Markets plunged dramatically last week as investors worried about the new coronavirus strain. What has happened to stock indices Which sectors were more affected than others? Is there anyone making a profit from the situation? I will try to provide the answers.

WHO emergency meeting

According to CNBC and Financial Times, the World Health Organization summoned an emergency meeting to discuss the situation surrounding the new COVID-19 strain. It took place in Geneva on Friday 26th November.

Scientists from South Africa discovered a new coronavirus strain a few days earlier. It was given the technical index B.1.1.529, and the name Omicron. There are over 30 mutations. Rumours circulated that this strain is more dangerous and viral than Delta, and that vaccines against it are ineffective.

WHO released a press release on November 28th, stating that there was not enough information to draw such conclusions. In the near future, we will learn more about Omicron.

Stock indices plunge steeply

Friday's Hong Kong Hang Seng (HSI), fell by 2.67%, to 24080.52 point, the Japanese Nikkei 225(N225) -- dropped by 2.53%, to 28751.62 point, and the South Korean KOSPI KS11 -- decreased by 1.47%, to 2936.44 point, and the Chinese Shanghai Composite (SSEC), declined by 0.56%, to 3564.09 Points.

The European Euro Stoxx 50 E (STOXX50E), fell by 4.74% at 4089.58 points; the French CAC 40e (FCHI) fell by 4.75% at 6739.73 points; the German DAX I (GDAXI), by 4.15%, to 15257.04 point, and the British FTSE 100e (FTSE) by 3.64%, to 7044.03 Points. The Dow Jones Industrial Average (DJI), which fell by 2.51% to 3498.1 points, was the US's worst market. This is the worst overnight slump since October 2020. S&P 500 (SPX), fell by 2.27% at 4594.62 points. NASDAQ Composite (IXIC), dropped by 2.23% at 15491.7 points.

Technology analysis of US stock indexes by MaksimArtyomov

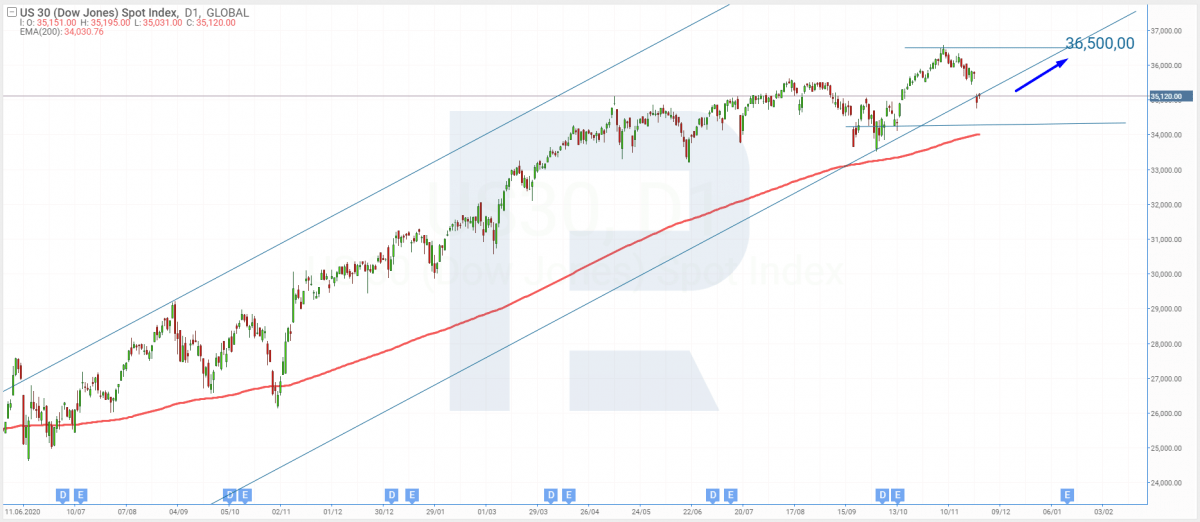

Dow Jones Industrial Average

D1 saw the index start the trading session with a gap, and then reached the lower border in the ascending channel. This could be a correction to the general panic surrounding COVID-19.

This will allow the quotations to bounce off of the support line and continue their uptrend. The resistance level at 36,500 points is what will stop growth within the ascending channel.

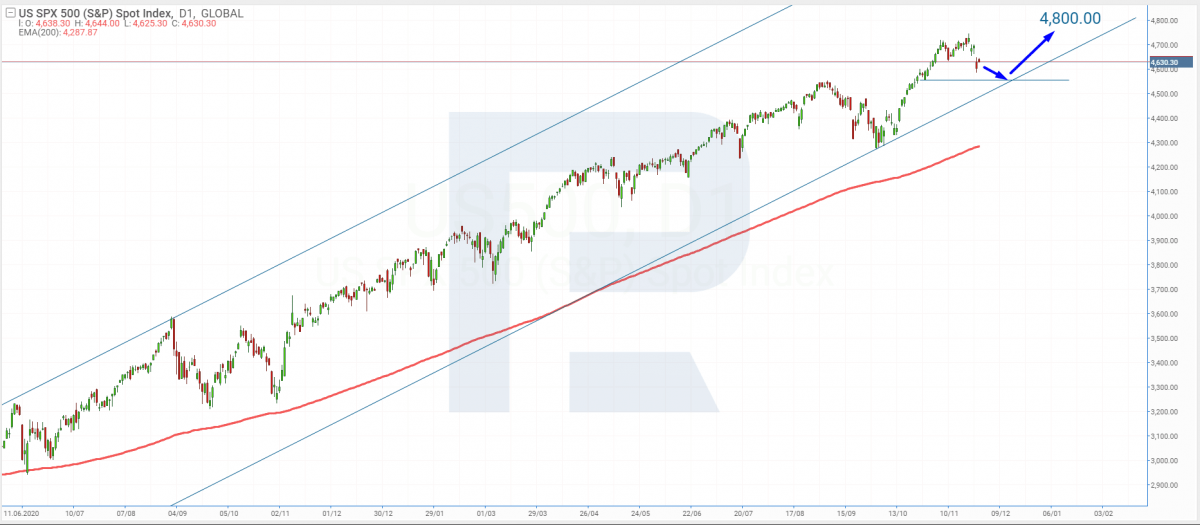

S&P 500

The correctional wave is being formed by the index after it has reached new highs. The next goal for growth is 4,800 points, I think after the pullback. This will allow for further growth of the uptrend.

The 200-days Moving Average confirms further growth: it remains below the chart but continues to show an uptrend. The upward channel can be maintained and the quotations will continue to grow later.

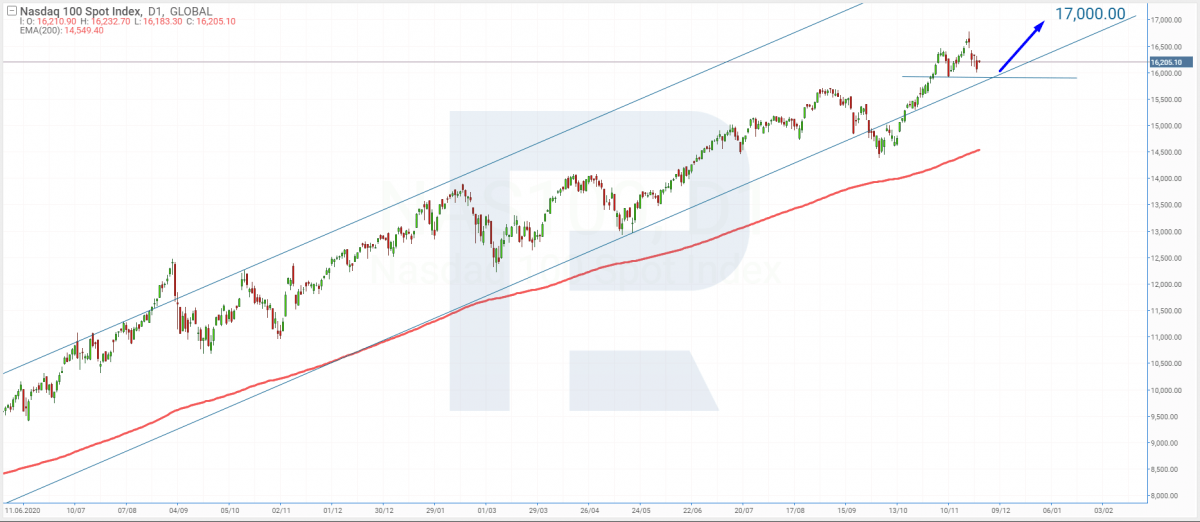

NASDAQ Composite

The index reaffirmed its highs and is now continuing the correctional wave at lower borders of the ascending channel. After the pullback, 17,000 points is the goal for growth. The 200-day MA below the chart is limiting the growth and sustaining the ascending dynamics.

The recent negative news about most companies suggests that the correction could last for several weeks. The index will quickly regain investor trust and the quotations will grow within the ascending channel.

Airline shares fall

Investors began a massive sale of airline shares after news broke about the new COVID-19 strain.

Friday's shares of International Consolidated Airlines Group S.A., which includes British Airways, fell by 14.85% to PS131.4. Wizz Air Holdings PLC's (LON : WIZZ), and EasyJet Airline Company's (LON : EZJ) quotations dropped by 15.23% each to PS3,729 and 11.45% respectively to PS499.8.

The share price for United Airlines Holdings Inc (NASDAQ UAL) fell by 9.57%, to $42.26, American Airlines Group (NASDAQ : AAL), by 8.79%, to $17.75, and Delta Air Lines Inc. (NYSE: DAL), by 8.34%, to $36.38.

Oil also drops

Investots believe that the spread of the coronavirus strain could hinder the recovery of global economies and the demand for black gold. These market conditions caused Brent (BG2) futures to fall 11.55%, or $72.72 per barrel, in February.

WTI (TF2) January futures lost 11.96% in price and fell to $68.15 per barrel. The Friday trading session saw the minimum price fall to $67.4.

Which shares grew?

While many market players saw their shares drop, the stocks of popular companies over the quarantine -- tech firms and vaccine manufacturers -- rose.

Moderna Inc (NASDAQ : MRNA) saw its stock prices rise by 20.57% to $329.63 Pfizer Inc (NYSE) shares rose by 6.11%, reaching $54.

Zoom Video Communications Inc (NASDAQ : ZM), which owns a popular platform to video communication, saw its shares rise by 5.72% and reach $220.21. Peloton Interactive Inc (NASDAQ): PTON saw its quotations rise by 5.67%, to $46.41.

Summarising

A new strain of COVID-19, B.1.1.529 (or Omicron) was discovered in November. WHO has not yet confirmed that this new strain is more dangerous and catchy than Delta. Stock market panics were triggered by fears that the new strain could spread and that the vaccine against it is not effective enough to stop it from happening.

The stock indices in various countries fell noticeably. Airlines shares lost a lot, and oil futures prices dropped again. Forbes reports that the fortunes of 10 of the world's most wealthy people fell by $37 billion on November 26th.

R Blog: More information about indices

-

What is Russell 2000? How does it differ from the S&P 500.

Jackson Hole: Head of Fed Talks at Jackson Hole to Help US Indices Grow

What's happening with global stock indices

-

How to Trade Volatility Index VIX?

--------------------

blog.roboforex.com/blog/2021/11/29/new-covid-19-strain-crashes-markets/

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions