You can use the account to create an emergency fund. You have the option to limit access to your account by having a debit card, or you can opt to have one. Register here for the Best High-Yield Savings accounts.

Individual Retirement Account:An individual retirement account (or IRA) is a great way to save for retirement. You have to meet certain contribution and income limits in order to be eligible for an IRA. Here are the top places to open an IRA.

401k Your employer may offer a 401k. You should definitely take advantage of it. Many employers offer "matching contribution" which is free money that your employer gives you to save for retirement. You're effectively taking a pay cut by not using it.

4. Take Care of Yourself

This may seem like a bad way to go about becoming debt-free or achieving any other financial goal, but it is. When you spend money constantly, it's much easier to get into debt. This is a major mindset shift in how you allocate your money.

Let's say, for example, you want to go out with friends to dinner or to the movies. So you decide to charge your credit card the amount instead of spending it. You can make sure you are paying yourself first so you have enough money to do what you want. You don't have to take on new debts. Pay yourself.

You are the one who is going to work hard for your goals. A separate savings account is the best way to pay you. You can transfer a small amount to your savings account if you have direct deposit.

5. Living within your means (and values)

All of us want things we don't have. You may desire a flat-screen 65 inch television. However, you can't afford it. It is best to save for it, or to not buy it. Living within your means involves making major changes and aligning your spending with your values.

You can do the following basic tasks:

-

Don't use savings or credit cards to buy items that you can't afford.

-

Based on your income, create a monthly budget.

-

Keep track of your spending.

-

You must pay your bills on time.

When making a trade-off, it is important to look at your values and determine what is most important to you. It may seem like you need a 65-inch TV. But what if you don't enjoy watching TV? Perhaps that money should not be spent or it should go to something you really value.

Bonus Tip: Find Free Money

Bonus reminder: I encourage everyone to look for the money they are entitled to. It's amazing how much money you might be entitled to. Wells Fargo owed $100 to me for an account they had closed. They never contacted me about it.

There are many offers and incentives available for things you already do! Perhaps you had planned to open a savings or checking account in the new year. Did you know that banks will offer customers bonus offers? Sign up if you want to get paid!

You can also check this guide for finding free money.

By: Robert Farrington

Title: 5 Tips To Make This The Best Financial Year

Sourced From: thecollegeinvestor.com/11424/best-financial-year/

Published Date: Tue, 04 Jan 2022 08:15:00 +0000

-----------------------------

Did you miss our previous article...

https://11waystomakemoney.com/investing/the-most-common-college-scams-and-how-to-avoid-them

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions