The end of last week was marked by quarterly reports of Walt Disney, Airbnb, and Palantir Technologies. Today I'm telling you more about the published data and the reaction of investors, as well as sharing the tech analysis prepared by Maksim Artyomov.

Walt Disney report: amusement parks and Disney+ provided for growth of revenue

On August 12th, Walt Disney presented the results of Q3 of the financial year. According to the report, visitors returned to amusement parks that had long been closed due to the COVID-19 pandemic. This segment brought the company $4.34 billion of revenue, which is 307.6% more than last year.

Another important result is the number of Disney+ users increasing. The streaming service now has 101.7% more subscribers, 116 million against 57.5 million users previously. At the same time, the revenue that 1 paid subscriber brings to the company decreased by 10%, from $4.62 to $4.16.

Though the results exceeded the expectations of analysts, they failed to provoke a boom in the stock market. The stock price of Walt Disney (NYSE: DIS) had been growing moderately for two sessions in a row waiting to for the report. On August 12th, trades closed with an increase in the stock price by 0.67%, to $179.29. On the next day, they grew by 1% more, reaching $181.08.

Important report details

- Revenue — $17 billion, +45%, forecast — $16.76 billion.

- Return on stock — $0.5, +120%, forecast — $0.3.

- Net profit — $923 million, +120%.

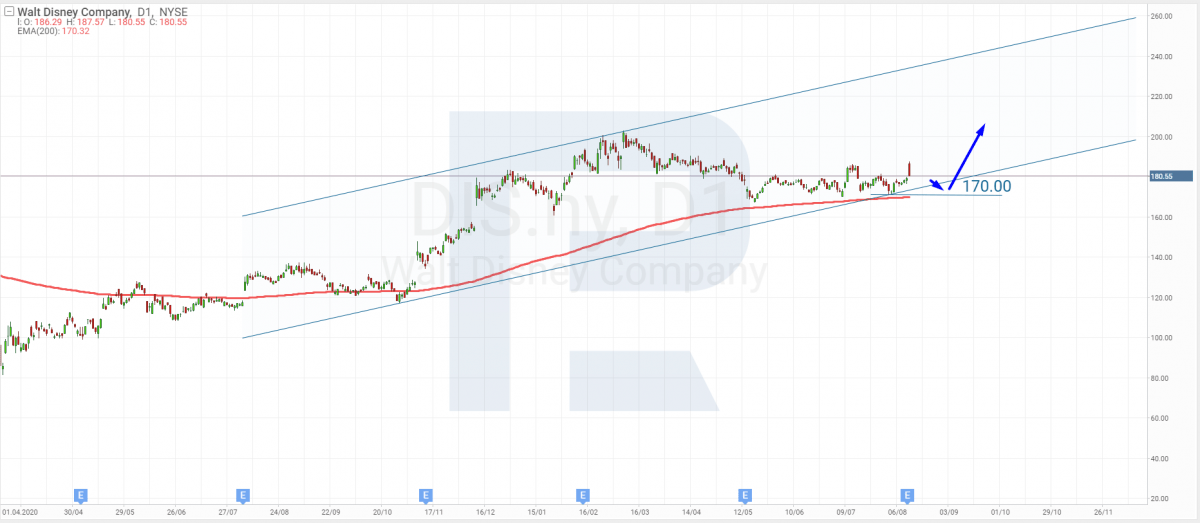

Tech analysis of Walt Disney shared by Maksim Artyomov

Regardless of the last trading session opening with a gap, Walt Disney shares decreased substantially. The price keeps going inside the ascending channel, which means in the future growth might continue.

For now, further correction looks quite probable now, the aim is the lower border of the channel and the horizontal support line. Testing the level of $170, the price might bounce. One more support level is the 200-days MA: a bounce off it will start a new ascending wave.

Airbnb report: revenue grew by 300%, loss shrunk by 90%

Airbnb had not demonstrated such brilliant quarterly statistics since long ago. For example, 83.1 million nights and events were booked via the service in the last quarter, while experts had promised 79.2 million bookings. Note that, compared to the same period of 2020, the number of bookings grew by 197%.

However, Airbnb openly warned investors that the results of the present quarter were likely to be much weaker. One reason is seasonal, since summer is nearly over; the other reason is the spreading of the Delta coronavirus strain.

Such rhetoric immediately influenced the stock price of the corporation, eliminating the success of the last three months almost completely. On August 12th, when the report was published, the stock price of Airbnb (NASDAQ: ABNB) grew by only 2.02% to $151.15. During the trading session, the quotations reached the high of $151.68.

Important report details

- Revenue — $1.34 billion, +300%, forecast — $1.26 billion

- Loss on stock — $0.11, -86%, forecast — $0.41

- Net loss — $68 million, -88%

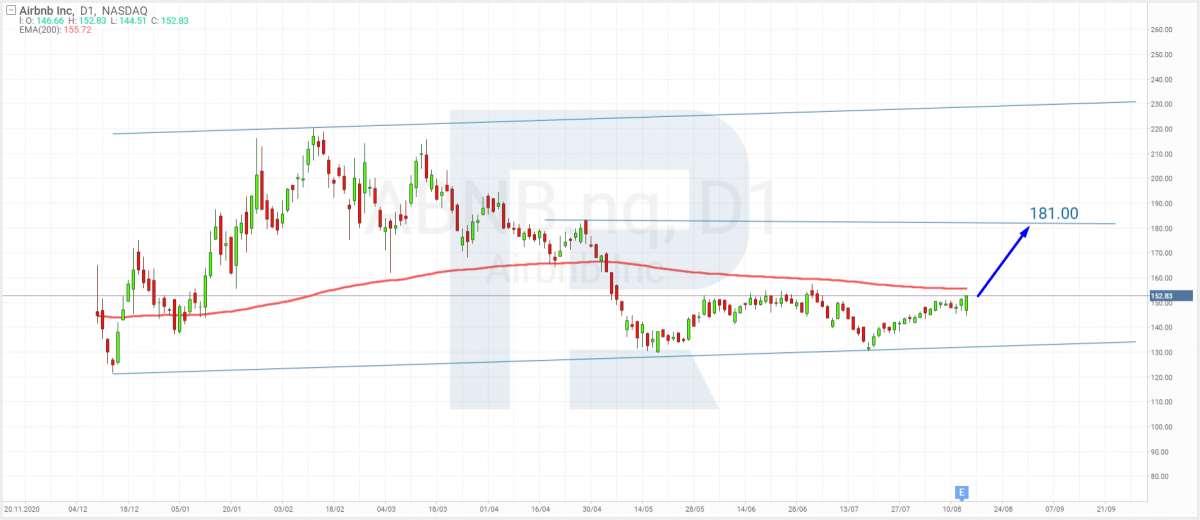

Tech analysis of Airbnb shares by Maksim Artyomov

Airbnb shares keep recovering calmly. The quotations currently rest under the 200-days MA. A breakaway of the resistance level will start a new wave of growth with the aim at the closest resistance level of $181.

However, if the company doesn't win the trust of investors back, instead of a breakaway of the 200-days MA we will see a bounce off it and a decline to the support level of $131.

Palantir report: revenue growing by 50%, and an ambitious forecast for Q3

Palantir Technologies, a company developing software for data collection and analysis, reported the results of Q2, 2021 on August 12th as well. On the list of its clients there are not only private companies but also federal structures, such as US Defense Forces, CPU, FDA.

From the report we found out that in the last quarter, the company signed 30 contracts for $4 million or more each. Moreover, they signed 21 contracts for at least $10 million each. It acquired 20 new clients, which is a 13% increase in their total number. The number of commercial clients grew by 32%, and the revenue in this segment — by 90%.

The free money flow is $201 million; new forecasts promise it to rise over $300 million at the end of the year. As for the growth of the revenue this year, an increase by 30% is forecast. Good reports and ambitious forecasts were a good influence: on August 12th, the shares of Palantir Technologies (NYSE: PLTR) rose by 11.36% to $24.89.

Important report details

- Revenue — $376 million, +49%, forecast — $361.1 million

- Return on stock — $0.04, forecast — $0.03.

- Net profit — $98 million.

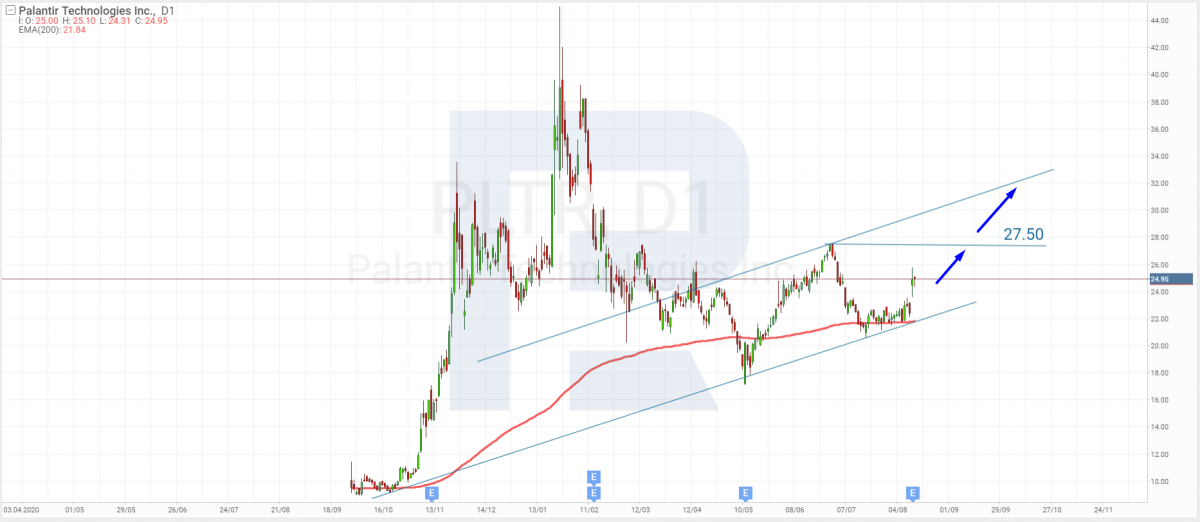

Tech analysis of Palantir by Maksim Artyomov

Palantir shares are bouncing off the 200-days MA. I suppose that, correcting slightly, the price will go on growing towards the resistance level. The aim of the growth is $27.5. As long as the financial performance of the company is positive, I expect a breakaway and further development of the uptrend after a test of the resistance level.

Summing up

Last Thursday, such companies as Walt Disney, Airbnb, and Palantir reported their performance in Q2. The first one reported substantial growth of the revenue and cheered investors up by the statistics of amusement parks and Disney+. However, this had little influence on its stock price that increased by barely a percent.

The second company filed a strong report but a pessimistic forecast for this quarter, which resulted in growth of the quotations by only 2% over a trading session. The third company boasted not only an increase in the revenue but also an increase in the number of signed contracts and clients. Here, the stocks grew substantially — by 11%.

More about quarterly reports on R Blog

- Alibaba Quarterly Report and Shares of Chinese Video Game Makers Falling

- Top League: Quarterly statement from Apple, Alphabet, Microsoft, and Facebook

- Quarterly statement from Tesla: record-breaking profit and moderate response from shares

- Quarterly statements from IBM, Netflix, Coca-Cola

The post Quarterly Reports of Walt Disney, Airbnb, and Palantir appeared first at R Blog - RoboForex.

---------------------------------

By: Server Ametov

Title: Quarterly Reports of Walt Disney, Airbnb, and Palantir

Sourced From: blog.roboforex.com/blog/2021/08/16/quarterly-reports-of-walt-disney-airbnb-and-palantir/

Published Date: Mon, 16 Aug 2021 09:56:00 +0000

Read More

Did you miss our previous article...

https://11waystomakemoney.com/forex/eurusd-falls-as-risk-aversion-grips-market

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions