In cosmopolitan centers all over the globe, short-term car rentals have become extremely popular, especially among young people who sometimes need cars for a few hours. It was much easier to locate one in a walkable distance, as the cars are often located in parking lots throughout a city.

These services offer a great alternative to taxis to clients who are able to and will drive their own cars. Most cases, carsharing is available via mobile apps.

Delimobil Holding S.A. is one of Russia's most well-known carsharing companies. It will have an IPO at the NYSE in the USA. The "DMOB" ticker symbol will be used to signify that the shares will begin trading on the day following the IPO.

The IPO date was delayed, so the company will not go public until January. Let's look at Delimobil's business to see if it has the potential to attract many investors.

Delimobil Holding S.A.

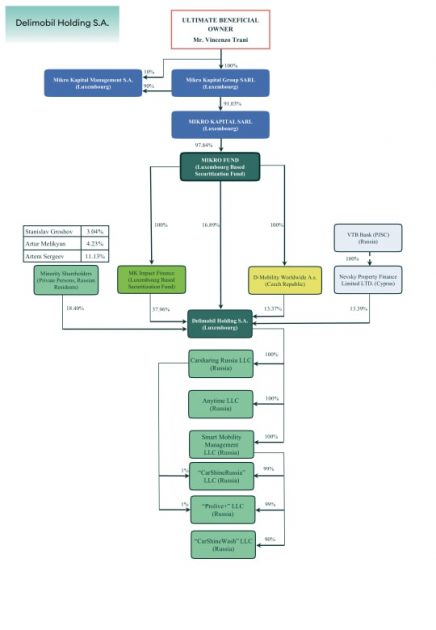

Delimobil Holding S.A., headquartered in Luxembourg, was founded in 2015. Vincenzo Trani is the founder and CEO of Delimobil Holding S.A. Delimobil employs more than 1,000 people, with over half of them involved in maintenance and car service.

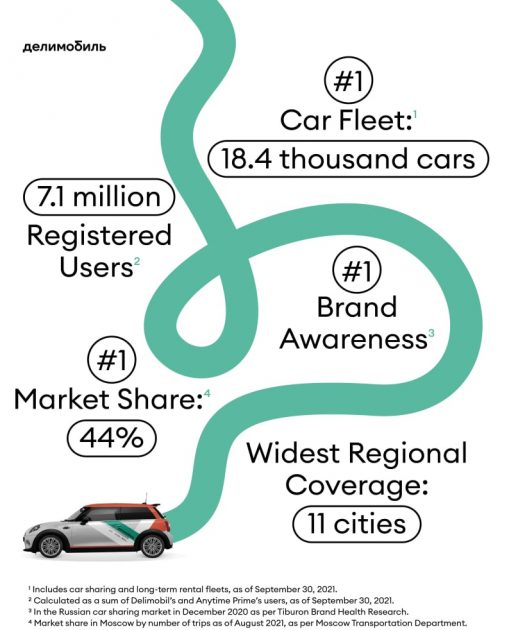

The company provides its services in 11 Russian cities, including Moscow and Saint Petersburg. Tiburon Brand Research reports that the brand "Delimobil", which is now more well-known in Russia, was at the end 2020.

Delimobil mission.

According to the Moscow Department of Transport Delimobil Holding accounts for 44% of all carsharing travels. Bank of America reports that Delimobil Holding is the leader in the industry, putting Yandex.Drive behind the scenes.

Key business parameters of Delimobil.

The company's service was used by over 7 million people. This number jumped 86% from the previous year. The fleet of cars owned by the issuer includes comfort-class cars and more than 18,000. The holding offers long-term rental services under the Anytime Prime brand, which includes over 600 vehicles.

Delimobil Holding structure.

Delimobil Holding services have a high popularity among young people, as clients average 19 years old. The company's proprietary platform, Smart Mobility Management, (SMM), is used to maintain its internal accounting and improve its business processes.

The issuer raised approximately $300 million during the investment rounds, which included VTB Capital, a national investment bank (a little over 13%).

Let's now take a closer look to the target market of the company. This will, in my opinion be a growth area for Delimobil Holding.

Delimobil Holding S.A.'s competitors and market share

Frost & Sullivan estimates that the global carsharing market will grow by 4% in 2020, and even a pandemic could not stop it expanding. According to the same research, global shared mobility (taxis and auto rentals) was worth $110 billion in 2020.

Market revenues are expected to grow by 7.8% each year through 2025, reaching $160 billion. The growth of the number clients among the young is the key driver for growth.

These are the key competitors of the company:

-

Yandex.Drive.

-

Sberautopodpiska.

-

YouDrive.

-

BelkaCar.

-

Ruli.

-

Carusel.

-

Carenda.

Financial performance

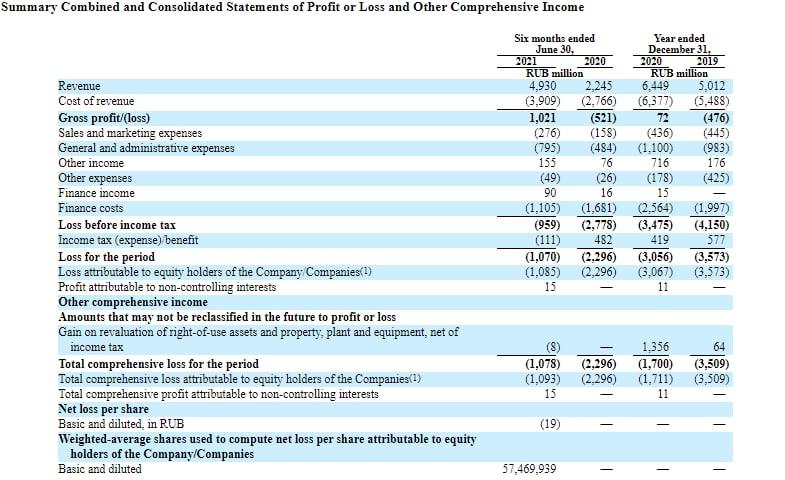

Delimobil Holding will go public because it is losing money. We'll be analyzing its revenue. The company's 2020 sales reached 6.45 billion rubles. This is a 28.74% rise over 2019.

Delimobil financial performance.

According to F-1, Delimobil's first two quarters of 2021 saw a revenue of 4.93 billion rubles. This is a 120.09% rise compared to the same period in 2020. The company's business is growing faster than the market.

The revenue for the 12 last calendar months was 9.13 billion rubles. This sum could reach 14.2 billion rubles if the current pace of development continues.

The net loss fell 53.03% to 1.07 billion rubles. The company has cash and cash equivalents of 4.30 billion rubles on its balance sheet, while its total liabilities amount to 22.10 billion.

Delimobil Holding S.A. has both strong and weak sides

Let's now look at the strengths and weaknesses of Delimobil Holding. The following are my views on the benefits of investing in shares of Delimobil Holding:

-

The volume of the target market.

-

Awareness of brands

-

Sound management.

-

Many young clients.

-

Rate of business growth.

These are some of the risks associated with investing in shares:

-

The company is losing money and doesn't pay out dividends.

-

Strong competition

-

The Russian jurisdiction limits business to a limited extent.

Details and estimates of Delimobil Holding S.A.capitalization

Delimobil Holding initially planned to go public in November. However, management decided to make an IPO in 2022. Sberbank CIB UK Limited, Banco Santander, S.A., Citigroup Global Markets Inc., VTB Capital plc, BofA Securities, Inc. are the underwriters for the IPO.

The company plans to sell 20,000,000 common shares during the IPO at a price of $10-12 per unit. The IPO volume is expected at $220 million, and the company's capitalization could reach $836 million. Delimobil Holding is the first publicly-owned carsharing company in the world.

We use the Price-toSales ratio (P/S) to assess companies that are losing money. The P/S value of a technological sector with such a rapidly growing target market could be as high as 10 during the lockup period. The company filed for an IPO at a price of 6.76. The upside for shares could be as high as 47.93% (10/6.76*100%).

All that being said, I consider this investment to be a venture. If the market is positive, there's a high chance of the company's capitalization "exploding". This is why I recommend this company as a short-term investment option for speculative purposes.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/12/29/ipo-of-delimobil-holding-s-a-a-russian-style-carsharing/

Did you miss our previous article...

https://11waystomakemoney.com/forex/slopes-and-crosses-forex-trading-strategy

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions