California-based Astra Space (ASTR) makes space launch vehicles. It counts NASA among its customers. Astra went public through a merger with Holicity in Q2 2021.

Let’s take a look at Astra’s latest financial performance, contract wins, and risk factors.

Astra’s Q2 Financial Results and Q3 Guidance

Astra has not begun generating revenue. It made a loss of $31.3 million in the second quarter, which widened from a loss of $8.83 million in the same period last year. It ended the quarter with $452.39 million in cash (including restricted cash). (See Astra stock charts on TipRanks).

For the third quarter, Astra still does not expect to generate revenue. It anticipates adjusted EBITDA between -$32 million and -$35 million. Astra estimates Q3 capital expenditure to be in the range of $10 million - $15 million.

Astra’s Contract Wins and Expansion Plans

Astra announced that Space Force will be its first “commercial launch customer.” It also signed Spire as a customer and plans to begin launches next spring. NASA has also selected Astra for a second contract. Additionally, the company has won a long-term launch contract from Planet Labs.

Astra has acquired Apollo Fusion in a deal it expects to expand its addressable market. It has also begun expanding its Alameda factory with the goal of tripling its capacity.

Astra’s Risk Factors

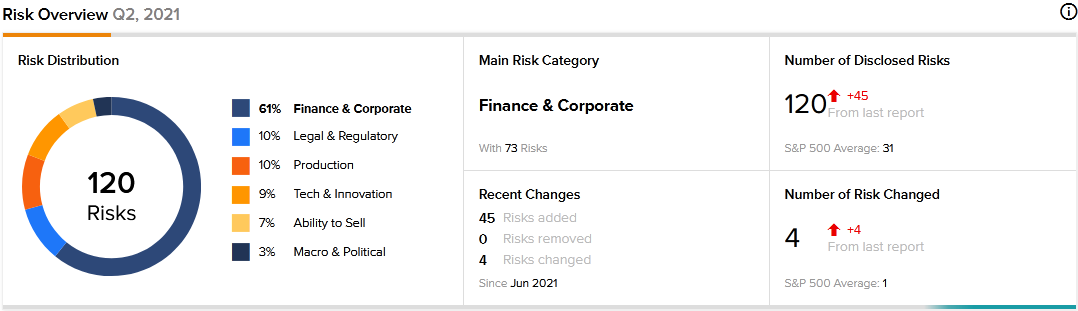

The new TipRanks Risk Factors tool shows 120 risk factors for Astra. Since December 2020, the company has amended its risk profile to introduce 45 new risk factors.

Astra cautions that its founders control about 75% of the voting power in the company. As a result, that limits the ability of other investors to influence the outcome of major corporate transactions.

Astra tells investors that while it has $150 million in contracts and $1.2 billion in potential contracts, there is no guarantee it will convert them into actual revenue. The company further says that it has a history of losses and cannot assure investors that it will become profitable or remain consistently profitable.

Moreover, the company cautions it may not achieve the benefits it anticipates from the businesses it acquires.

Finance and Corporate is Astra’s top risk category, accounting for 61% of the total risks. That is above the sector average of 39%. Astra’s shares have declined about 5% since the beginning of 2021.

Analysts’ Take

Deutsche Bank analyst Edison Yu recently reaffirmed a Buy rating on Astra stock with a price target of $13.

Consensus among analysts is a Moderate Buy based on 1 Buy. The average Astra price target of $13 implies 35.14% upside potential to current levels.

Related News:

What Do Citizens’ Risk Factors Tell Investors Amid Acquisitions?

Deere & Co. Beats Estimates in Q3; Shares Decline 2.1%

What Do Proterra’s Earnings and Risk Factors Reveal?

The post What Do Astra Space’s Earnings and Risk Factors Tell Investors? appeared first on TipRanks Financial Blog.

-----------------------------

By: Neha Gupta

Title: What Do Astra Space’s Earnings and Risk Factors Tell Investors?

Sourced From: blog.tipranks.com/what-do-astra-spaces-earnings-and-risk-factors-tell-investors/

Published Date: Mon, 23 Aug 2021 07:38:34 +0000

Read More

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions