Canada-based Open Text Corp. (OTEX) offers enterprise information management solutions. It serves customers around the world. Let’s take a look at the company’s latest financial performance and risk factors.

Open Text’s Fiscal 2021 Fourth-Quarter and Full-Year Results

The company reported an 8.1% year-over-year increase in revenue to $893.5 million for its Fiscal 2021 fourth-quarter ended June 30. Revenue topped consensus estimates of $839.62 million. Adjusted EPS of $0.80 remained flat from the same quarter last year but beat consensus estimates of $0.71.

For the fiscal full-year 2021, revenue increased 8.9% to $3.39 billion. Adjusted EPS rose to $3.39 from $2.89 in the previous year. (See Open Text stock charts on TipRanks).

Open Text plans to distribute a quarterly cash dividend of $0.2209 per share on September 24. The company repurchased 2.5 million shares during Fiscal 2021 and has returned $1.3 billion to shareholders through dividends and stock repurchases since Fiscal 2013. Open Text expects to increase its shareholder returns in the next fiscal year.

Open Text’s Risk Factors

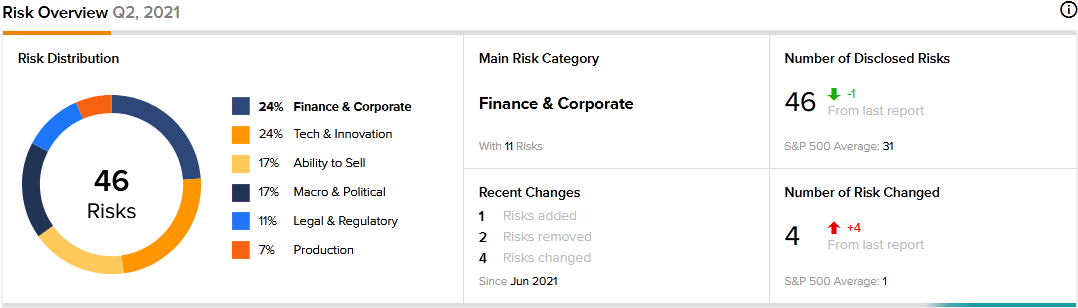

The new TipRanks Risk Factors tool shows 46 risk factors for Open Text. The company introduced a new risk factor under the Macro and Political category in its Fiscal 2021 annual report.

The newly added risk factor cautions about the potential adverse effects of Brexit. Open Text notes that after the U.K. withdrew from the E.U., the country and the bloc reached a new trade agreement that took effect in May 2021. It says the new agreement is complex and subject to uncertainties. As a result, Open Text warns that the uncertainties may cause its customers to reduce their spending on its products. That could, in turn, adversely affect its operating results and financial condition.

While adding a new Macro and Political risk factor, OpenText removed one Finance and Corporate risk factor related to the Carbonite acquisition. The company had cautioned investors that it could fail to achieve the anticipated benefits of that acquisition. That risk is no longer there as the deal has since closed.

Finance and Corporate is Open Text’s top risk category, accounting for 24% of its total risks. That is below the sector average at 39%. Open Text’s shares have gained about 18% since the beginning of 2021.

Analysts’ Take

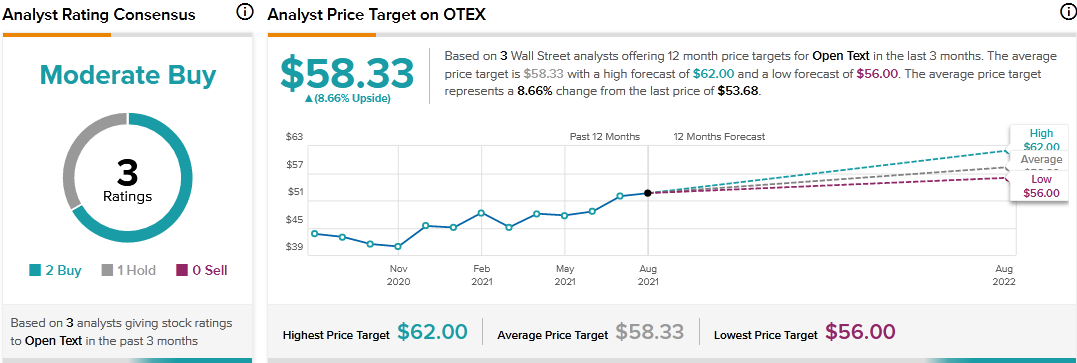

Barclays analyst Raimo Lenschow recently reiterated a Hold rating on Open Text stock but raised the price target to $57 from $56. Lenschow’s new price target suggests 6.18% upside potential.

Consensus among analysts is a Moderate Buy based on 2 Buys and 1 Hold. The average Open Text price target of $58.33 implies 8.66% upside potential to current levels.

Related News:

What Do Astra Space’s Earnings and Risk Factors Tell Investors?

A Look at 23andMe’s Earnings and Risk Factors Amid Therapeutic Efforts

TD Bank Q3 Earnings Preview: What to Expect

The post What Does Open Text’s Newly Added Risk Factor Tell Investors? appeared first on TipRanks Financial Blog.

-----------------------------

By: Neha Gupta

Title: What Does Open Text’s Newly Added Risk Factor Tell Investors?

Sourced From: blog.tipranks.com/what-does-open-texts-newly-added-risk-factor-tell-investors/

Published Date: Tue, 24 Aug 2021 07:06:43 +0000

Read More

Did you miss our previous article...

https://11waystomakemoney.com/investing/santander-consumer-usa-will-go-private-in-4150-per-share-cash-deal

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions