Ed: sorry if you got hit with the double send. Feedburner is unpredictable, but that should be the last time (I explicitly turned off Feedburner email, now).

Hey folks! It's great to be talking with you all again – I hope you had an excellent weekend.

First thing: Google's Feedburner shut down this month. We've moved the newsletter over to FeedBlitz for a trial. (Quick links: privacy policy, terms of service.)

Could you please drag this email to the appropriate inbox, and if it landed in spam can you mark it as "Not Spam"?

Appreciate the assist – FeedBlitz looks like an excellent service, so I hope to continue to send emails at a low cost to me (and no cost to you, of course!).

FinTwit and Compounders

Turn back if you're solely a passive investor, haha. We're going to talk about individual stocks for a bit!

Maybe I haven't been paying close enough attention, but lately in FinTwit – that's a cute term for Financial Twitter – seems to have moved over to the concept of compounding companies or compounders. Not that it wasn't below the surface for the last 3-8 years, but it's exploded in popularity during the most recent stock runup. Compounding discussion is even drowning out the pure growth stock folks, haha.

If you aren't familiar, compounders are companies with consistent, high returns on equity (or invested capital, or capital employed, or incremental capital... it's a debate) that also can reinvest their profits. That last point is critical; investing in compounders is the next evolution of Peter Lynch's "growth at a reasonable price," or Charlie Munger's "great businesses at fair prices," or even the Motley Fool's "winners keep winning."

These companies aren't the classic castle in the sky growth companies, although they have to grow for this to work. They also aren't your deep value asset plays, special situations, or turnarounds with a catalyst and a time limit. Instead, they're firms that you can – in theory – hold on to for 10+ years and let the company do all the hard work of reinvesting and compounding your money.

I'm not skeptical; in fact, I'm intrigued; this would work if you pick the right firms. Growth investors have blown value investors (or at least value factor investors, that's a whole other post though...) out of the water for 10+ years in the United States.

Concentrating on compounding is a way to marry a value background to quality growing companies by pushing out your value realization by years. By eschewing an institutional investor's need to hit quarterly numbers for years of runway, yes, you could make it work.

It makes sense, in theory. The practice, though?

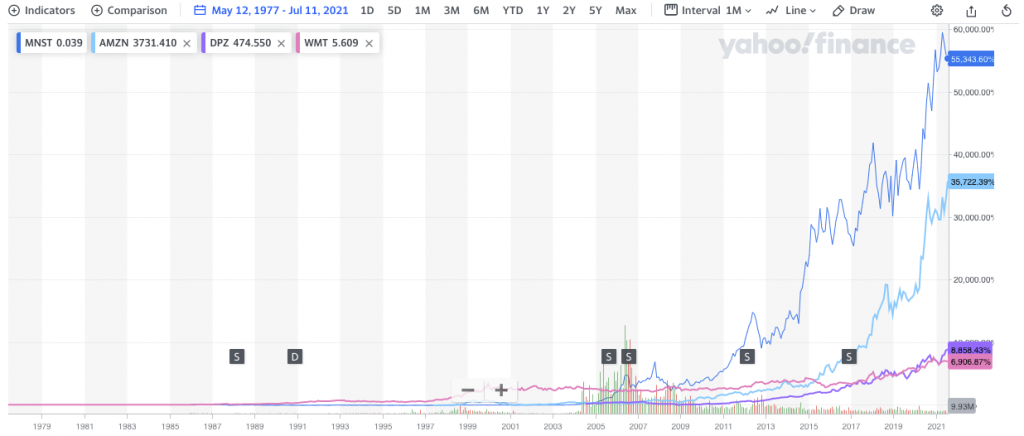

Some Compounding Companies: Monster Beverage, Amazon, Domino's Pizza, and Walmart (Yahoo!)

We're still humans – if your investment thesis is to hold onto quality, you can't force that thesis on the rest of the market. The next time the market falls – I mean further than in March & April of 2020 – it's going to be a gut-check for everyone ostensibly following the compounder strategy. It fails on the "good" side, too – how many people fall back on crutches like "sell half your investment and play with house money"?

Could you reinvest more in a company that's doubled, tripled, or even 10x'd?

This link takes you to the Twitter FinTwit portfolio updates for Q2, where you'll find more compounder ideas than you'll know how to handle.

Coffee Cans and Illiquidity

Traditionally, illiquidity is viewed as a negative. People certainly value the ability to exit a position or generate cash on short notice. But – is that appropriate?

Investors Meb Faber and Cliff Asness have talked about the opposite – what if illiquidity is, in many situations, a better thing for our human urges?

Think about it – how many people do you know who held onto a "hundred bagger" (100x their initial investment). How about a ten-bagger? Heck, a three-bagger? (I have a 14-bagger, so you know me, haha)

Yet we all know people who compounded their money for decades in their home.

Woodlock House Family Capital's Chris Mayer – who has done tons to help people reason around compounding and avoiding biases – likes to bring up the "Coffee Can Portfolio." In it, asset manager Robert Kirby talks about how one of the most successful investors he saw in his career took all his buy recommendations... and ignored all his sell recommendations.

Yes, of course, he had a bunch of losses. No surprise there. But some of those stocks – notably, Haloid, later Xerox – outperformed pretty much all his other clients' portfolios!

Illiquidity isn't just "not selling," although, effectively, it causes you not to sell. So maybe there's something to locking up some of your money – if you can spare it! – in illiquid investments, such as VC, PE, or hedge funds, or real estate?

Never Selling and Index Funds

One of the earlier proponents of compounding was Chuck Akre of Akre Capital Management – read their philosophy here. Akre's Chris Cerrone talked through their ideas about "never" – or at least, exceptionally rarely and for non-investment reasons – selling.

And Akre has receipts; this isn't just theorycrafting – he rode American Tower to over a 100-bagger inside his fund.

So – if you can combine "not selling" with public investments like Akre or Fundsmith, you might have something amazing here. Well, if you can ignore the market's daily ups and downs and volatility, of course.

I've recently been on a bias-avoiding kick and am experimenting with this model in the brokerage M1 Finance (note: affiliate link).

M1 lets you create "pies" where you divide incoming money to many companies on a percentage basis. It puts up minor barriers to seeing how individual names are doing inside the pies. Of course, you do need to be careful – M1 buys in a window and is price agnostic, so illiquid names might get terrible fills... but for most companies $500 million in market cap or up, you're likely in good shape (but check it, first).

Think of it like an index fund – when you dollar cost average into an index fund, do you worry about the prices of the individual names?

Anyway, maybe I'll update you in a couple of quarters – and years and decades? – on how that strategy works (We also have some compounding style investments with Fidelity and E*Trade, ha. They can be the control.). Maybe it's not perfect (if you want to stop buying a company, you need to play with the pie percentages, which means you need to look!), but it seems promising. Those extra steps to drill down into company performance, plus the delayed trading windows, might be a good barrier to human nature.

Here are more resources on compounding:

- Chris Mayer's book, 100 Baggers *

- Thomas William Phelps's book, 100 to 1 in the Stock Market (a classic) *

- Geoff Gannon and Andrew Kuhn's Focused Compounding YouTube Channel (and fund)

- Robert Kirby's Coffee Can Portfolio

- M1 Finance if you want to play along

- Our stock return calculator to check on reinvested returns

* Affiliate links

DQYDJ Updates

I already told you about the email list – switching is pretty annoying, but we've been running for free off of Feedburner for a while, haha.

In the background, I've been creating traffic-driving calculators, too dull to bother you with for the most part... they do pay the bills, though. I owe you some asset allocation posts next, then perhaps I'll look at some long-term wishlist things... like the infamous mutual fund return calculator or a company stock options tool. And thank you for all the props on the ESPP tool. As some of you guessed, I built it to think through things on my own, haha.

September/October, we'll be back in Income mode once the CPS drops again. Let me know if there are new income posts you'd like to see – just reply to this email. (See the income archives here.)

Also note, I'll be somewhat scarce after the middle of next week. Don't worry, everything is fine – just don't expect fast responses (or tons of posts).

Hope you are having a great summer and staying healthy!

The post The DQYDJ Weekender, 7/11/2021 appeared first on DQYDJ – Don't Quit Your Day Job....

-----------------------------

By: PK

Title: The DQYDJ Weekender, 7/11/2021

Sourced From: dqydj.com/the-dqydj-weekender-7-11-2021/

Published Date: Mon, 12 Jul 2021 01:22:41 +0000

Read More

Did you miss our previous article...

https://11waystomakemoney.com/investing/docs-real-estate-by-the-decade

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions