Key Takeaways

-

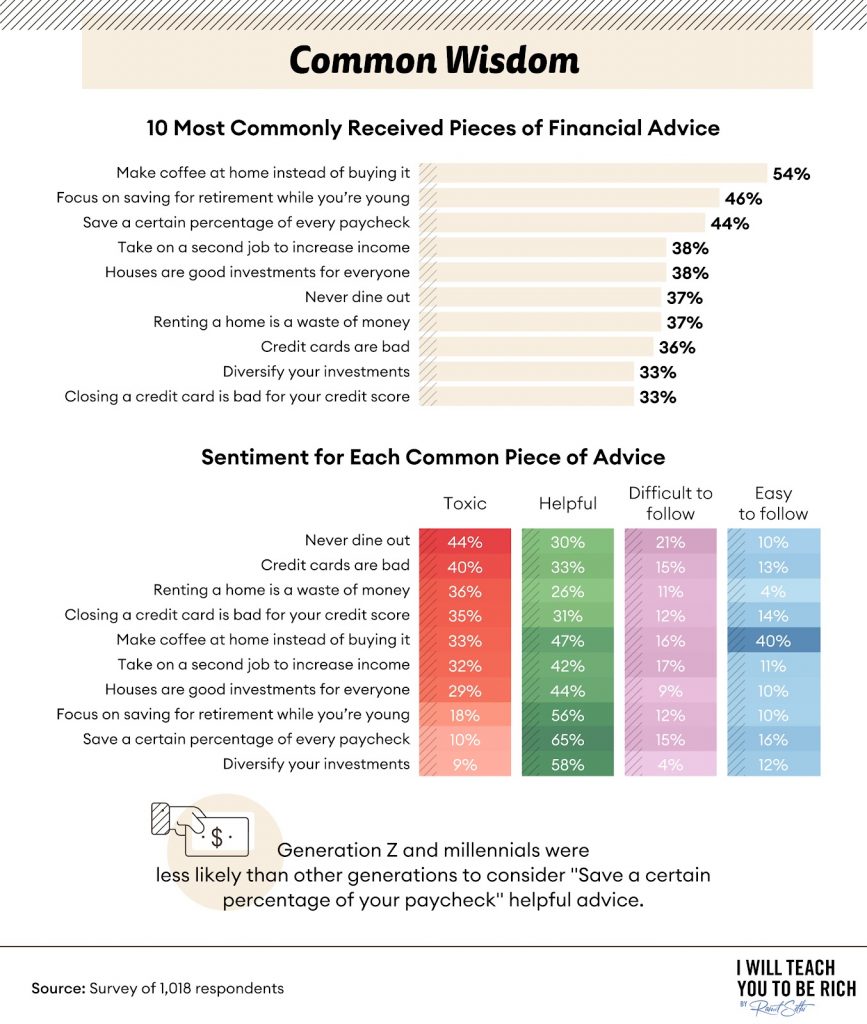

The most harmful piece of financial advice is "Never dine out", followed by "credit card are bad" (and "renting a house is a waste money") in second and third places, respectively.

-

The most useful piece of financial advice is "save a percentage of your paycheck", followed by "diversify you investments" and "save money for retirement while still young".

-

Three times as likely as the average person to view some financial advice received as harmful was a financially healthy person.

Friends and family members who are well-meaning often give financial advice. Although well-intentioned, some of this advice might not be very helpful.

There are many financial strategies out there, but not all of them will work for you. Sometimes, money management tips can even be harmful to your financial health. We surveyed more than 1,000 people to gain insights into money management and determine if they are helpful. Continue reading to find out what advice people think is best.

Popular Financial Tidbits

You're likely to get 10 different strategies from 10 people if you ask them for advice on the same financial problem. There is no denying that there are a lot of financial advice available. But it can be difficult to discern what's useful from what's not. There is a good chance that you have received money management tips in the past. We'll be looking at the most common.

Many of the financial advice that respondents cited related to housing and homes. 54% of respondents were advised to make coffee at home. 38% said that buying a home was always the best move. Renting can be a good option depending on your lifestyle and the location you live in. Today's real estate market is booming. This means that there is limited supply and high demand for homes. For some, homeownership may be the best decision. However, for others renting could be the right choice.

Another piece of financial advice was about when to start saving for retirement. According to 46% of respondents, saving money is always a good idea. Many people have heard that cooking at home can save you money and that credit cards should be avoided. However, it is rare that a single strategy will work for everyone.

If a relative or several tells you to not put all your eggs in the same basket, chances are that they mean your money. 33% of respondents believed that diversification was always better. Gen Zers and millennials are less likely to be moved when the speech "save some money for each paycheck" is repeated so often.

Most financial advice is given with good intentions. But, even if you have good intentions, it doesn't mean that your advice will be well received. While eating only at home can save money, 44% of respondents felt it was "toxic" and 36% believed renting was a waste of money. It's cheaper to make coffee at home than to buy $5.00+ drinks at specialty shops. 40% of respondents agreed that it was straightforward advice to follow. One-third of respondents still consider such advice "toxic", and we agree. Distracting yourself from $5.00 money questions can be distracting. Long-term success will be more if you focus on larger financial wins.

Money Advice varies based on gender and age

Financial advice is not all equally distributed. Our survey respondents found that women received half the advice on money more often than men. Only 37% of financial guidance was shared equally between men and women.

The most notable advice gap between men and women was found in renting versus purchasing and keeping an eye on spending. These issues were 29% more common for women than for their male counterparts. One-fifth of women were told to save money every payday and to look into other opportunities to make extra cash. It was 18% more common for men to be reminded of the dangers of taking on debt than women.

Genres can have different advice about money. Baby boomers, who are approaching retirement age, often hear that they should save more money than the younger generation. The advice that baby boomers received was more focused on other topics. The standouts were that renting can be a waste of time and that buying a home is the best move.

Generation Xers, and most millennials, are in their prime years of work and hopefully have developed healthy financial habits. Gen Xers were most likely to advise that they forgo the Starbucks drive-thru and instead go home and get their caffeine fix.

Gen Zers got their fair share advice about saving money early. Gen Zers were given more money advice than any other generation. They were advised to eat less and to work a second job to increase their income. Gen Zers have more opportunities than any other generation to make extra income.

You can make extra savings by using your existing skills or to pay down high-interest debt. Another option is to learn how to make income from your current hobby.

Advice Perceptions

Sometimes, even the best advice can be misinterpreted.

Seven out of 10 respondents stated that getting a loan without having a plan of when and how to repay it was the worst advice they received. Sometimes, the opposite of the "save your money" crowd can show up as a distant cousin with a "might as well have it while you still can" mindset. It didn't motivate 57% respondents.

Although investing comes with risks, 49% of respondents knew that investing properly isn't like gambling, despite having heard the same toxic advice.

The Dow Jones Industrial Average has returned 10.73% on average between 2010 and 2020. In 2018, the Dow Jones Industrial Average had a return of -5.63%, while it returned 26.5% in 2013. Only two of the 11 years had negative returns. The market has historically gone up if there is enough time.

Trusted sources are often able to give good advice that is well received. Nearly three quarters of respondents stated that saving a portion of each paycheck was the best advice. Over half of respondents said that spreading money in a diverse portfolio and setting up a retirement savings plan early on was helpful. The generation of millennials also considered the majority of financial advice they received "toxic."

It can be difficult to know when and how you should interpret financial advice. Respondents with better financial health were three times more likely to listen to "toxic" advice than those without. Three quarters of financially well-off people deemed diversifying investments, saving early for retirement, and designating a percentage to the piggybank each month as the best advice.

Searching for Financial Advice

It can be difficult to find reliable sources in today's fast-paced world. Many respondents favored the financial resources of relatives and certain social media sites.

Given that Dad shared his wisdom with 52% of respondents, Mom and siblings were not far behind, the phrase "Father knows Best" was certainly applicable to financial advice given by relatives.

Mom won the best financial advice prize, with 4 percentage points more than Dad (47% to 43%), respectively. The top three sources of the most harmful money advice were friends, extended families, and coworkers. Unsolicited advice is also available, which was most often given to our respondents by siblings, co-workers, and grandparents.

When it came to financial information, print material was a distant memory in comparison to the many online sources. Nearly half of our respondents accessed YouTube for financial advice. Instagram and Facebook were also popular.

There were many differences between generations when it came to the top financial sources of respondents. YouTube was the common denominator, with Gen Zers and millennials favoring it most. While they all agreed that Facebook was their second choice, Gen Zers and millennials disagreed on which source they preferred, with the former preferring Instagram while the latter TikTok.

Both Gen Xers and baby boomers prefer financial advice via online publications. YouTube is second. However, the third choice of these two generations was different: Gen Xers preferred Facebook, while baby boomers chose printed books.

Start a Financial Future Today

It shouldn't take long to learn how to invest and gain financial knowledge. We make it easy for you to learn the secrets of making money. 11 Ways to Make Money helps people from all walks of the life find financial freedom. We are confident that our strategies will help you invest and manage your money well. It doesn't mean you have to sacrifice everything. Learn the basics to start your financial journey.

Limitations and Methodology

We surveyed 1,018 people using Amazon MTurk to conduct this analysis. There were 562 men and 447 women among those who responded. Nine of the respondents were non-binary. The average age of our respondents was 41 years. They ranged from 18 to 77. To ensure sufficient response rates from each generation, survey quotas were used. These were Generation Z: 207; millennials: 302, GenerationX: 301 and baby boomers, 208.

All respondents were required by the attention-check question to ensure that they correctly answered it. Sometimes, questions and answers were rephrased to make them more concise or clearer. These data are self-reported and could be subject to telescoping and selective memory.

Fair Use Statement

While not everyone is interested in sharing financial secrets, it's okay to pass this article along. We only ask that you do not share the information for commercial purposes. Please link back to this article to credit proper credit.

Did you miss our previous article...

https://11waystomakemoney.com/make-money-online/10-companies-that-let-you-work-remotely-from-anywhere

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions