Only a few indicators can claim to be able to provide a complete trading strategy. A majority of traders would require another indicator to identify trends, filter out bad trades and provide an entry trigger.

However, the Ichimoku Kinko Hyo indicator is one of few indicators that can be called a complete trading strategy by using a single indicator. It has all the components necessary for a complete trading strategy. The modified moving average lines are highly effective and reliable in identifying the long-term and mid-term trends. This allows traders align the long-term and mid-term trends. The indicator uses the same lines to identify both the short-term and mid-term trends. It also gives traders a specific entry signal that they could use to decide whether to enter or exit trades. It also includes a line that could be used to help traders spot choppy market conditions, based on price action. This would eliminate trade setups that occur in a poor market condition.

The Ichimoku Kinko Hyo indicator consists of five lines: the Kijun Sen, Tenkan Sen (Turning Line), Chikou Span(Lagging Line), Chikou Span Span (Lagging Line), and Senkou Span A. These forms the Kumo (Cloud).

The Base Line, or Kijun Sen, is the first. It simply represents the median of 26 periods with the highest and lowest highs. This line is the trend over the short to medium term.

The line that is paired with the Kijun Sen is called the Tenkan Sen, or the Turning Line. It represents the trend in the short-term and is the median for the nine previous periods.

When the lines cross, trade signals are usually generated. Trade signals are generated when the two lines intersect. However, traders are filter based on the market's long-term trend as well as whether it is choppy.

The Chikou Span, or the Lagging Line, is used to identify choppy market conditions. It simply shows the closing price for each candle, plotted 26 times behind the current price action. This line will often intersect with other lines during choppy markets and move erratically.

Senkou Span A simply represents the average of the Tenkan Sen, and the Kijun Sen plotted 26 period ahead of the current price action. Senkou Span B, on the other side, is calculated by averaging 52 of the most high and lowest low periods. It plotted 26 periods ahead the current price action. These two lines form the long-term trend. The market is in an uptrend if Senkous Span A is higher than Senkou Span B. If the lines are stacked invertedly, the market will be in a downtrend.

Ichimoku Kinko Hyo Trading Strategy

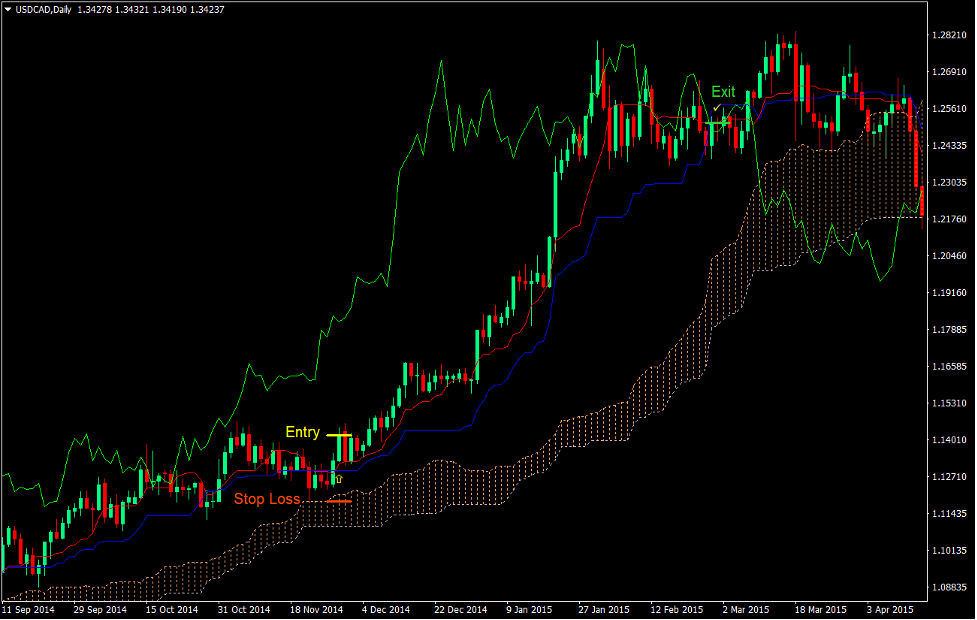

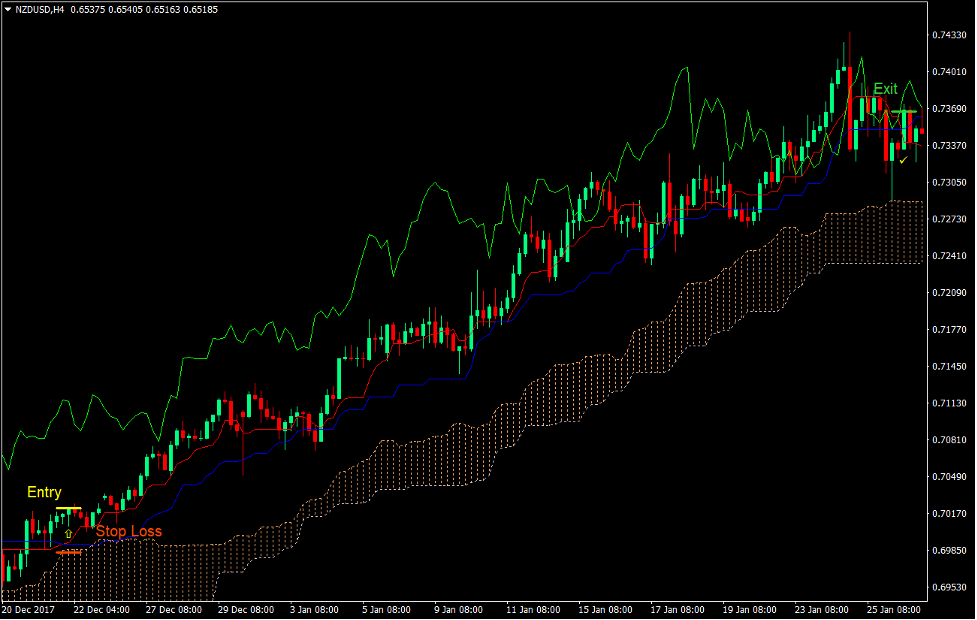

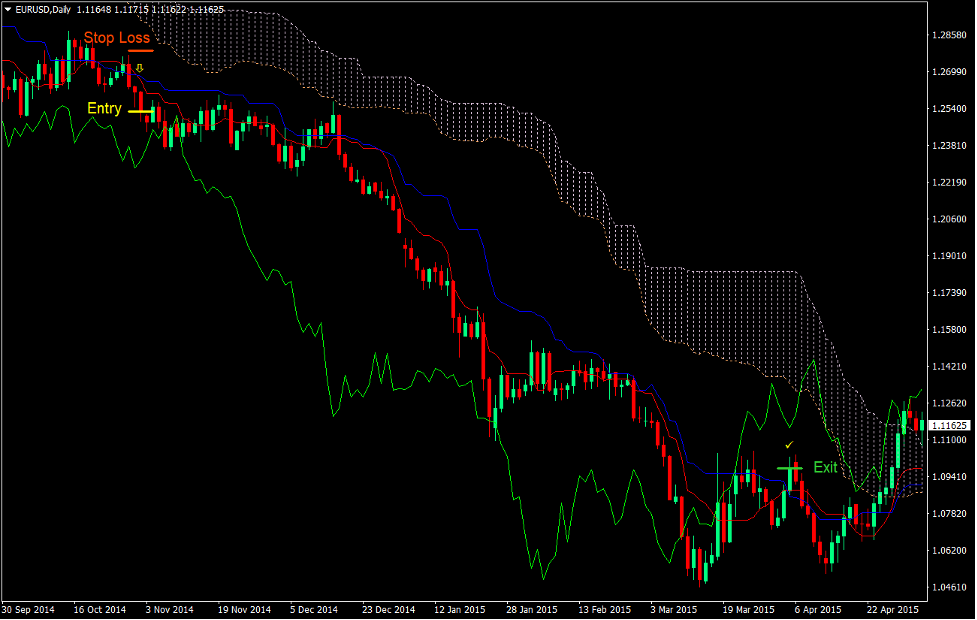

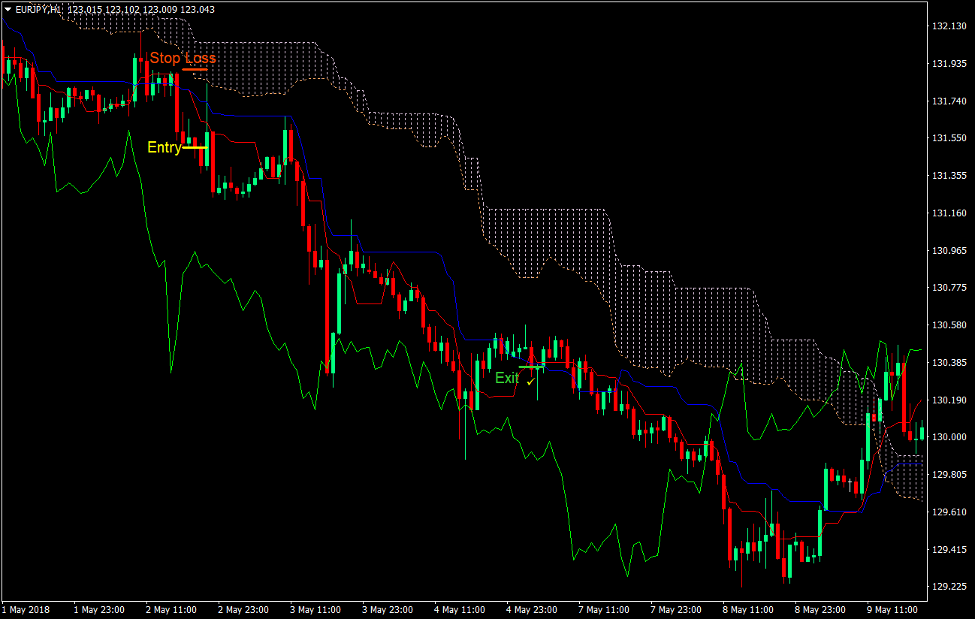

This is one way traders use the Ichimoku Kinko Hyo indicator for identifying trade setups. It focuses primarily on aligning the long-term trends indicated by the Senkou Span A, B and crossover signals of Tenkan Sen and Kijun Sen lines.

The long-term trend will be the basis of trade filtering. This will be based upon how the Senkou Span A (dotted lines), are stacked, as discussed above.

The expansion phase of a trend will see the Kijun Sen (blue) and Tenkan Sen(red) stack up in a manner that is consistent with the long-term trend. However, these lines will temporarily reverse during retracements.

Traders need to check if the Chikou Span, or lime line, is crossing over other lines. This indicates a choppy market. Trading should be stopped if this happens.

Ichimoku: Indicators

Prefer Time Frames: 1 hour, HTML4 hours and HTML5_ daily charts

Currency pairs: major, minor pairs

Forex Sessions: Tokyo sessions.

Trade Setup

Entry

-

Senkou Span A should always be higher than Senkou SpanB.

-

Price should retrace, causing the Kijun Sen to (blue line), and the Tenkan Sen to (red line) temporarily to reverse.

-

The Tenkan Sen line should be above the Kijun Sen.

-

The Chikou Span (limeline) should not cross any other lines.

-

On confirmation of these conditions, place a purchase order

Stop Loss

-

Place the stop loss for the fractal under the entry candle.

Exit

-

When the Tenkan Sen line crosses under the Kijun Sen line, close the trade.

Setup for Trades

Entry

-

Senkou Span B should be lower than Senkou Span.

-

Price should retrace, causing the Kijun Sen to (blue line), and the Tenkan Sen to (red line) temporarily to reverse.

-

The Tenkan Sen line should be below the Kijun Sen Line.

-

The Chikou Span (limeline) should not cross any other lines.

-

On confirmation of these conditions, place a sale order

Stop Loss

-

Place the stop loss on fractals above the entry candle.

Exit

-

When the Tenkan Sen line crosses over the Kijun Sen Line, close the trade.

Conclusion

Because of the number of lines presented, many new traders don't want to use the Ichimoku Kinko Hyo indicator. This indicator can give the impression that it is difficult to use and can be confusing.

It can take some time for new traders, but the Ichimoku Kinko Hyo has been shown to be profitable on the basis of a long-term backtest.

This indicator is a focal point for traders and it can be used as the only indicator. Traders who use it consistently earn profits in the long-term.

Forex Trading Strategy Installation Instructions

Ichimoku Kinko Hyo Trading Strategy combines Metatrader 4 (MT4) indicators and a template.

This forex strategy aims to transform historical data and trading signals.

The Ichimoku Kinko Hyo Trading Strategy allows you to spot patterns and peculiarities in price dynamics that are not visible to the naked eye.

This information allows traders to assume additional price movements and adjust their strategy accordingly.

Forex Metatrader 4 Trading Platform

-

Support available 24/7 by an international broker.

-

Over 12,000 assets, including Stocks, Indices, Forex.

-

Spreads and execution of orders are faster than ever with spreads starting at 0 pip.

-

Start depositing now to get a bonus of up to $50,000

-

Demo accounts are available to test trading strategies.

Step-by-Step RoboForex Trading Account Open Guide

How do I install Ichimoku Kinko Hyo Trading Strategy.

-

Download Ichimoku Kinko Hyo Trading Strategy.zip

-

*Copy the mq4 & ex4 files to your Metatrader Directory/experts /indicators /

-

Copy the tpl (Template) file to your Metatrader Directory/Templates

-

Your Metatrader client can be started or stopped.

-

Choose the Chart and Timeframe in which you would like to test your forex strategy

-

Right-click on your trading chart, hover over "Template",

-

You can now choose Ichimoku Kinko Hyo Trading Strategy

-

Your Chart will show you that Ichimoku Kinko Hyo Trading Strategies is available

*Note that not all forex strategies include mq4/ex4 files. Some templates can be integrated with the MT4 indicators from the MetaTrader Platform.

--------------------

www.forexmt4indicators.com/ichimoku-kinko-hyo-trading-strategy/?utm_source=rss&utm_medium=rss&utm_campaign=ichimoku-kinko-hyo-trading-strategy

Did you miss our previous article...

https://11waystomakemoney.com/forex/how-to-use-eps-to-evaluate-shares

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions