I always say, “Show me a person’s calendar and I’ll show you their priorities.”

Well, I have a newer version of that: Show me a person’s spending, and I can show you what they love.

I spent years talking to people about their spending habits, and I boiled them down to 10 “Money Dials.” They’re called Money Dials because you can “tune” them up or down — just like a dial.

If you were to look at someone else’s spending for 10 minutes, you would instantly know what their Money Dial was. And if I were to look at your spending, I could tell you what yours is. Money Dials allow you to understand why people make the choices they do … and then go deeper than you ever thought possible.

I find Money Dials fascinating for several reasons: People go where their time and money go. For example, fit people spend time and money to be fit. Fashionable people spend time and money reading fashion magazines and shopping.

The most fascinating part is when we’re misaligned. For example, some people say, “Family is #1,” but if you look at their calendars and spending, family is not even in the top 10.

Money Dials are an easy way to diagnose what you claim is important vs. what is actually important.

Ready to set up your finances to align with your Money Dials? Download my FREE Ultimate Guide to Personal Finance.

Every one of us has an area that we naturally love to spend money on. I’ve identified 10 Money Dials that we LOVE to pour our money into.

If you look at your own spending, what gets you excited?

- Convenience

- Travel

- Health / fitness

- Experiences

- Freedom

- Relationships

- Generosity

- Luxury

- Social status

- Self-improvement

If you had $25,000 to spend on any of the above, which would you put your money into? Your answer — the one you instinctively came to within seconds — is likely your #1 Money Dial.

Want to know how to make as much money as you want and live life on your terms? Download my FREE Ultimate Guide to Making Money

Knowing your Money Dial can transform the way you think about your spending, because it lets you understand what you spend money on and why, and it enables you to redirect your spending from other areas to spend extravagantly on your Money Dial. THIS is what true Conscious Spending looks like.

Money Dials are the evolution of Conscious Spending and zoom in on the concept of spending extravagantly — guilt-free.

Below, I’m going to show you examples of people with different Money Dials.

But the common theme is that whatever Money Dial a person chooses, they can build a life that allows them to spend extravagantly and unapologetically on the things that truly matter to them but also cut costs mercilessly on the things that don’t matter to them.

This is the power of Money Dials.

My favorite part of Money Dials is that once you understand your own, and you accept it, you can zoom in on what you love by TURNING THE DIAL ALL THE WAY UP.

![]()

Finding your own Money Dials

To find your Money Dials, you just have to ask yourself one question: What do you LOVE to spend money on?

That can be a deeply uncomfortable question to ask. It can actually be a little scary. Our culture and society love to demonize spending, especially when it comes to spending on ourselves. It comes with guilt, shame, and judgment.

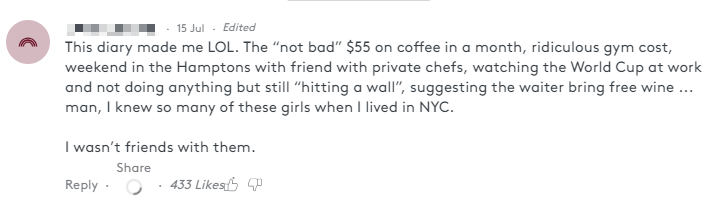

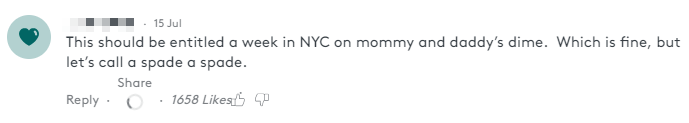

Don’t believe me? Here are some comments I’ve received on my various spending posts:

What a judgmental reaction — as if it’s forbidden and downright evil to spend on the things you love (and have the means to purchase).

But what if we take these same judgmental people and examine their spending for a month? I bet I’d be able to find areas in their life where others would think they’re “wasting” their money too.

It’s OK to recognize that you have areas you naturally love and want to spend on. What others think of your spending doesn’t matter because everyone has different Money Dials. It’s simply a matter of different priorities! In other words, what you value will be different from what others value. If you LOVE to spend your money on week-long trips to exotic locales, but someone else would rather spend that same amount of money on having the latest iPhone, that’s great — and perfectly normal!

It’s just being true and honest to ourselves about what our Money Dials are.

In fact, when we’re honest about acknowledging our Money Dials, we can adjust the dial (hence the term) as we need to be moderate, or turn them all the way up to spend even more on the things that bring us joy and more pleasant experiences (think splurging on first-class tickets instead of economy all the time, for example).

This is crucial psychologically.

Not only will we have more money and energy to spend on the things that bring us happiness, but we’ll be able to spend on those things guilt-free, since we know we’ve freed up the money by ignoring everything else.

It’s intimidating and liberating at the same time. It allows us to say, “Hey, this is important to me — and that’s not.”

The most successful people I’ve met are all very conscious about how they spend their money. That doesn’t mean they don’t spend at all. It means that they choose HOW and WHERE to spend their money, and are unapologetic in allocating significant resources to live a better life.

Want to work from home, control your schedule, and make more money? Download my FREE Ultimate Guide to Working from Home.

10 most common Money Dials

Do you know what you naturally gravitate toward spending on? Most people don’t — even though everyone tends to have a few overriding priorities for their discretionary spending.

When it comes to Money Dials, though, people’s spending almost always matches up with these 10 priorities.

- Convenience

- Travel

- Health / fitness

- Experiences

- Freedom

- Relationships

- Generosity

- Luxury

- Social status

- Self-improvement

I want to take a look at the four most common Money Dials. As you read, take note of how they fit into your spending habits.

Here are the categories again:

- Convenience

- Travel

- Health / fitness

- Experiences

- Freedom

- Relationships

- Generosity

- Luxury

- Social status

- Self-improvement

Let’s take a look at what each of these Money Dials looks like. As you read, take note of how they fit into your own spending habits.

Money Dial #1: Convenience

This Money Dial means spending on anything that makes your life more convenient.

Examples:

- Travel apps

- Ubers

- Extra iPhone charger

- Pre-cooked meals

- Everything delivered

- Automated bank accounts (and automation in many parts of life)

I love spending my money on convenience. I’ve turned the Money Dial all the way up. I spend more than $50,000 a year on a personal trainer, chef, and other luxury services to streamline my life and reduce stress in those areas. And I also have a VA who:

- Optimizes my calendar for me

- Arranges all my travel — right down to the perfect seat on the perfect flight and the perfect route to the airport

- Schedules all my appointments and calls

When a friend tells me a story about how they built a system that lets their assistant manage their workout schedule to save them an hour a week, I’m like “What! How’d you do it? I want that. I need that!” In other words, anything related to convenience gets me really fired up. It’s just how I’m wired. I love it.

If you want more convenience, simpler examples would be buying pre-cut vegetables at the grocery store so you can avoid the messy and time-consuming chopping at home.

Here are other examples from our readers:

“For a year we spent money on Blue Apron. It made life easier to come home and know what we were having for dinner and everything was right there in the fridge…I love buying back my time!”

“Splurged on a luxury car service to take me from Los Angeles to Huntington Beach. Cost hundreds more than an Uber would have, but I wanted the convenience of knowing I’d have a ride at the time I wanted. I rode in style and comfort and didn’t need to worry about the logistics of that trip: I learned that when you splurge on a ‘luxury’ experience, they take care of things like showing up on time for you — you don’t need to worry about that.”

“The $350 I spent on a Roomba was a game-changer in the dog hair game.”

Money Dial #2: Travel

What do average people do for travel? Maybe they take a one-week vacation at Christmas, and a one-week vacation in the summer. But if travel was their #1 Money Dial, what would that look like?

Here are some basic examples:

- On January 1st, they already know where they’re traveling this year

- They’re often masters of points/travel hacking

- They have an overflowing list of travel destinations saved and their conversations revolve around where they’ve been and where they’re going

- They have strong opinions about the “right” suitcase, the right way to pack, and the best seats on the plane

But what if someone REALLY loves travel? Here are some extreme examples:

- Once a year, they take their family to Paris for a full month and rent a beautiful apartment above a patisserie

- They surprise their partner with weekend road trips once a month

- They fly Emirates first class to Dubai

If you turn this Money Dial all the way up, it means traveling for months every year; joining a travel group; splurging on high-end travel experiences like a safari, Inspirato membership, or multi-generational travel; and developing strong perspectives on travel, including which friends to invite, how much “authenticity” matters, and specific parts of the world to return to.

Here are some examples from our readers who value travel as their primary Money Dial:

“I didn’t really think it would be travel, but realized that my husband and I have owned three campers now (which is still much cheaper than a flight — so it doesn’t feel extravagant) but still eats into a significant amount of our free time and discretionary funds. I am not into camping at all, so this is shocking to me. Having a camper allows us to travel with our dogs without worrying about whether a place will be pet-friendly or trying to get them on a plane. My husband gets to do the type of travel that he wants, which is to be in the middle of nowhere, and I get to do the type of travel I want — which is to explore a new city — all in the same trip because we can move every day (or not) without the inconvenience of changing hotels. Between the payment, insurance, and parking, our monthly cost is about $550. That doesn’t include gas or fees for parks (if we stay in one). That is a lot of money on our budget, but it’s worth it because it gives us the type of freedom we want to explore.”

“We have spent $15,000 two years in a row (and will probably do it for another five years, even though it extends our budget and we make sacrifices in other places) for a week-long family trip with kids (8 and 11) to Tavarua Island in Fiji. Best family time, surf time (my passion), and dedicated time with family and friends every year. My kids want us to book it for next year the second we start to pack up. May have to sacrifice a year or two at some point to make sure we keep overall finances in check.”

“I spent on family Disney vacation. We stayed at the Disney’s Polynesian (right on the Monorail line) and bought the full meal plan and the full ‘Park Hopper’ tickets for the entire vacation. I know it was a crap ton of extra money than trying to go cheap. But my family and I spent the entire vacation just having fun. We never worried about food. We never worried about where we wanted to go that day, because we had complete freedom. The memories are priceless.”

Starting your own business can help you take your money dials to the next level. Learn how to start with my FREE Ultimate Guide to Business.

Money Dial #3: Health / fitness

LeBron James spends $1.5 million a year keeping his body in top form, according to this article from The Ringer, investing in nuanced health-promoting practices like cryotherapy and hyperbaric chambers. Not to mention his personal chefs and trainers who help him adhere to a strict diet and routine.

I LOVE IT.

Everything in his life, down to the last detail, is focused on achieving peak physical fitness. He’s not just spending $100 on a massage and calling it good. His #1 Money Dial is health and fitness, and so he’s architected his life and finances around physical fitness and investing a significant amount of money in it.

Here are some other examples:

- Membership at a gym based on quality, not necessarily distance to your house / apartment

- Personal trainer + nutritionist

- Choosing food based on macros, not simply taste (e.g., Ezekiel bread)

- Selective about your workout gear (Lululemon + Nike are the best)

Taken to its logical extreme, the health and fitness Money Dial can mean annual yoga retreats, always checking restaurant menus before you go, and joining social groups based on fitness.

Here are some additional examples from readers:

“Currently paying a nutritionist $275/month for a six-month program.”

“I spend around $12,000 per year in personal trainer for Pilates and Gyrotonics class. It’s absolutely worth it.”

“Right now I am spending a bit more than average of my monthly income to go to a specific karate dojo in town. I take classes with one of the best masters of karate in Europe. It was one of the best decisions. I am in better shape than ever, physically and mentally (this master is old school so he includes all the spiritual parts of karate in his classes).”

Money Dial #4: Experiences

The experiences Money Dial is perfect for anyone who values novelty and unique experiences over material possessions.

Examples:

- Skydiving

- Concerts

- Unique vacation activities like swimming with blue whales

- Dinners at Michelin-starred restaurants

Recently, I’ve been turning up my experiences Money Dial. I decided that my dream was to take my whole family to a huge house somewhere in the Caribbean. We could all be together, the kids could be playing in the pool, we could rent this big house. There would be someone there to make the beds and clean. My mom wouldn’t have to cook. We did it, and we ABSOLUTELY LOVED IT. It was amazing to see the family together in this awesome environment for a week together. We just played and built great memories spending time together.

I also took a factory tour of one of my favorite Italian clothing brands, because I love learning about craftsmanship.

On our honeymoon, we spontaneously decided to hire a photographer at the Taj Mahal, something we would normally never do. I have those photos sitting on our living room table. I really love these photos and these memories, because normally I would have never done this. But the photographer was there. Yes, he charged more than I normally would have paid, but I thought to myself, “This is something we’ll never forget.” So I was happy to do it.

Here are some more examples from our readers:

“I always buy concert tickets VIP. Box seats have a great view, private wait staff with better food, etc. I’m not smashed next to sweaty armpits (I am short so this is reality), and VIP parking is usually included and is extremely close to the venue. Sometimes there’s a catered event pre-show or meet and greet with different bands. I’m not 15 anymore — roughing it is not my style. I’ve spent $100 and [as much as] $1,000 on a single concert ticket. It’s like a game to find the best tickets, and I never regret going to a show.”

“I bought 2017 World Series tickets: $2,600 for two bad tickets, but I HAD to experience it.”

“I spent $1,000+ (a LOT of money for me) to go to Las Vegas to see Stevie Wonder in concert. I didn’t care about going to Vegas, but it was one of only two places Stevie was performing this year. He is my favorite living musician, but I’d never seen him live before. I splurged and got a great seat — on the floor, in the center, 13 rows back. He was, as you would expect, a wonderful performer, and I had a fantastic time. It made me so happy to be alive. I would absolutely do it again.”

Money Dial #5: Freedom

For me, a Rich Life is about freedom. It’s about not having to think about money all the time and being able to travel and work on the things that interest me. It’s about being able to use money to do whatever I want, and not having to worry about taking a taxi or ordering what I want at a restaurant or how I’ll ever be able to afford a house.

People with a freedom Money Dial value the ability to do what they want, when they want. Money is no longer a major constraint in their lives. In fact, cost is rarely the first thing they consider. More often, it’s time, quality, experience, relationships, or simply “I want it.”

Here are some examples from readers:

“Self-funding our own 1-year mat leave. A lot of our friends have full-time jobs that they hate but stick around because it ‘has benefits.’ People also believe that because we run our own business, that ‘Oh, it’s too bad you don’t have benefits or mat leave to fall back on.’ It makes me feel awesome that we have a profitable business that we love to work on and that pays us more than enough to self-fund our own mat leave. It’s still a work in progress (we’re planning to start a family 2 years from now) but it feels great to know that we’ll be ready and can enjoy the early parenting experience without worrying about money.”

“My wife is about to finish medical residency, and it doesn’t matter if she works, how many days she works, or how much money she makes for the days she does work. She can literally pick exactly the job and hours she wants without having to worry about our overall family financial health. Freedom!”

“I set aside enough money to free up some of my time to focus on my writing and dream of becoming a screenwriter. After ‘dabbling’ in short fiction and documentaries for years, I gave myself a 5-year time limit to get my first feature in the movie theatres. Turns out I didn’t need much money to get by without feeling like I was losing out on anything.”

Money Dial #6: Relationships

I have a friend who’s 40-something and works in tech. He earns multiple 6 figures per year. By most accounts, he has enough money to do anything he wants in life. Travel the world, retire early, or buy expensive watches and cars.

Instead, he chooses to live in Palo Alto — one of the most expensive areas in the U.S — to be close to his family. He’s not considered rich in Palo Alto. If anything, he’s middle class there. He also chooses to send his kids to private school, which costs tens of thousands per year. To top it off, he just bought a property and is building a dream house with a special suite for his parents. The trade-off means that, despite his high income, he almost never goes on lavish trips or buys anything fancy for himself — but none of those things matter to him.

Whenever we talk, he loves talking about his family. It makes perfect sense. That’s because his relationship with his family is his #1 Money Dial.

That’s one flavor of making relationships your #1 Money Dial. I’ve got another friend who sends a “FUN LIST” email to all his friends once a month with events and activities in NYC. It’s packed with things like a “Taste of Tribeca” food tour, a Cinco de Mayo event and fundraiser, and something called “Intrepid Summer Movie Series,” where you watch movies on an aircraft carrier. Then he goes with friends to the ones they get excited about. This is a great example of someone who spends his time and money on relationships with friends.

Here are a few great examples from readers:

“Greeting cards, like for birthdays or bridal showers. No matter the level of relationship, I skip the cheap options and get a bomb-ass card. I keep a lot of the cards I receive and a quality or special card is a really nice touch for a gift or milestone.”

“We booked both our parents on a 7-night cruise (our treat) for their anniversaries. This is something they wouldn’t have thought of or done otherwise. It made us happy that we could do this for them, especially after everything they have done for us.”

“My brother and I took my mom (and dad and our families) to Rome for 10 days. A Latin teacher her whole life, my mom (shockingly) had never been to the very place she taught kids about for decades! That changed in 2016 when we plunked down a bunch of $$$ (thanks to my part-time wedding photography business) and spent over a week in the eternal city. We STILL reminisce about the pizza and gelato! Best $$$ ever spent!!!”

Ready to set up your finances to align with your Money Dials? Download my FREE Ultimate Guide to Personal Finance.

Money Dial #7: Generosity

Most people donate to charity at the end of the year. Or they volunteer at their kids’ school every now and then. Maybe they offer to drive their friend to the airport.

But if generosity was your #1 Money Dial, what would that look like?

- You could become known for giving great tips. 25% tips? That’s your minimum. 100% tips? Sure, why not.

- You’d surprise your nieces and nephews with gifts just because.

- Every year on your birthday, you’d throw a huge event and raise $10,000 for your favorite charity.

A few years ago, my wife and I held a fundraiser in NYC. We both come from families of immigrants and we wanted to raise money for families being separated at the border. What we saw made us feel helpless, outraged, and sad. But we also know that we’re in the enviable position of being able to do something about it. So we did.

When this is your #1 Money Dial, you can be truly generous.

Here are other generosity examples from readers:

“When Beyoncé was on tour a couple years ago I bought tickets for my wife and whichever 4 friends she wanted to bring with her (five people in one car). The tickets were around $200 each, so around a grand total. The look in her eyes after I gave her the tickets was something I’ll remember forever and she still talks about that concert.”

“On an annual basis, I donate $15,000 to various charities. I consider this as luxury living and some may call me crazy because I could have had fancy dinners, BMW, jewelry, etc. Giving back is my priority.”

“One of my best friends was in some credit card debt and was killing herself to pay it off … but worked for a nonprofit (read: doesn’t get paid much). It was going to take her years! Two of us went in and paid it off for her, just like that. Writing a $5,000 check that frees a friend from chains without having to think twice? Priceless.”

Money Dial #8: Luxury

Most people think of luxury as “excess.” It’s someone paying more than they “should” for something that you can get for a lot less. Or it’s something that’s “totally unnecessary.” Who needs a $20,000 watch? A $15 Timex has the same, or even better, functionality.

But luxury is about the emotion, the feeling, the packaging. It’s about the identity you create by indulging in a luxury product.YOU choose what luxury means to you.

Notice our first reaction: “LOL, stupid people. Don’t they know they’re getting ripped off?”

But it’s not stupid.

I might think it’s insane, your college friend might think it’s insane, but if you’re getting superlative value from it, that’s luxury.

Why do you think Mercedes-Benz chose “The best or nothing” as their slogan? Can’t a Honda Civic get you from place to place without premium sound or a 577 horsepower engine? Of course. But Mercedes owners want more than functional transportation. They want an experience.

Here are a few examples of luxury from readers:

“A well-designed high-quality backpack. I spend a lot of time commuting on public transit, so having a bag where everything is easily accessible when you’re in a cramped space is crucial. I recently got a Peak Design backpack and I love it.”

“I spend $300 a pop on Allen Edmonds shoes (I own two now). People freak out when I tell them what I paid. It’s such a luxury purchase that most of my friends and family can’t conceive of having $300 extra to spend on something as ‘frivolous’ as shoes. However, everyone comments on how nice they are and what it does for my overall appearance.”

“Paid thousands for an Eames lounge chair. Haven’t regretted it for a moment, and it automatically improves my day every time I sit in it. Worth every penny.”

“I spent $700 on a pair of boots over 7 years ago and at the time it was an insane luxury. I almost hyperventilated when I bought them, I felt irresponsible, I was anxious, and I LOVED THEM! … 7 years later I still have them and I still wear them and they’re still hot!! I still get compliments.”

Money Dial #9: Social status

Social status may at first seem a bit shallow — and sometimes it is! We remember back in high school when we were judged by the brand of clothing we wore. Ugh.

But there can also be good reasons to value social status.

For example, a Rolex watch or Loro Piana sweater is functionally the same as something 1/100th the cost, but it signifies certain things about who’s wearing it. Don’t laugh — most people scoff at status (which is ironic since every one of us factors in status to other parts of our lives: the college we attend, the neighborhood we live in, the job we take). But these items convey a subtle status that can garner people “in” status because it says something about their income or personal taste or style.

Airlines, hotels, credit cards, retail stores, and others offer loyalty cards that can get you extra benefits — better rooms, higher cash back, free trips, and so on. Having a higher status can be worth thousands of dollars per year.

Here are a few other examples of what the social status Money Dial looks like:

“I was scheduled to have a vanilla wash and wax on Sunday, and instead I asked them what their highest level of service was. They told me they often prep cars for car shows or dealer rooms, everything from high end exotics to antique cars, and can do everything from mirror shine polishes to full paint jobs. I ended up paying them just shy of $1,000 to do a full paint correction and a bunch of other stuff. Basically 3 guys rubbed stuff on my car for about 8 hours. I don’t know exactly what all it entailed, but it looks badass and I feel like a badass.”

“Three months ago I signed up for a $159 monthly subscription to Rent the Runway, a designer clothing site that sends you 4 pieces at a time to keep for as long as you want. I spend less time making decisions about what to wear, I feel and look better wearing well-made clothes, and I’m never bored with my closet. It feels a bit extravagant but it’s so worth it.”

“I bought a $1,500 tailored full-canvas construction suit made in the U.S. People say ‘You know how many suits I can buy for $1,500?? Just buy off the rack and get alterations.’ It’s hard to buy suits in my size. The first time I wore a tailored suit, my VP at the time said, ‘Dude, you look like a model.’ I continue to get comments like that. With the above purchase, people assume you take yourself seriously and they, in turn, take you seriously. This is worth far more than a few grand.”

“I pay $450/year for a Chase Sapphire Reserve card that gets me airline lounge access for comfort and relaxation plus car rental status to get any car off the lot (from Corvettes to SUVs and I only pay for midsize).”

Money Dial #10: Self-improvement

There are several ways most people spend money on self-improvement:

- Take an online course (copywriting, social skills)

- Sign up for an in-person class (public speaking, dance)

- Hire a trainer at the gym

I’m a big reader (I try to read two books a week). In fact, I came up with “Ramit’s Book-Buying Rule”: If you think a book looks even remotely interesting, buy it. Don’t even waste five seconds debating it. If you glean just one idea from the book, it makes it even more than worth the price. That idea could be the one that changes your life or simply challenges long-held beliefs you’ve always had. And those moments are invaluable to your development.

Another great way to think about self-improvement is called “The Hotshot Rule.” It comes from former Cinnabon president Kat Cole: Four times a year, Cole would go somewhere quiet, think about the state of the company, and ask herself: “Let’s say a hotshot takes over my job today. What two or three things would the hotshot look at and say, ‘That’s unacceptable’”?

I think that’s a great rule not only for business but also for every area of life. If someone else came in and looked at a certain aspect of my life — what food I eat, my relationships, my health — what would they say is unacceptable? When you identify those areas, you can focus on making changes.

Here are some examples from readers of how self-improvement is their Money Dial:

“Ski instruction. I do it every day we go. It has changed my abilities, and with greater abilities you get much better experiences (views, terrain, thrills, peace) on the mountains.”

“I spent $15k on a sales coach. Turned out to be the best investment I ever made. More than doubled my income in less than a year. Was promoted, then later headhunted for an incredible job. About 9 months later, work volunteered to start paying for it. New co I’ve joined sends the other managers to similar programs now. My only regret is not doing it sooner.”

“I love to spend money on improving my electric guitar skills by taking lessons from really good people. I recently had the chance to take lessons with the lead guitarist of an international touring heavy-metal band from the Bay Area. I have looked up to these guys for years and my abilities have gone through the roof.”

What’s your Money Dial?

One thing you may have noticed is that several of these Money Dials overlap — some things we spend money on appear in two categories. For example, a Rolex can be both a luxury and provide social status. Or hiring a trainer can be for health / fitness and for self-improvement.

That’s OK!

If something that you spend money on appears in two categories, see if you can quickly identify the primary category it belongs to. If it still isn’t clear, look at other things you spend on. Are they in one of those two Money Dials?

Once you identify your #1 Money Dial, it flows through your life, and it affects everything about how you spend your money. It’s your personal strategy. And the ways you spend your money are the tactics to implement that strategy. You are now the CEO of your life.

My favorite part of Money Dials: Once you recognize yours, and you accept it, you can zoom in on what you love by turning the dial all the way up, as I’ve done for myself for convenience.

This might seem extreme to some — but for me it’s a complete no-brainer. Because I know my Money Dial and can focus on it, I actually free up time to invest in my company … and I can earn even more money as a result.

Money Dial challenge

Here’s my challenge for you: If you can afford to, take $500 and spend it extravagantly on something you love.

That’s going to be a lot of money for some of you — but that’s the point. Spending money on the things you love can be uncomfortable at first. Especially when you consider all the “Invisible Scripts” — the ubiquitous assumptions that we no longer question in our lives — and noise around spending.

But when you do, you’ll feel the value these things bring to you. And that allows you to tailor your spending so that you can live your Rich Life.

Did you miss our previous article...

https://11waystomakemoney.com/make-money-online/how-to-avoid-becoming-a-negative-blogger

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions