There are many controversies in the stock market. There are many controversies in the stock market. Some sellers are trying to sell a particular share while others rush to buy that exact share. Whom should we trust?

You can only trust your own judgment in the stock market. Nobody knows what the future price of a financial instrument is going to be. We can still evaluate all the pros and cons of a financial instrument and decide for ourselves if we want to purchase it.

Today we will examine such a situation using ROKU shares.

ROKU, Inc

ROKU, Inc (NASDAQ : ROKU), along its subsidiaries, manages a streaming TV platform, produces hardware for streaming services, makes money on advertising, and also manages a stream TV platform. The shares fell 10% in two days after the publication of the quarterly report.

In my previous article, I explained what investors use to decide whether to purchase or sell a share. I specifically mentioned the expectations of future profits/losses for the company.

This is because ROKU management stated that it expects a slowdown in income growth in Q4. Investors were able to sell the shares regardless of the Q3 results.

MoffettNathanson analytic company added fuel to the fire by decreasing ROKU's share price to 220 USD. They also rated the company Sell. The stock price fell faster, and shares lost 15% more.

ROKU shares bought by ARKK trusts and ARKW trusts

Cathie Wood appeared out of nowhere and began buying thousands ROKU shares. The trust she manages, ARKK bought 245,321 shares at a price of about 62,000,000 USD. Her second trust, ARKW bought 64,931 more shares for 16 million USD. Cathie now holds 4,860,000 ROKU shares, and she isn't going to sell them in the current decline.

What do you do? Follow Cathie Wood's lead and buy now or wait for the prices to drop to 220 USD.

Let's start by looking at the quarterly ROKU report. The company's revenue in Q3 was 679.95 million US dollars, which is slightly less than the 683 million forecast. But, the growth was more than 50% compared to last year's results.

It is notable that the ROKU quarterly income has been lower than the analysts' forecasts since 2017. This is bad news. However, the stock return was 0.48 USD. 700% more than what was expected.

The total free money flow has reached a record high of 2.1 million USD. ROKU's debts grew to 1.2 Billion USD. However, with 2.1 Billion USD on the accounts, this spread isn't huge. Revenue from ads increased by 82% and watching time by 21%. This amounts to 18 billion hours of Q3.

Although quarterly results were better than expected, the shares are still trading in a downtrend, losing 50% since July. This can partly be explained by the announcements made by the management in Q2. They stated that they expected a slowdown in revenue growth.

ROKU is not without its obstacles

It is impossible to say whether the management's forecast was correct. Investors believed that a weakening lockdown could have a negative effect on ROKU's business as people will spend less time watching television. The company is actually increasing its income and the risk is quite different. ROKU is concerned about supply chain breaches and shortages of semiconductors.

MoffettNathanson, explaining why ROKU was rated lower, stated that the company is having trouble maintaining its income growth. New lockdowns are unlikely and the delivery issues (including high prices) will also affect ROKU's marginality.

According to the company, it will not increase the price of its products. Because of increasing competition, the main goal isn't to make more money selling equipment. It is about expanding the market share. All these facts make MoffettNathanson's arguments valid. ROKU revenue might slow down for a while.

The worst scenario is already in place for the share price

Another side of the medal: Cathie wood and other ROKU supporters claim that the worst case scenario has been included in the ROKU share price. The shares have been declining since July 2021 but the financial performance continues to improve.

Even more fascinating is the fact that ROKU management still expects revenue to exceed 900 million US dollars, even though it makes a cautious forecast for Q4. This is 38% higher than the previous year.

Notice: On November 19, the government of Austria announced an updated lockdown, which will be in effect on November 22nd. ROKU shares will reach an all-time high if lockdowns are repeated.

The company began generating net profits one year ago. A slowdown in its growth is an inevitable consequence that poses no threat to the future. Remember that Q2 is not the time to watch TV while sitting on a coach. Even in such situations, the company still manages to make profits and not let people spend less time in front TV.

General news background around ROKU

You should also check ROKU general news background. Experts recommend that you invest in shares. The average target price for growth stocks is 375 USD. Only MoffettNathanson has set the target price at 220 US dollars and recommends selling.

ROKU, Inc. Stock analysis

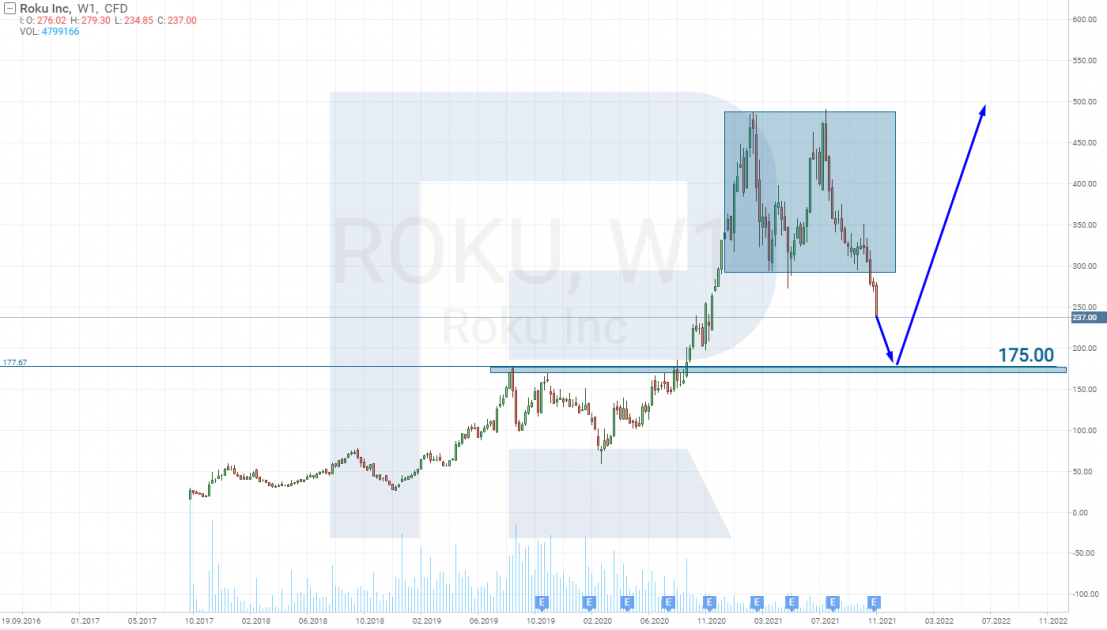

Let's take a look at the chart. The situation on W1 looks grim: There is a Double Top reversal pattern which means that the price could fall to 175 USD.

Weekly chart of ROKU, Inc shares

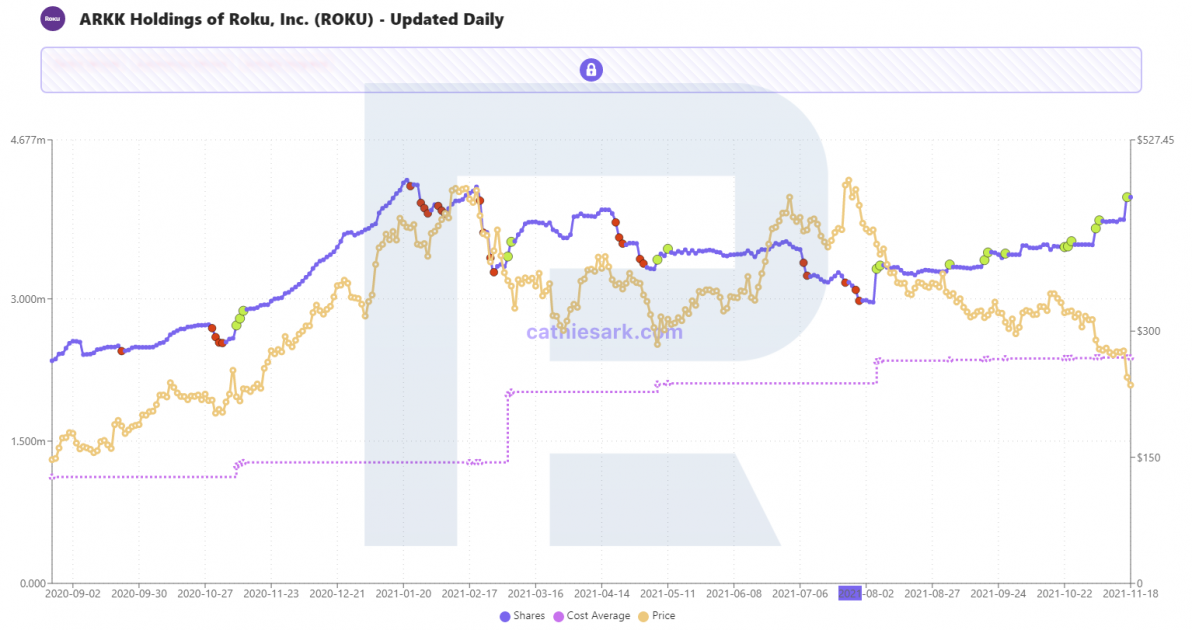

Cathie Wood has been buying ROKU shares. However, according to the chart she made some profit at 400 USD. The average buying price for ROKU shares is 268 USD. Her position is now losing.

The number of ROKU shares at Cathie Wood’s ARKK trust

You can decide whether you want to follow Cathie's lead. D1 shows shares trading in a downtrend. This is shown by the 200-days Moving average and the descending channel. The Moving Average is a slow indicator and you can avoid 100 USD price growth if you wait for a signal. Therefore, it is important to focus on the trend lines and the breakaway from key resistance levels.

The situation is now such that the quotations could drop to the channel's lower border, which coincides with the support level at 175 USD. The rebound from this level will indicate a recovery. Further signals include a breakaway from the trendline, and then a breakaway from the resistance levels at 280 USD or 300 USD.

Tech analysis of ROKU shares

If the world is placed under quarantine, however, then things could change dramatically. ROKU's advertising revenue will increase rapidly. A breakaway of 280 USD would mean that the shares are growing again.

Closing thoughts

According to tech analysis, ROKU shares are not attractive investments at the moment, regardless of what experts may say. You should simply keep an eye on the shares of ROKU.

It is possible that investors are being too dramatic. The current price already includes a potential slowdown in revenue growth. Wait for signs of a reversal to purchase the shares. It might not be possible to catch the bottom in ROKU shares.

RoboForex offers favorable terms for investing in American stocks You can trade real shares on the R StocksTrader platform starting at $ 0.0045 pershare, with a minimum transaction fee of $ 0.25. A demo account is available on RoboForex.com. You can also test your trading skills on the R StocksTrader platform.

--------------------

blog.roboforex.com/blog/2021/11/24/roku-shares-falling-hedge-funds-buy-thousands-of-them-what-to-do/

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions