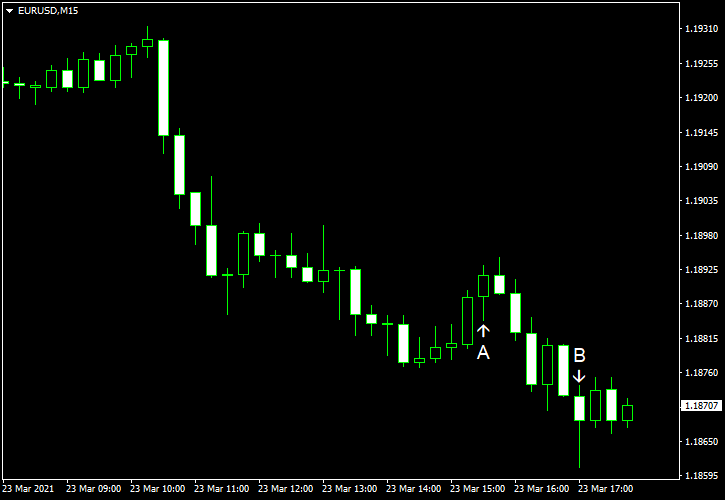

EUR/USD declined today, erasing yesterday’s gains. Market analysts explained the decline by risk aversion caused by the spread of the COVID-19 across Europe as well as rising political tensions between China and the European Union as well as other Western powers.

US current account logged a deficit of $188.5 billion in Q4 2020, up from $180.9 billion in Q3. The actual value was in line with analysts’ forecasts. (Event A on the chart.)

Richmond Fed manufacturing index rose from 14 in February to 17 in March. The consensus forecast had promised just a marginal increase to 15. (Event B on the chart.)

New home sales were at a seasonally adjusted annual rate of 775k in February, missing the consensus forecast of 872k. The previous month’s figure got a positive revision from 923k to 948k. (Event B on the chart.)

Yesterday, a report on existing home sales was released, showing that they were at a seasonally adjusted annual rate of 6.22 million in February, down from the previous month’s revised level of 6.66 million (6.69 million before the revision). The market consensus had promised a better reading of 6.55 million. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.

---------------------------------

By: Vladimir Vyun

Title: EUR/USD Declines as Risk Aversion Grips Market

Sourced From: www.earnforex.com/blog/eur-usd-declines-as-risk-aversion-grips-market/

Published Date: Tue, 23 Mar 2021 14:58:52 +0000

Read More

Did you miss our previous article...

https://11waystomakemoney.com/forex/bollinger-band-is-a-reversal-forex-trading-strategy

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions