Your home could be the most expensive purchase you make in your entire life. This can be both exciting and nerve-wracking.

The purchase of a primary residence falls somewhere in the middle between an investment (meant increase one's capital) or a consumer good (meant increase one's happiness). We recognize that your home may have aspects of both. You might purchase a home because it is close to family members or in a certain school district. These are valid inputs that can help you make a purchase decision.

As your financial advisor, however, this guide will be primarily focused on the financial aspects for your potential home purchase. We'll walk through the five things you should do before purchasing your home.

1. Make sure you have an emergency fund.

To keep houses stable, they are built on top foundations. Your finances need to be solid, just like houses. Your emergency fund is an important part of this. A fully-funded emergency fund is a must before you purchase a home. You should have at least three months worth of expenses in your emergency fund.

It is common to ask how large your emergency fund should really be. It is difficult to plan for emergencies. We don't know what they will cost or when they will happen. We do know that life is not always easy. Therefore, it's important to plan for any unexpected situations.

Everyone needs emergency funds, but homeowners are more likely to need them. Renters are likely to be responsible for most repairs and maintenance on their buildings. This responsibility falls on you as a homeowner. Although a home is a great investment, it can also prove to be costly. This is why it is important to have a well-funded emergency fund before you purchase a house.

Don't forget to factor in the possibility that your monthly expenses will increase after you buy your new home. We recommend that you consider what your monthly expenses will look like after you purchase your new home.

2. You can choose a fixed-rate mortgage.

According to the 2020 survey data from the National Association of Realtors(r), 86% of homeowners took out a mortgage. Most people need to decide which type of mortgage they want. This is why it is important to determine whether an adjustable-rate mortgage(ARM) or a fixed rate mortgage (FRM). 11 Ways to Make Money recommends a fixed rate mortgage.

Why?

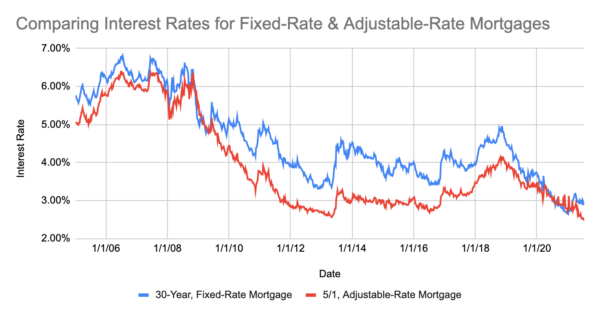

As you can see, ARMs offer a lower initial rate of interest than FRMs.

Source: Federal Reserve Bank of St. Louis. 11 Ways to Make Money Visualizations of Data

However, this lower rate does come with increased risk. An ARM can cause your monthly payments to increase over time. It is also difficult to predict the exact amount of those payments. It can be difficult to plan and stick to your budget.

Fixed-rate mortgages on the other side lock in the interest rates for the life of the loan. This stability allows you to plan for your financial future and budget with ease. You can budget more effectively and reduce risk by locking in an interest rate for the term of your mortgage.

Luckily, most home buyers do choose a fixed-rate mortgage. The 2020 survey data from the National Association of Realtors(r) shows that 89% of homebuyers used a fixed rate mortgage to finance their home purchase. This was consistent across all age groups. The Urban Institute's research also showed that FRMs account for the majority of mortgages in the last two decades.

Source: National Association of Realtors (r), 2020 Home Buyers & Sellers Generational Trends. 11 Ways to Make Money: Visualization of data

3. You can save on the upfront costs by paying a down payment and closing.

To purchase your dream home, you will need more than an emergency fund. A down payment and funds for closing costs are also required. 11 Methods to Make Money suggests that you make a minimum 20% down payment and set aside 2% for closing costs.

According to a 2020 National Association of Realtors (r) survey, the median down payment for home purchases is 12%. The chart below illustrates that younger buyers are more likely to pay lower down payments than their older counterparts.

Source: National Association of Realtors (r), 2020 Home Buyers & Sellers Generational Trends. 11 Ways to Make Money: Visualization of data

Is it wise to make a down payment of 12%? You are allowed to buy a home with down payments below 20%. Take this example:

-

FHA loans offer a low down payment of as little as 3.5%

-

Fannie Mae permits mortgages with as little as 3% down payment

-

You can purchase a house with no down payment using VA loans

11 Ways To Make Money recommends that you put down at least 20% to purchase your home. Private Mortgage Insurance (PMI) can be avoided by a 20% down payment. A down payment of at least 20% is a sign that you aren't overleveraging.

A minimum 20% down payment may be able to lower your interest rates. The CFPB acknowledges this and it is apparent when we compare interest rate of mortgages with Loan to Values (LTVs), below and above 80%.

Source: Federal Reserve Bank of St. Louis. Visualization of data using 11 Ways to Make Money.

It may be a good idea to pay more than 20% depending on your financial situation. Keep in mind that you shouldn't invest every dollar you have in your home. This will make it more difficult to save enough money for other goals, such as retirement.

Closing costs

A down payment is not the only cost of buying a house. There are also significant transaction costs. These transaction costs are often referred to as "closing cost" or "settlement cost".

Closing costs are dependent on many factors such as where you live, and the value of your home.

ClosingCorp is a company that specialises in closing costs and other services. It conducted a study of 2.9 million home sales throughout 2020. The average closing cost for buyers was 1.69% of the purchase price. This ranged from Missouri's low of 0.71% (Missouri), to Delaware's high of 5.90% (Delaware). Below is a chart that provides more details.

Source: ClosingCorp 2020 Closing Cost Trends. 11 Ways to Make Money: Visualization of data

We recommend that you save about 2% of your home's price (about the average national rate) to cover closing costs. However, your state may have a higher or lower average home price, so plan accordingly.

This means that you will need to save around 20% on your home's price for a down payment and around 2% on estimated closing costs.

You have 11 ways to make money. You can open a Major Purchase Goal and save for your downpayment, closing costs, and other expenses using either a cash or investing portfolio depending on your risk tolerance, and when you expect to buy your home.

4. Consider the long-term

Although we have already mentioned closing costs for buyers, remember that there are closing costs when you decide to sell your home. This means that it might take you some time to make a profit on your purchase. Selling your home too soon can lead to a loss of financial capital. 11 Ways to Make Money recommends not buying a house unless you intend to live there for at least four years and, ideally, longer.

Closing costs for selling a house are often higher than those associated with buying a home. They are estimated at between 8% and 10% by Zillow and Opendoor, Bankrate and NerdWallet as well as NerdWallet and The Balance.

11 Ways to Make Money researched closing costs for buying and selling as well as the potential costs of investing that money. The average breakeven point is approximately 4 years, as shown in the below graph. This is a guideline, though it will vary depending on many factors. If you don't plan on owning your home for more than 4 years, it is worth considering whether purchasing a home at this stage in your life is wise.

Source: 11 Ways to Make Money. Is Buying a Home a Good Investment? Visualization of data by 11 Methods to Make Money.

It appears that home buyers tend to stay in their homes for longer than the 4-year rule. This chart is based on 2020 survey data from the National Association of Realtors(r). It displays how long people of different ages remained in their homes before they sold them.

The median age was 10 years across all age groups. This is more than twice our 4-year rule. This is excellent. We can however see that the median age of younger buyers is much lower than the 10-year average. This indicates that they are more likely to not make it through their home purchase.

Source: National Association of Realtors (r), 2020 Home Buyers & Sellers Generational Trends. 11 Ways to Make Money: Visualization of data

You can take these steps to ensure that you are able to stay in your home for at least a year.

-

Renting in the area is a good idea if you are buying a house in an unfamiliar neighborhood.

-

Look ahead to ensure that the home is suitable for your future 4 years, and not just today. Do you plan to have children soon? Are your parents aging and moving in with you? What is your job stability? These are all good questions to ask.

-

Do not rush to buy a home. This is a major decision that will require a lot of thought and time. Home purchases are a perfect example of the phrase "measure twice and cut once".

5. Calculate your Monthly Affordability

Home affordability is not only about the upfront costs. The monthly cost of your home is another important factor. 11 Ways to Make Money suggests creating a financial plan in order to establish a budget and determine the amount of home you can afford, while still reaching your financial goals. If you don't have one, we recommend that you not exceed a 36% debt-to-income ratio.

This means that you multiply your gross monthly income by your monthly debt payments, including housing costs. This is often used by lenders to approve you for a mortgage.

Debt Income Ratios

There are many rules regarding what income is considered and what debt is. These rules can be found in Fannie Mae’s Selling Guide as well as Freddie Mac’s Seller/Servicer Guide. Although the formula above is only an estimate, it can be used for planning purposes.

Fannie Mae or Freddie Mac may allow ratios of debt to income as high as 45%-50% in certain circumstances. However, just because you are able to get approved doesn't mean that it is financially sensible.

Remember that the lender is only concerned about your ability to repay the money they loaned you. The lender is less concerned about whether you have the money to pay off your loan and whether or not your children can afford college. Also, the debt to income ratio calculation doesn't take into account income taxes and home repairs. These can both be very significant.

All this is to say that while DTI ratios can be used to determine home affordability, they don't capture all the key inputs necessary to figure out how much you can afford. Below is our preferred method, but we recommend a maximum of 36% if you use a DTI Ratio. This means that your total debts, including your housing payment, should not exceed 36% your gross income.

We believe that a financial plan is the best way to figure out how much house you can afford. This will allow you to identify your financial goals and calculate how much money you must be saving each month to reach them. Once you have confidence in your other goals, any extra cash flow can be used to pay for monthly housing costs. This is a way to start with your financial goals and then move towards home affordability.

Wrapping up

These five steps will help you make an informed purchase decision if you are serious about owning a house.

-

To cover unexpected maintenance or emergencies, keep an emergency fund that covers at least three months of expenses.

-

To help you keep your budget steady, choose a fixed-rate mortgage.

-

To avoid PMI, save at least 20% and plan to pay 2% for closing costs.

-

If you don't plan to live in the home for at least four years, it is best not to buy one. If you don't, it is unlikely that you will break even once you consider the costs associated with homeownership.

-

To determine your monthly financial affordability, create a financial plan. However, as a guideline, do not exceed 36% debt-to-income ratio.

Register for 11 Ways to Make Money today if you need help saving money or creating a financial plan.

By: Nick Holeman, CFP®

Title: Buying A Home: Down Payments, Mortgages, And Saving For Your Future

Sourced From: www.betterment.com/resources/buying-home/

Published Date: Tue, 07 Sep 2021 19:52:18 +0000

-----------------------------

Did you miss our previous article...

https://11waystomakemoney.com/investing/hibbett-plunges-9-despite-exceeding-q2-expectations

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions