By Dr. James M. Dahle, Emergency Physician, WCI Founder

Q. Is it better to invest in VTI or VTSAX?

A. Short answer: It doesn't matter much. Long answer: It matters a little.

The Vanguard Total Stock Market Fund

The Vanguard Total Stock Market Fund, one of a fair number of Total Stock Market (TSM) funds offered by the various mutual fund companies is my favorite mutual fund. It was the first mutual fund I purchased, at least once I figured out what I was doing, and I have owned it in its various forms ever since. Today's question has to do with its various forms.

The Share Classes of TSM

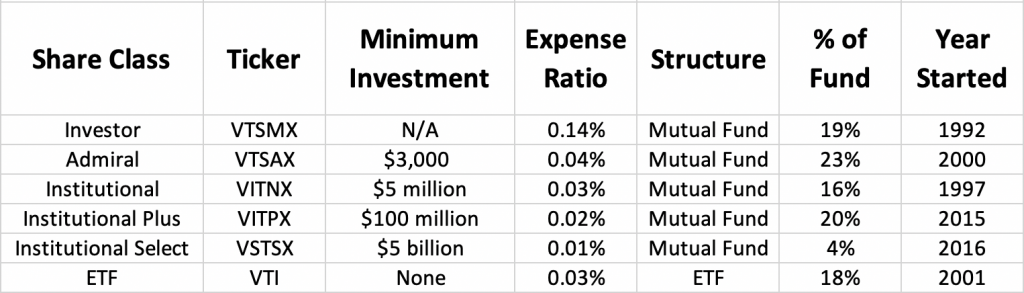

There are actually six share classes of the Vanguard TSM fund.

A bit of history is in order here. It all started in 1992 with the Investor shares. A few years later in 1997, they added an Institutional share class for the big boys at a discounted expense ratio. In 2000, Vanguard started the Admiral share class for personal investors with a bit more money. Where the Investor share class had a minimum investment of $3,000, the Admiral share class had a minimum investment of $10,000. The next year Vanguard started a bunch of Exchange Traded Funds (ETFs), including this one. Traditionally, the ETF and the Admiral share classes had about the same expense ratio, but the Admiral shares minimum investment was dramatically higher. So eventually, they lowered the minimum investment on the Admiral shares and mostly stopped selling the Investor shares. The Investor shares continue to be used in the Target Retirement and Life Strategy balanced funds, and perhaps in some 401(k)s or 529s somewhere, but you can't buy them directly at Vanguard or any brokerage. In the last few years, they have added the Institutional Plus and Institutional Select share classes for the real high rollers, basically shaving their expenses by a basis point or two.

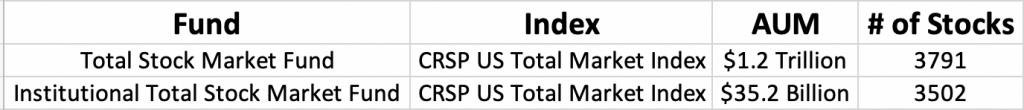

If you go too far down this rabbit hole, you will discover a completely separate mutual fund called the Vanguard Institutional Total Stock Market Fund, not to be confused with the Vanguard Total Stock Market Fund Institutional Share Class. This fund also has multiple share classes, both Institutional (VITNX, $5 million minimum, 0.03% ER) and Institutional Plus (VITPX, $100 million minimum, 0.02% ER). While extremely similar, these two funds are slightly different.

So who invests in the Institutional TSM fund and who invests in the regular one? It's pretty hard to figure out, but I can tell you that the Utah 529 invests in the Institutional TSM Fund, not the regular one.

Why ETFs Are More Tax-Efficient Than Mutual Funds

It is a fact that a typical ETF is more tax-efficient than a typical mutual fund. That by itself suggests it is worth the hassle to use ETFs in your taxable account. While that does not necessarily apply to Vanguard mutual funds with an ETF share class (see the next section), it is important to understand WHY ETFs are more tax efficient. ETFs ARE mutual funds. The ones I advocate around here are open-ended, broadly diversified, low-cost index funds. The main difference between an ETF and a traditional mutual fund is that you can buy and sell ETF shares during the trading day and all traditional mutual fund shares are bought and sold at the close of the trading day. Thus the name “EXCHANGE TRADED Funds”. But that aspect of an ETF doesn't really matter much to the long term investor. I really don't care if I have to wait a few more hours to buy or sell a fund.

The reason an ETF is more tax-efficient than a mutual fund is that it distributes to its investors fewer short and long term capital gains than a comparable traditional mutual fund following the same index. Instead of selling shares of stock on the open market when investors sell their ETF shares, the ETF simply gives the shares in-kind to authorized participants, who then provide the cash the fund pays out to the selling investors. This is part of the ETF share creation and destruction process and the key difference between how a mutual fund and an ETF is built.

Who are authorized participants? They're typically large investment banks like Bank of America, Morgan Stanley, JP Morgan, Goldman Sachs, and JPMorgan Chase.

Which shares do the ETFs give to the authorized participants? The ones with the lowest basis, thus flushing them out of the ETF.

What does the authorized participant do with these low basis shares? Who cares? That's their problem. The point is that your ETF is not passing along those capital gains to you to pay taxes on.

Is an ETF following the same index really more tax-efficient than a traditional mutual fund? What does the data show? Let's look at a very common ETF, SPY, which follows the S&P 500 index and the Fidelity index fund that also follows the S&P 500 Index (FXAIX). Per Morningstar, the pre-tax returns are as follows:

- SPY: 15.13% per year for the last 10 years

- FXAIX: 15.25% per year for the last 10 years

Close enough for our purposes. What does Morningstar say about the tax-efficiency?

- SPY: 0.65% per year

- FXAIX: 0.69% per year

So indeed, the fund is a little less tax efficient than the ETF, but not by all that much. How does that play out if you look at the government-mandated tax data in the prospectuses?

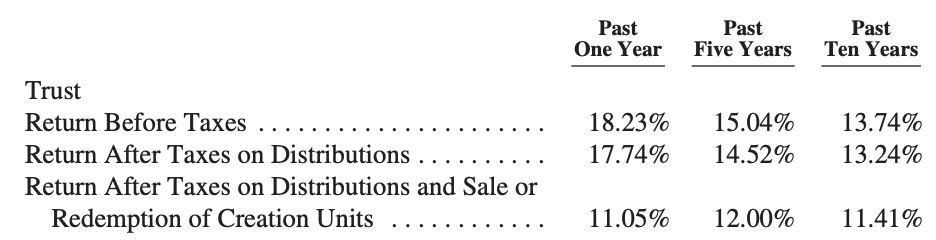

SPY:

FXAIX:

We'll use the 5-year numbers to compare since when the prospectus was written the Fidelity fund wasn't quite 10 years old. As you can see, without selling the ETF lost less of its return (0.56% per year) than the fund (0.63% per year.) After selling, the difference was 3.04% to 3.11%. Not a large difference, but we're also comparing two investments that were already very tax-efficient. The ETF structure just allows it to be slightly more tax-efficient.

The Unique Vanguard Structure

When we talk about “the unique Vanguard structure”, we're usually referring to the fact that Vanguard is a “mutual” mutual fund company. Vanguard is actually owned by its constituent funds, which in turn are owned by the investors in those funds. In a typical mutual fund company, there are three groups of people who want to make money:

- The fund investors,

- The fund managers, and

- The company owners, whether private (like Fidelity) or public (like Schwab).

At Vanguard, the fund investors are the company owners, so there are only two groups of people trying to make money, which helps keep costs down.

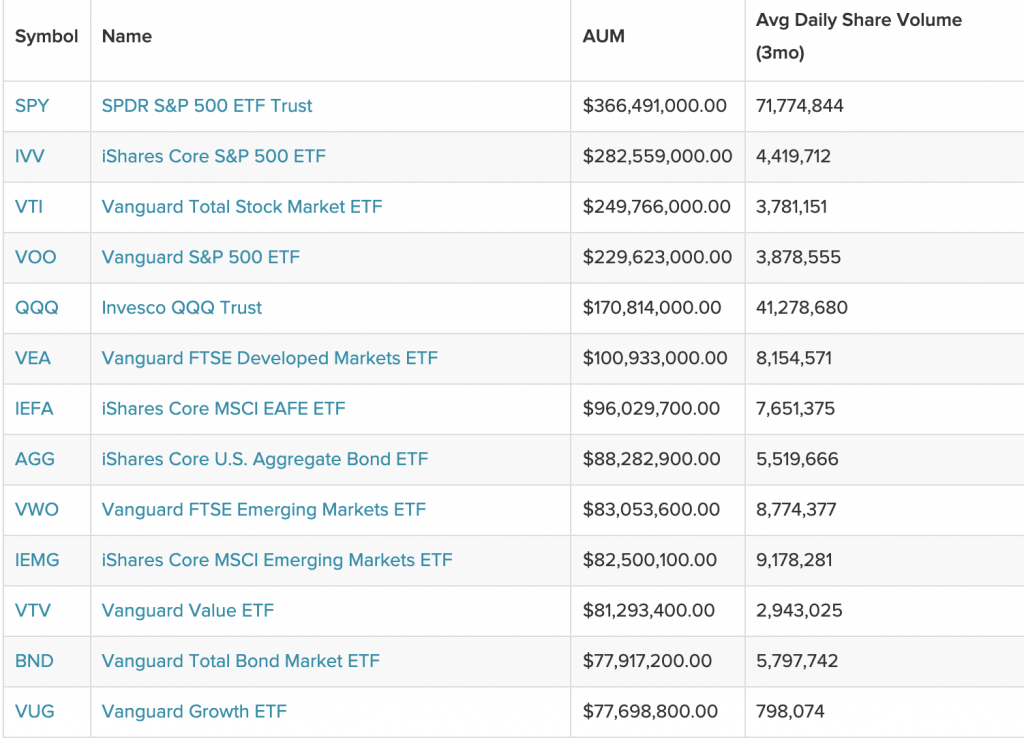

But that's not what we're talking about here. There is another unique thing about Vanguard. When ETFs were being invented back in the 1990s, the most famous ones were called “Spiders” (SPDRs, put out by State Street) and iShares (put out by Blackrock). QQQ, an Invesco ETF that followed the tech-heavy NASDAQ Index was also very popular during the late 1990s tech boom. However, now Blackrock (iShares) has 39% of the ETF market, Vanguard has 25%, and State Street (SPDRs) has 16%. Despite being a Johnny-Come-Lately, Vanguard is now the second-largest ETF company in the world and offers the largest Total Stock Market ETF out there. For some dumb reason, a lot of people have invested a lot of money into S&P 500 ETFs (the other 3 of the largest 4 ETFs track the large-cap heavy S&P 500 index) rather than a total stock market ETF.

The reason Vanguard has been able to make such inroads is due to two factors.

#1 Trust

People trust Vanguard because it is mutually-owned and theoretically run at cost, at least more than most mutual fund companies AND investors have often already been investing at Vanguard for years when they start using ETFs. So it is natural to just use Vanguard ETFs. Investors are also able to still get Vanguard funds even when their accounts are at other brokerages simply by using the ETF share classes.

#2 Fund Structure

Vanguard offers a very unique (and patented) fund structure. At Vanguard, most of the ETFs (including the TSM ETF, VTI) are simply a share class of the mutual fund. When ETF shares are redeemed for its constituent components, the fund simply gives the ETF Authorized Participant the most appreciated shares, continually flushing appreciated shares out of the fund, raising the basis on the average shares in the fund, and avoiding the need to distribute capital gains to the investors. The ETF share class has made the Vanguard mutual funds the most tax-efficient mutual funds out there. The Vanguard Total Stock Market Fund has not distributed capital gains, either short-term or long-term, since 2000! This is an incredible record. At first, people thought it was due to the 2000-2002 bear market. But in reality, it's probably mostly from the fact that the ETF share class was added in 2001.

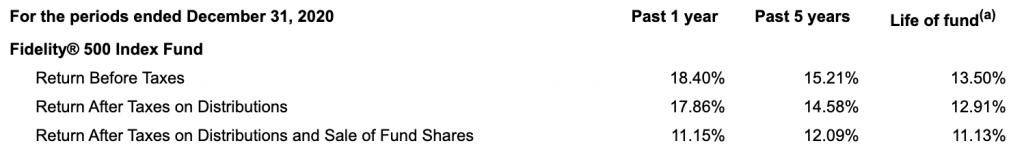

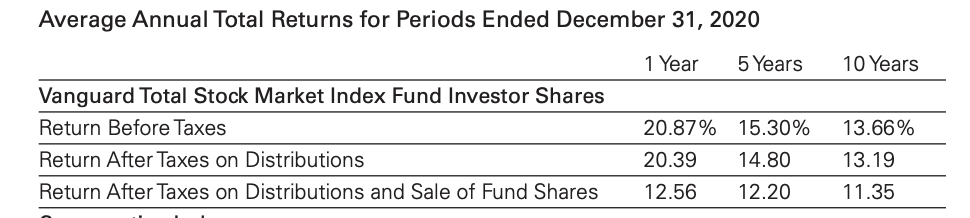

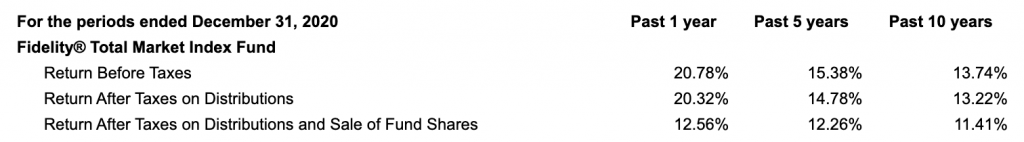

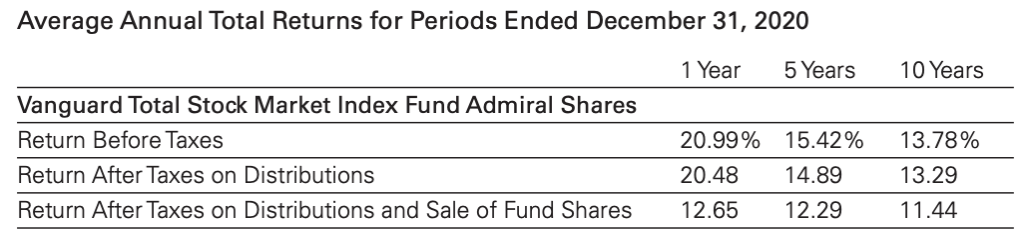

You can really see what a huge benefit (at least in a taxable account) it is to use a Vanguard fund over a comparable fund from another company. Per Morningstar, over the last five years, the Vanguard fund has returned 18.54% per year while the Fidelity Fund has returned 18.52% per year. They're essentially equal, at least on a pre-tax basis. But mutual funds are also required to report their after-tax returns for an investor in the highest federal tax bracket. Morningstar reports this as a “Tax Cost Ratio”, essentially how much the return was reduced by taxes over the last three years. The return of the Vanguard Fund was reduced by 0.46% and the Fidelity fund was reduced by 0.74% per year. 0.28% is nothing to sniff at. Over 30 years earning 8.28% instead of just 8% on $100K adds up to a difference of $82K ($1,088,000 vs $1,006,000). You can also see this in the prospectuses for the two funds. Keep in mind the two funds follow a different index, so returns differ slightly.

Now I don't want you to concentrate on the absolute returns here (Fidelity won over the 5 and 10 year periods and Vanguard won over the 1 year period if you must know). Those differences are mostly due to the different indexes they follow. I want you to concentrate on the difference between the pre-tax returns and the after-tax returns, especially for those who don't sell the shares, i.e. the middle line. Over 1 year, the Vanguard fund lost 0.48% to taxes and the Fidelity fund lost 0.46% to taxes. Over the longer time periods, the Vanguard Fund lost 0.5% and 0.47% per year while the Fidelity Fund lost 0.6% and 0.52% per year. The Vanguard fund is slightly more tax-efficient. Why? Because of that ETF share class.

Now, I totally get that the differences here are minimal. That's absolutely true. Both of these funds are excellent, very tax-efficient funds that I would not hesitate to use in my own portfolio. So if you wonder why I just wasted so many words talking about the differences, I will refer you back to the first line of this post:

Short answer: It doesn't matter much. Long answer: It matters a little.

This whole post is only for those who care about the trivial little details. If you didn't care about them, why did you read this far?

Should You Use VTI or VTSAX?

So now that we know that ETFs are generally a little more tax-efficient than mutual funds and we know that the unique Vanguard fund structure is a possible exception to this rule, how do we decide whether to use VTI or VTSAX?

Better Returns?

First, let's just look at the sheer return numbers. VTI has an expense ratio of 0.03% versus the Admiral shares expense ratio of 0.04%. Maybe that translates into a bit more return. Per Morningstar, the 15 year annualized returns for each investment is as follows:

- VTI: 11.10%

- VTSAX: 11.05%

On that basis, the ETF wins (although let's be honest, it's a pretty slight difference.)

Tax-Efficiency?

Next, let's consider the tax-efficiency. Let's see if there really is no difference between the two share classes of this fund. Again, per Morningstar, the 3-year tax cost ratios are as follows:

Whoa! Didn't expect that. Can that be real? Why wouldn't they be the same? Or if one was going to win, why wouldn't it be the ETF? Let's check the after-tax returns in the prospectus for verification of this.

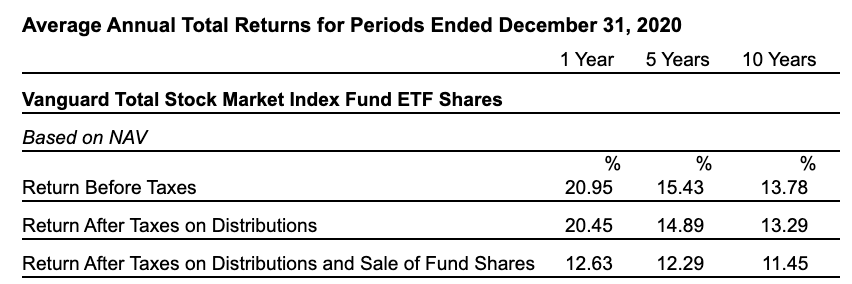

First, VTI:

As you can see, the 10-year return was reduced by 0.49% without selling and 2.33% when you sell.

Now, VTSAX:

The 10-year return was reduced by 0.49% without selling and 2.34% by selling.

As you can see and as you would expect from the unique Vanguard fund structure, the two share classes are equally tax-efficient. So I have no idea what Morningstar is reporting. Whatever it is, it doesn't seem to show up in what you really care about.

Fees

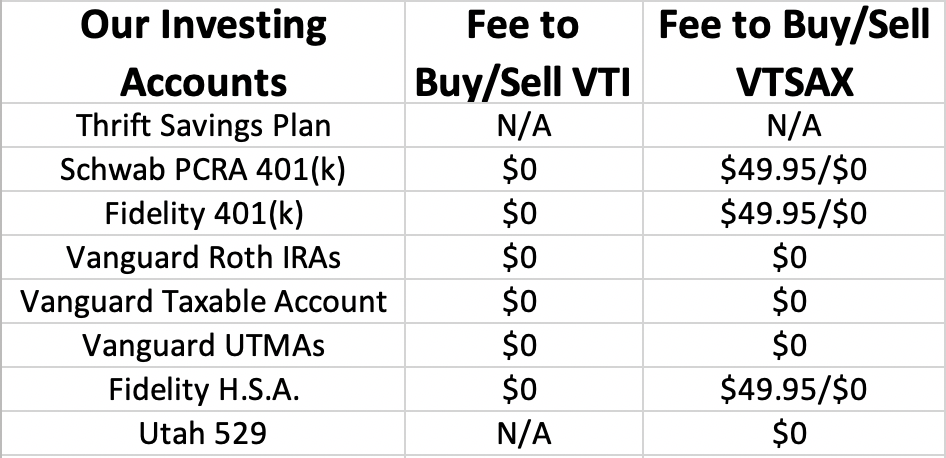

Now let's consider the costs of buying and selling each of these. Fees matter and add up over time. I have a number of investing accounts and the fees for each of these two options in each of our accounts varies.

This has been a bit of a moving target over the years, as has the account in which we actually hold our Total Stock Market Fund. But you can see why one might favor the ETF over the traditional mutual fund depending on the account. If you're holding the Vanguard Fund in a Schwab or Fidelity account, you'll save $50 per buy by using VTI instead of VTSAX. But if you're at Vanguard, you can use either one for the same price. Note that there are accounts where only one (such as our 529s) or neither (such as the TSP) are available. Currently, our Total Stock Market fund sits entirely in our taxable account. It used to be VTSAX until we ended up tax-loss harvesting into a non-Vanguard ETF during the pandemic-associated bear market and so when I bought again, I just stuck with ETFs and so that asset class is now in VTI (and the iShares TSM ETF I swapped into). So I'm obviously fine with either VTSAX or VTI in a taxable account!

Other Considerations

Some people simply prefer ETFs over traditional mutual funds or vice versa. I kind of prefer traditional mutual funds. I like the idea of putting in a buy order on Friday evening and having it execute on Monday at 4 pm Eastern while I'm off on a trip rather than having to find a time on Monday while the markets are open to put in a buy order, calculate out how many shares I can buy, watch it to make sure it executes, and then lament the fact that there are always a few dollars sitting there in cash that can't be invested (although Fidelity and some new fangled brokerages like RobinHood allow the purchase of fractional shares which solves this problem). There is a bit more control with ETFs, but that comes with additional hassle. When the other differences are so minimal, perhaps that is the factor that matters most to you.

When tax-loss harvesting in a volatile market, ETFs offer more opportunity but also more risk. It's pretty easy to go from the TSM mutual fund to the Large-cap index mutual fund or the Vanguard 500 fund at 4 pm. But if you want to maximize that loss, you might want to try to trade ETFs during the actual trading session. You can get burned though if the market jumps between the time you sell the one you were owning and the time you buy the new one. In a volatile market, you could easily wipe out all the benefit of the tax-loss harvesting process by accidentally selling low and buying high!

The Bottom Line

As I mentioned at the top, you can safely use either VTI or VTSAX as a great investment. Fully 1/4 of our retirement portfolio is invested in this investment and it also appears in our HSA, our kids' UTMAs, and our kids' Roth IRAs (via a target retirement fund). While ETFs are generally more tax-efficient than funds, that's really not the case with Vanguard due to their unique fund structure. You should make the decision about which to use based on fees, hassle, and personal preference.

What do you think? Do you use VTI or VTSAX and why? Comment below!

The post VTSAX vs VTI appeared first on The White Coat Investor - Investing & Personal Finance for Doctors.

-----------------------------

By: The White Coat Investor

Title: VTSAX vs VTI

Sourced From: www.whitecoatinvestor.com/vtsax-vs-vti/

Published Date: Mon, 16 Aug 2021 06:30:27 +0000

Read More

Always check our latest articles at...

https://11waystomakemoney.com/investing

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions